Riding the Bitcoin Wave with QuantMage: A Daring Adventure

Tackling the Bitcoin Phenomenon with a Mix of Strategy and Nerve

Bitcoin's back in the spotlight, and it's impossible not to notice. With the buzz around spot ETFs and the anticipation of the halving event, the OG cryptocurrency is on everyone's radar. This excitement nudged me to explore tactical Bitcoin investment strategies using QuantMage. Here's the scoop.

📣 Please remember, I'm just sharing insights, not financial advice. Do your due diligence or consult with a finance professional before jumping in, especially considering the roller coaster ride that is crypto investing.

Seizing Opportunities with Precision

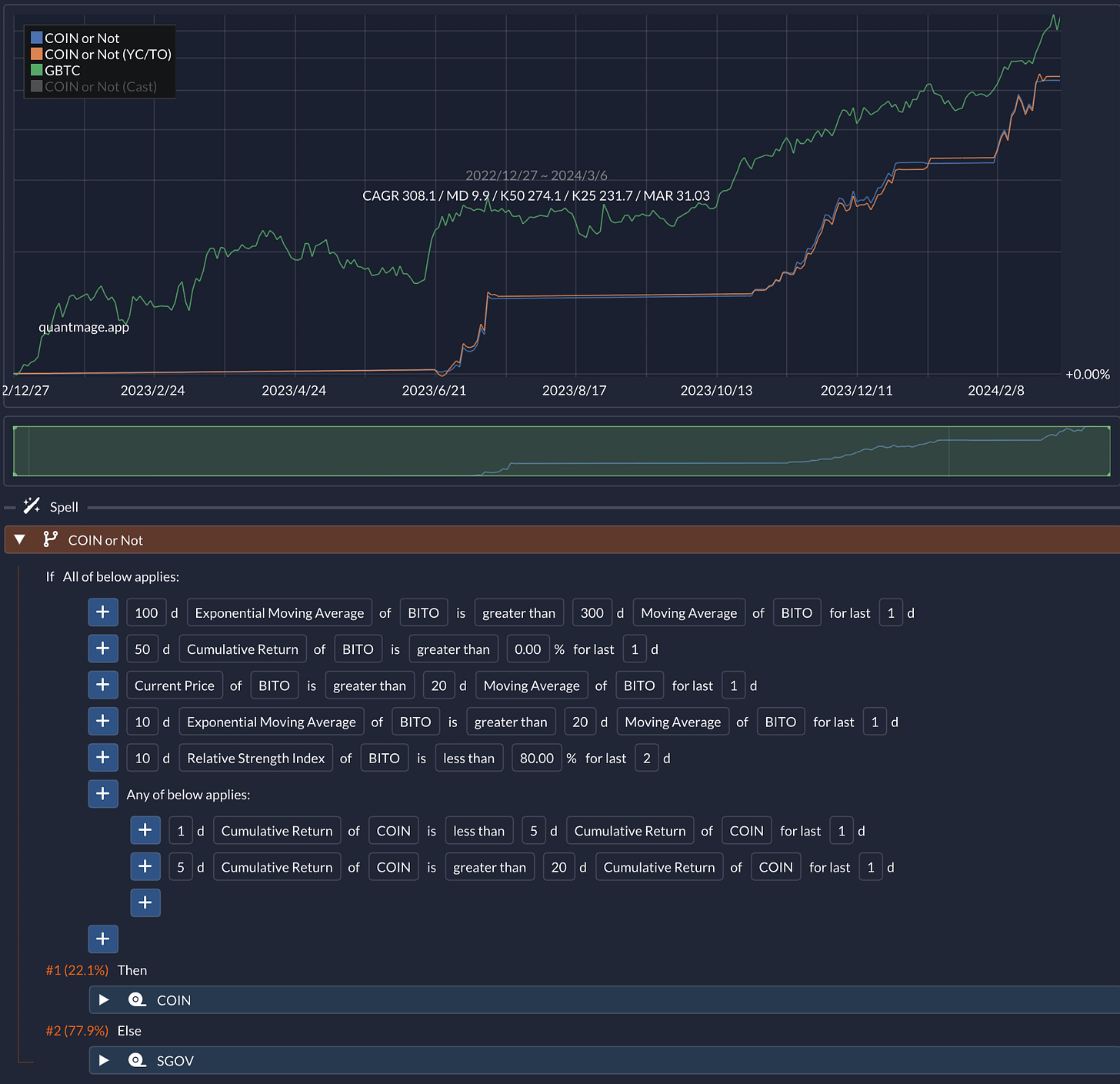

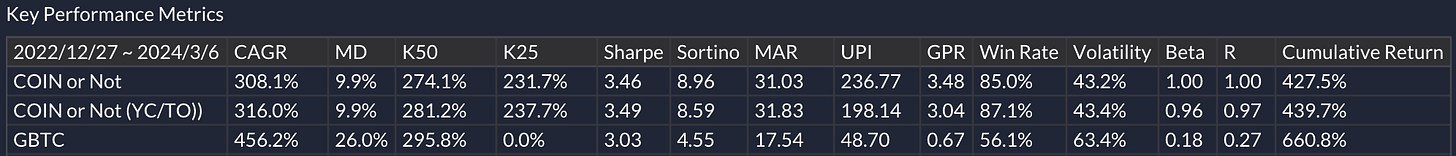

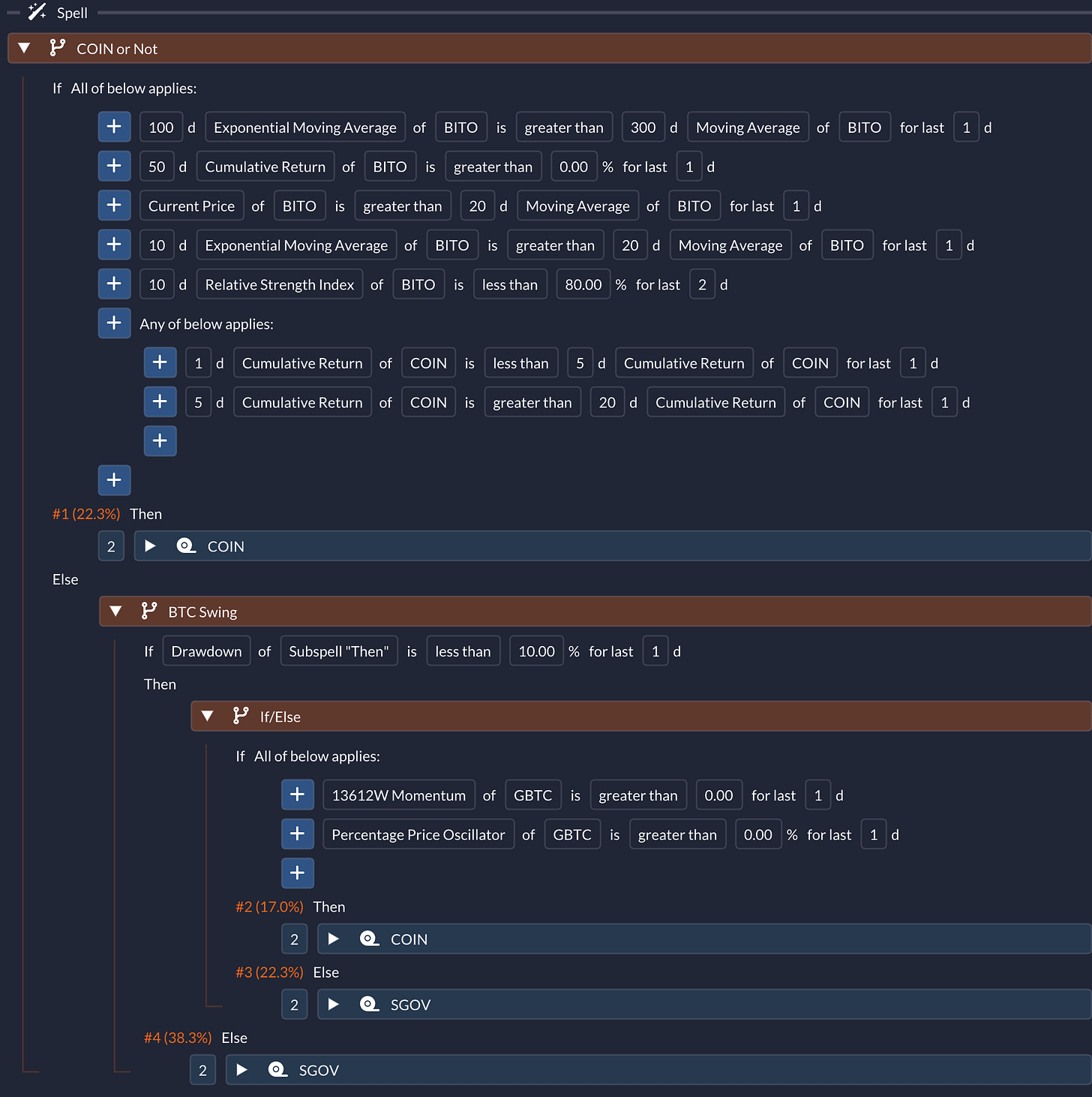

A strategy that caught my eye involves trading COIN (Coinbase stock) as a leveraged play on Bitcoin, guided by the movements in BITO (Bitcoin futures ETF). This gem came from a brilliant Discord community I've mentioned before. Adapting this strategy to QuantMage has shown promising, albeit preliminary, results:

