JJ's Spell Series: Mix Mix

Retired Too Soon?

Time to spotlight another of my spells—this one’s already retired, though I’m having second thoughts as I type this! 😅 The original idea behind Mix Mix was to showcase the power of a Mixed incantation by combining multiple small strategies based on it into one grand design.

🚨 Disclaimer: This post is for informational purposes only and does NOT constitute investment advice or a recommendation to buy or sell any securities. Always do your own research and, if needed, consult a financial professional before making any decisions. Past performance isn’t indicative of future results, and I may update or modify this strategy in the future—so proceed with caution!

Mixed Combo

The core idea was to use the Mixed approach with a single asset plus a simple indicator (like volatility or relative strength index), and then stitch together several of these mini-strategies. When it all came together, the results looked promising.

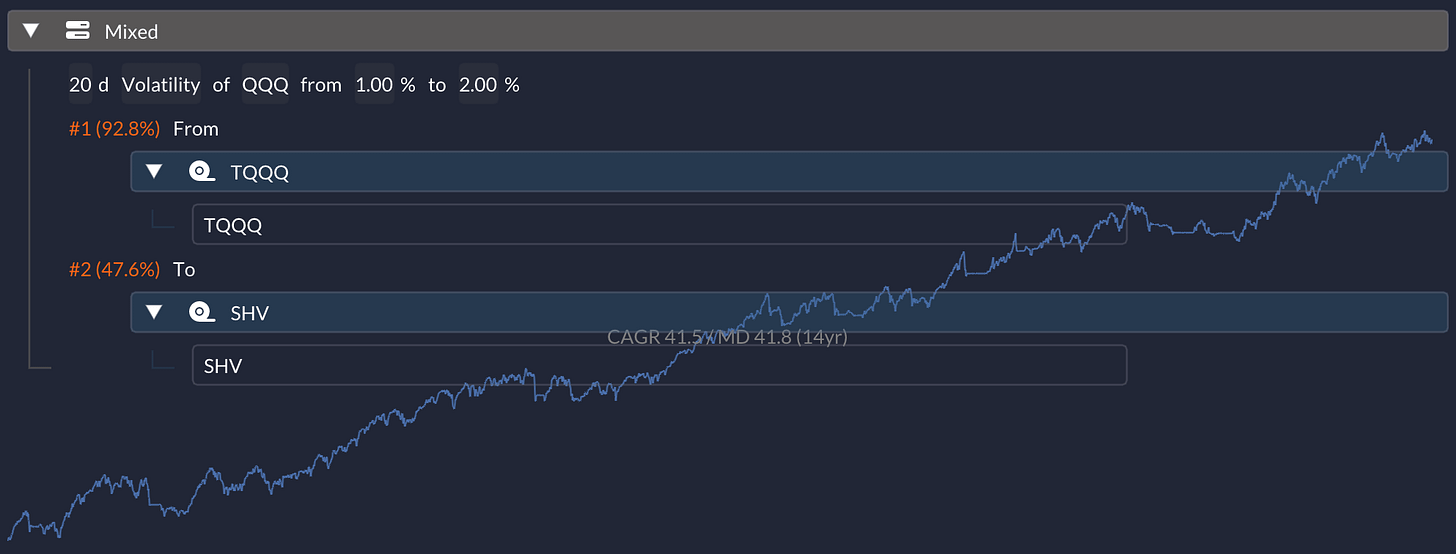

Levered Nasdaq-100 in Low Volatility

The first piece of the puzzle involved TQQQ, the 3× levered Nasdaq-100 ETF. After some tinkering, I noticed scaling into TQQQ when the 20-day volatility of QQQ dipped produced decent returns:

For a risk-off asset, I used SHV (a short-term treasury bond ETF) and scaled into it whenever the main signal said, “Hey, let’s pull back.”

