JJ’s Spell Series: Trending Alternatives

Alternative Asset Momentum with a Short Volatility Kick

TL;DR

I’m testing a live “side-quest” strategy meant to zig when my core portfolio zags: a diversified basket of alt asset/strategy ETFs selected by 180‑day momentum (hold the top 3). A conditional short‑vol overlay (via SVOL) kicks in only when HY credit spreads are elevated. Backtests look exciting—but history is short, risks are real, and I’m keeping conviction appropriately modest.

I’ve long hunted for a spell that’s uncorrelated to the rest of my book yet still trends up and to the right. The idea: lean on alternative asset/strategy ETFs that dance to different drummers than broad equity beta.

The Core Strategy: Alternative Asset Momentum

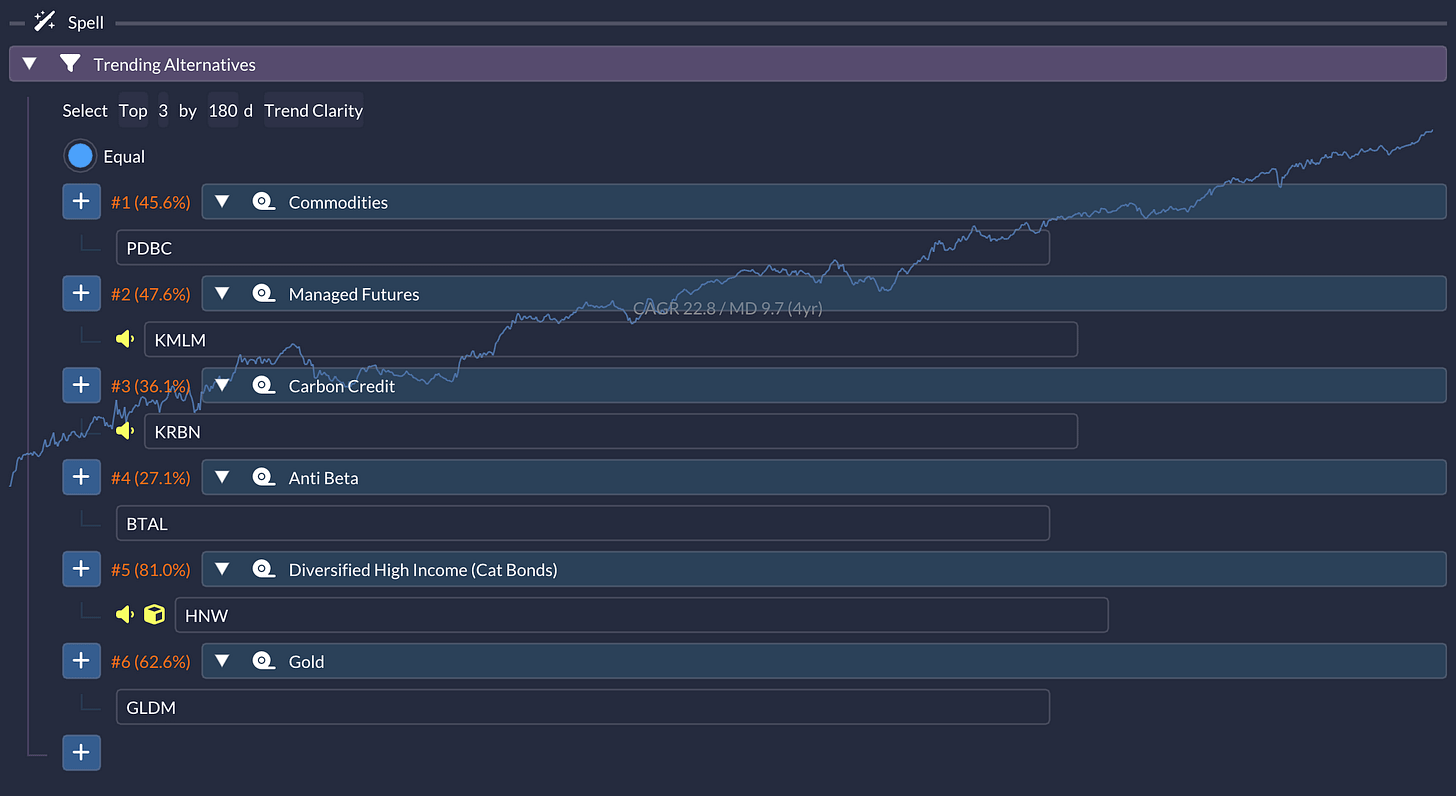

I use six ETFs:

PDBC — broad commodities

KMLM — managed futures

KRBN — carbon credits

BTAL — market‑neutral, anti‑beta tilt

