Portfolio Update 11/15/2024 - A Small Gain 🔺

Strategic Mediocrity or Simple Mediocrity?

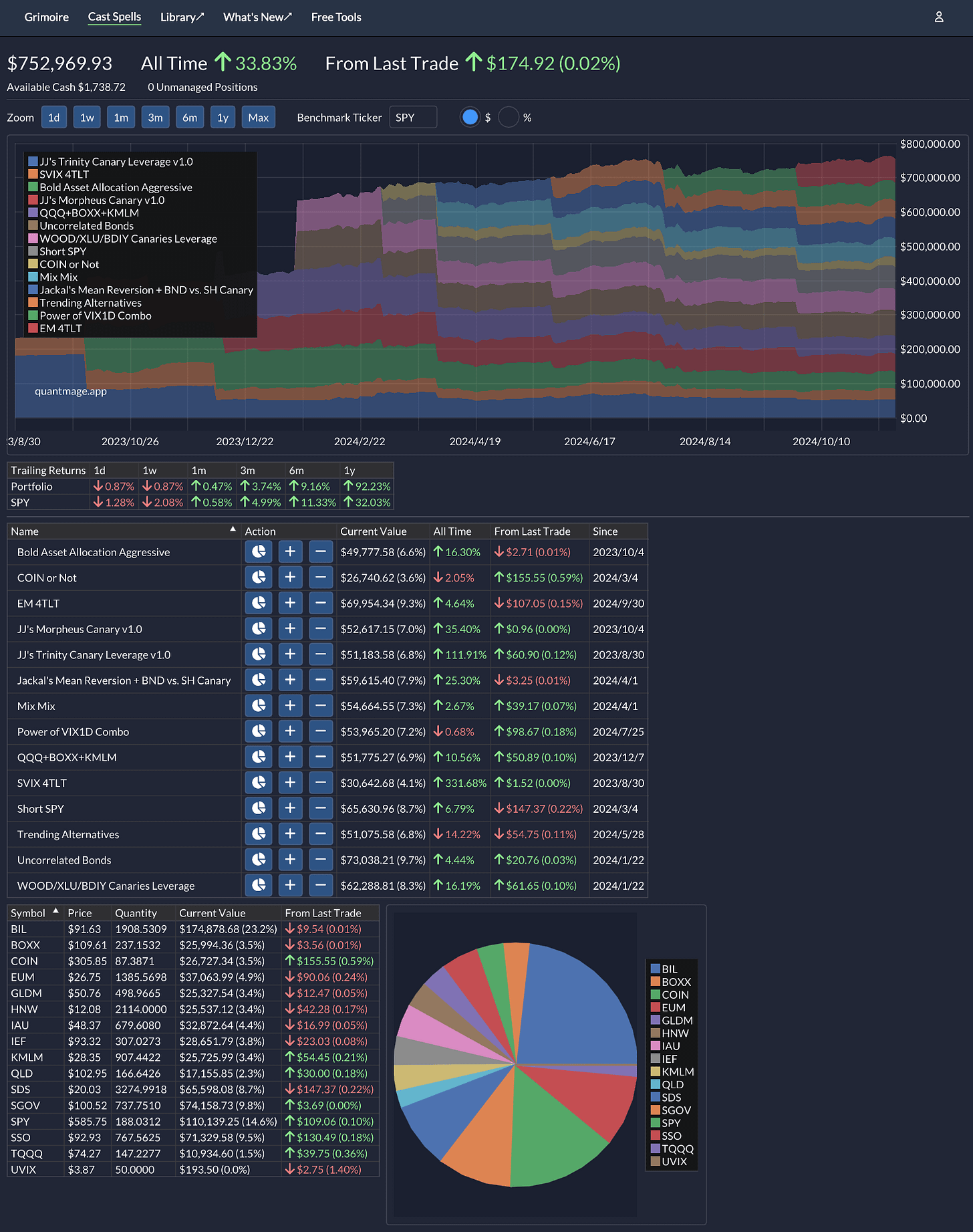

It’s time for another portfolio update! Since my last check-in, both the SPY (S&P 500 ETF) and my portfolio have edged up by about 1%. Over the trailing twelve months from November 15, 2023, my portfolio has achieved a respectable gain of 25.6%, and I’m genuinely pleased with that. However, the SPY outpaced us with a 30.3% gain during the same period.