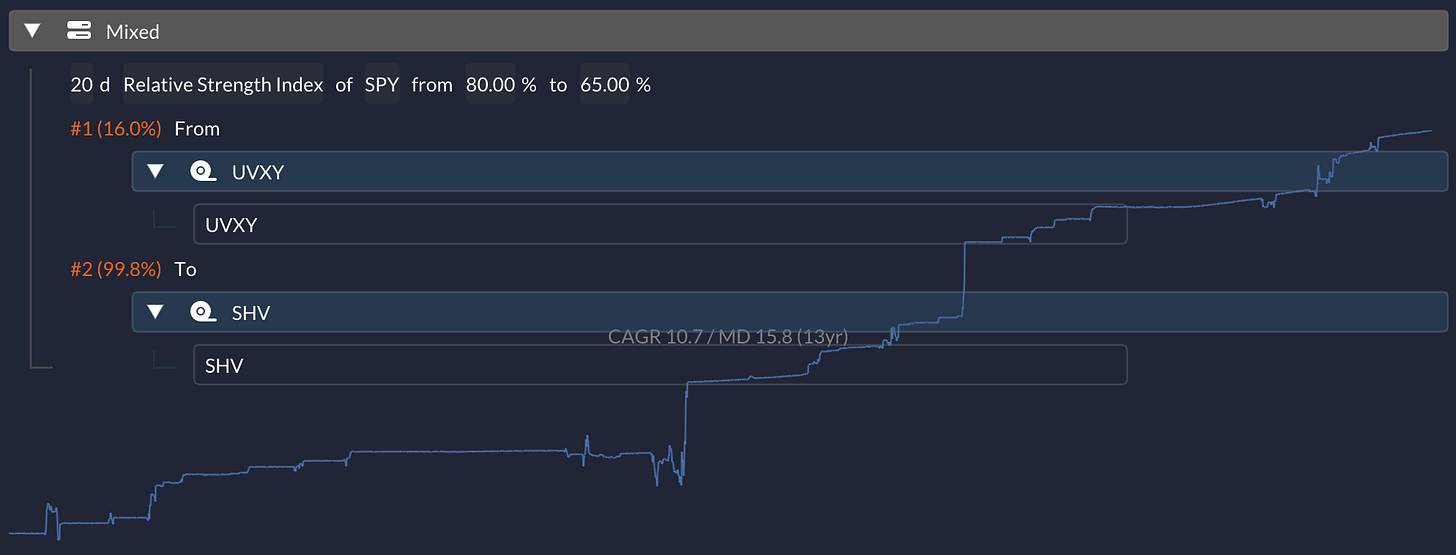

Levered Bet on Volatility When SPY is Overbought

Next up, UVXY—a levered VIX futures ETF. The logic: volatility might spike when SPY looks overbought, so I used the 20-day RSI of SPY to decide when to enter UVXY:

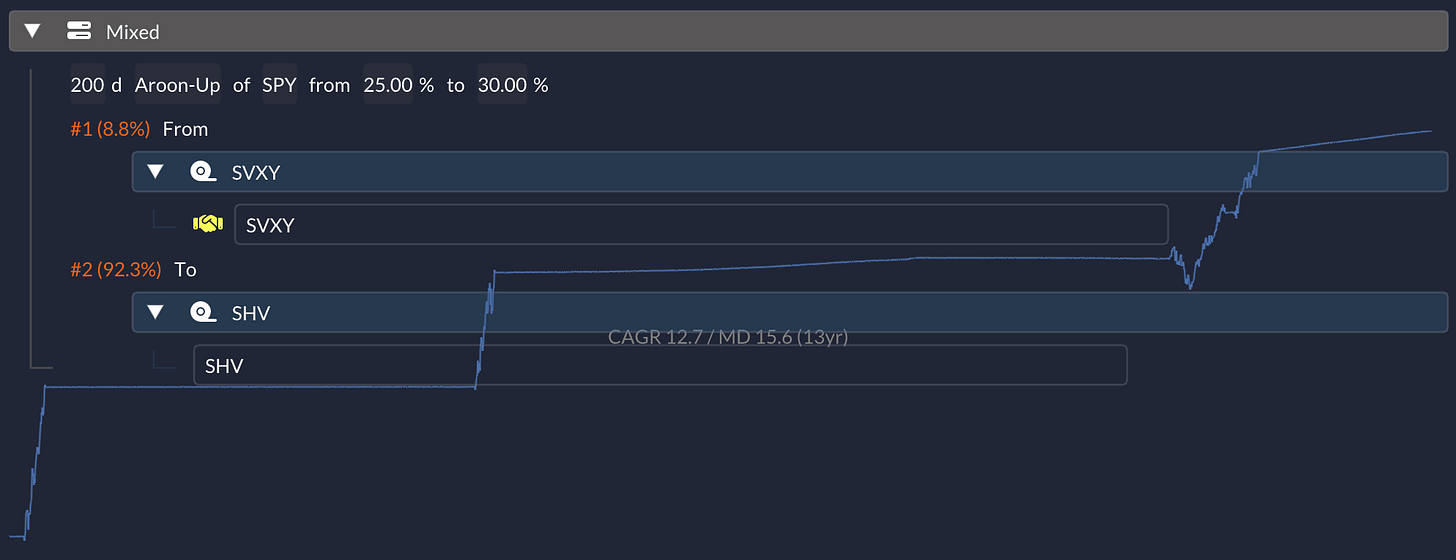

Short Volatility When 200-day High is Distant

On the flip side, SVXY “shorts” VIX futures, so it gains when VIX drops. I hopped into SVXY when SPY’s 200-day high was a fading memory—specifically, using the 200-day Aroon-Up indicator:

Fascinatingly enough, that signal only triggered three times in a 13-year span!

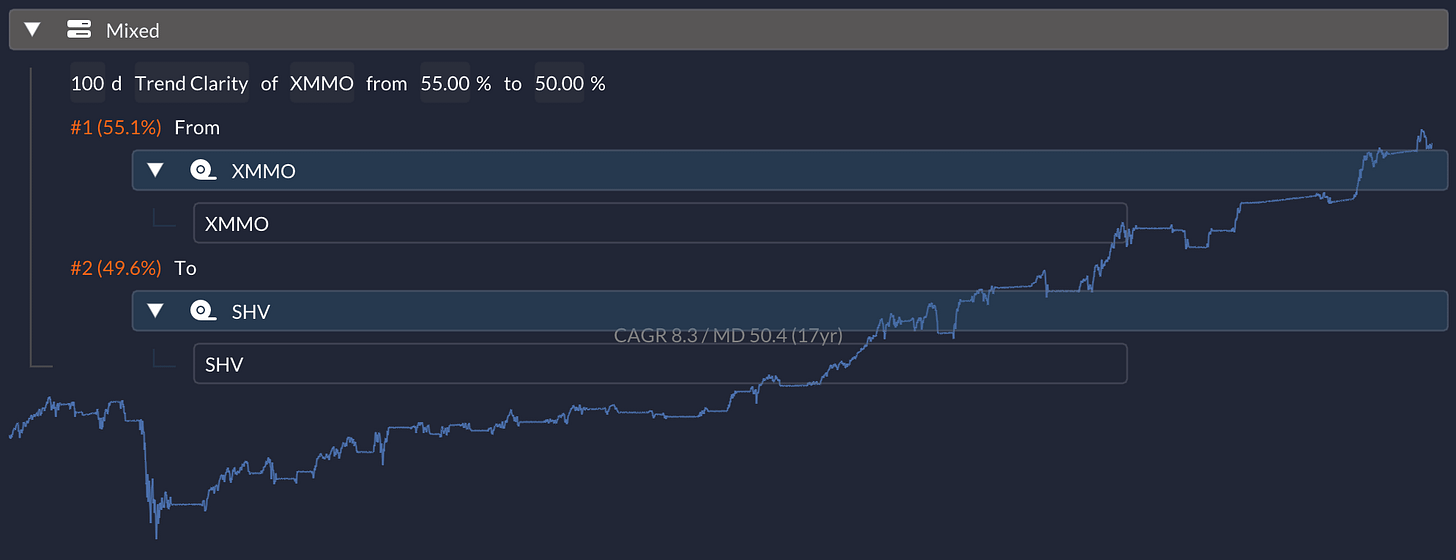

Mid-Cap as a Diversifier

Finally, I added XMMO (a mid-cap momentum ETF) using a 100-day Trend Clarity measure—basically scaling in and out based on how strong its trend appeared:

On its own, this piece didn’t knock it out of the park. However, combined with the other elements, it bumped up the overall risk-adjusted return—sometimes a diversifier’s modest returns can still help smooth out the bumps. Its drawdown during Global Financial Crisis is a genuine concern, though, as the term is not included in the final strategy’s backtesting period.

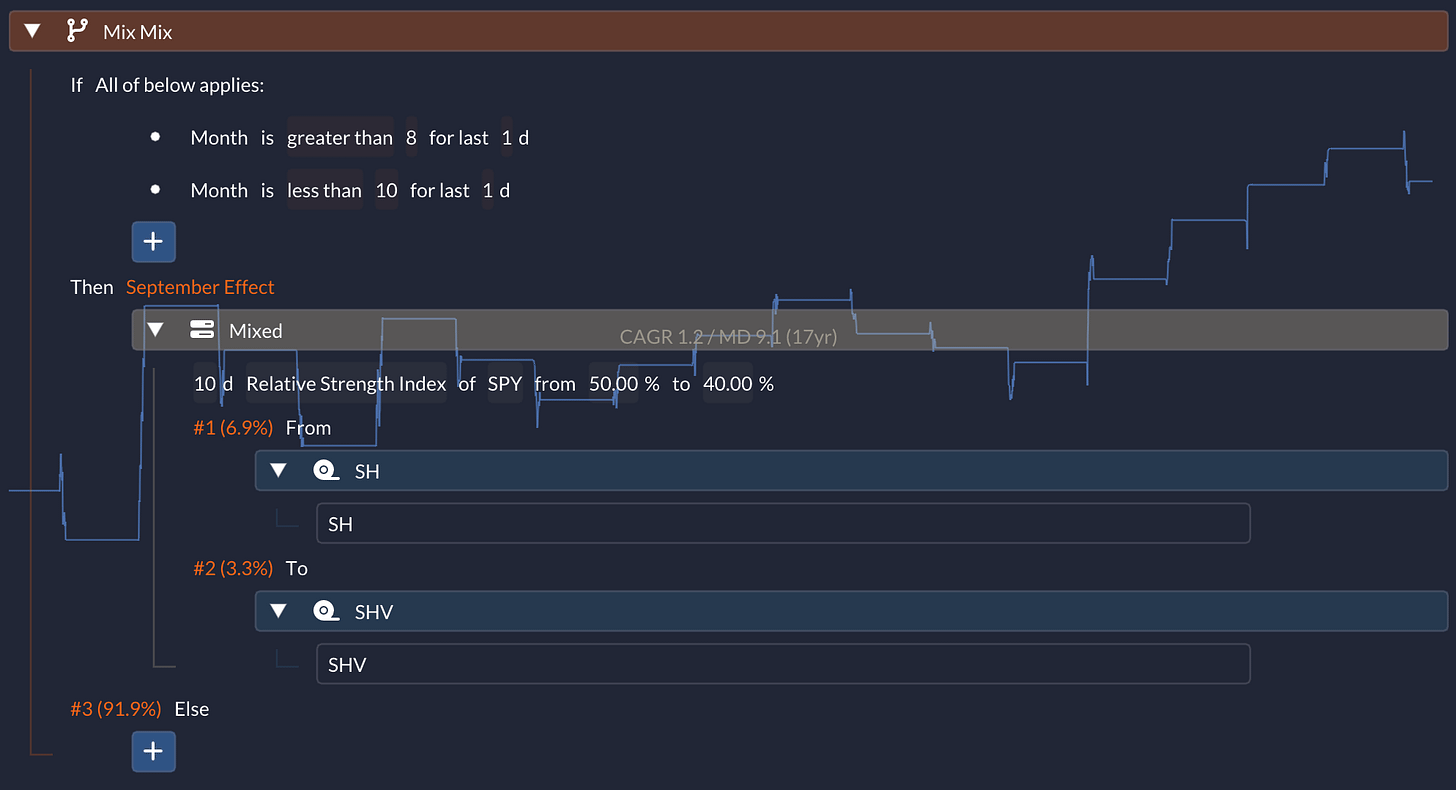

September Effect

When I equal-weighted these four pieces, I got some impressive results. But here’s the rub: the average return for September was negative, while every other month showed a gain. Cue the dreaded September Effect.

To combat that, I added another Mixed incantation: if SPY’s RSI wasn’t too low in September, the strategy shorted the market with SH (an inverse S&P 500 ETF). That turned the month positive, too:

