Portfolio Update 08/15/2024 - A Market Crash 💥📉

An Humble-Pie-Eating 🥧 Moment for My Portfolio

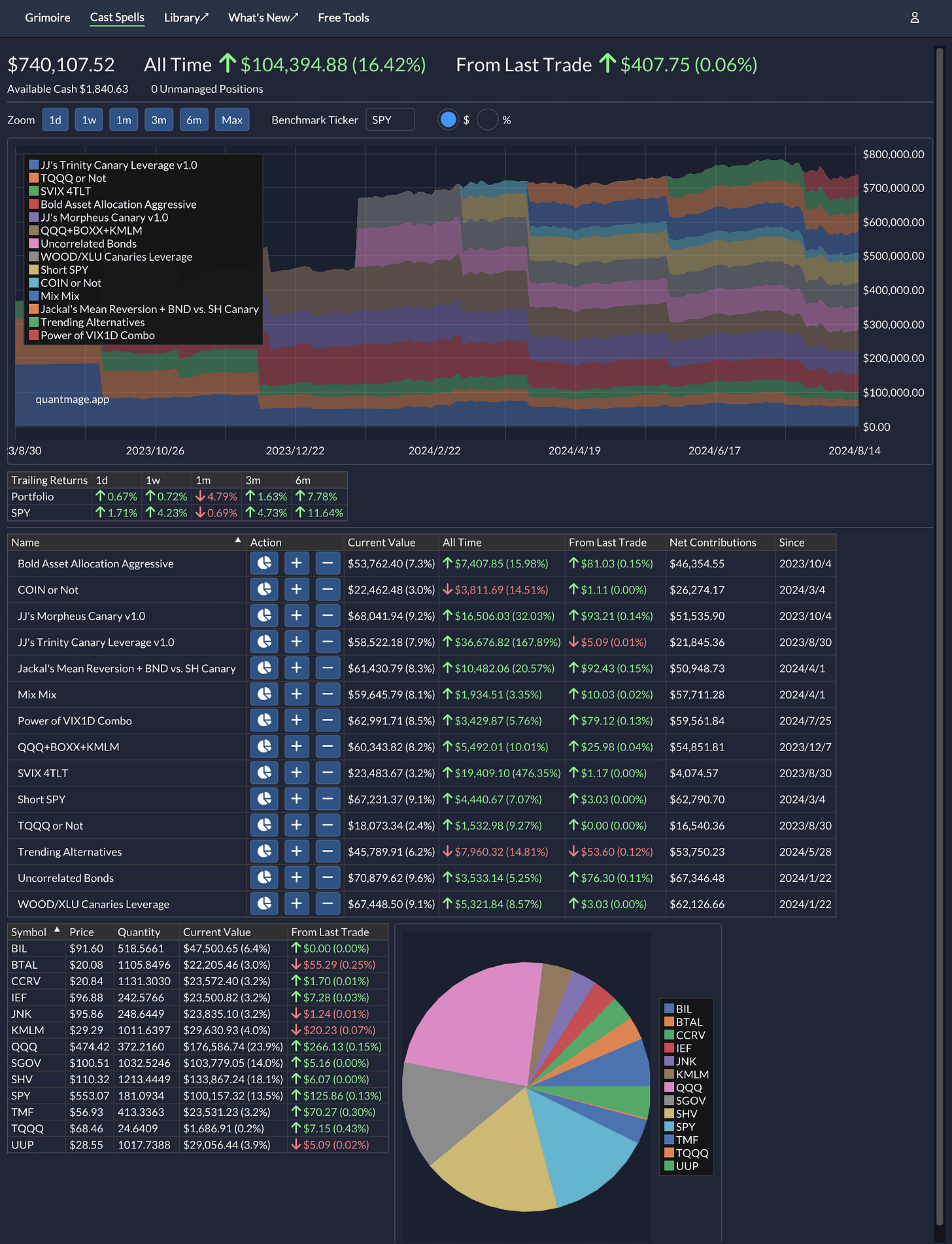

Last week was a tough pill to swallow for my portfolio. It took a 5% hit since my last update, while SPY managed to slide only 1.5%. Now, I’m officially underperforming SPY over the one-month, three-month, and six-month periods. Ouch.

