2025 Recap

Strategic Mediocrity or Underperformance?

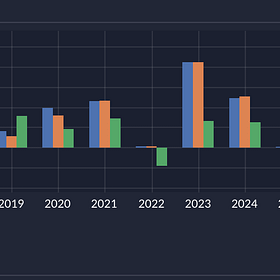

My portfolio finished 2025 up 17%, while SPY returned 17.7% (including dividends). Not exactly champagne-popping alpha… but I’ll take a clean two‑digit gain any year. More importantly, it rode market beta pretty well despite a bunch of idiosyncratic events along the way—so I’m calling it a “photo finish” loss to the index, not a blowout.

Best Spells

I looked at how each of my live spells performed for the year, counting only those fully invested the entire period. That means BDRY-signaled SSO/EUM with RSI Pops, KMLM Canary Combo, Price Ratio Momentums, and SPHB/SPLV with RSI Ensemble didn’t make the cut. On a time-weighted basis, the top three were:

SVIX 4TLT

JJ’s Trinity Canary Leverage v1.0

A quick “what-if”: BDRY-signaled SSO/EUM with RSI Pops (entered on 1/7/2025) likely would’ve taken the top spot if it had been invested just one week earlier.

By risk-adjusted return (MAR), the leaderboard shifts slightly:

WOOD/XLU/BDRY Canaries Leverage

EM 4TLT

JJ’s Trinity Canary Leverage v1.0

Worst Spells

On the other end of the spectrum, a few spells made themselves… memorable:

COIN or Not

Jackal’s Mean Reversion + BND vs. SH Canary

Also worth calling out: KMLM Canary Combo (entered in March) has been a rough ride so far as well.

Post Stats

I published 32 posts in 2025—short of my one-per-week goal, mostly because I lost momentum in Q4. The three most-viewed pieces were:

The Best Macro Indicator, Round Two

Happy New Year, everyone! I hope your 2025 is off to a fantastic start—may it be filled with green candles and minimal drawdowns! 📈

Canary Signal Series: High Beta vs. Low Vol

Lately I stumbled across a post (somewhere in the internet rabbit hole—credit to the mystery author!) that compared two ETFs I only half‑remembered: SPHB, which holds the 100 highest‑beta names in the S&P 500, and SPLV, which holds the 100 lowest‑volatility names. The idea felt obvious in hindsight: when the raciest stocks are outrunning the sleepiest o…

JJ’s Spell Series: Trending Alternatives

TL;DR I’m testing a live “side-quest” strategy meant to zig when my core portfolio zags: a diversified basket of alt asset/strategy ETFs selected by 180‑day momentum (hold the top 3). A conditional short‑vol overlay (via SVOL) kicks in only when HY credit spreads are elevated. Backtests look exciting—but history is short, risks are real, and I’m keeping …

Major QuantMage Features Added

QuantMage also got a solid set of upgrades this year:

Looking Ahead to 2026

I’m not satisfied with the current performance. I’m hunting for more uncorrelated sources of return, and I already have a few spells on the shortlist to retire or replace.

2026 will also bring a big personal change for me and my family, which likely means less time for investment research than I had in 2025—so I’m going to be more intentional about what I keep, what I cut, and what I automate.

Happy New Year, everyone—here’s to a more prosperous 2026!

All I know is that I find your posts and your approaches highly intruiging and useful.

Why, I was even close to including your "High-Beta/Low-Volatility" in my published list of strategies in which I'll be invested in 2026. But then I thought that would be tantamount to adorning myself with borrowed plumes.

Anyway, thank you and keep up the good work JJ, and have a great year!

You say "17%, while SPY returned 17.7%", but what was your drawdown vs the SPY? I think you're doing better than just CAGR of 17%.