JJ's Spell Series: WOOD/XLU Canaries Leverage

Squeezing More Juice from the WOOD/XLU Canary Combo

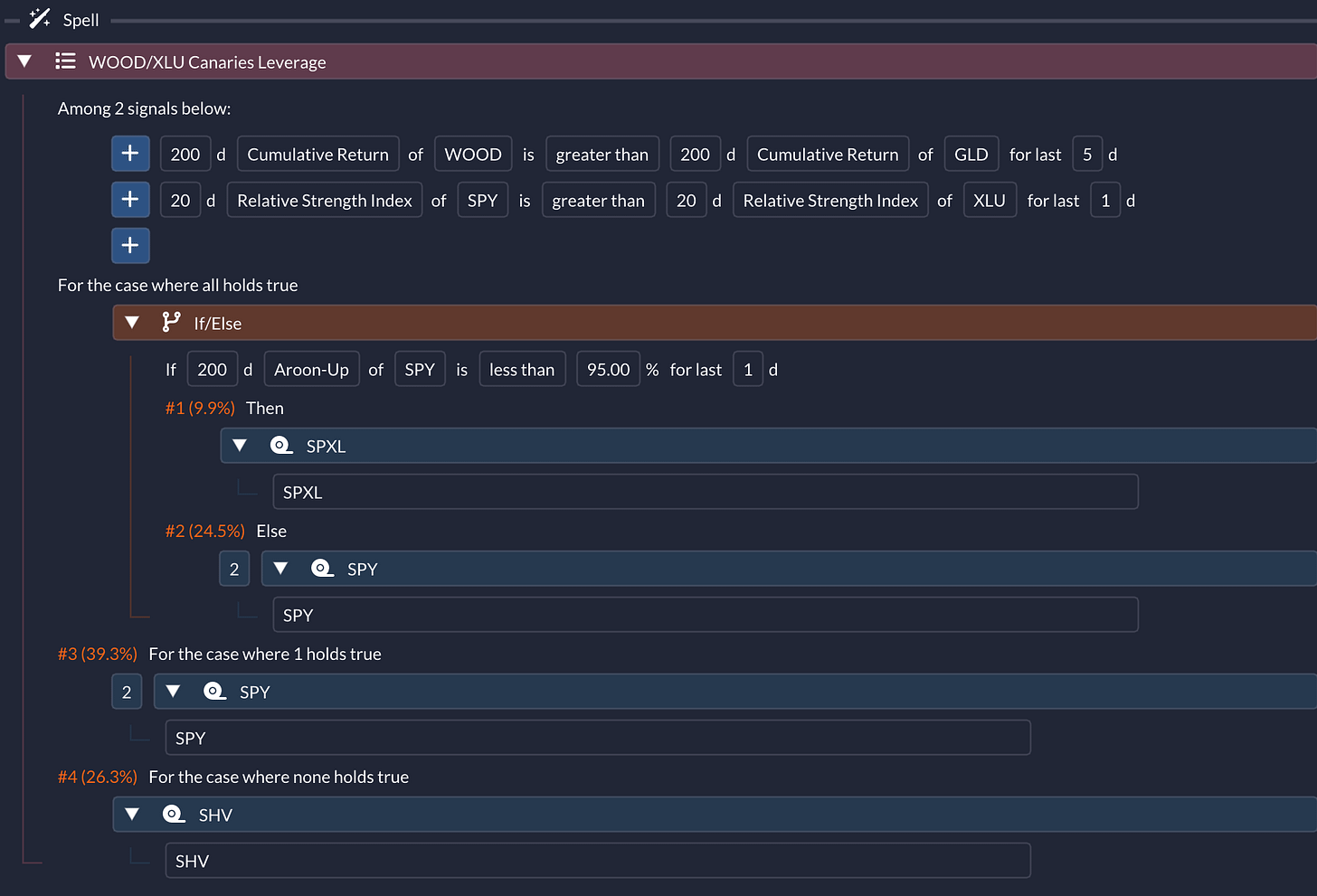

It’s time to share some of the strategies I’ve been live-trading on QuantMage. The spotlight today is on the WOOD/XLU Canaries Leverage. As you might guess from the name, this strategy primarily relies on the WOOD and XLU canary combo, which I introduced in one of my canary signal series.

