Three Tidbits 03/24/2025

More Price Ratio Momentums

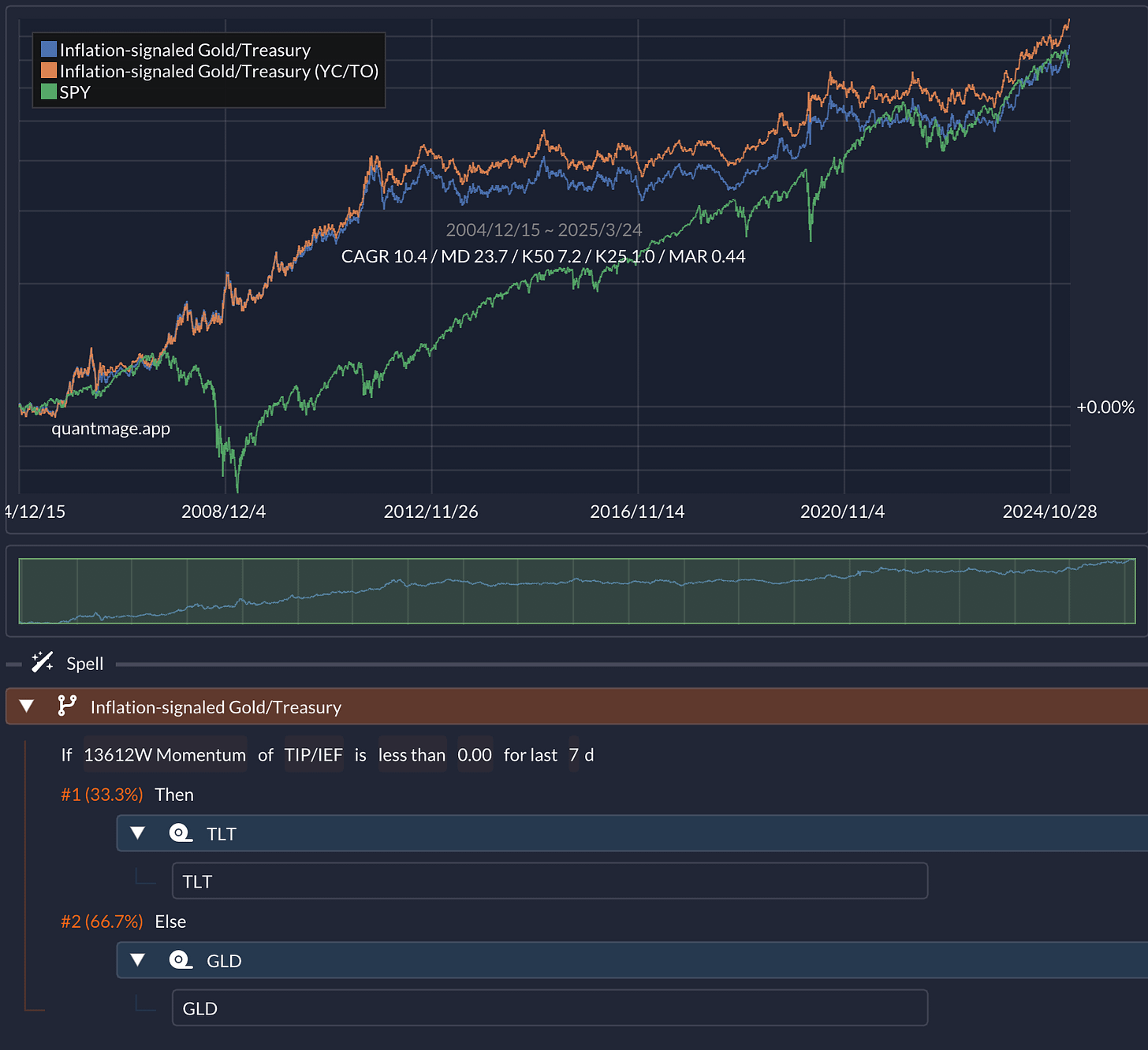

Inflation-signaled Gold/Treasury

I recently stumbled upon an intriguing idea from Quantpedia: switching between GLD (a gold ETF) and TLT (long-term treasuries) based on inflation signals. Here's how it works: if TIP (inflation-protected bonds) is outperforming IEF (intermediate-term bonds) by a price ratio momentum measure, inflation expectations are rising—so you move into gold. Otherwise, stick with treasuries:

The backtested results over 20 years look promising: a solid 10.4% CAGR with a manageable 23.7% max drawdown. What's even better? It offers negative correlation with the stock market (SPY), making it a potentially valuable diversification tool.

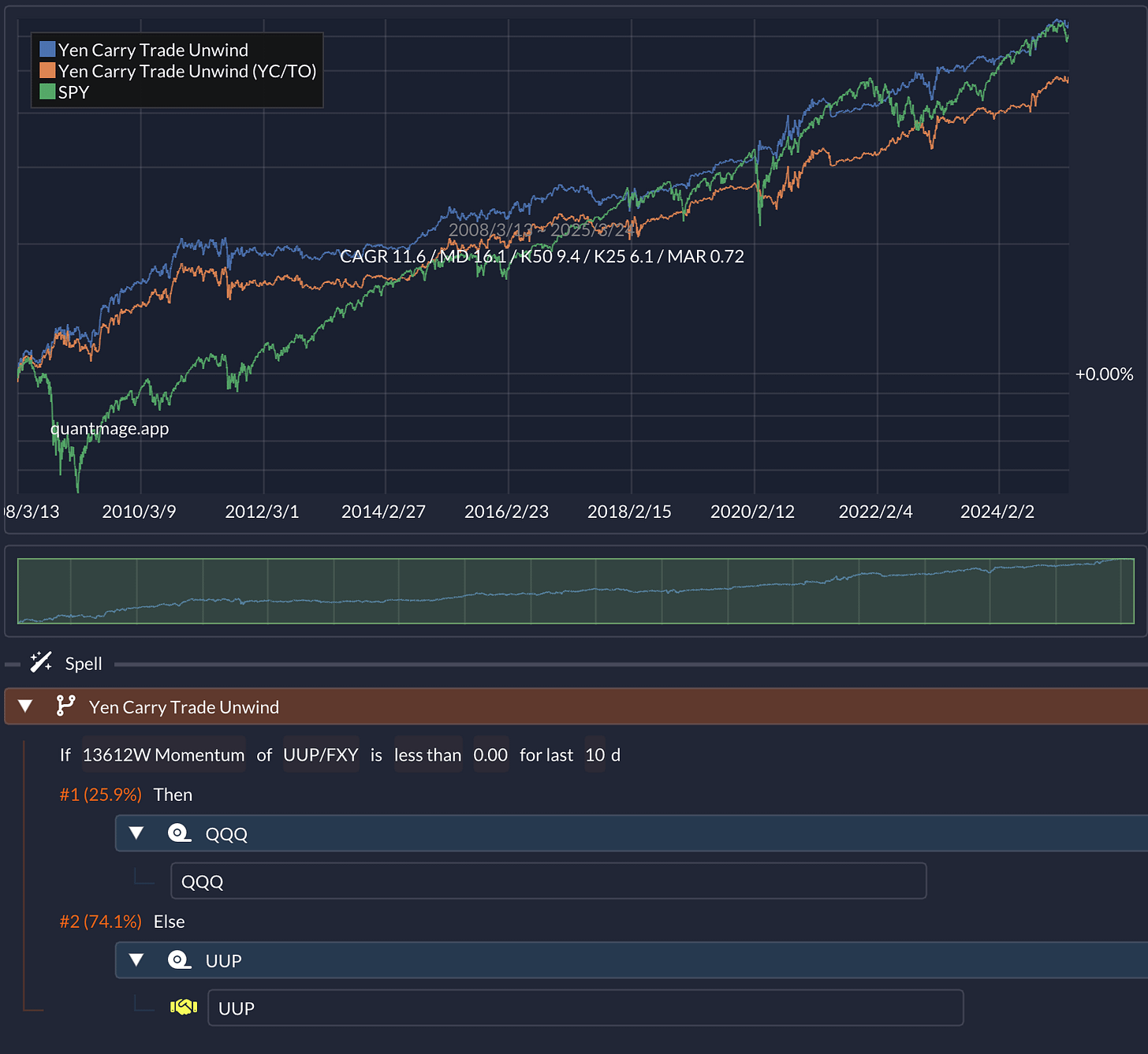

Yen Carry Trade Unwind

You've probably heard of the yen carry trade—borrowing cheap yen to invest in higher-yielding assets. But when the yen suddenly strengthens, this trade can unwind quickly, causing market volatility. This strategy specifically targets those moments by jumping into US growth stocks (like QQQ) for a bounce-back, capturing the mean reversion after a sharp yen rally. Otherwise, it parks safely in UUP, the dollar ETF. It checks the price ratio momentum of UUP over FXY (a yen ETF) to gauge the relative strength of the currencies:

With an impressive 11.6% CAGR and only a 16.1% max drawdown over 17 years, it's notably beaten SPY both absolutely and on a risk-adjusted basis. It even skillfully sidestepped big crises like 2008 and the 2020 Covid crash. The only catch? It might lose effectiveness once Japan's interest rates normalize—so enjoy the ride while it lasts!

