The Volatility Edge

Long/Short Volatility via Risk Premium & Term Structure

Just when I thought I’d seen every angle on volatility trading, Concretum Research drops another paper that caught my attention. “The Volatility Edge” presents a systematic approach to trading volatility that combines two powerful signals: volatility risk premium and VIX term structure. Let me walk you through why this matters—and how I’ve adapted it for QuantMage.

🧠 Volatility‑Risk Premium (VRP) — a 30‑second refresher

If you’ve been following along, you know I’ve covered volatility risk premium before. But here’s the elegant way the paper breaks it down:

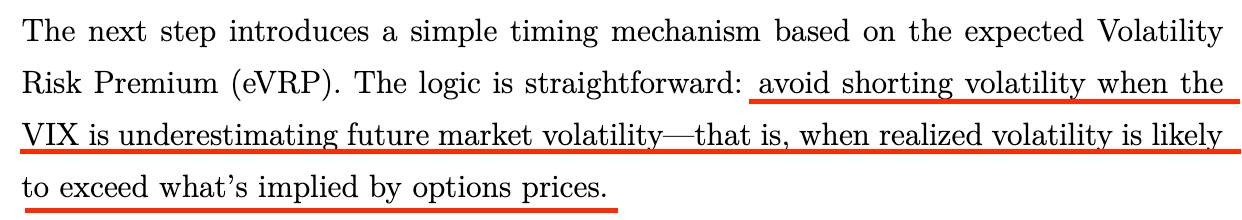

Think of VRP as the difference between what the market fears (implied vol) and what actually happens (realized vol). Concretum proxies realized vol by taking the standard deviation of the last ten daily returns of SPY, then annualizes it, and finally compares that figure to the VIX. When the implied is juiced relative to the realized, short vol pays; when the relationship flips, you want to be long vol.

📈 VIX Term Structure — Backwardation or Contango

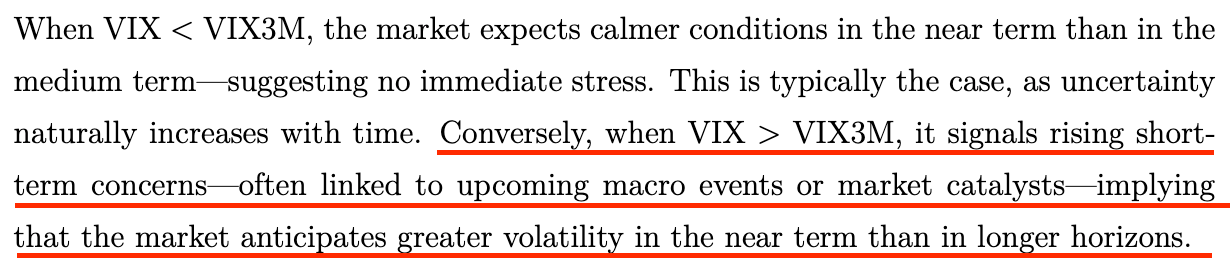

The paper also dives into VIX term structure—something we’ve explored with contango and backwardation concepts. Here’s their take:

