Portfolio Update 07/15/2025 - Firmly Risk-On 🐂

What might stop this train?

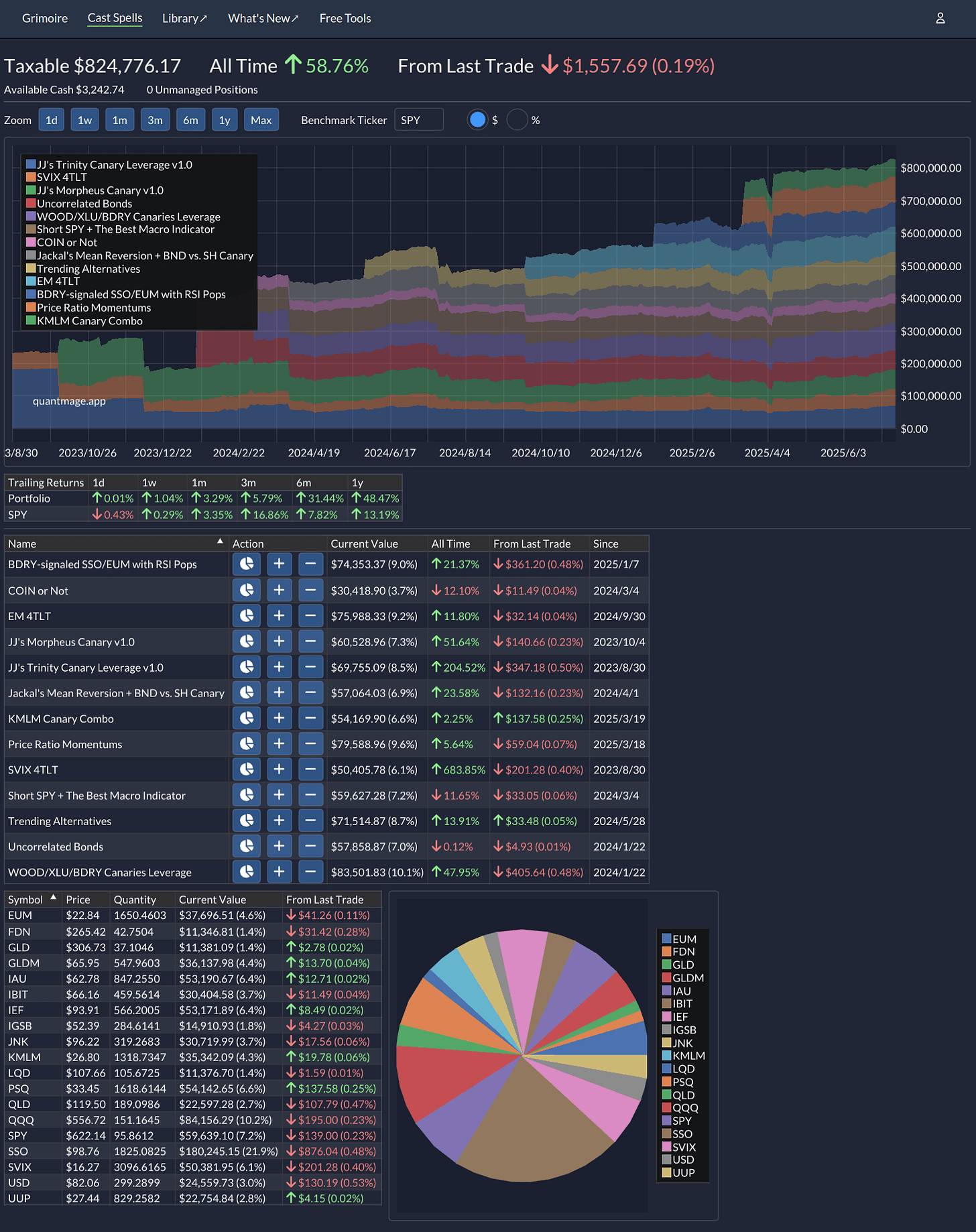

Since the last update, my portfolio climbed +3.8%, just a touch behind SPY’s +4.2%. Still, I’m happy to see it break into the $800K range—finally. Let’s see how long it stays there.