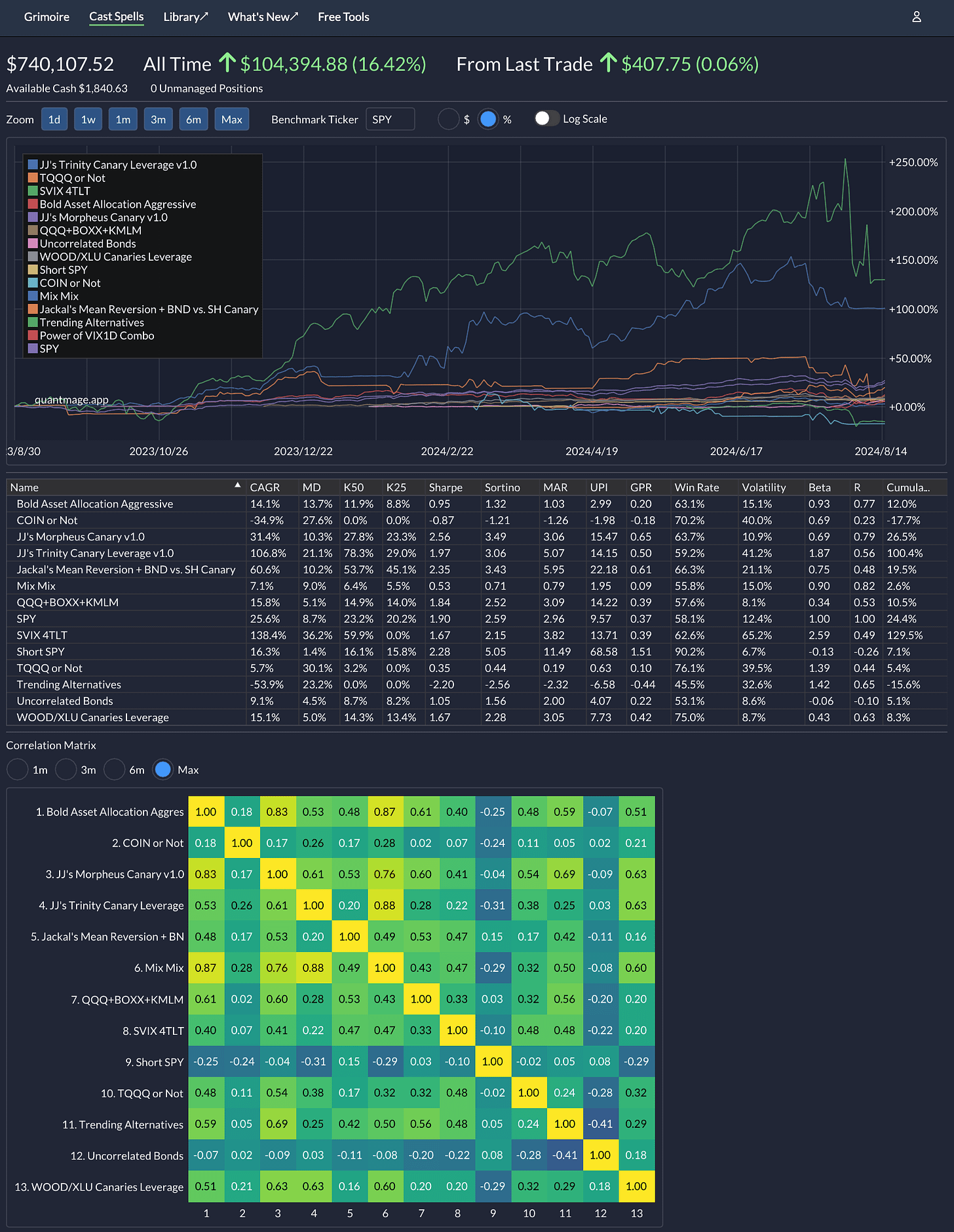

Over the past few months, I’ve been dialing back my strategies to be more conservative, which has occasionally led to some FOMO as I watched more aggressive plays surge. But even this cautious stance couldn’t shield me from the abrupt market crash last week. With the VIX spiking sharply—and then settling down just as fast—I got a firsthand taste of the risks tied to short and long volatility plays like SVIX and UVIX, as many did. Some of my strategies were caught flat-footed, ending up in all the wrong positions at the worst possible times (think SVIX when it should’ve been UVIX, and vice versa).

