Revisiting the Dry Bulk Shipping “Canary”

And Two Early-Warning Signals for My Discretionary Portfolio

Have you ever wished you had an early warning system for your portfolio—something that would chirp when it’s time to dial back risk? Today, I want to revisit the idea of using the Baltic Dry Index (BDI) as just that kind of “canary” for the markets. Since QuantMage no longer supports direct index data, we’ll look at an ETF workaround (BDRY) for signals instead. While we’re at it, I’ll also walk you through two “canaries” I’ve been using in my own discretionary investing. The U.S. stock market feels pretty frothy these days, so I wanted a couple of leading indicators to help me know when to exit the party before it gets too rowdy.

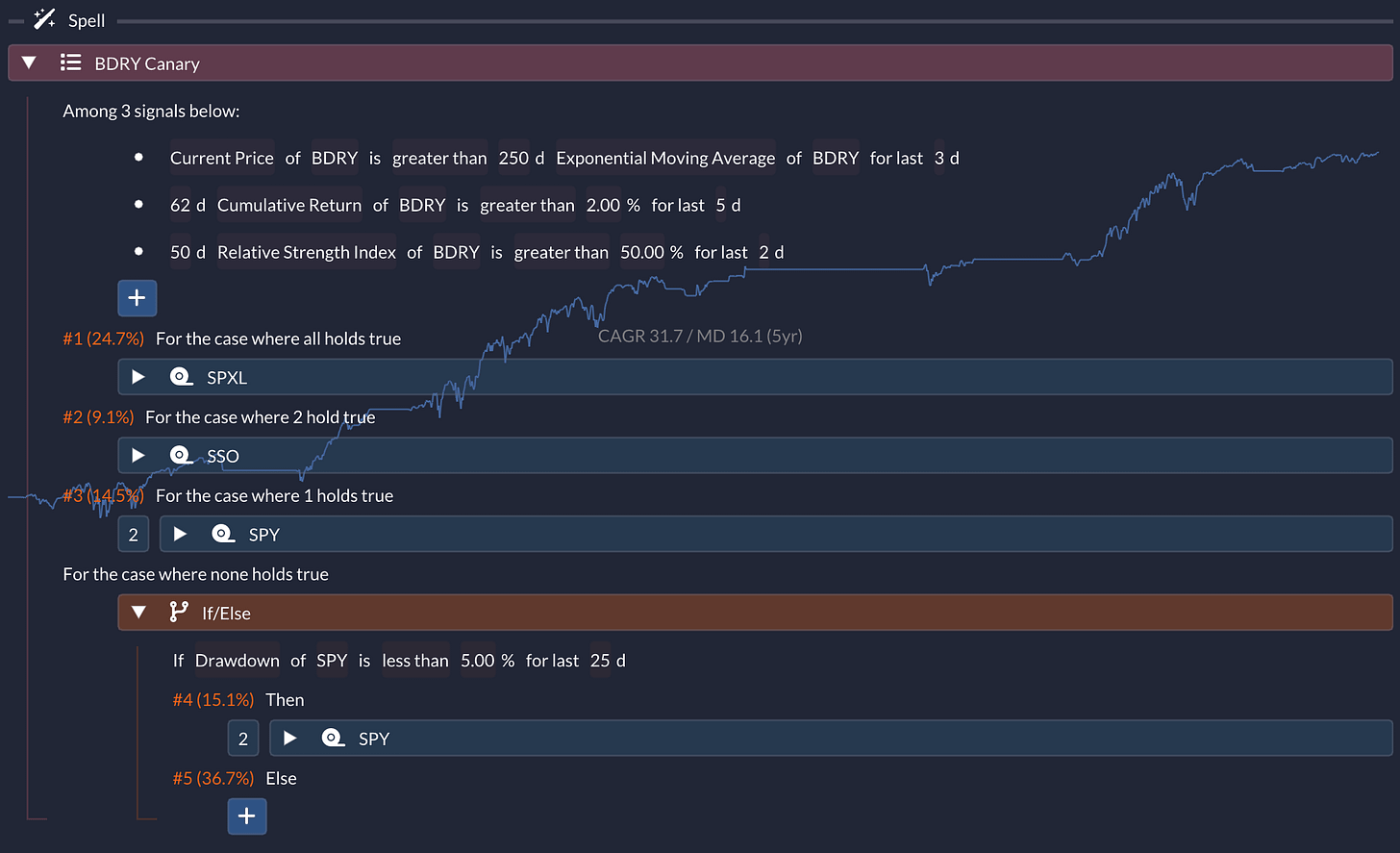

BDRY Signal

My original interest in the Baltic Dry Index was sparked by Martin, a fellow systematic investor. He pointed out that there’s an ETF called BDRY that tracks dry bulk shipping rates. Yes, it’s only been around for six years, but it can still offer a useful signal if you don’t have direct access to the BDI.