Levered Logic

The key upgrade here is the smart use of leverage (using SPXL, Direxion Daily S&P 500 Bull 3X Shares) combined with an Aroon-Up indicator. The 200-day Aroon-Up measures how recently the ticker hit its 200-day high. A 100% reading means today was the 200-day high, while 0% means it was 200 days ago. The strategy switches to SPXL if SPY’s 200-day high was more than 10 days ago. Essentially, it takes on more risk when the 200-day high is sufficiently in the past and the WOOD and XLU canaries are signaling bullish.

Backtest Analysis

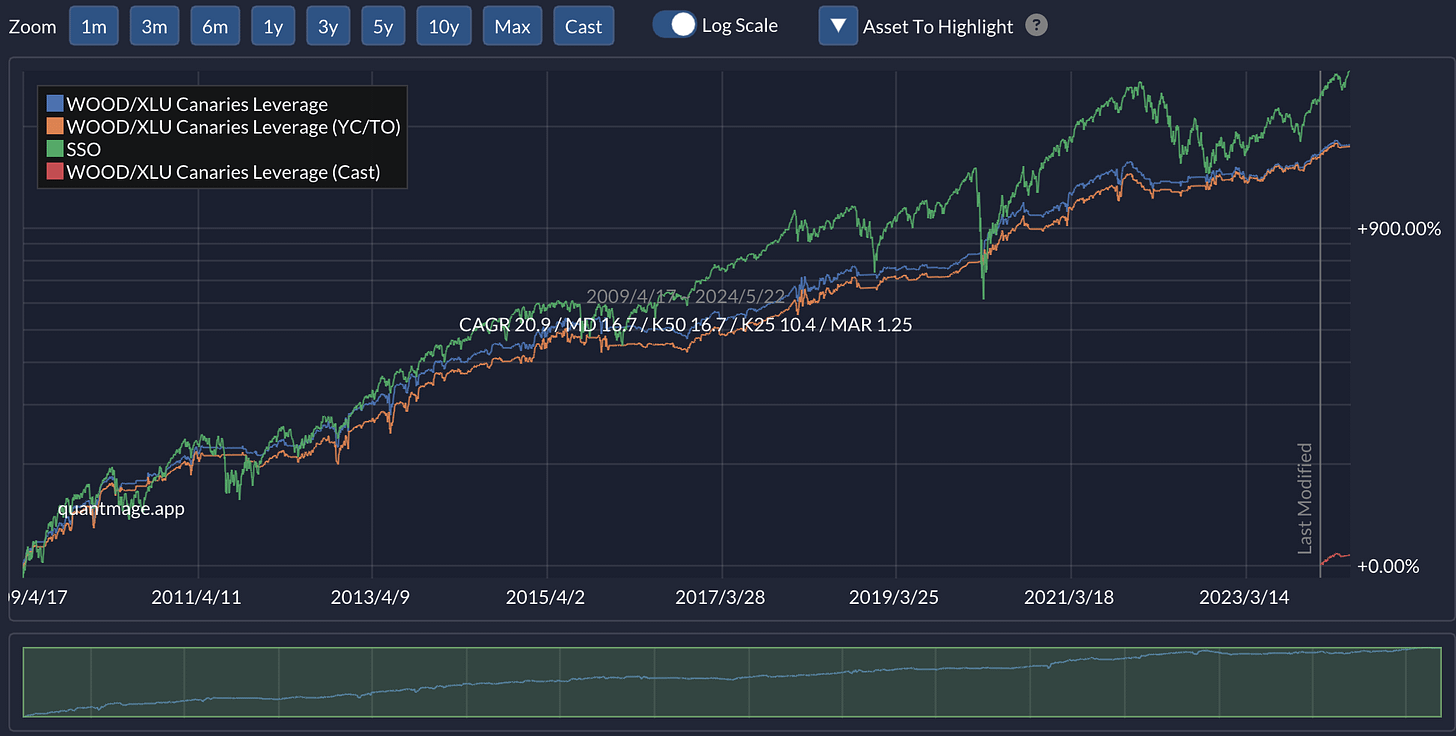

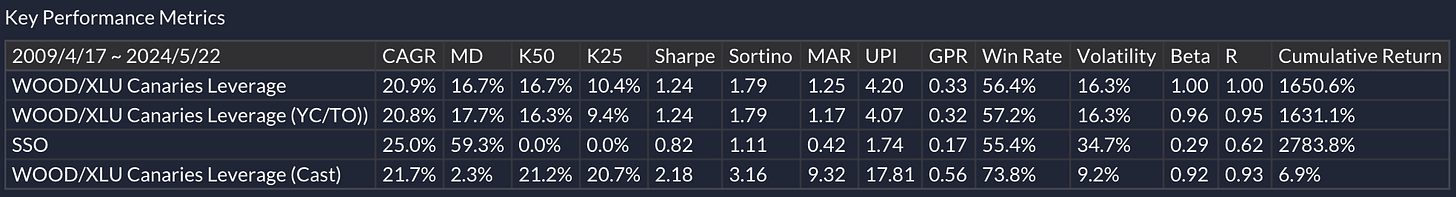

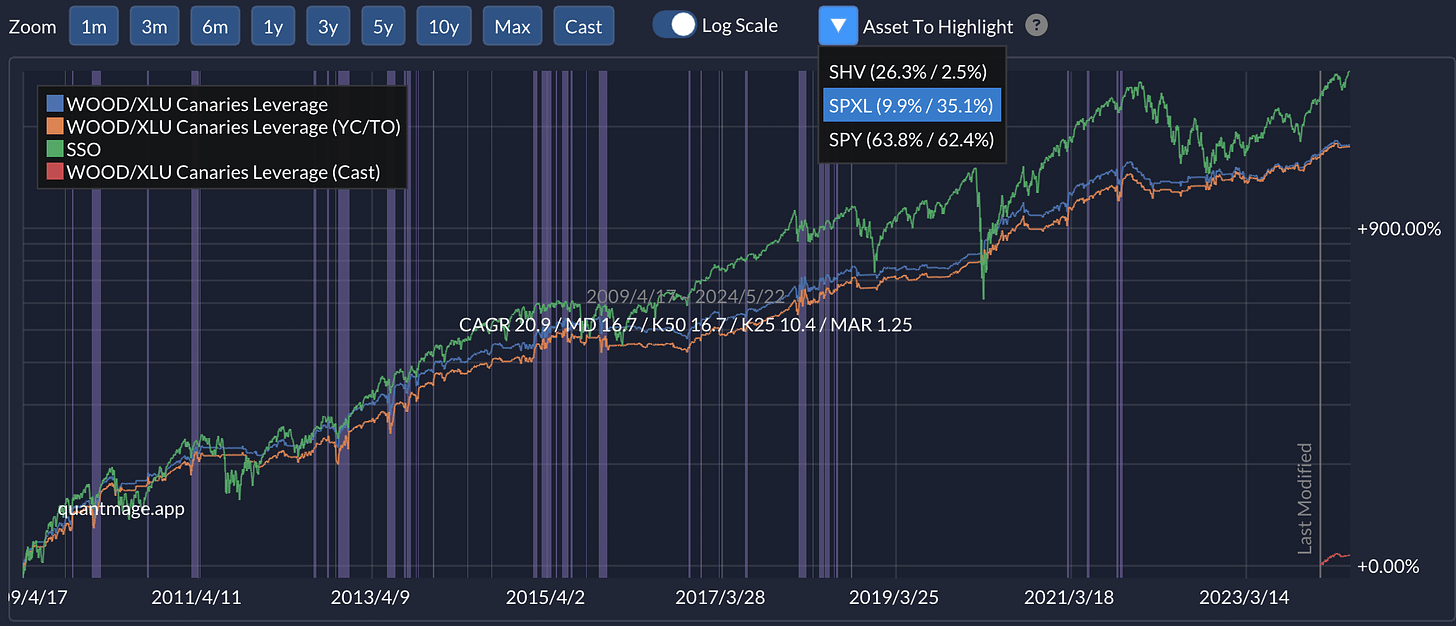

With this setup, the backtest results are as follows:

CAGR: 20.9%

Max Drawdown: 16.7%

Volatility: 16.3%

The CAGR is lower than the benchmark’s 25.0% (SSO, ProShares Ultra S&P 500 ETF), but the risk-adjusted returns are much better, as confirmed by Sharpe, Sortino, MAR, UPI, and GPR ratios. Without leverage, the CAGR drops to 14.7%, with the Max Drawdown remaining the same. The distribution stats show the impact clearly:

SPXL was only active 9.9% of the time but contributed to 35.1% of the return. The plot below shows when it was active:

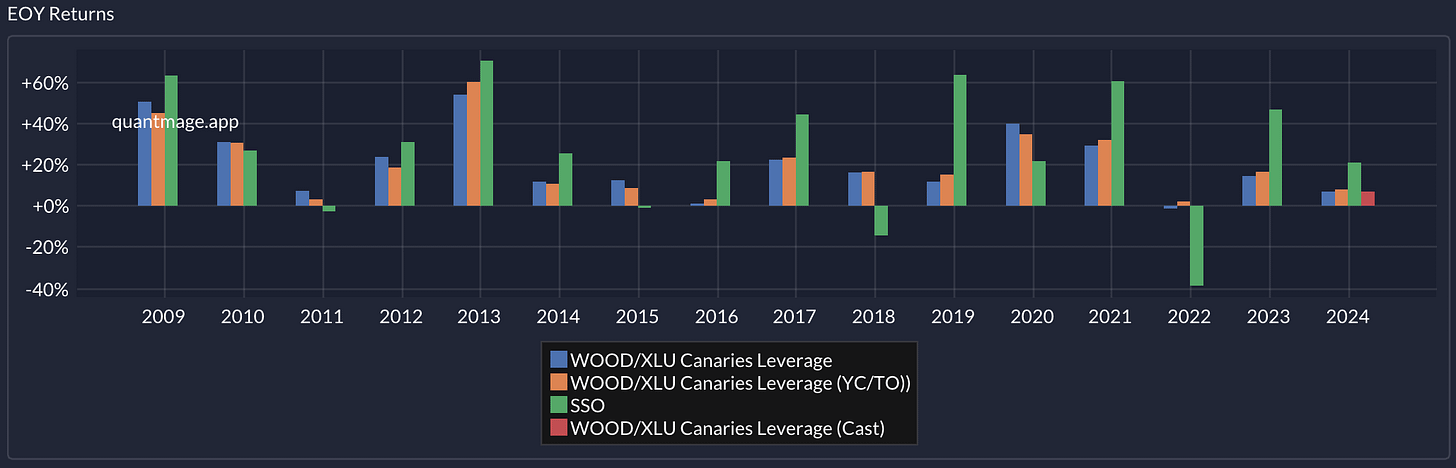

Here’s a breakdown of returns by year:

The strategy outperformed the benchmark in tough years like 2015, 2018, and 2022 but traded off some gains in good years like 2016, 2019, and 2023.

