Portfolio Update 06/15/2025 - Moving Sideways

In the Chop Zone

Can you believe we’re almost halfway through 2025? Time flies when you’re watching your portfolio do the cha-cha – one step forward, one step back, and a whole lot of sideways action.

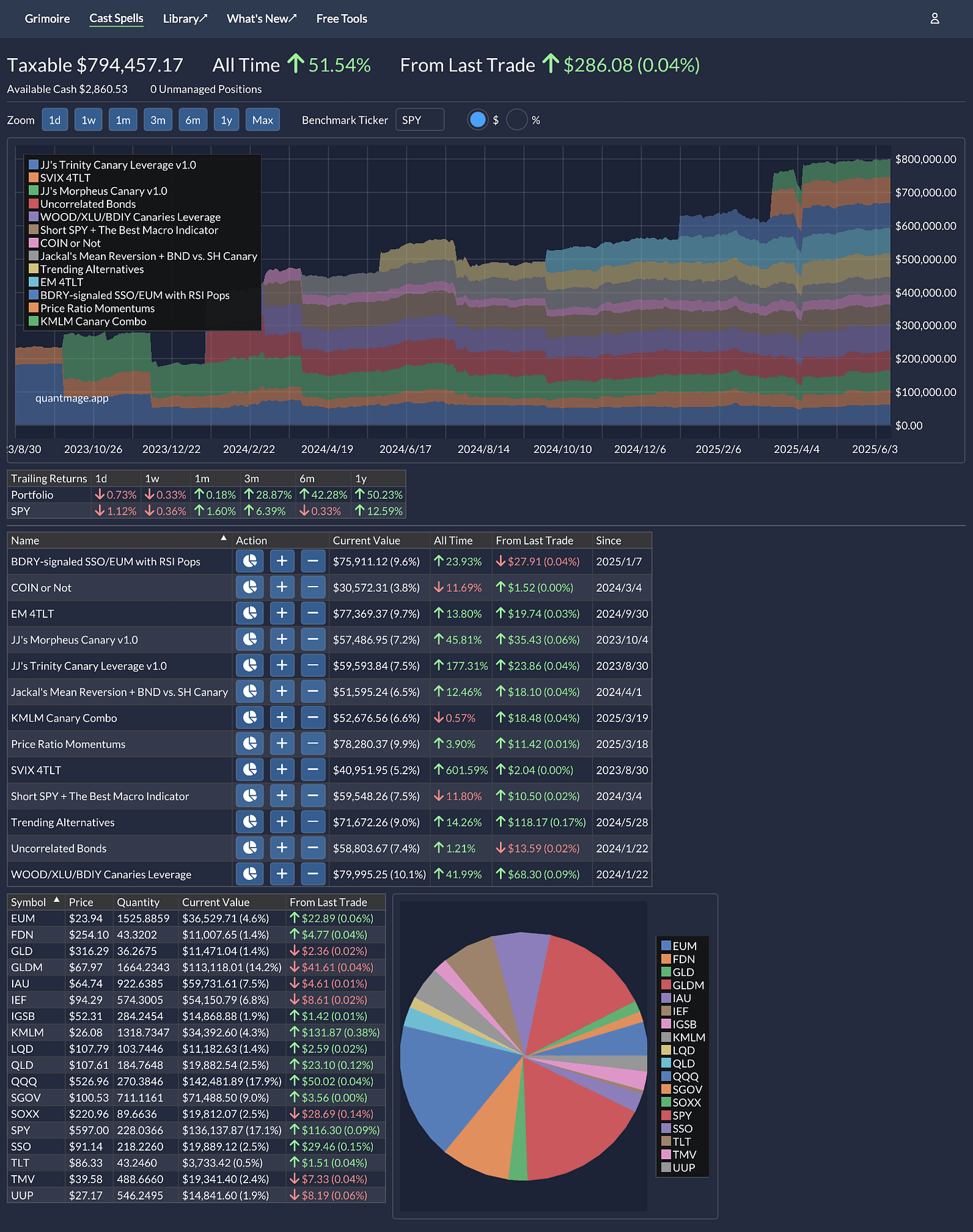

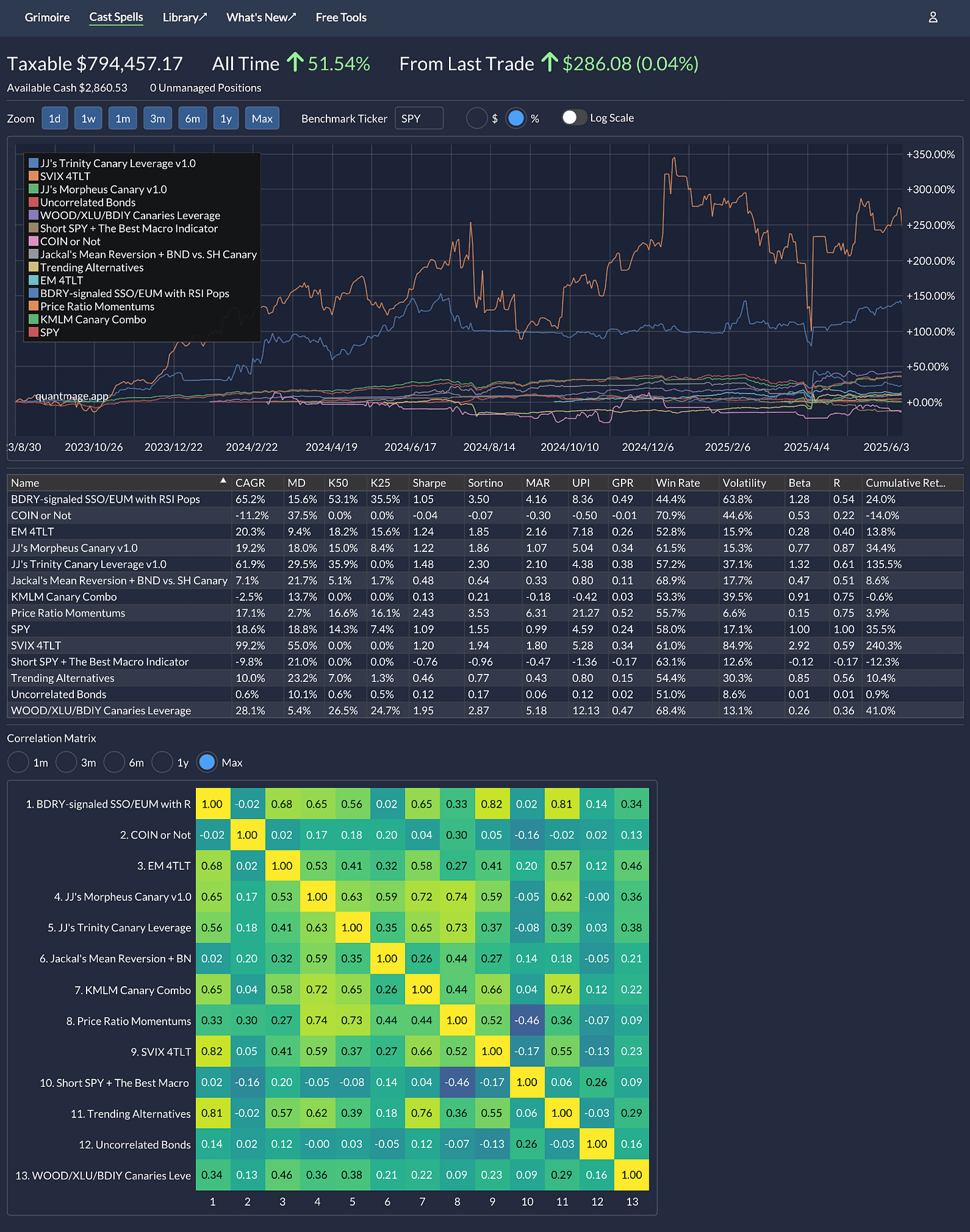

This month’s numbers tell a familiar story: my portfolio gained a modest 0.3% while the SPY edged ahead with 1.1%. Nothing to write home about, but hey, at least we’re in the green. The portfolio did briefly flirt with the $800k mark for the second time (cue the champagne emoji), but Friday’s geopolitical jitters brought us right back down to earth. The only change to the lineup was a minor adjustment to my Short SPY + The Best Macro Indicator spell.