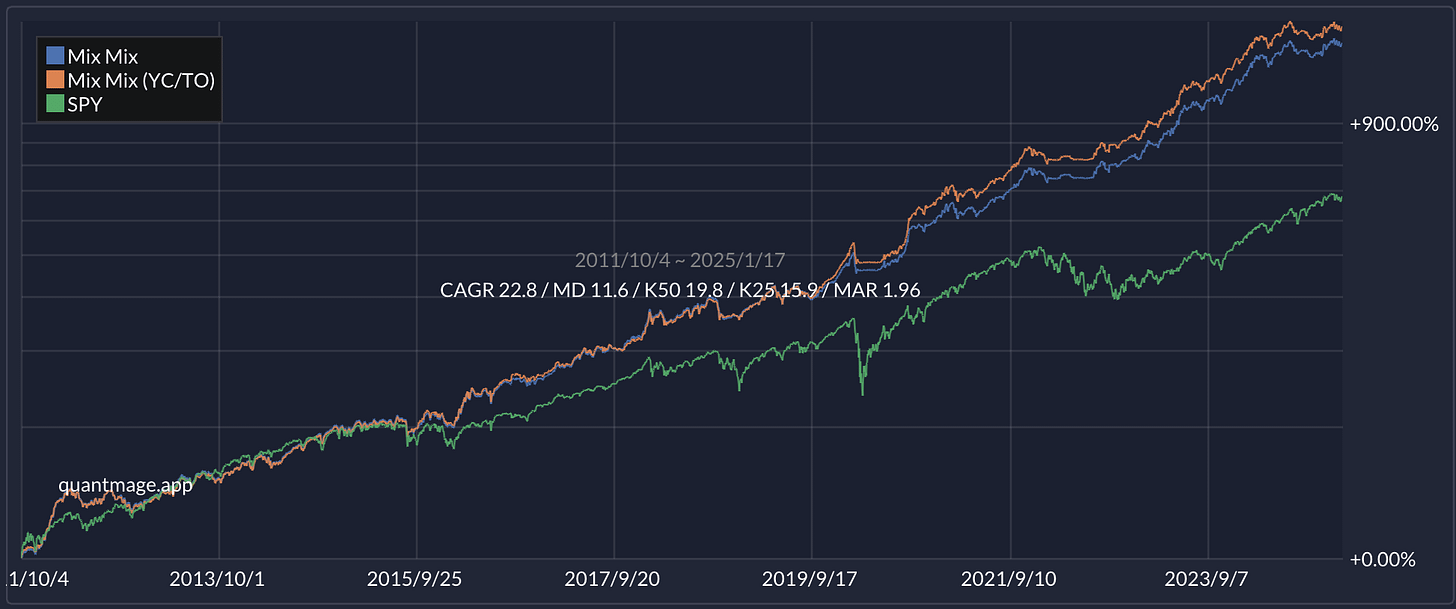

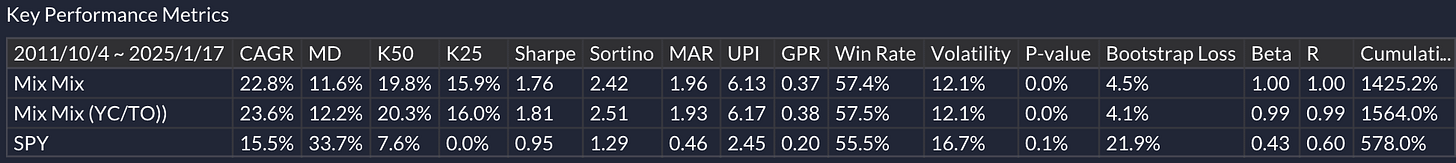

Final Result

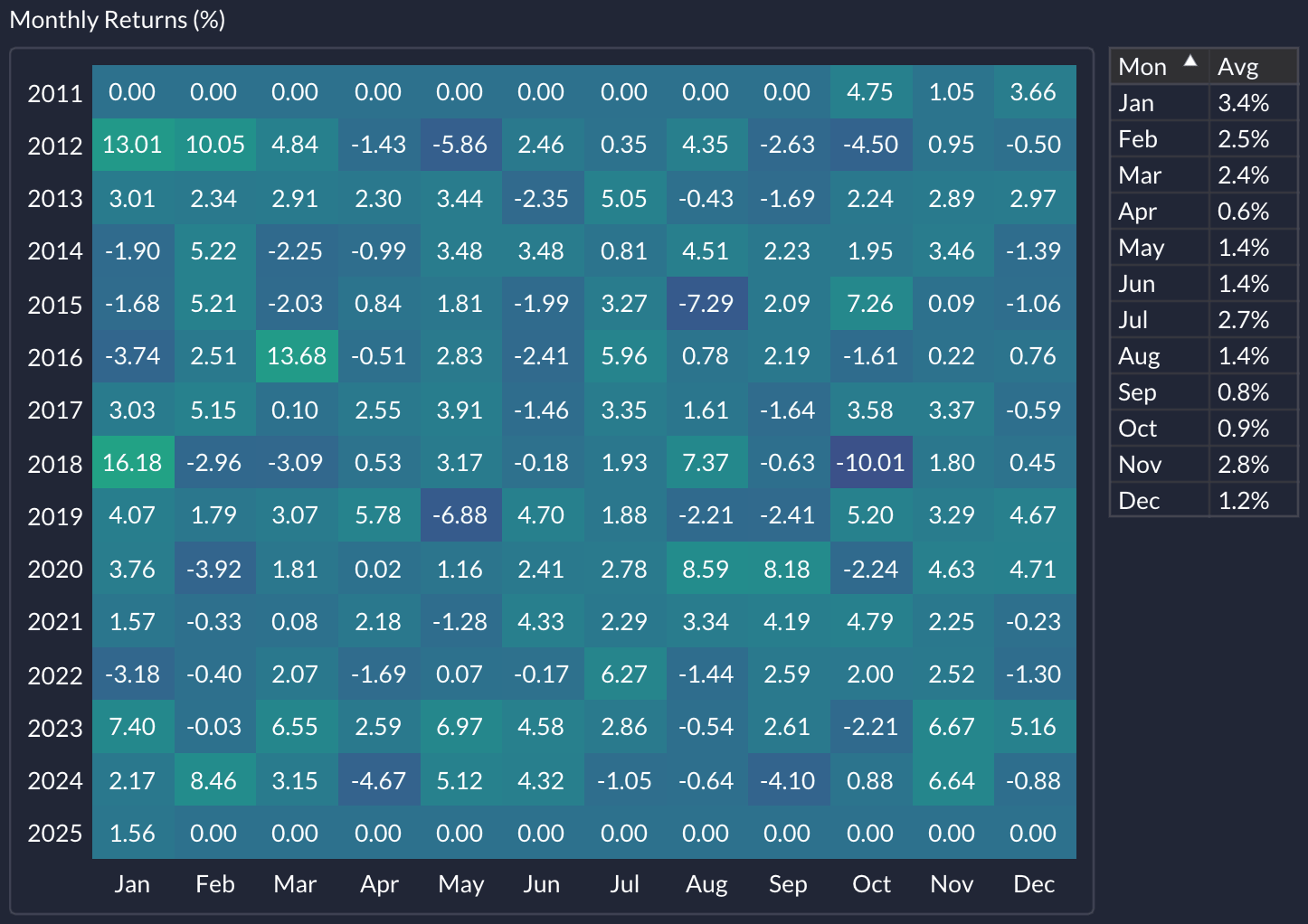

Curious about the complete strategy? It boasted a historical annual return of 22.8%, a max drawdown of 11.6%, and volatility of 12.1% over 13 years:

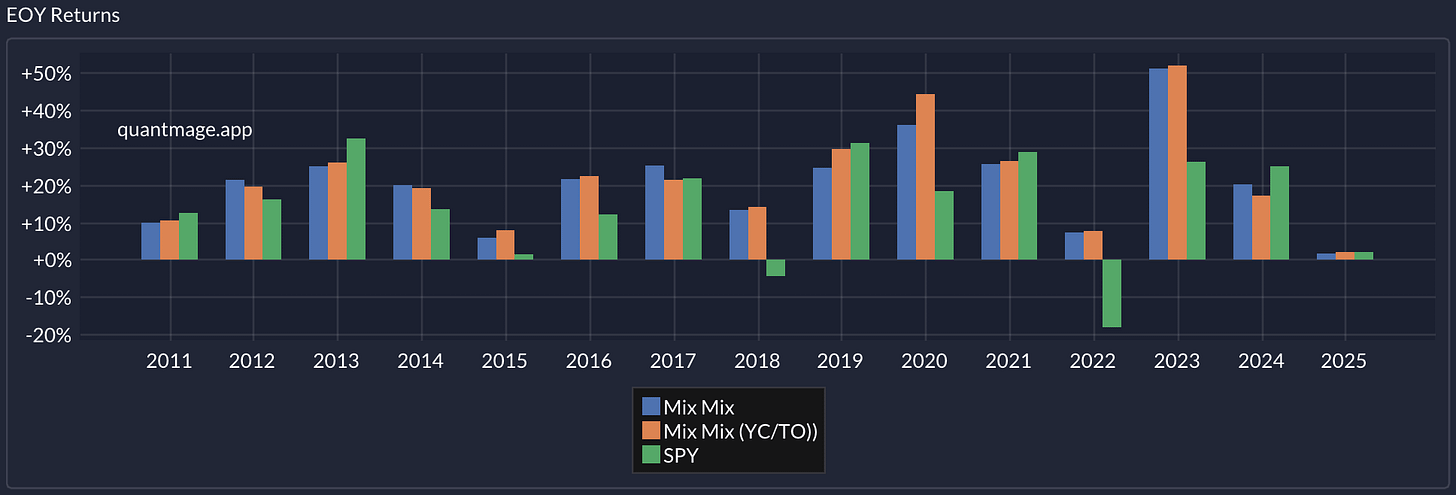

Better yet, it never had a single negative year (though GFC is not covered):

And each month, on average, trended positive (though October 2018 still delivered a double-digit loss):

Bottom Line

Using Mixed’s gradual scale-in/-out approach can bring a bit more nuance compared to, say, an all-or-nothing If/Else approach. That said, be wary: instruments like SVXY and UVXY can be very risky if you find yourself holding the wrong one in an inopportune time.

So what do you think? Did I hang up this strategy too soon? Is it too overfit for comfort? And can you think of any other assets that might vibe well with Mixed?

Jaewon this is great! In other discussions I saw that there is an option to weight signals (and strategies mix?) either by inverse volatility or equal weight.

What about momentum over volatility or momentum over correlation matrix? The former is the Kelly solution for a single asset strategy and the latter for a multi-asset strategy.

https://www.vertoxquant.com/p/kelly-criterion-in-practice