HNW — catastrophe bond proxy

GLDM — gold

Quick note on HNW—it’s not a pure catastrophe bond play (there wasn’t one available when I started this while one is available now), but it does allocate about 20% to insurance-linked securities alongside other high-income bonds. Close enough for our purposes.

The strategy is beautifully simple: I measure each fund’s momentum using 180-day Trend Clarity, then invest in the top three performers. Here’s how it’s been playing out:

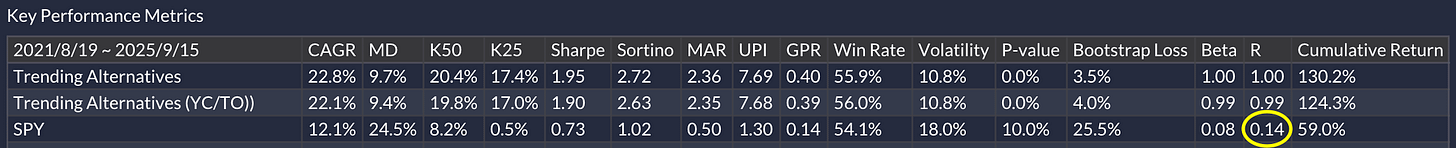

Now, I’ll be the first to admit that four years isn’t exactly a lengthy track record. But the numbers are hard to ignore: a 22.8% CAGR with just a 9.7% max drawdown. Even better? Check out that low correlation to SPY:

That’s exactly what we’re after—returns that don’t depend on whether the S&P is having a good day.

Taking It Up a Notch: The Short Volatility Overlay

Here’s where things get interesting (and yes, a bit spicier).

