Canary Signal Series: Bond vs. Short

Comparing a bond ETF's momentum against a market short ETF's

Welcome to another installment of my Canary Signal Series! This time, we’re diving into a few simple but powerful RSI (Relative Strength Index)-based canaries shared by the discord community.

These canaries are built on the idea that it’s better to go risk-off when a market short ETF shows stronger momentum than a bond ETF. Since short ETFs tend to lose value (as the market climbs over the long run) and bonds are often seen as “smart money” and leading indicators of the macro economy, comparing their momentums can make sense for assessing market regimes.

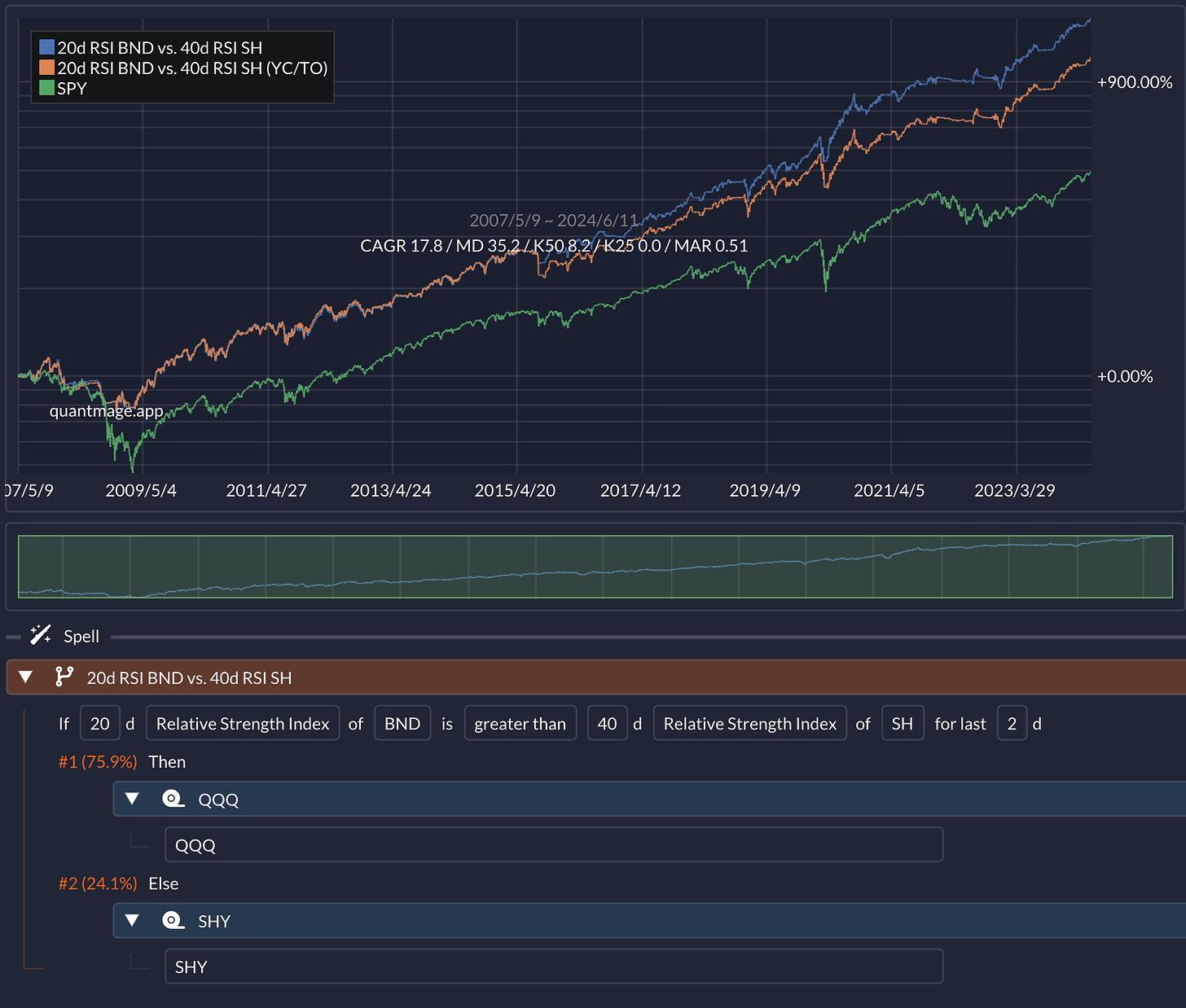

BND vs. SH

The first comparison looks at the 20-day RSI of BND (an aggregate bond ETF) against the 40-day RSI of SH (a short S&P 500 ETF). Note the longer RSI window for the short ETF, as a longer window tends to produce less volatile and extreme readings. This strategy goes to QQQ (a Nasdaq 100 ETF) when risk-on and to SHY (a short-term treasury bond ETF) otherwise. It checks their momentum over the last 2 days to get a more reliable risk-on signal.