🧪 The Concretum Recipe: eVRP + BoC + Sizing

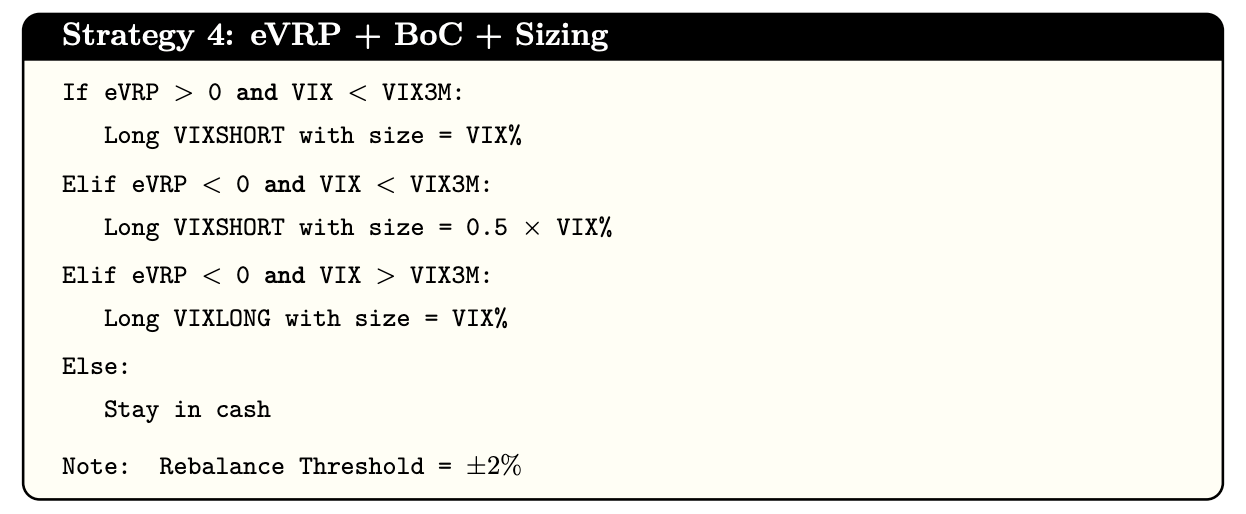

Now here’s where it gets interesting. The paper doesn’t just combine these signals—it adds dynamic position sizing based on VIX levels:

Instead of fixed allocations, the strategy scales in and out based on market volatility. The backtested results? A solid 16.3% CAGR with 16.4% volatility and a 31% max drawdown over 17 years. Respectable numbers—particularly for a strategy that often sits on the messy side of the risk spectrum.

🧙♂️ QuantMage Adaptation

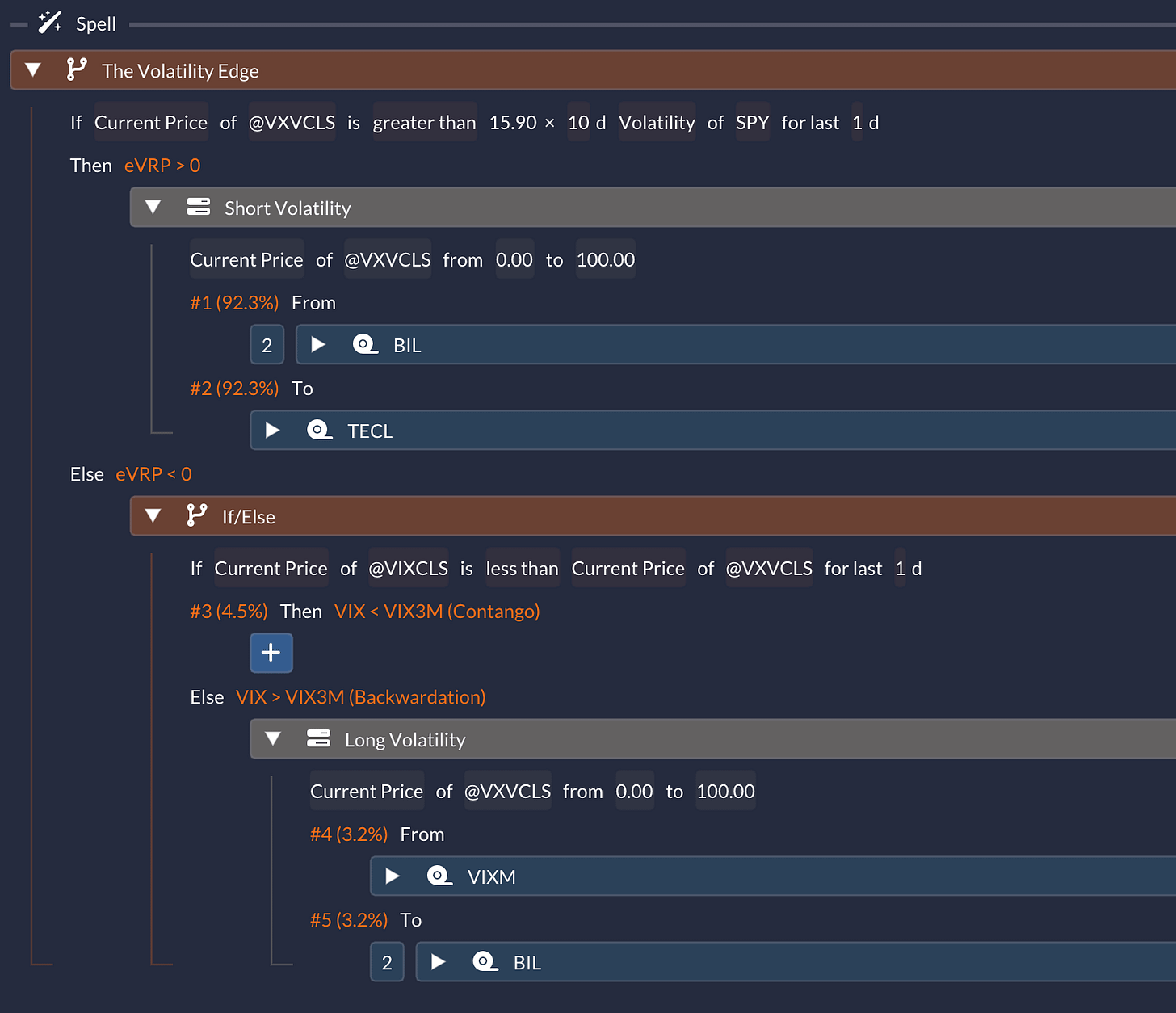

Naturally, I had to try this myself. After about 30 minutes of tinkering, here’s what emerged:

I’ve streamlined the logic considerably. The short volatility case now only checks eVRP (no 0.5x partial positions), and I’m using TECL (levered tech ETF) instead of VIX-linked products like SVIX or SVXY. For long volatility exposure, VIXM does the job nicely.

The dynamic sizing works through a Mixed incantation, but with a twist—I’m using VIX3M (@VXVCLS) instead of regular VIX (@VIXCLS) for scaling. When shorting volatility, higher VIX3M means more TECL allocation. When long volatility, higher VIX3M means less VIXM. That 15.9 multiplier you see? It’s roughly √252, annualizing our daily volatility measure.

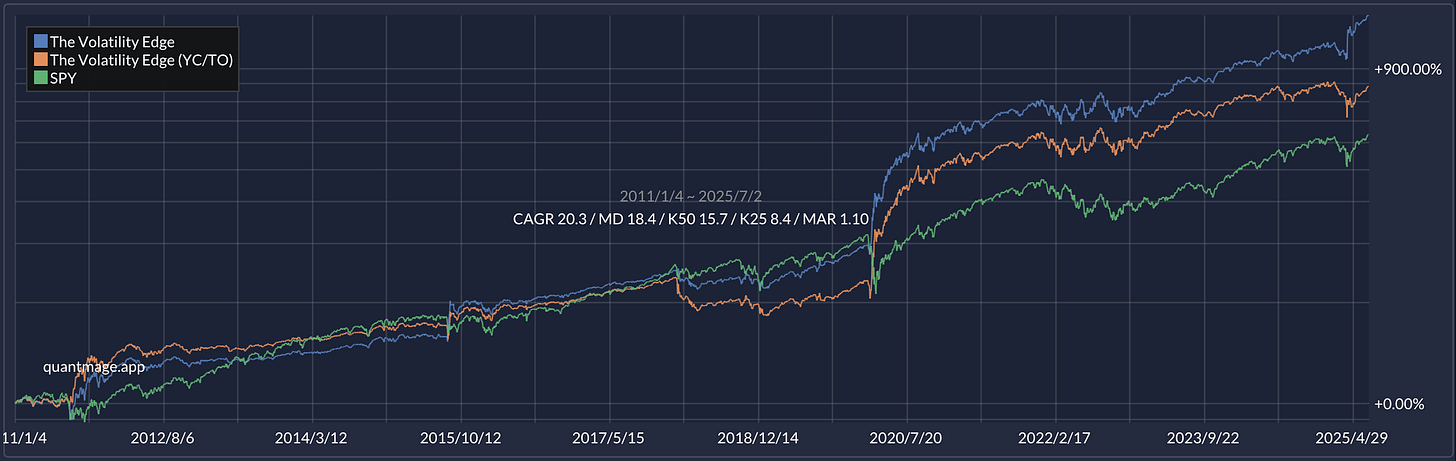

So how did it perform?

The results surprised even me: 20.3% CAGR with just 18.4% max drawdown over 14 years. Give it a spin yourself here.

⚠️ Caveats

Let’s keep it real—there are some important considerations:

QuantMage’s VIX and VIX3M data comes with a one-day delay, not real-time

That massive COVID-era spike definitely juices the annualized returns

The YC/TO plot divergence suggests some concerning timing sensitivity

📣 Disclaimer: This post is for informational purposes only and isn’t investment advice. Do your own research (DYOR) and consult a pro before deploying real capital.

🧭 Wrapping Up

If you haven’t already, grab the original paper—it’s surprisingly accessible and packed with insights. While I was familiar with volatility risk premium and term structure concepts, the dynamic VIX-based sizing was a fresh angle that could enhance other strategies.

The beauty of this approach is its flexibility. Different implementations could yield even more interesting results. Maybe you’ll find a better asset combination, or perhaps a different sizing mechanism resonates with your risk tolerance.

What’s your take? Have you experimented with similar volatility strategies? I’d love to hear about your adaptations.