JJ's Spell Series: Short SPY

A Market Short Strategy With a Positive Overall Return, a.k.a. Yieldy Put

It’s time to unveil another one of my live trading spells. This time, it’s a hedge strategy designed to zig when the market zags. But here’s the kicker—I’m aiming for a strategy that still yields positive returns overall. Crafting such a “Yieldy Put” isn’t easy, but I love a good challenge. So, I dove in with SDS, the 2x leveraged inverse S&P 500 ETF, as the core asset.

🚨 As always, what you read here is purely for informational purposes. This isn’t investment advice or a recommendation to buy or sell anything. Always do your own homework and consider chatting with a financial pro before making any investment moves. Remember, I may update or even retire this strategy in the future, and I might not be able to share these changes with you in time.

Algorithm

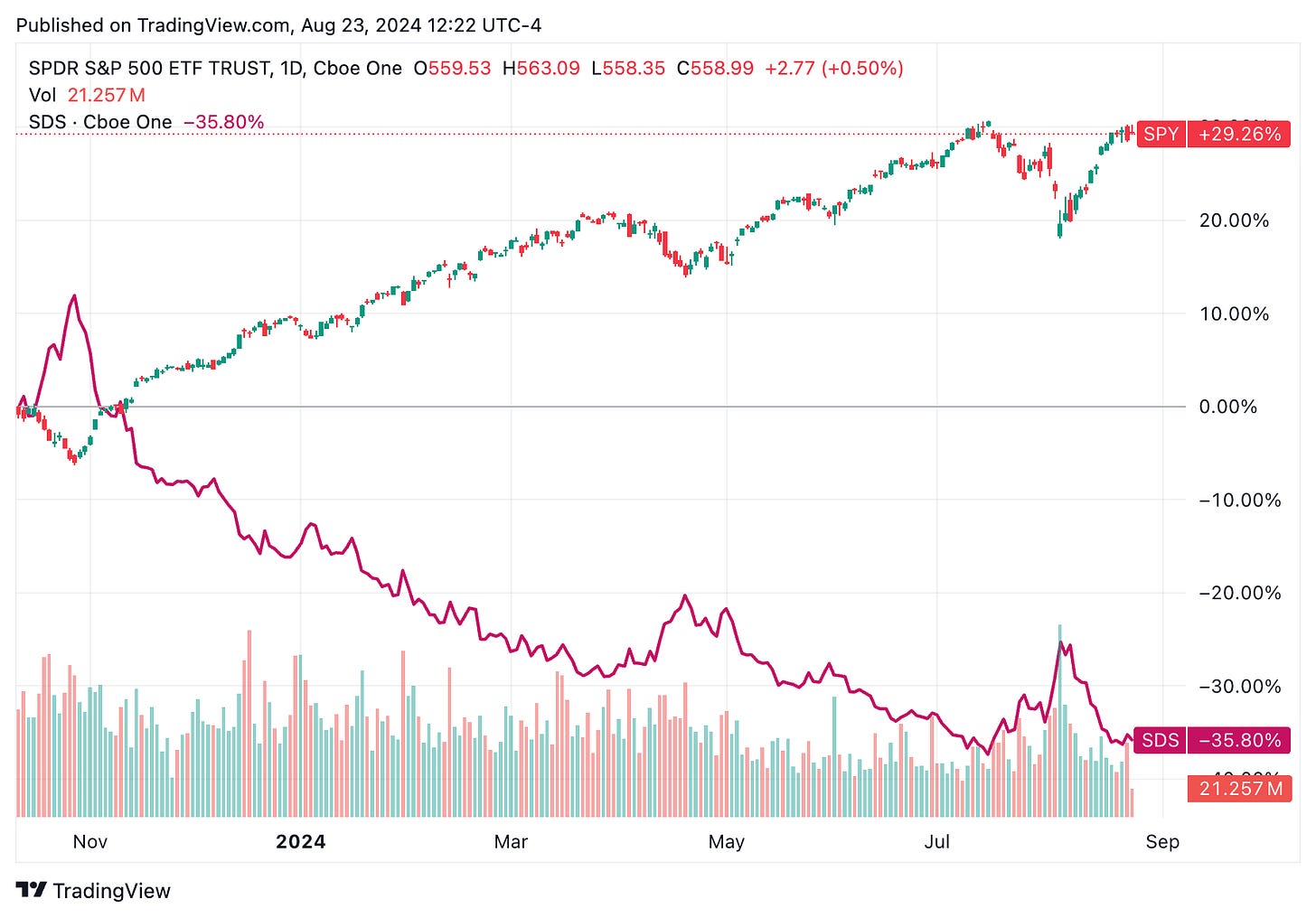

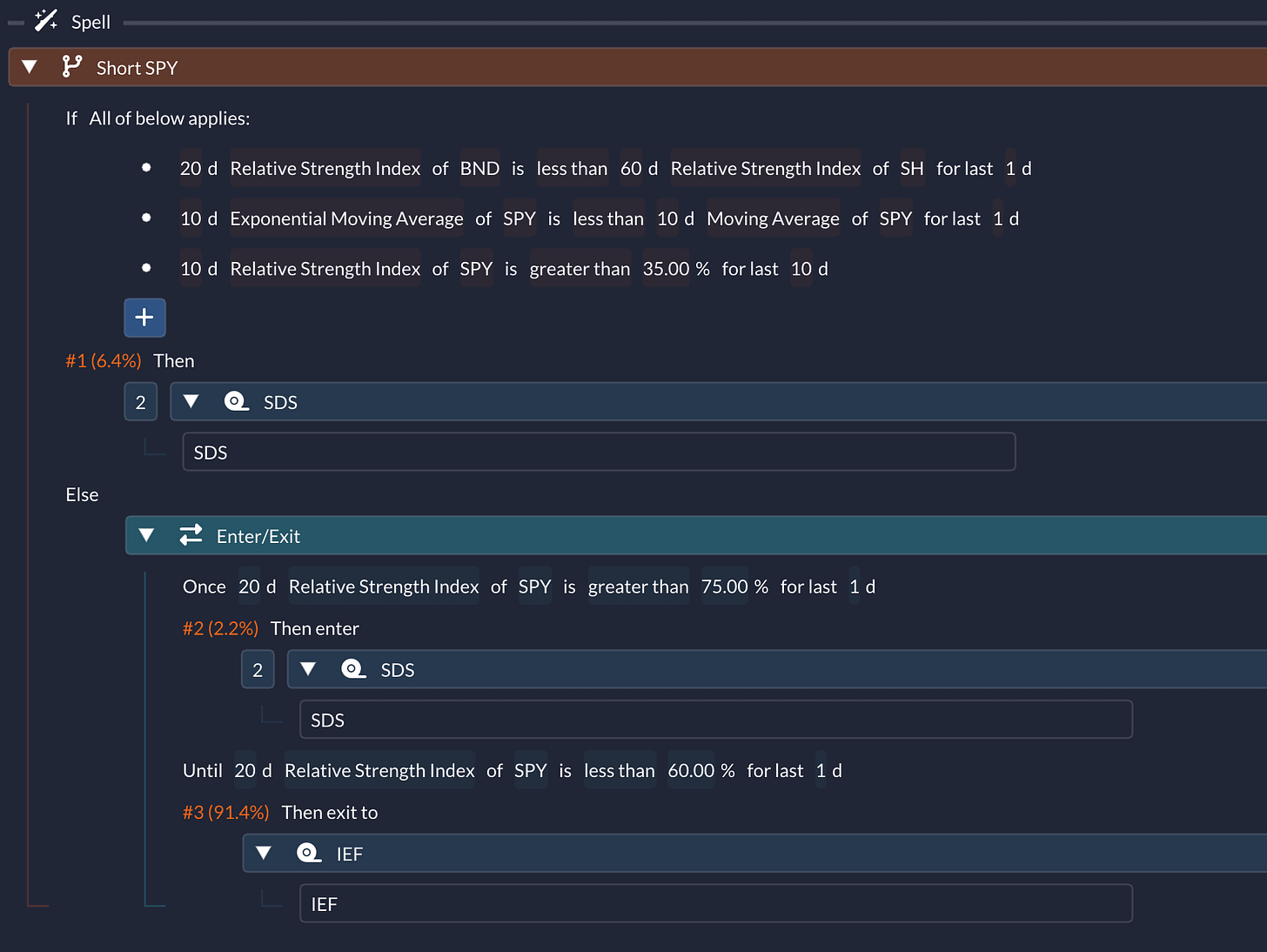

Over the long run, markets tend to rise, so holding an inverse ETF long-term is usually a bad idea, as shown in the TradingView chart above. To avoid costly reversals, you need to time entries and exits with precision. I use three signals: a BND vs. SH canary, a bearish EMA crossover, and a “no recent weakness” check. Let me explain the last one—if SPY has been oversold recently, it’s unlikely to dip again. So, SDS only comes into play when SPY’s 10-day Relative Strength Index has been above 35 for at least the last 10 days. The strategy only enters the inverse position when all three signals align.