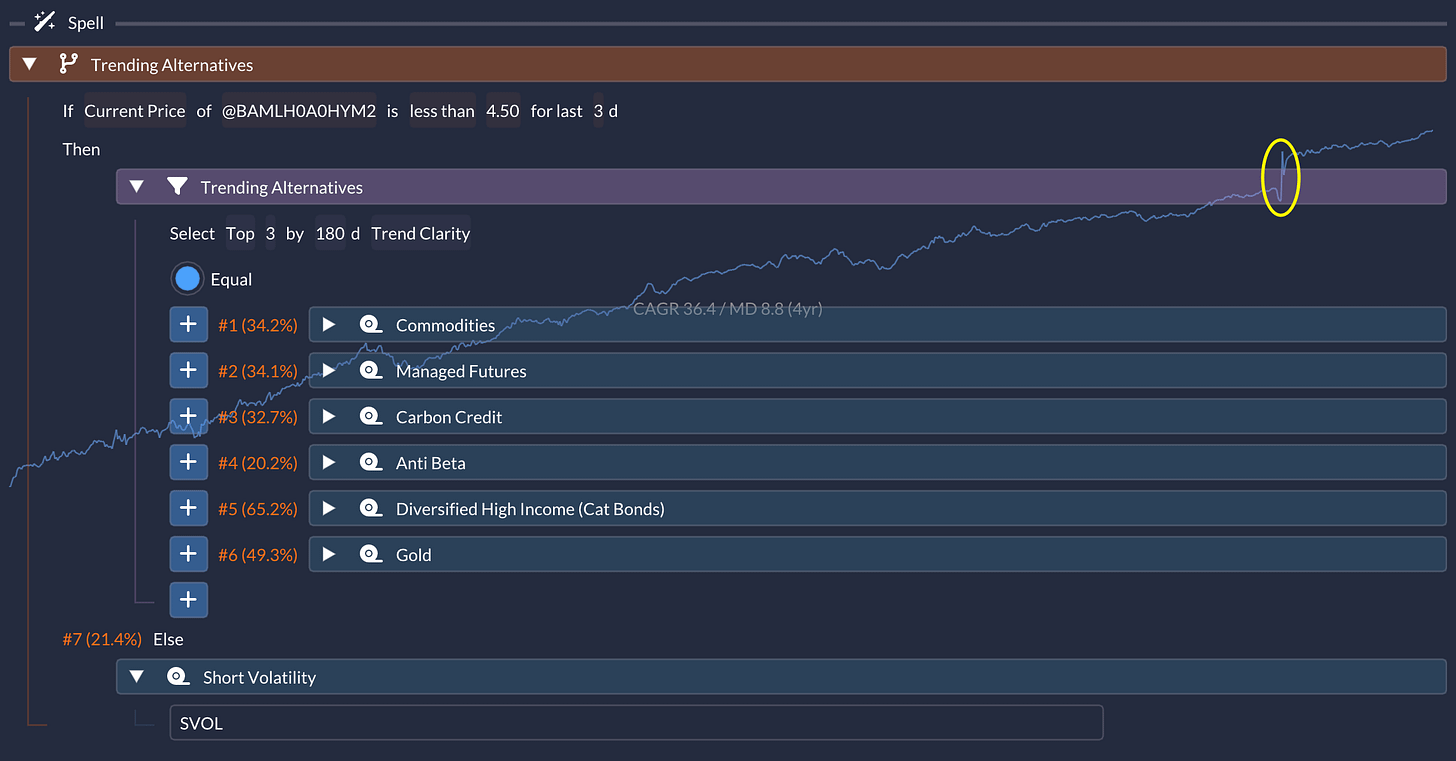

Through some experimentation, I discovered that layering in a mean-reversion play using short volatility can seriously boost performance. The trigger? When high-yield credit spreads climb above a certain threshold, it often signals a volatility spike that’s ripe for harvesting. I use SVOL for this overlay:

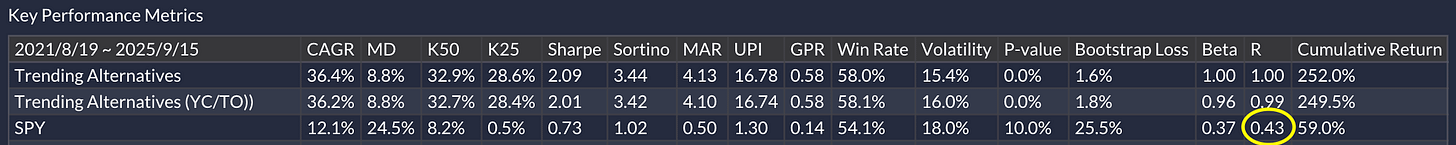

The results speak for themselves: CAGR jumps to 36.4% while max drawdown barely budges at 8.8%. That impressive bounce around Liberation Day? Probably some timing luck, if we’re being honest. The trade-off is a bump in correlation with the broader market:

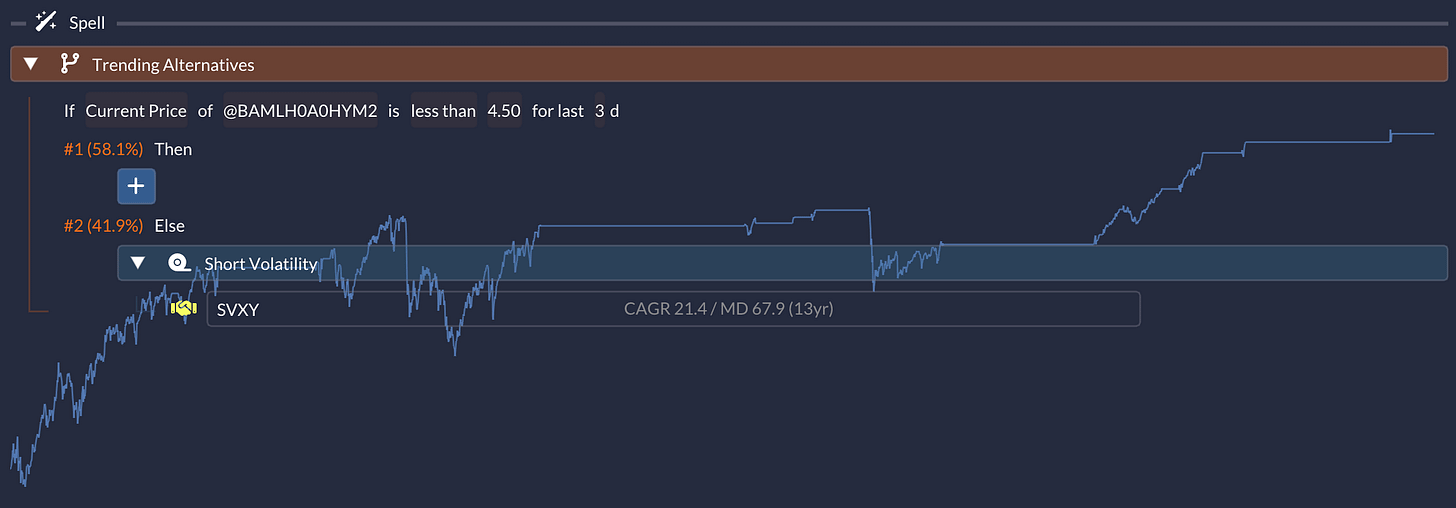

Let me be crystal clear: this short vol overlay isn’t for the faint of heart. Want proof? Here’s what happens when you isolate just the overlay component and use the longer-history SVXY instead of SVOL:

See those stomach-churning drops over a 13-year period? That’s why I opted for SVOL, which is essentially a deleveraged version of short volatility exposure.

I also need to flag something: my credit spread threshold of 4.5 is somewhat arbitrary. It works now, but regime changes could easily break this relationship. Markets have a funny way of evolving just when you think you’ve figured them out.

Give the spell a try here.

🚨 The Necessary Fine Print: This is me sharing what I’m doing, not telling you what to do. Past performance is about as reliable as a weather forecast beyond next week. This strategy could evolve, break, or get completely overhauled at any moment. Please do your homework before putting real money at risk.

Final Thoughts

I’ll level with you—my conviction on this strategy is moderate at best. With only four years of history, we’re walking a tightrope between genuine edge and statistical noise. Overfitting and recency bias are real concerns that keep me up at night.

But that’s part of what makes this interesting, right? We’re exploring less-traveled paths in search of uncorrelated returns. Sometimes that means accepting more uncertainty in exchange for potential diversification benefits.

So what’s your take? Have you found any alternative assets or strategies that successfully break free from market beta? I’m always curious to hear what others are experimenting with in this space.

🤦🏻♂️ me a line with your thoughts—especially if you think I’m missing something obvious or heading for a cliff I haven’t spotted yet.

Update 9/26/2025: Apparently HNW is being delisted today: https://pioneerinvestments.com/content/dam/pioneer/en/documents/closed-end-fund/notices/CEF-Press-Release-09-25-2025.pdf. I removed it from the spell. What a timing! 🤦🏻♂️

intriguing approach, much appreciated! And thank you for reminding me about HNW and ILS. These deserve a closer look (which I hope to take in an uncoming post...)

Here's one I like (financed tail protection plus MF + L/S + int rate) -- correlation -0.55 last 4 years!

https://tinyurl.com/y3ermwmb