This strategy shows a decent risk-adjusted return over a 17-year period and easily beats the benchmark, SPY. Explore it yourself here.

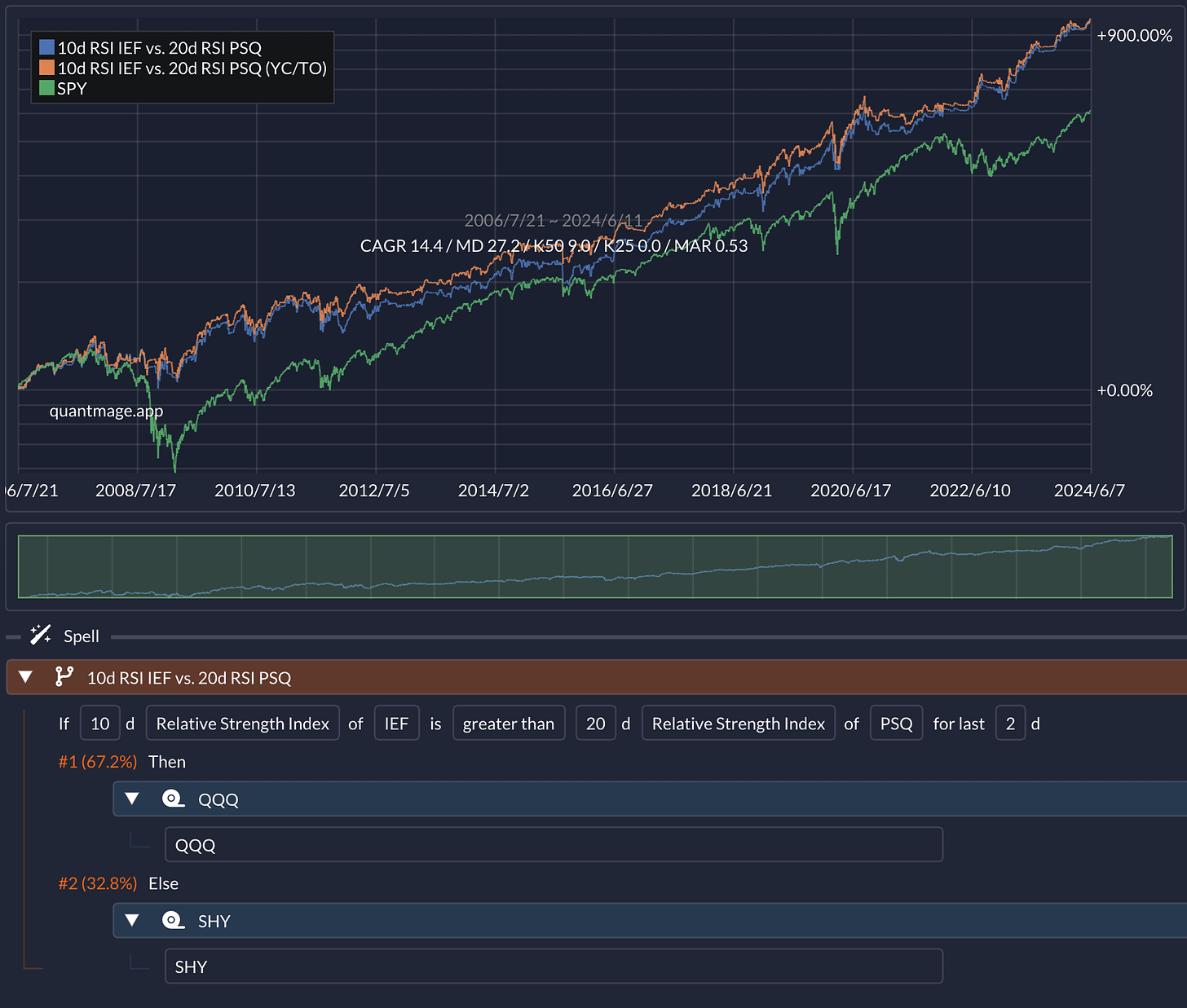

IEF vs. PSQ

This next one is similar but uses IEF (a mid-term treasury bond ETF) instead of BND and PSQ (a short QQQ ETF) instead of SH. It also uses shorter RSI windows.

Again, this strategy handily beats the SPY buy-and-hold with a better risk-adjusted return over an 18-year period. Give it a try here.

My Take

Overall, I like these canaries for their simplicity and the reasonable thesis behind them. They are part of some of my live strategies. What do you think? Does the thesis make sense to you, or do you smell the risk of overfitting?

As usual, the content here is purely informational. It’s not investment advice or a recommendation to buy or sell any stocks. Always do your own research and consider talking to a financial pro before making any investment moves.