Additionally, there’s an Enter/Exit block that looks to squeeze more out of SDS by entering when SPY’s 20-day RSI tops 75, signaling an overbought condition. Otherwise, the strategy moves into IEF, a mid-term Treasury bond ETF. Overall, in backtests, the strategy has only been in the short position 8.8% of the time (6.4% + 2.2%).

Historical Performance

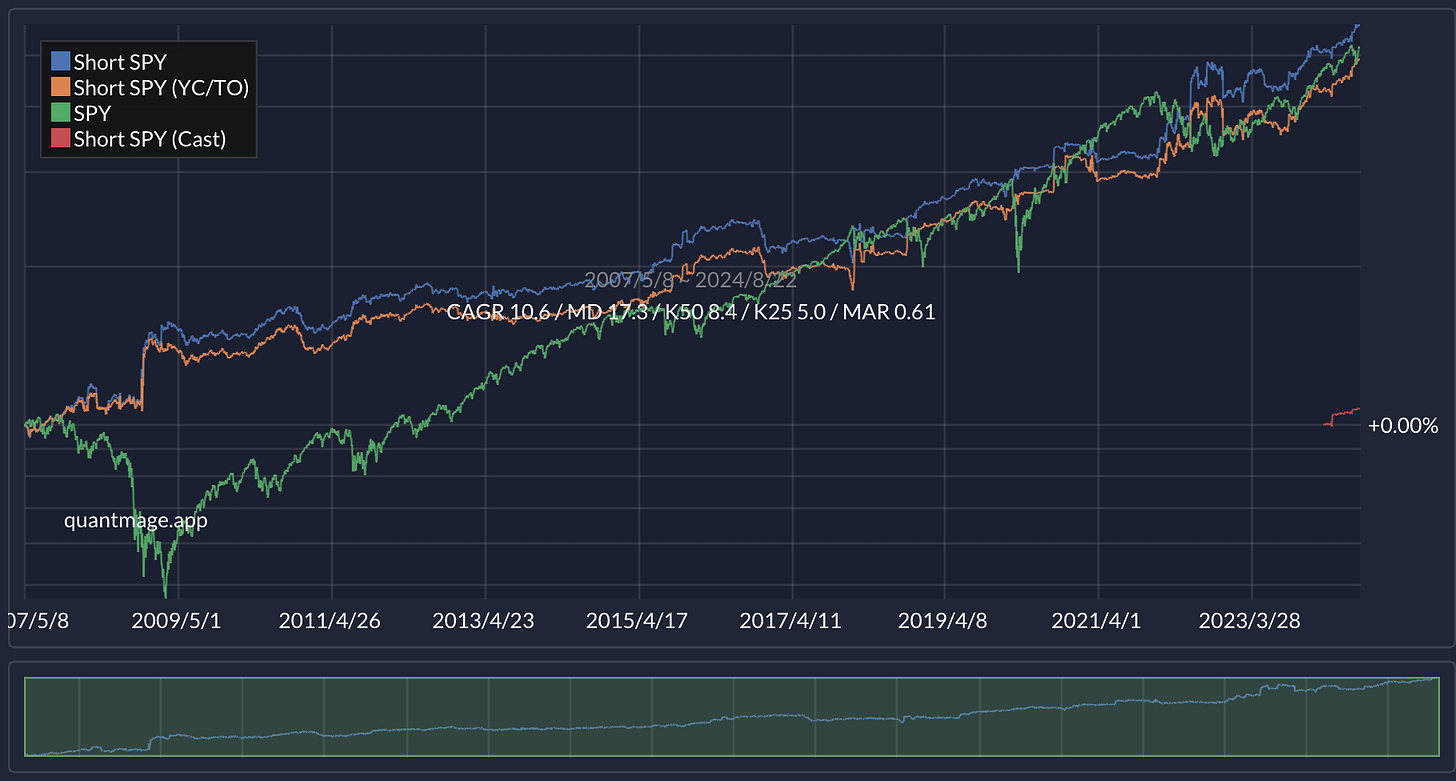

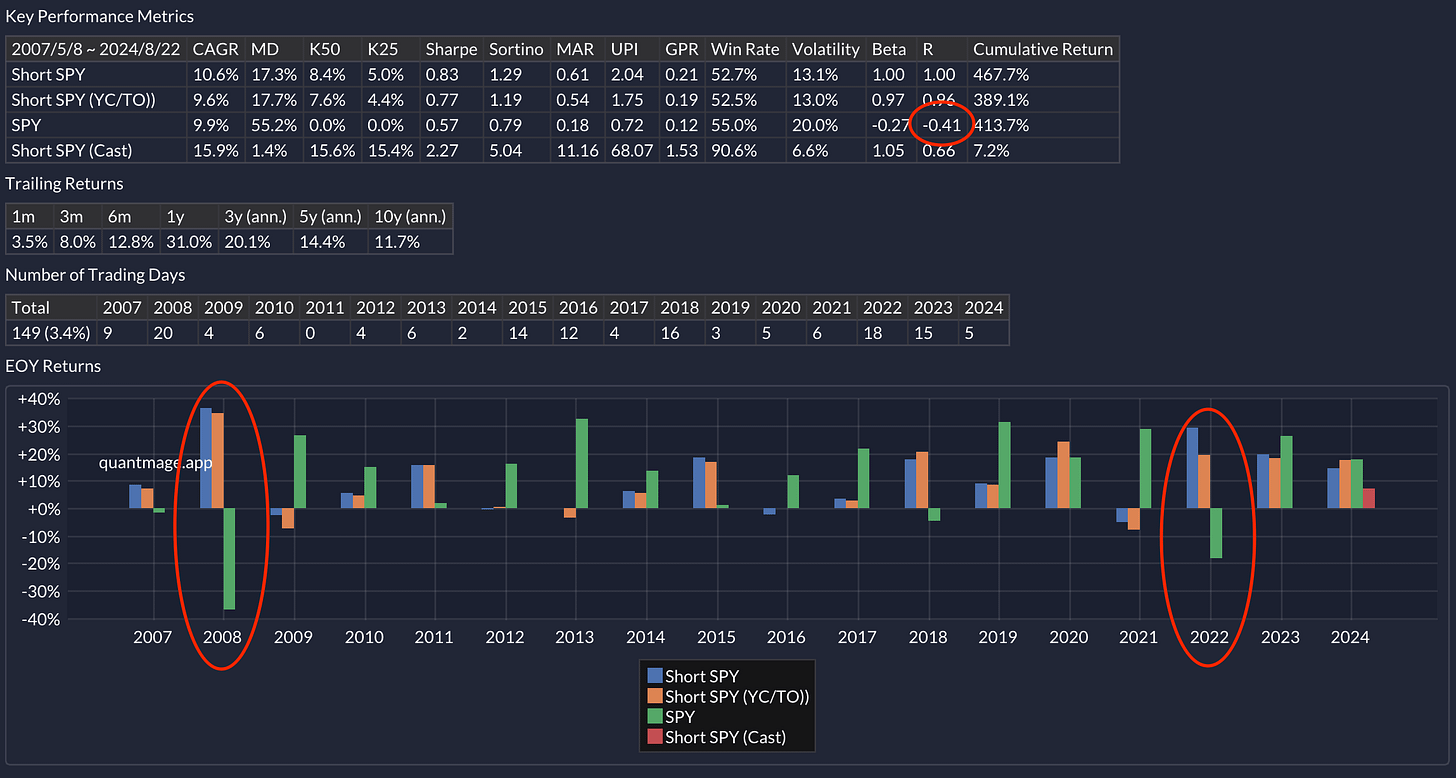

The strategy delivers a solid 10.6% CAGR with a 17.3% max drawdown over 17 years. In risk-adjusted terms, it easily outperforms SPY, which posted a 9.9% CAGR with a 55.2% max drawdown over the same period:

Notably, the strategy has a negative correlation with SPY at -0.41, making it a strong market hedge. You can see its success in the yearly return chart, particularly in downturns like 2008 and 2022. But being contrarian isn’t always easy—you’d likely have felt some FOMO and doubt during strong market years like 2009, 2012, 2013, 2017, and 2021 when the strategy struggled.

Bottom Line

What do you think? With over three signals and relatively few entry points, there’s always a risk of overfitting. Still, I love the “Yieldy Put” component, which is why it’s part of my current portfolio.

I’d love to hear your thoughts on this spell and any ideas you have for better yieldy puts! ✍️💡👇

I noticed that removing the 10d SPY EMA < MA signal improves CAGR w/o reducing MD. (10.6% --> 11.4%)

🤔 Perhaps this short-term momentum signal is often followed by mean reversion? So we don't necessarily want SPY trending down prior to holding SDS?