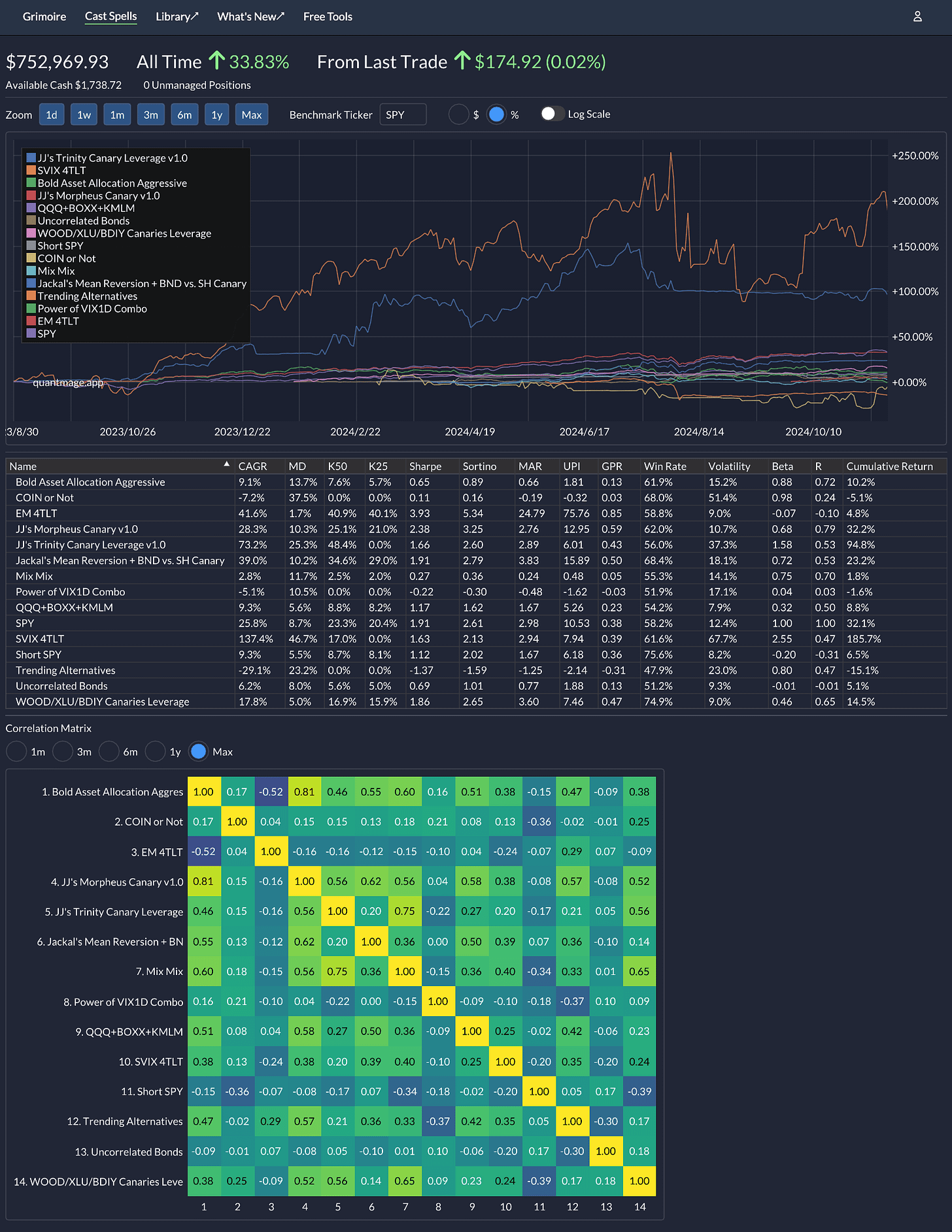

You might be thinking: what’s the point of all these systematic strategies if they can’t beat a simple buy-and-hold approach with the SPY? Fair question. My perspective is what I like to call Strategic Mediocrity. If you’re significantly outperforming the market when it’s on a bullish run, chances are your portfolio is either too concentrated or leveraged—which can be risky.

My aim is to have a portfolio that might not always outshine the market during boom times but is poised to outperform during tougher periods—like the extended drawdowns we saw in 2022. Only then can we truly assess whether my approach is strategic mediocrity or just plain mediocrity! 😅

On another note, I’ve made minor updates to the Power of VIX1D Combo and Short SPY strategies. Also worth mentioning is that COIN or Not has clawed back most of its losses thanks to the recent Bitcoin surge following the election outcome, though it’s not in positive territory just yet.

Here’s hoping both your portfolio and mine are ready for the second term of the elected president! 🙏

I also am not so worried about some underperformance when SPY is fat and bouncy. Even including some cash (which to me remains the best hedge) seriously undermines ones efforts to shine, if that was what one intended to do.

The name of the game (for me) is a) compounding, preferably in a heavy-duty manner (more than 10% CAGR both mid- and long-term). And b), surviving.