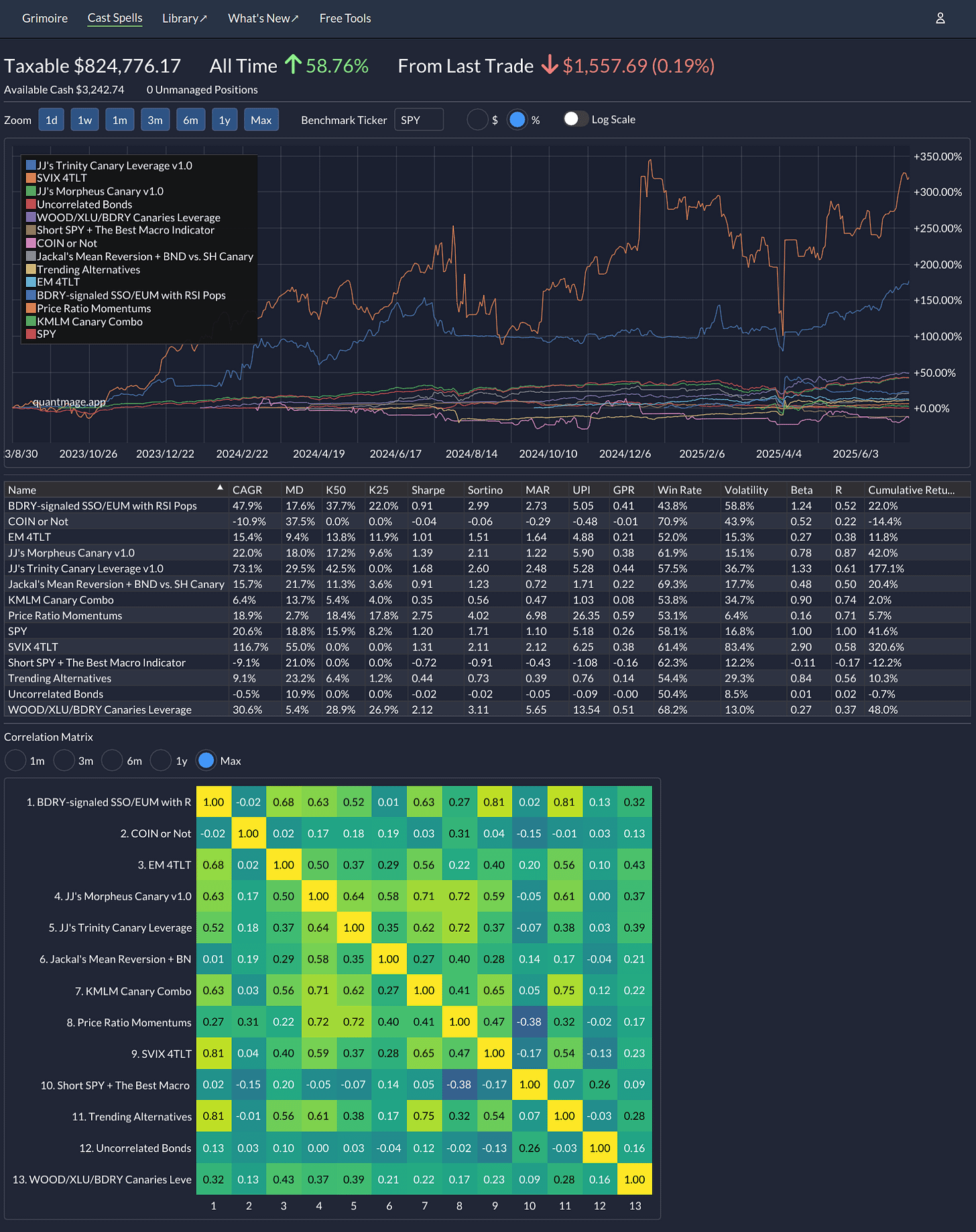

The market’s strength has been surprisingly persistent. Geopolitical noise? Macro headwinds? The market doesn’t seem to care. Both of my main canary signals are flashing green, and a few others I monitor are also in clear bullish territory. For now, risk-on is the name of the game.

I also gave COIN or Not a much-needed revamp. It had been lagging, and I debated sunsetting it entirely. In the end, I opted for a major simplification—stripping it back to the core thesis. Let’s see if leaner performs better.

As for the rest of the portfolio—no major changes. Sometimes, not tinkering is the best move.

And as for this bull train? Something will derail it eventually. But the fiscal train? That one barrels on, seemingly unstoppable. Something to chew on as you think about risk—and what kind of tracks we’re all riding.

Stay nimble out there.

Thanks for providing a great strategy on BTC. I have been searching for a good one. I assume when you say the Percentage Price Oscillator is greater than 0%, you mean the PPO line, not the PPO histogram. Is this correct?

Incidentally, the YouTube channel Financial Wisdom has a strategy in the same vein. He requires the weekly MACD histogram to be positive, the MACD signal line to be above 0, and then uses the daily MACD to enter and a stop loss put at the day's low when the daily MACD histogram turns red. I am not sure how that strategy measures up to yours.

Thanks. :)