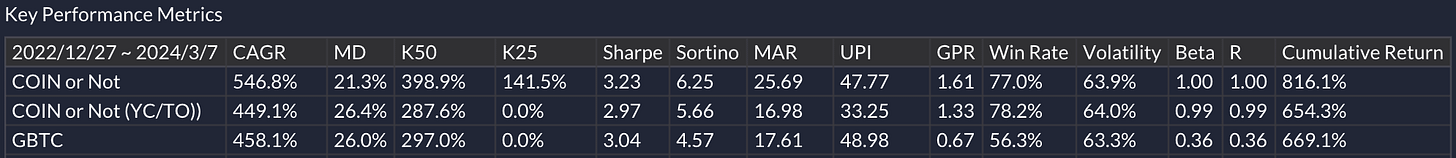

Here's the gist: Dive into COIN when the stars align with bullish momentum, or switch to SGOV, a short-term treasury bond ETF, when signals are mixed. Given the ad hoc specificity of the signals used above, I’m pretty sure that there is an indelible amount of data mining bias going on. Its track record is too short (just over a year) to gauge its reliability, too. Still I liked its logical simplicity. It boasted a jaw-dropping 308.1% CAGR with a max drawdown of just 9.9% and a volatility of 43.2%. Although the annual return doesn't quite outshine a simple buy-and-hold strategy with GBTC over the same period, it offers a smoother ride with significantly lower volatility and drawdown. GBTC is used as a benchmark here because it’s the only spot bitcoin ETF that has a meaningful track record at this point, even though it hadn’t accurately tracked Bitcoin’s price movement until it was converted to a spot ETF of late.