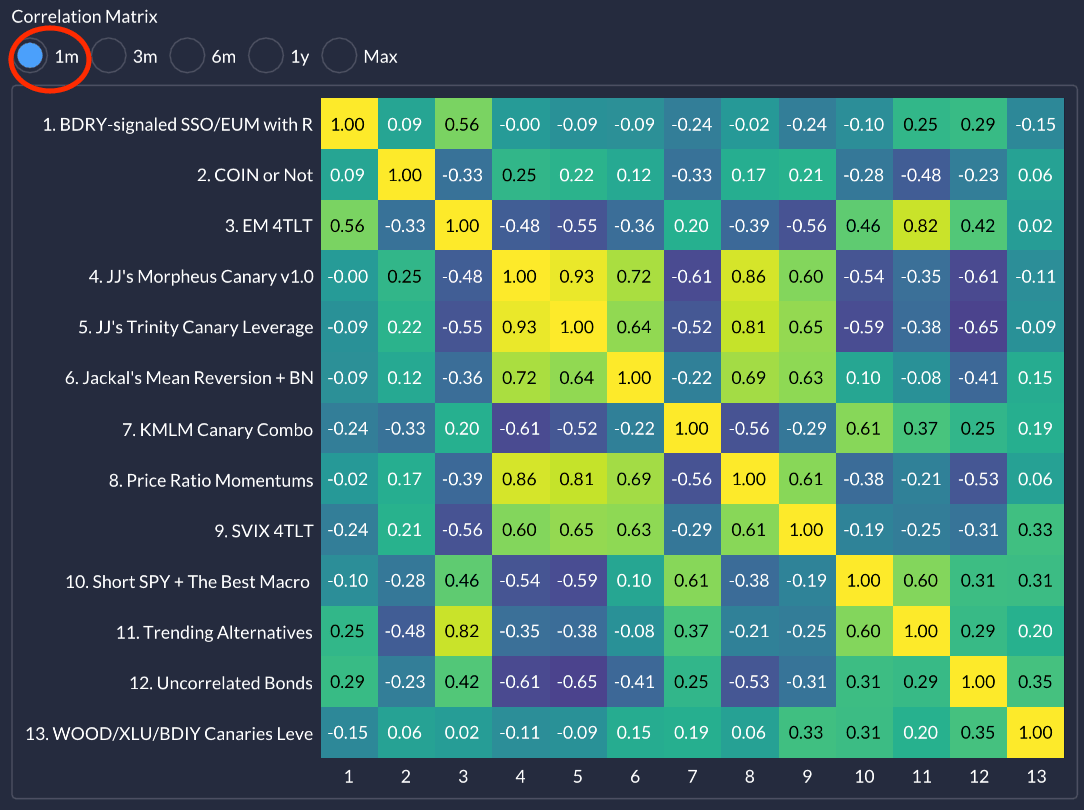

Here’s where things get interesting. Compare this month’s correlation matrix (below) with the full-period one above, and you’ll see my strategies are having a bit of an identity crisis. They’re pulling in different directions like kids fighting over a toy – which explains why we’re stuck in this choppy sideways market. My systematic strategies can’t seem to agree on where the market’s headed, and honestly, who can blame them?

Now, let’s address the elephant in the room. The news cycle has been... intense. Between escalating internal tensions here at home and a new international conflict teetering on the edge of something bigger, it’s enough to make anyone nervous. Market veterans keep reminding us not to panic-sell during times like these – markets have a funny habit of bouncing back once the dust settles, regardless of which way things go. It’s solid advice, even if it’s easier said than done.

All of this has me thinking about Ray Dalio’s take on the changing world order. His framework for understanding where we sit in the bigger historical cycle feels less like abstract theory and more like a roadmap these days.

Be safe out there, and—especially in an election year—choose your leaders as carefully as you choose your position sizing.

If Dalio's thoughts are a road map, then Gold is a necessity. In recent months, I have done well with GLD and AUMI (gold miners), but not with much else (except for European defense industry stocks, not much of a surprise but well dependent on geopolitical issues -- if Russia folds, then watch that bubble burst). Anyway -- thanks for the good article!