Über Spell or Not

How I skip the über spell—and still benefit from it

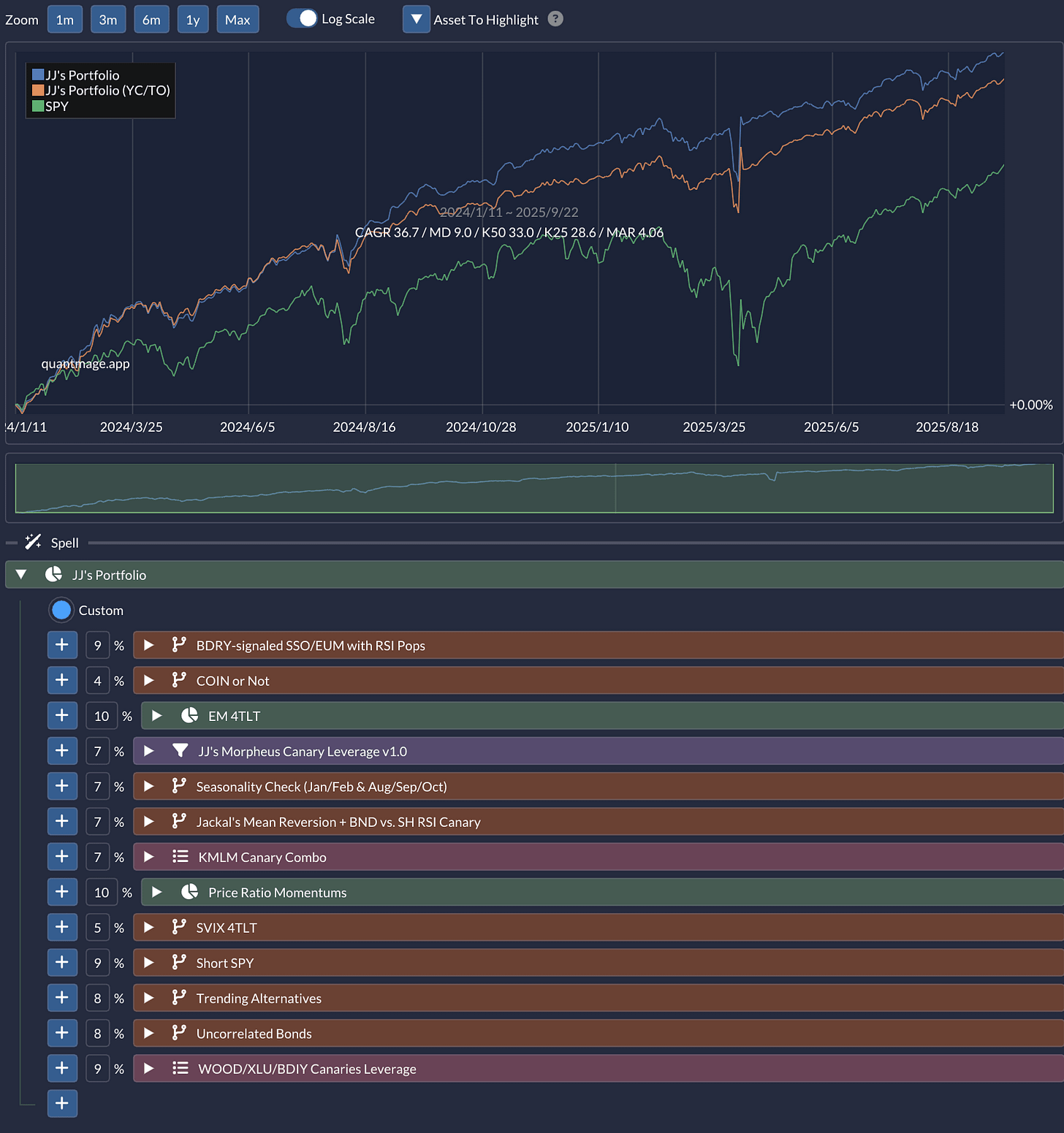

TL;DR: QuantMage lets you run a single “über spell” that encodes your whole portfolio as one strategy or a portfolio of independent spells. I prefer the portfolio approach for transparency, diversification controls, and cadence flexibility—but I still keep an über spell around as a handy simulator and record‑keeper.

Let’s talk portfolio strategy. If you’re using QuantMage, you’ve probably wrestled with this question: Should you bundle everything into one mega-strategy (the “über spell”), or keep your strategies independent?

I’ve landed firmly in the “keep them separate” camp—but with a twist. Here’s why.

The Allure of the All-in-One Approach

Using a single über spell sounds great on paper. Here’s why some users go that route:

Hands‑off automation. No need to rebalance manually or swap spells—just tweak the über spell’s internal logic, and you’re done.

Instant aggregate backtests. You get a nice clean backtest of your entire portfolio’s historical performance, which can give you a reasonable benchmark (though, of course, past performance ≠ future results).

Why I’m Not Sold

Here’s where the über spell loses its magic for me:

Flying blind on individual strategies. You lose the ability to see each strategy’s live behavior like I show in my portfolio updates. And trust me, you’ll miss it when you need to diagnose what’s working and what isn’t.

Kiss advanced rebalancing goodbye. Want to use QuantMage’s Inverse Volatility weighting with that sweet Low Correlation Boost? Not happening with an über spell.

Shorter backtests. Your historical data gets chopped down to match your newest asset. If one strategy only has two years of history, that’s all you get for the whole portfolio.

No correlation insights. Those handy correlation matrices that show whether you’re actually diversified as you can see in this post? Not available. I find this matrix critical to avoid hidden risks.

One-size-fits-all trading. Different strategies often need different rhythms. Maybe you want monthly rebalancing for one strategy and threshold trading for another. With an über spell, everyone marches to the same beat.

For me, these limitations are deal-breakers. The flexibility and insight I get from separate strategies far outweigh the convenience of bundling.

My Hybrid Solution

Despite all that, I still keep a über spell in my toolkit—but I treat it like a simulation sandbox, not the main event. Here’s how I use it:

Sanity‑check the portfolio’s simulated performance in one place.

Test different weightings and see how they move the needle historically.

Document the weights I used during the last rebalance (so I don’t forget).

As you can see, the history is short. Also, my live portfolio will drift from this simulation because different spells run on different cadences and weights naturally wander between rebalances. Plus, every time I tweak a strategy or rebalance, I need to update the über spell to keep things synchronized. It’s maintenance, but worth it for the insights.

The Bottom Line

There’s no universal right answer here. The best approach depends on your trading style, how much control you want, and whether you value convenience over granularity.

My approach—separate strategies with an über spell shadow—might seem like extra work, but it gives me both detailed control and big-picture perspective.

What’s your take? Are you team über spell, team portfolio, or somewhere in between like me?

Drop a comment below—I’d love to hear how you manage your own systematic portfolio.

Your hybrid has value.

I create multiple accounts and manage each strategy individually. I then use Google Sheets to track the overall account returns and balances. It's a bit of a hassle, lol.