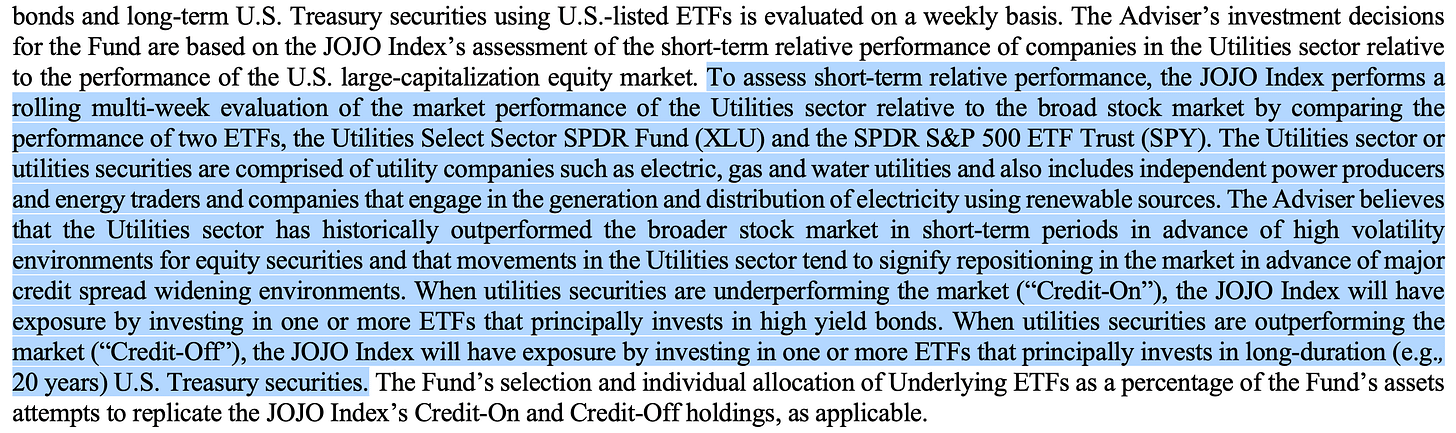

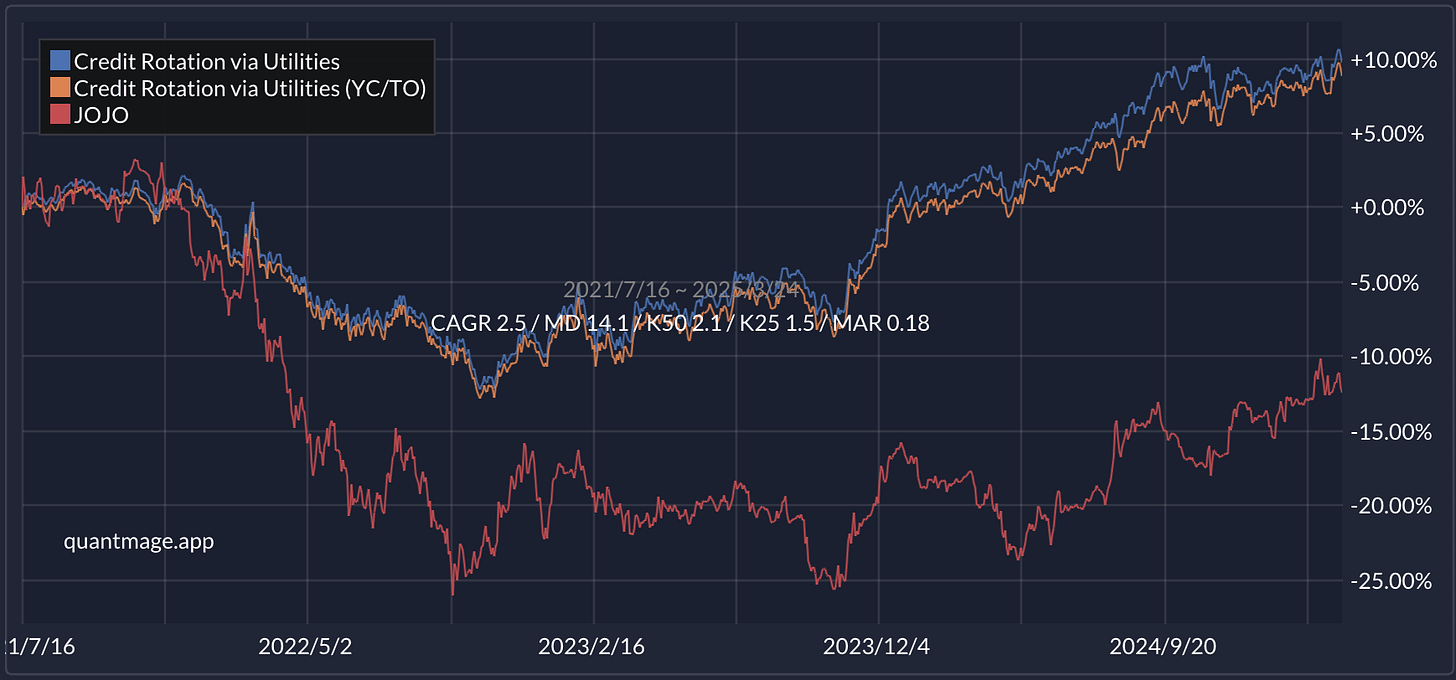

Credit Rotation via Utilities

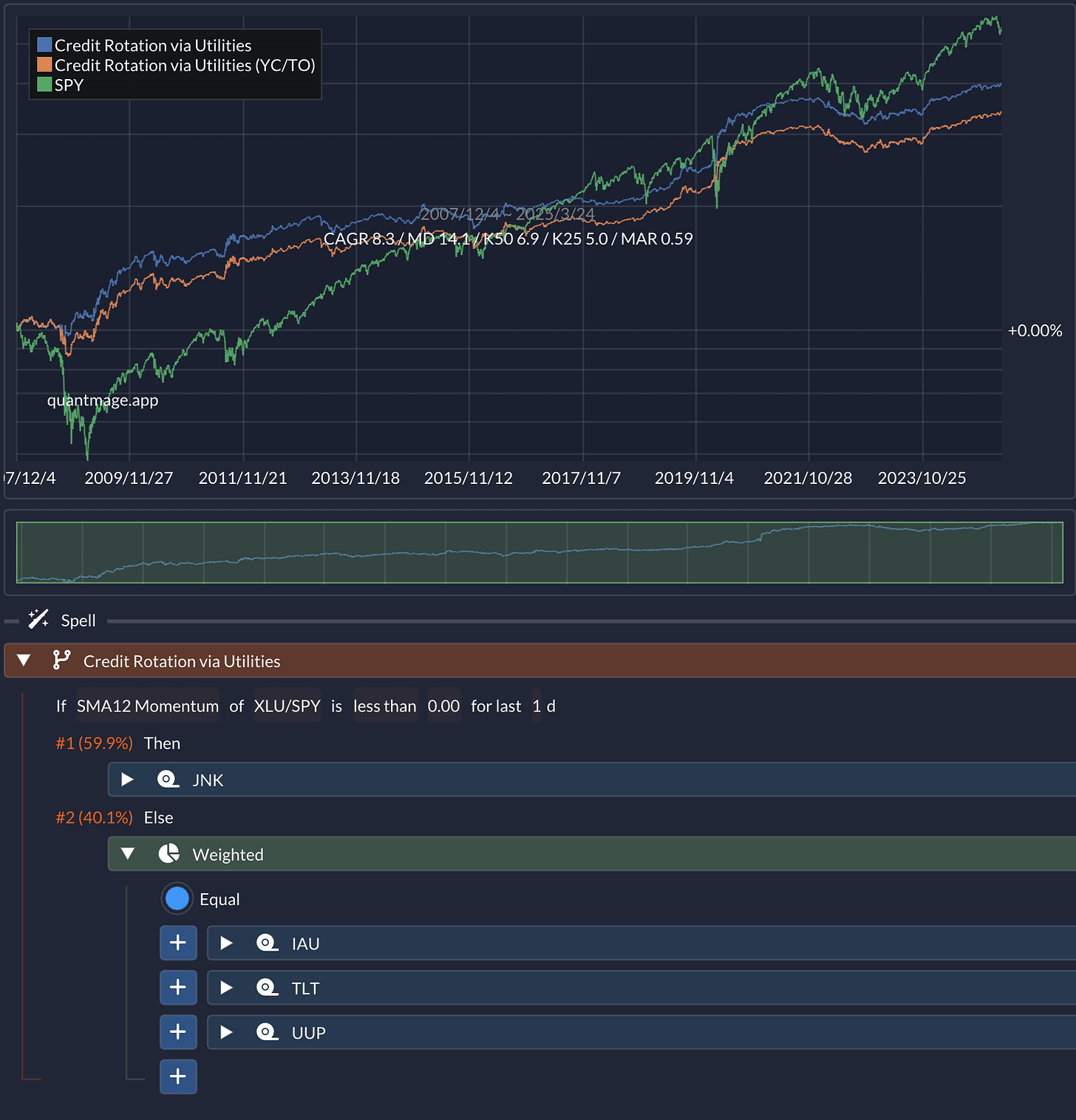

Finally, inspired by a recent insight from The Lead-Lag Report, here's a clever twist: using utilities sector outperformance (XLU vs. SPY) as a signal for rotating credit exposure. Originally introduced through an ETF called JOJO, the idea is straightforward—when utilities outperform, it's a risk-off signal, prompting a move into safe havens:

My twist? Using another momentum indicator to measure the relative market performance and diversifying the safe-haven basket by adding gold (IAU) and dollars (UUP) alongside TLT to smooth volatility:

This adjusted approach clocked an attractive 8.3% CAGR with just 14.1% max drawdown over 17 years, clearly beating SPY on a risk-adjusted basis while uncorrelated and significantly outperforming the original JOJO ETF since inception:

So, what do you think? Do any of these narratives resonate with you, or do you have a favorite? I'd love to hear your thoughts!

📣 Quick disclaimer: This is all informational—not financial advice. Do your own research and talk to a professional if you're unsure!