Portfolio Update 10/15/2024 - Still Underperforming the Market 📈⏳

Patience as an Edge

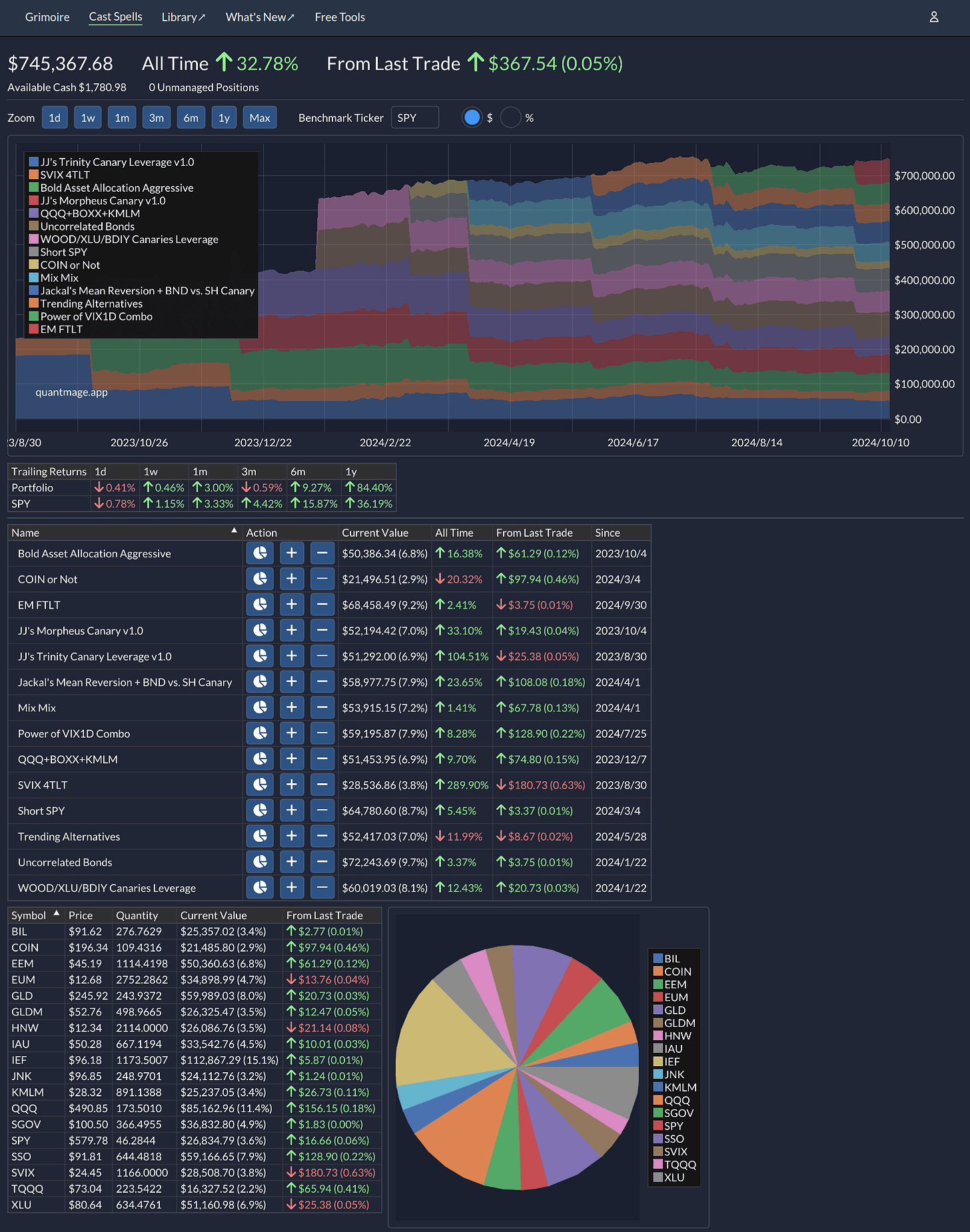

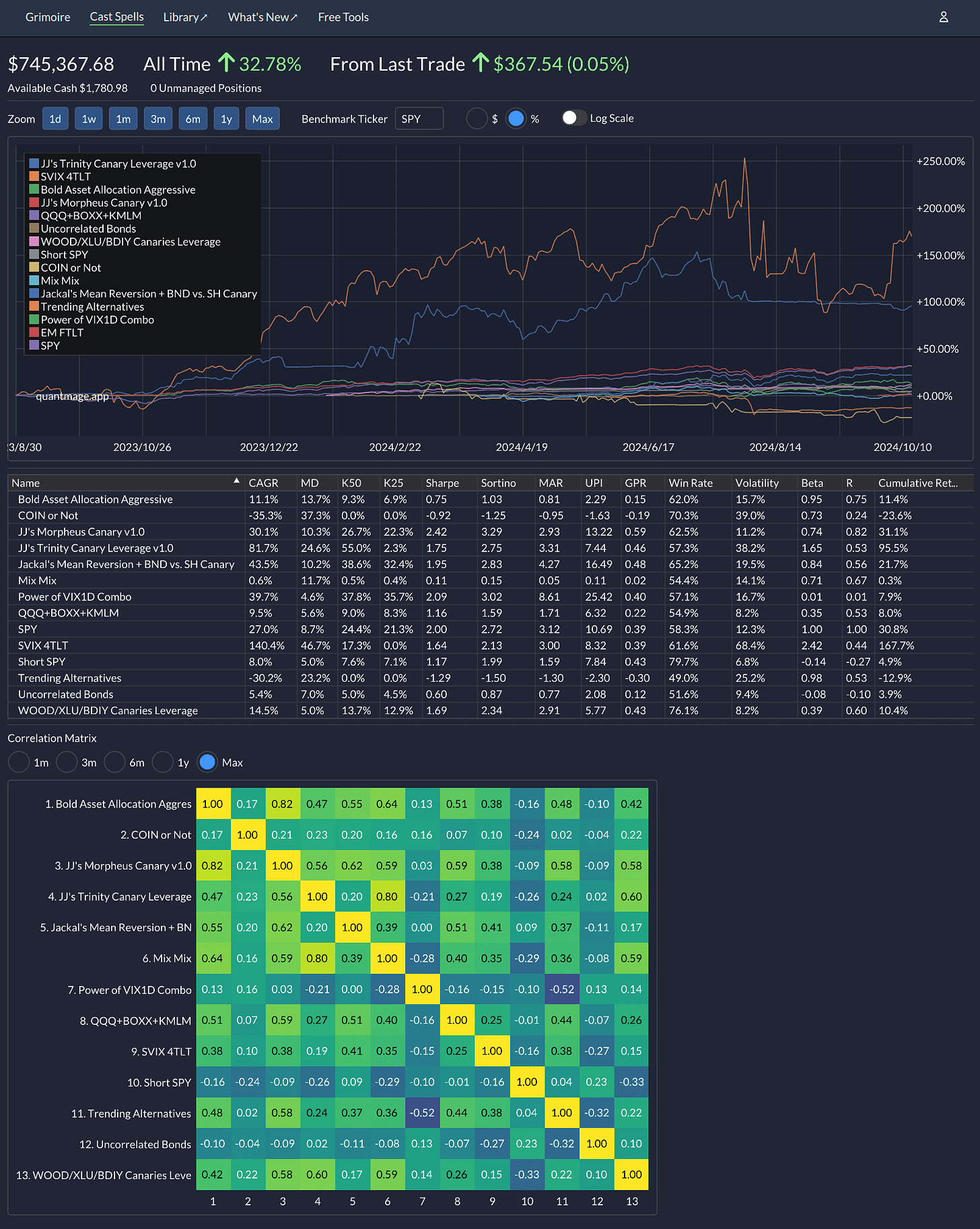

Time for another portfolio update! Since my last check-in, my portfolio eked out a modest gain of 0.58%, while the SPY surged ahead with an impressive 3.16% during the same period. Despite uncertainties swirling around elections, potential rate cuts, China's stimulus measures, and various geopolitical tensions, the U.S. market just keeps climbing.

I've made some changes to my portfolio. I decided to retire TQQQ or Not, as it deviated too much from its expected performance. In its place, I've introduced a new strategy called EM FTLT, based on ideas I shared in my post on asset rotation. Additionally, I've tweaked QQQ+BOXX+KMLM and Trending Alternatives to squeeze a bit more performance out of them by applying concepts from my latest post on momentum crashes. The WOOD/XLU/BDIY Canaries Leverage has also been updated to incorporate the Baltic Dry Index canary, as the new name suggests.

I'll be honest—it's tough watching your portfolio lag behind the market, especially after pouring so much time and effort into it. But I remain convinced of its long-term potential. Traveling this week has reminded me that making money isn't the end goal; it's a tool to achieve what truly matters. It's important not to lose sight of the bigger picture. Reflecting on where my portfolio was exactly a year ago when this journey started also puts things into perspective.