Hey there! I'm JJ. While I've clocked in hours as a software engineer (think video games and autonomous driving simulations), the stock market caught my eye around 2015. That was the year I watched my stock options transform into public shares of a parent company. Suddenly, I was playing with some real seed money. Downloaded Robinhood, started small, and as confidence grew (let's be real - the 2010s bull market helped), I invested more. Fast forward to the 2020 Covid downturn and the 2022 bear market. Whew, talk about a reality check!

I've been tracking my net worth and each investment's performance since November 2019. I've had my moments – those knee-jerk reactions and impulsive decisions (haven't we all?). Given my background, I thought, "Why not code my own investment algorithm?" But it's never that simple, right? Reliable daily price data, dividend adjustments, stock splits... they all posed their own challenges. And honestly, most of the commercial tools out there? They didn't cut it for me.

That's when the idea of QuantMage was born. Creating an algorithmic and quantitative stock investment tool from scratch, especially with the Bay Area's cost of living and a family to consider, was risky. But with some savings set aside and an escape plan (going back to regular employment), I took the leap. Worst-case scenario? I'd have a shiny new tool for my investments.

But here's the thing: no tool, no matter how fancy, works magic on its own. Hence, this blog/newsletter – is my raw, unfiltered journey as I navigate the stock world with QuantMage. I believe it's crucial for creators, especially in the finance world, to 'walk the talk'. This is me, doing just that.

Now, for the juicy details:

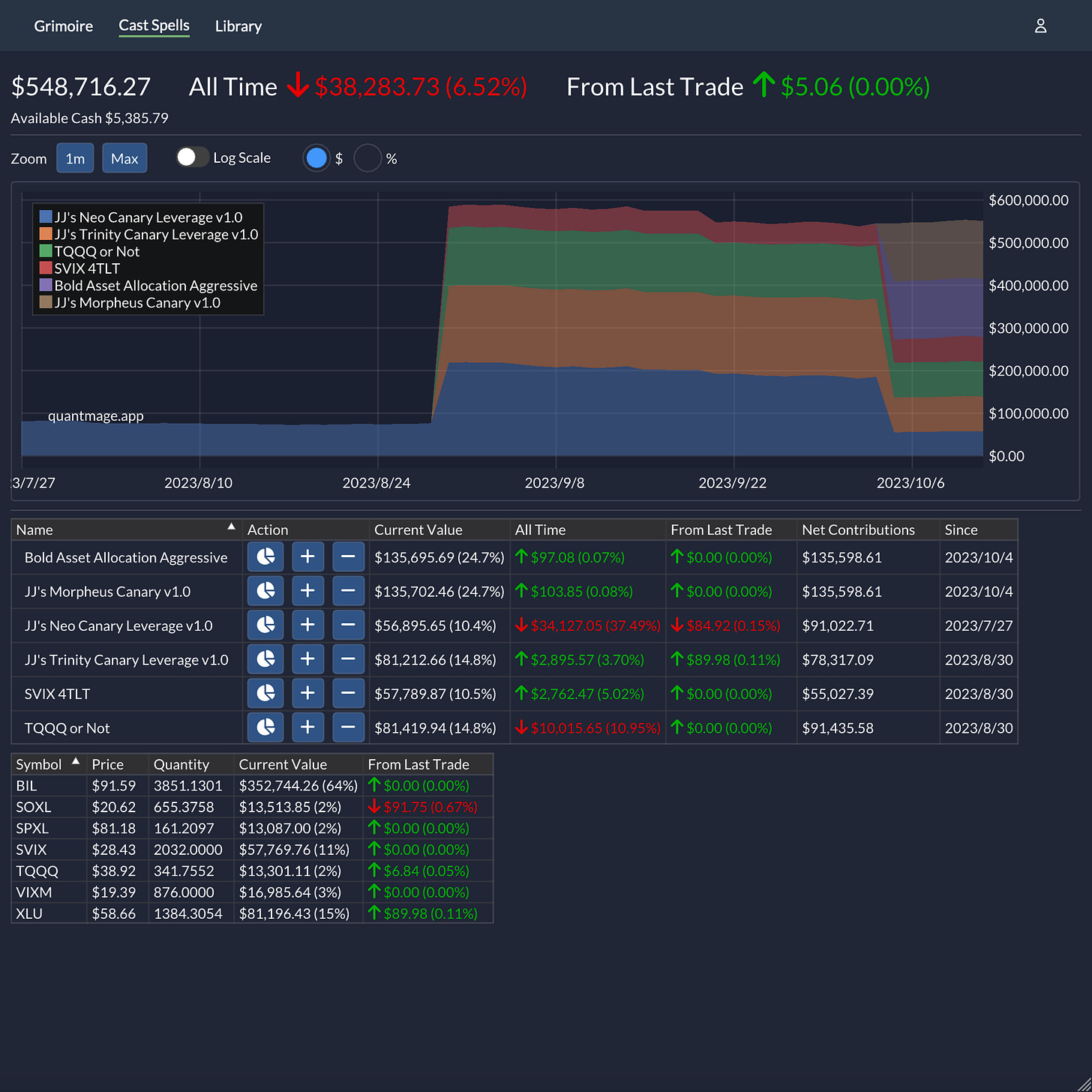

I kicked off with QuantMage at the end of July. Got serious by August's end and did some rebalancing after integrating two new strategies (or "spells", as we call them in QuantMage-speak) by early October. As of 10/12/2023, I'm down 6.52%, compared to SPY's 4.2%. Yep, I'll be upfront about the lows and highs. Stay tuned as I share more about my evolving investment strategies and the continuous growth of QuantMage.

Until next time, thanks for joining this ride!