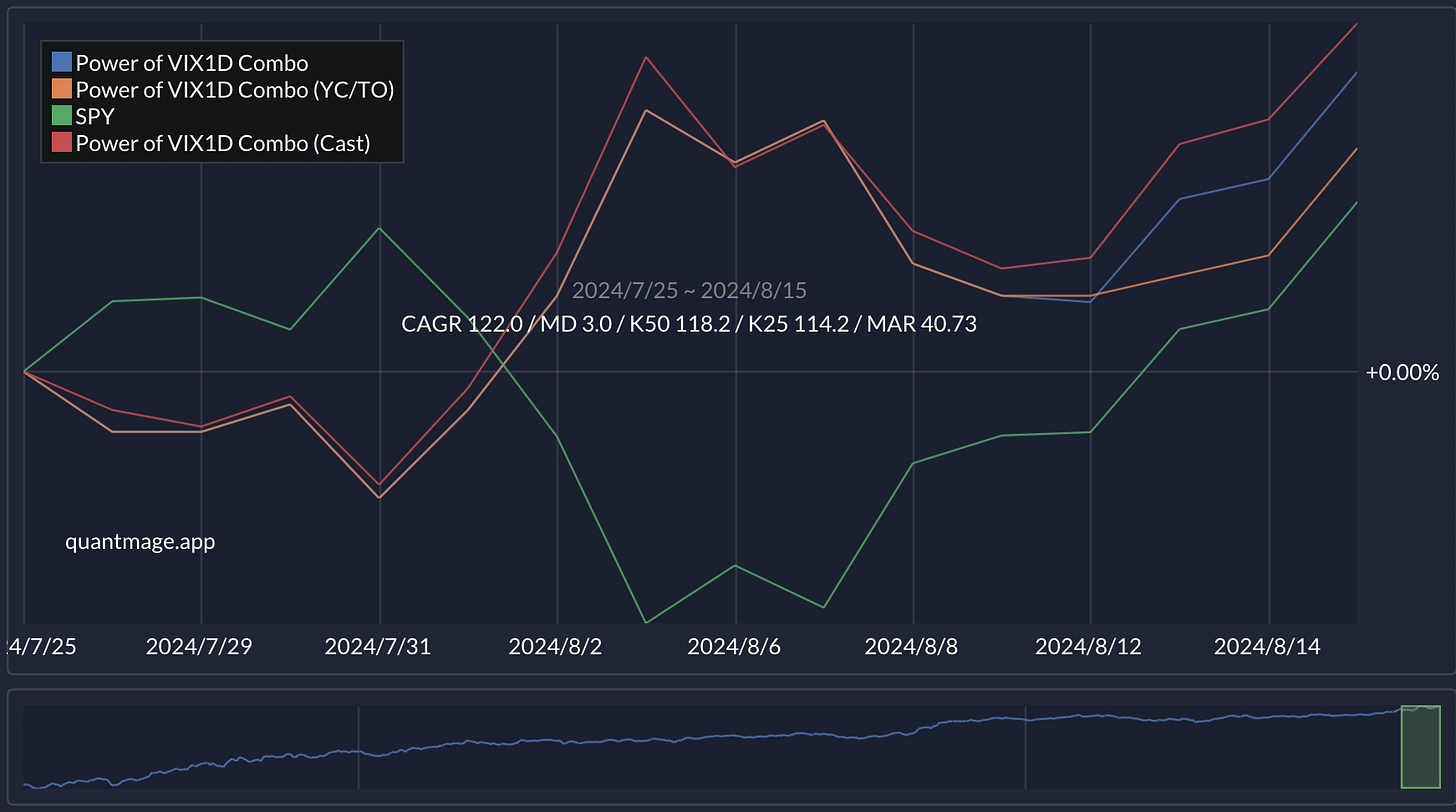

In response, I made some key adjustments. I fine-tuned multiple strategies that rely on volatility ETFs—removing the use for the ones that I felt weren’t nimble enough to handle sudden market swings and adding VIX-based safety checks for the rest to reduce the odds of landing in the wrong trade. I also introduced a new strategy that uses VIX1D as a sort of canary in the coal mine, which offered some protection during last week’s turbulence. Given its short backtesting history, though, I’ll be keeping a close eye on it for now.

My overarching goal is to “beta hitchhike” just a little better than most: capture a bit more when the market’s up and lose a bit less when it’s down. That approach had been working well—until this crash, that is. Still, I’m in this for the long haul, and I remain optimistic about my evolving systematic strategies.

I hope your portfolio held up better than mine. Here’s to sticking with the long game! 📈🏆