Here’s what I did:

I used the Switch incantation on QuantMage, focusing on an EMA crossover, a 3-month cumulative return check, and a new 50-day RSI condition.

The final “score” of how many of those three indicators are bullish helps me decide which leveraged ETF to be in (SPY, SSO for 2x, or SPXL for 3x).

If the market looks risky (e.g., SPY is down more than 5%), I go to cash. Otherwise, if SPY’s drawdown is under that threshold, I still hold SPY even in risk-off periods.

Despite having just over five years of data, the results look pretty spicy—about 31.7% annualized return and 16.1% max drawdown. Not too shabby, but remember: a short testing window can lead to overly optimistic conclusions. If you’re curious, you can give the spell a whirl on QuantMage and see how it performs in different market scenarios here.

Two Market Canaries

I have a discretionary portfolio that’s been doing quite well lately (knock on wood). But as the market continues climbing its wall of worry, I’m more concerned than ever about preserving gains during the next correction. That’s where my two “market canaries” come in.

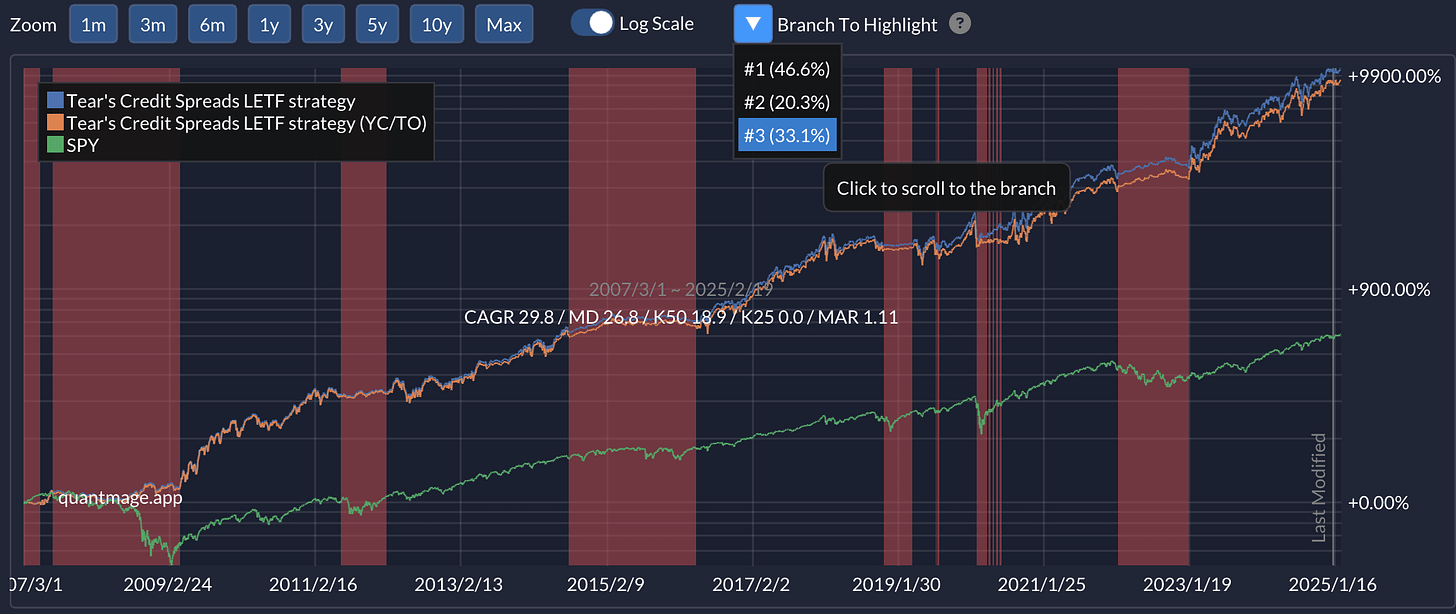

High-Yield Spreads (Primary Canary)

I’m a big believer in high-yield spreads as one of the best macro indicators. When credit spreads start widening, it often foreshadows trouble. I’ve set up a QuantMage spell that goes “risk-off” when those spreads look spooky. The red zones on my backtest are periods where the system signals it’s time to take cover. Right now, it’s still in “risk-on” mode, but I’m checking daily to see if it flips:

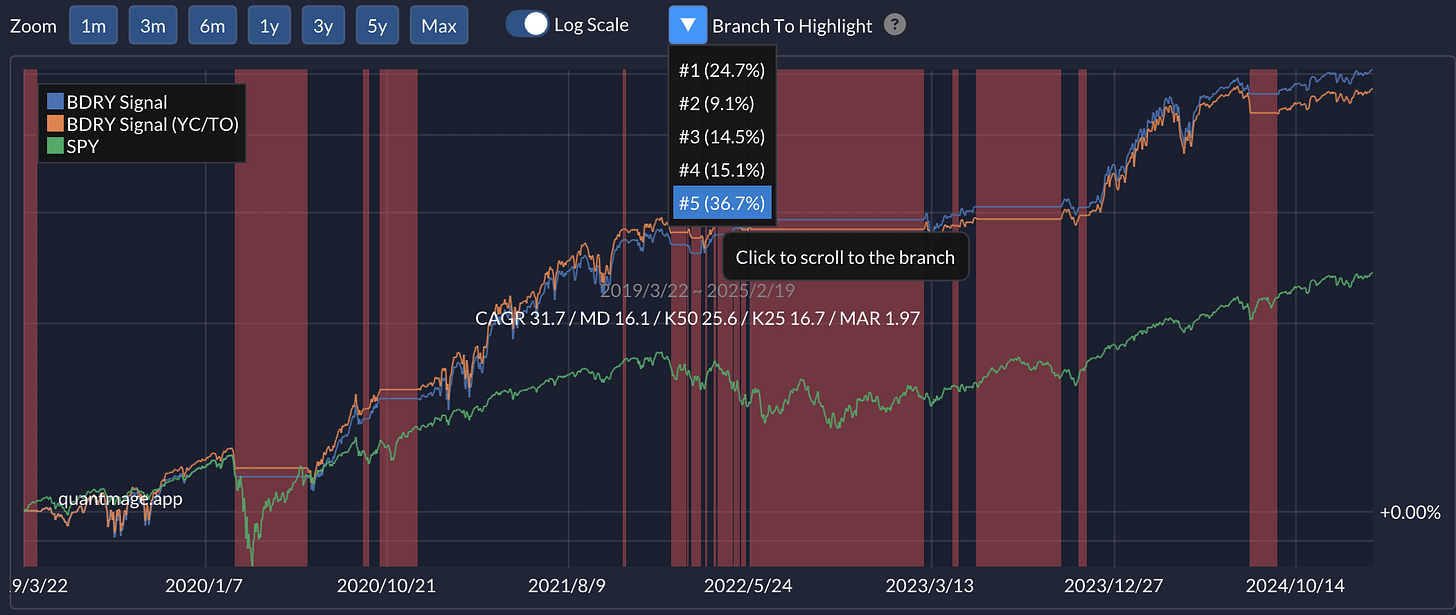

Dry Bulk Shipping (Secondary Canary)

The second canary is the BDRY-based system I just mentioned. It’s also not yet signaling any imminent danger, but again, I’m watching closely:

My plan is straightforward:

If either canary starts flashing red, I’ll reduce my market exposure.

If both start screaming at once, I’ll dial it down even further.

Martin also wrote recently about using HYG (a high-yield bond ETF) as another canary. The logic is simple: if HYG is rising, that means high-yield bond yields are falling and spreads are tightening—bullish signals all around. It’s got some promising backtests behind it, too, and I’ve adapted it for QuantMage here in case you’d like to explore it.

Bottom Line

Do high-yield spreads and dry bulk shipping signals make sense as leading indicators for discretionary investing? Or do you prefer to close your eyes, hold onto your positions with diamond hands, and tough it out through every correction? I’m somewhere in the middle—I like having these warning systems but recognize they’re not foolproof. Sometimes they’ll squawk at shadows, other times they might be asleep when a bear suddenly appears. But they’re still worth keeping in the toolbox, especially when the market looks like it’s bracing for a shift.

🚨 Heads-up: This content is for informational purposes only—nothing here is investment advice or a recommendation to buy or sell any securities. Always do your own research, and consider talking to a financial professional before making any investment decisions.

Happy investing! If you’ve got any favorite canaries of your own, drop me a line. I’m always game for adding a new little bird 🐦 to the watchlist.

very good work, thanks!

My version of the Baltic Dry strategy which I originally posted in April 2022 has been in cash for months now, oddly enough. (Nonetheless, it has retained its good performance of CAGR 31.48% with a maximum drawdown of -9.41%). My readers have voiced pretty interesting opinions on why Baltic Dry has been kaput for such a long time; only time will tell whether de-globalization means this metric has lost its oomph.

I agree that it's necessary to have some robust risk-off signals. Personally, I use a lot more than two such signals; six months ago I presented some 10 here

https://martinschwoerer.substack.com/p/most-of-the-charts-that-i-like-really?r=5976a

, and in the meantime I have added a few more to my list.

If someone said "too many signals lead to decision paralysis", I'd agree, though the question of course is when too much is really too much. For instance, I think Chris Ciovacco with his 400+ charts is unable to sell because he's always seeing something positive going on...

I appreciate you sharing your efforts with QuantMage. You and @Martin are two of my favorite reads. Keep up the terrific work!