Live Results So Far

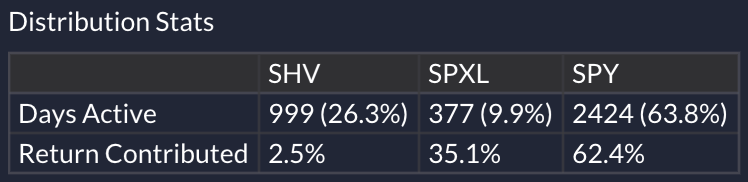

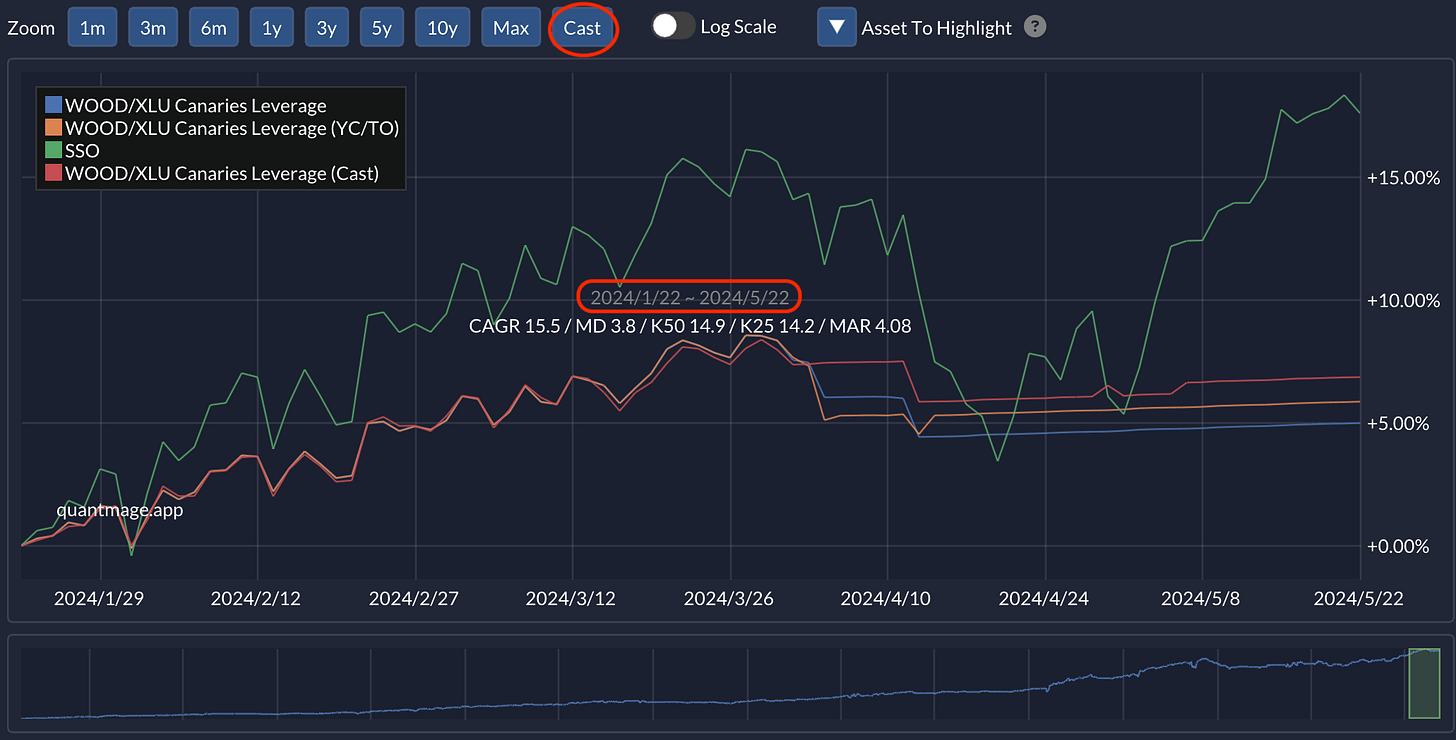

Historical performance is one thing, but how about live performance? Here’s a look at its 4-month live performance:

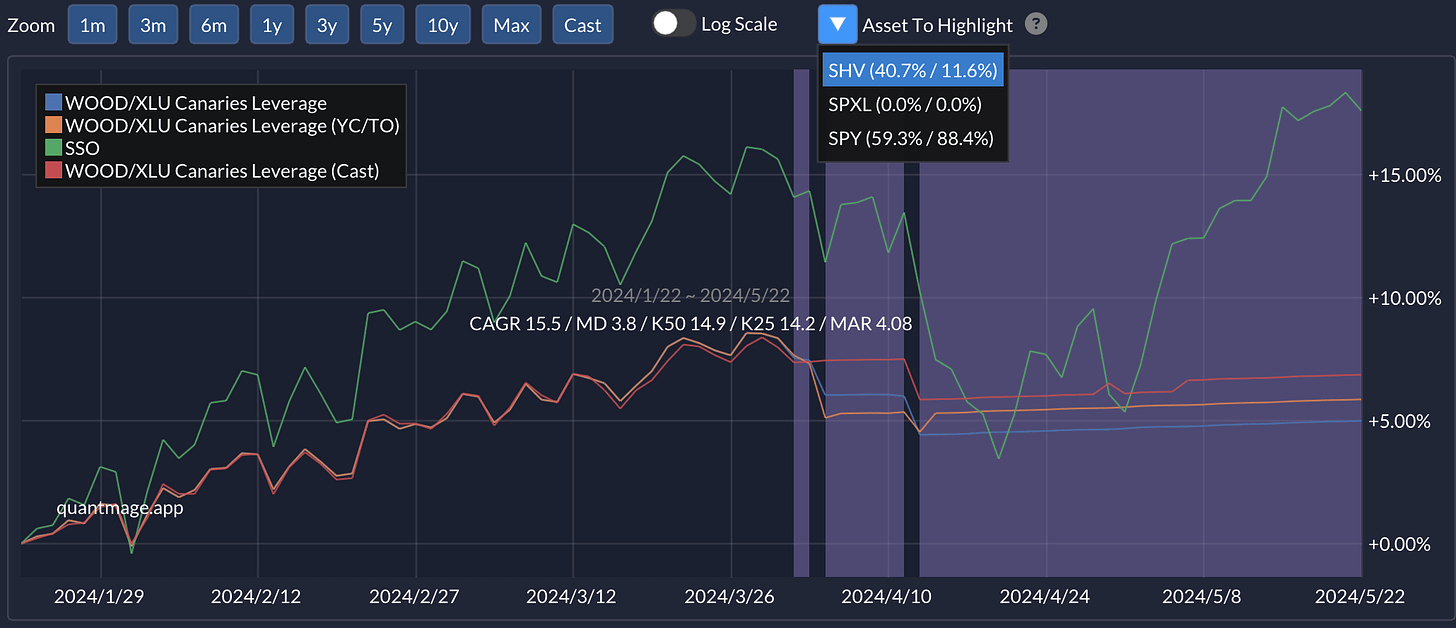

It showed a solid gain of 6.85%, which annualizes to 21.7%, as shown in the key performance metrics table. Notably, the live performance (red line) mostly aligned with the backtest (blue line), with a slight deviation around 4/3 that actually worked in our favor (and that’s why the 15.5% CAGR shown in the backtest plot is lower than the 21.7% annualized return of the live.) Luck probably has played a significant part for this nice profit (i.e. the market has been overall bullish for the period), but the strategy dodged the April drawdown that hit the benchmark hard. 😎 The canaries did their job, guiding us to the safety of short-term treasury bonds:

Takeaway

So, what do you think? 🤔 Do these canaries have some alpha up their sleeves? Is leveraging based on Aroon-Up signals a smart move? I'm throwing down the gauntlet - can you come up with ideas to boost this strategy's risk-adjusted returns even further? Drop your thoughts in the comments! 📝

As usual, the content here is purely informational. It’s not investment advice or a recommendation to buy or sell any stocks. Always do your own research and consider chatting with a financial pro before making any investment moves. Keep in mind that I may update or even retire this strategy in the future, and I might not be able to share these changes with you in time.

09/24/2024: The spell has been updated with the BDI canary.