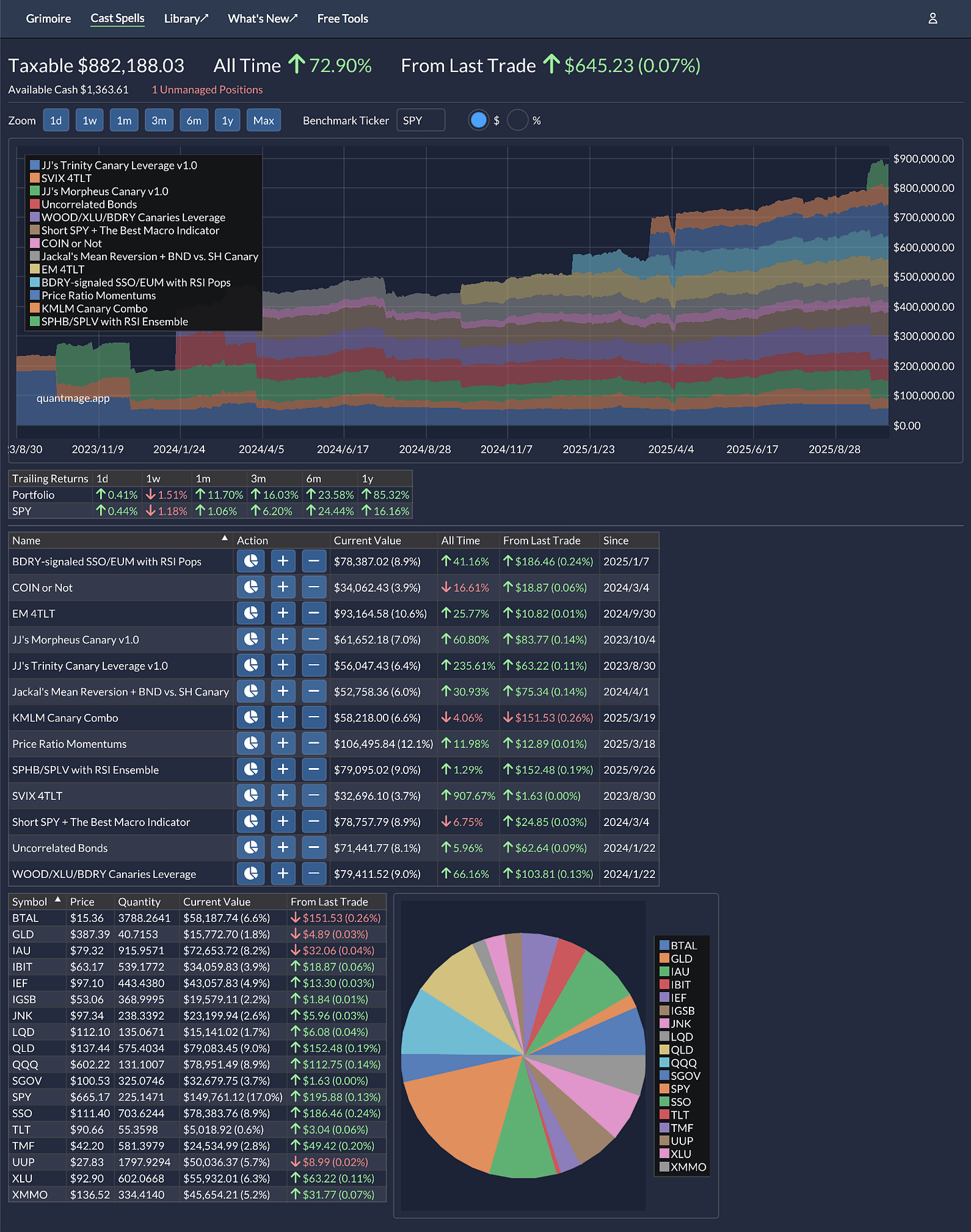

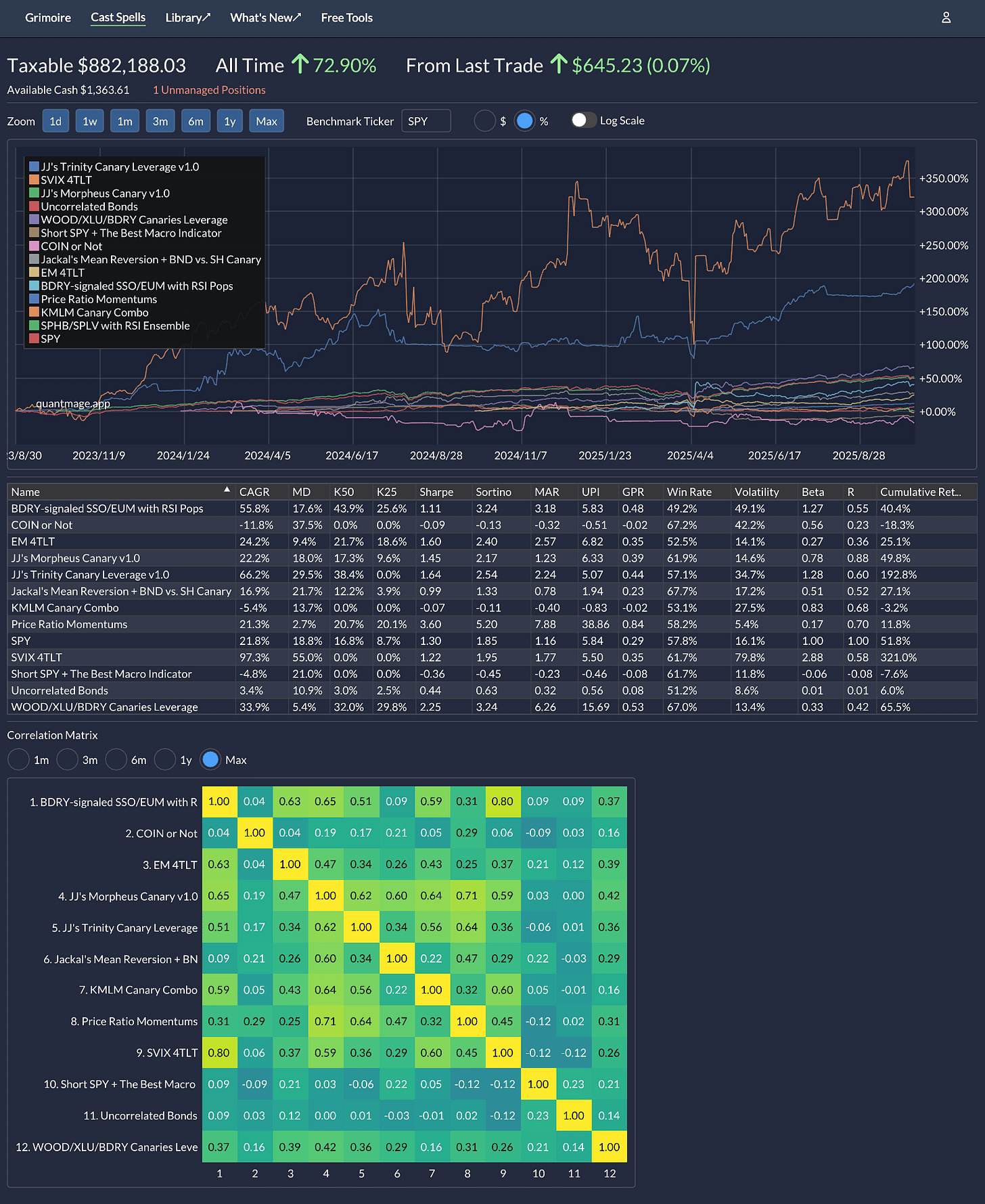

Portfolio Update 10/15/2025 - The Bull Carries On 🐂

Despite another bout of tariff drama

My portfolio climbed 1.9% since my last update, outpacing SPY’s 1.0% over the same period. I was this close to cracking the $900k mark, but the latest tariff flare‑up trimmed the final leg of the run. Markets gonna market.

You might notice I made an unexpected call to retire Trending Alternatives, the live strategy I recently shared. One of its core holdings, HNW, was delisted—making this the second time that spell had to be reworked due to a delisting. Rather than patch it again, I shelved the spell and rotated into SPHB/SPLV with RSI Ensemble. I used the change as an opportunity to rebalance the whole portfolio.

Between recurring tariff brinkmanship and expanding state capitalism, it’s been a tricky market for systematic strategies to navigate. I’m feeling pretty fortunate about how things have played out so far this year. Here’s to a strong finish before year-end!

Thanks for the insight.

I'm very curious about "SVIX/TLT"!

I looked closely and the total this month is significantly lower than last month! Is this due to rebalancing? Or is it a significant drop?

Thanks for this update.

Do you have a post regarding portfolio rebalance?

Would love to hear about your rebalance strategy.