Swing with a Safety Net

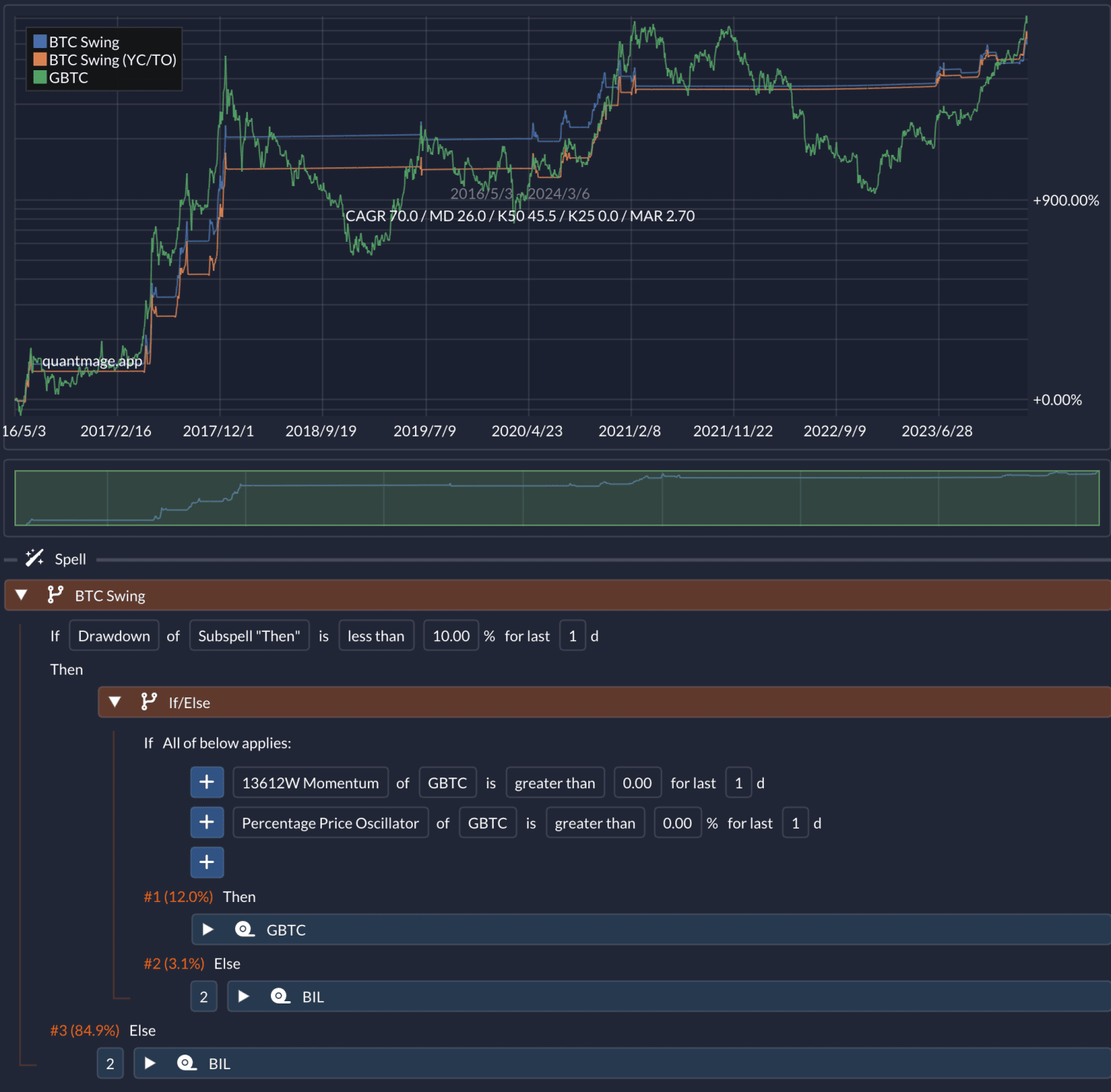

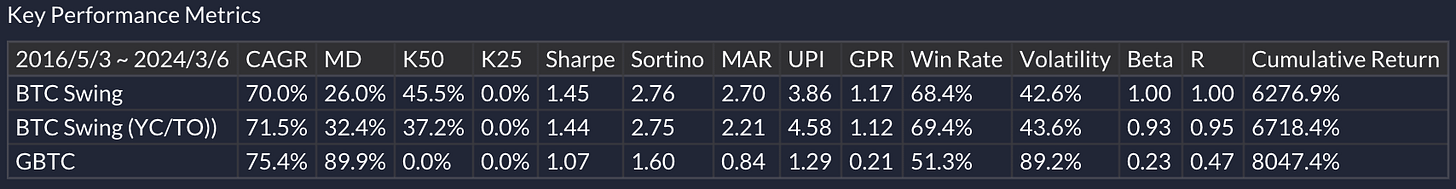

I also devised a simpler swing trading strategy for Bitcoin, focusing on GBTC for its more extended historical data. This strategy uses a 10% trailing stop loss as a safety cushion:

The first If/Else achieves the trailing stop loss by combining the concept of a subspell with Drawdown indicator in QuantMage. In essence, this strategy monitors a pair of momentum indicators: 13612W Momentum and Percentage Price Oscillator. If they signal a go, it's all in on GBTC; if not, or if a 10% drawdown is breached, it shifts to BIL (since SGOV’s history is too short) for safety. Over eight years, this approach yielded a respectable 70% annual return, which is slightly less than GBTC’s for the same period, but significantly reducing max drawdown and volatility, while only engaging in GBTC trades 12% of the time. This would be much more realistic performance you can expect for such a tactical approach through the multiple highs and lows of Bitcoin's market cycles.

Merging Strategies for an Aggressive Stance

By combining these strategies — swapping GBTC for COIN in the swing trading model and integrating it into the first strategy — I've crafted a more aggressive approach:

This fusion ups the ante, pushing the CAGR to 546.8% but also increasing the risk profile with a higher max drawdown of 21.3% and a scary volatility of 63.9%. If you compare its performance numbers against GBTC’s, you’ll note that they are mostly in the same ballpark. It poses the question: Is tactical market timing worth the hassle if it doesn't clearly outperform a straightforward buy-and-hold strategy in a risk-adjusted basis? We need to keep in mind the unfortunate fact of the track record being very short here and basically containing one bull period only. Market timing can really excel when things are not simply going up and right.

Optimism with a Side of Caution

I remain bullish on Bitcoin's long-term prospects, with industry experts like Lyn Alden providing well-reasoned insights into its potential. The current trends and historical patterns suggest there's more runway for growth, but I'm also acutely aware of the risks, particularly when using COIN as a proxy for Bitcoin. Regulatory shifts or company-specific issues could introduce additional volatility, which is why I've only allocated a small portion of my portfolio to this experimental strategy.

Investing in crypto carries significant risk, and it's crucial not to invest more than you can afford to lose without impacting your lifestyle. As we navigate these uncharted waters, staying informed, adaptable, and cautious will be key to harnessing the potential of Bitcoin and the broader cryptocurrency market.

In conclusion, while the allure of high returns is tempting, the path to crypto investment is fraught with volatility and uncertainty. Always approach with a strategy, a backup plan, and, most importantly, a clear understanding of your risk tolerance. Let's ride this wave with eyes wide open.