Portfolio Update 04/15/2025 - Escalating Tariff Fiasco 💣

No Algo for Headline-Driven Markets

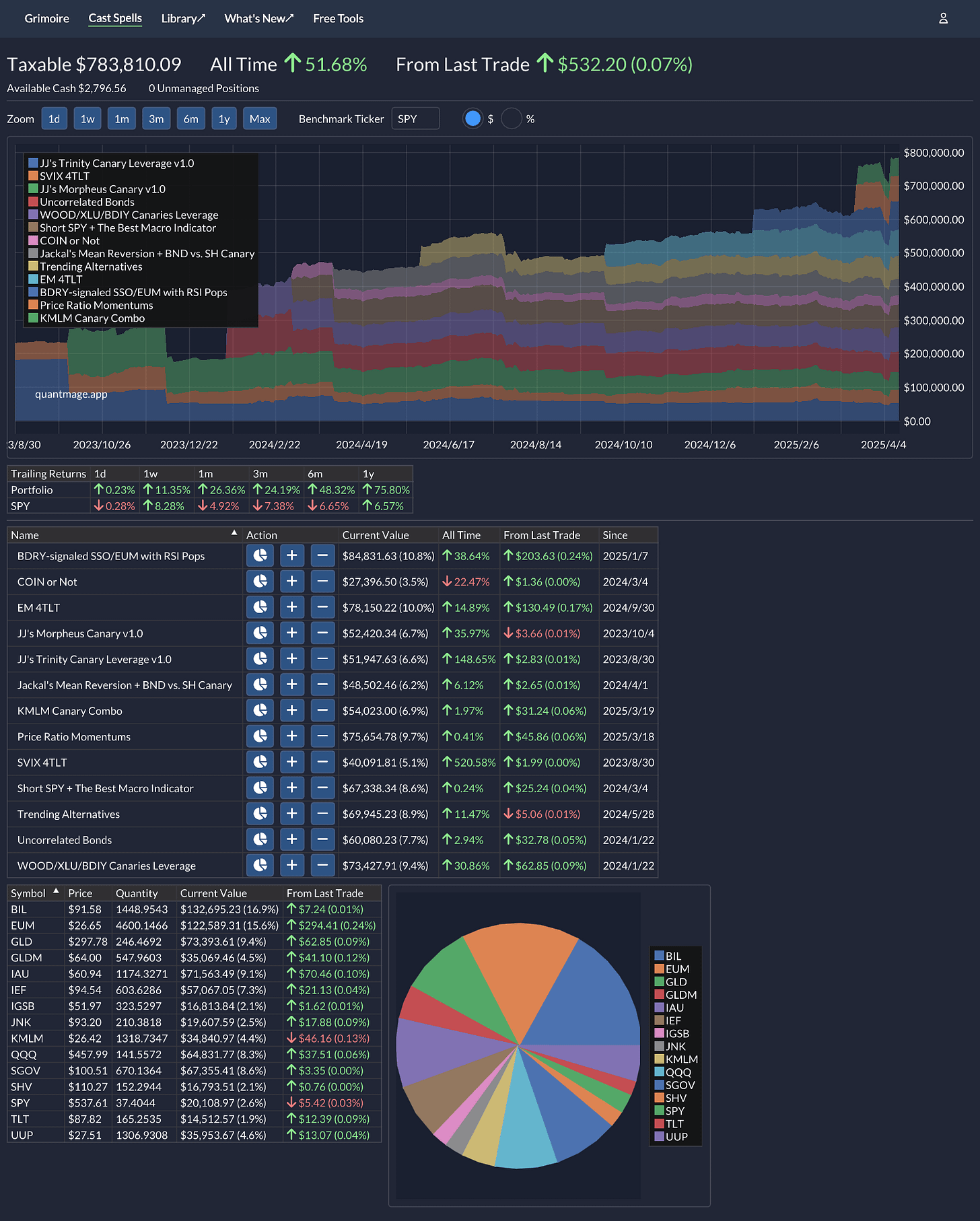

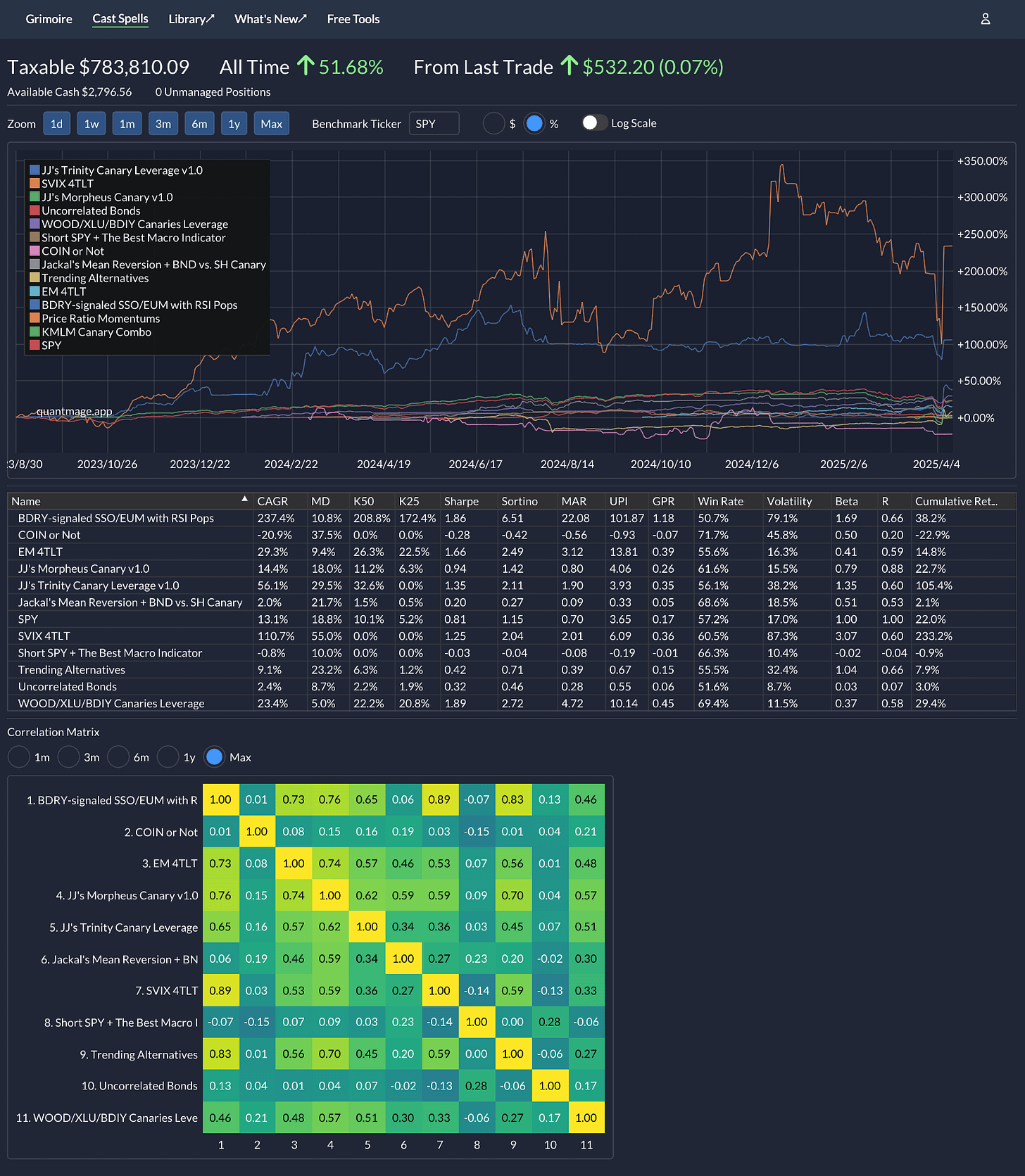

Today marks the tax deadline in the US, and coincidentally, it's also time for another portfolio update. I'm relieved to report a solid gain of +4.4% since the last update—especially considering the S&P 500 (SPY) took a rough hit of -4.5% during the same period. This month’s results put my systematic portfolio at an all-time high, at least according to my monthly records. Unfortunately, my discretionary portfolio, which isn’t shared here, didn’t fare quite as well.

I’ve also made some noteworthy adjustments to the portfolio: I decided to retire two conservative but underperforming strategies—Bold Asset Allocation Aggressive and KMLM+QQQ+BOXX—and introduced two fresh faces, Price Ratio Momentums and KMLM Canary Combo.

On a more serious note, the ongoing geopolitical tensions and the escalating tariff fiasco have me genuinely concerned. Beyond the immediate volatility we see day-to-day, it's the longer-term, second-order effects that worry me the most. Amid the noise and chaos, Howard Marks’ recent memo stood out to me as particularly insightful. Increasingly, I sense we might be witnessing the "beginning of an end"—though I'll leave it up to you to decide exactly what might be ending.

Stay sharp out there, and may your portfolio navigate these turbulent times with grace. 🌊

Congratulations for the good performance!

thanks, what are your requirements for retiring a strategy?