Portfolio Update 01/15/2025 - Plenty of Uncertainty 🤔

Beat the Market, But Still a Loss

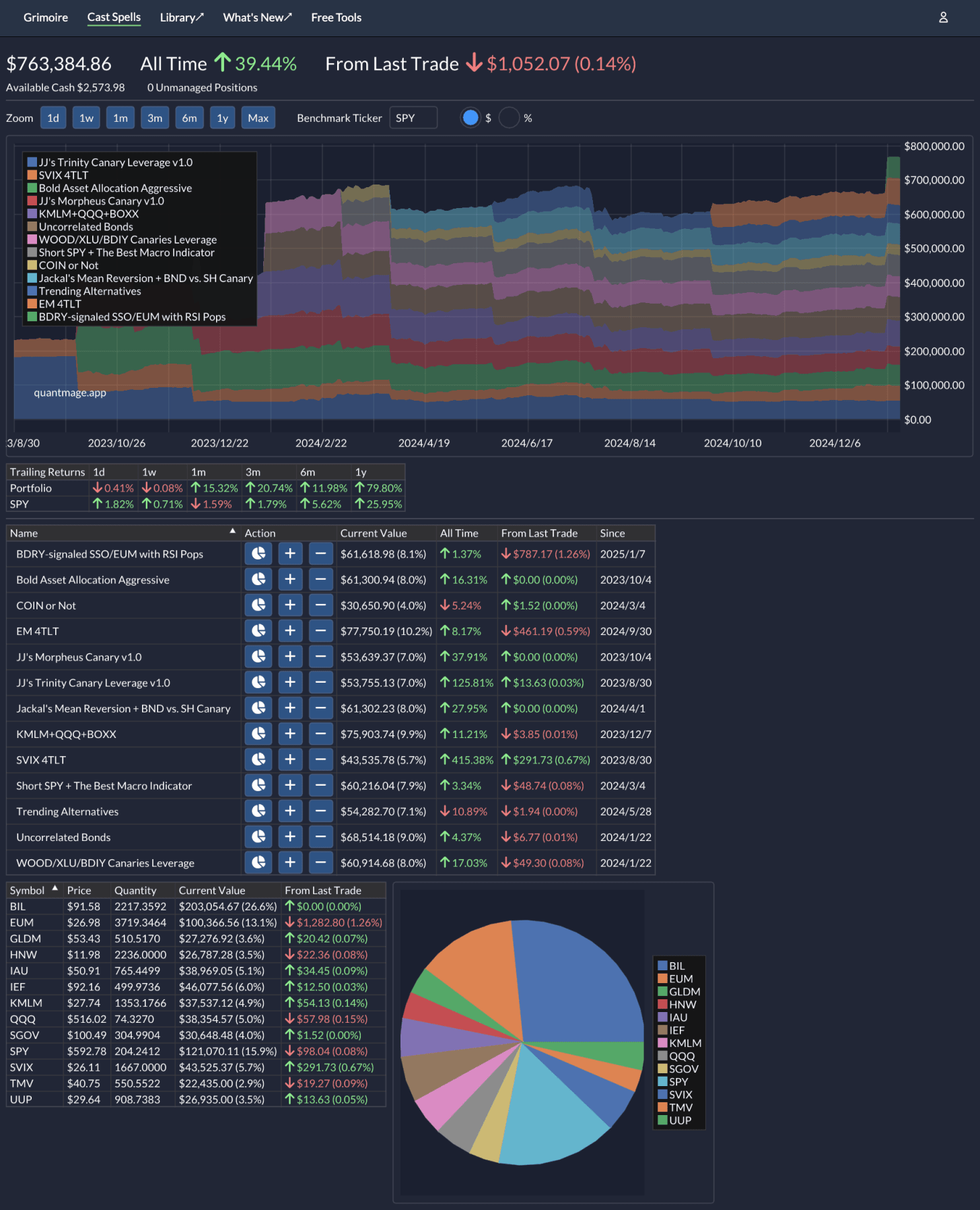

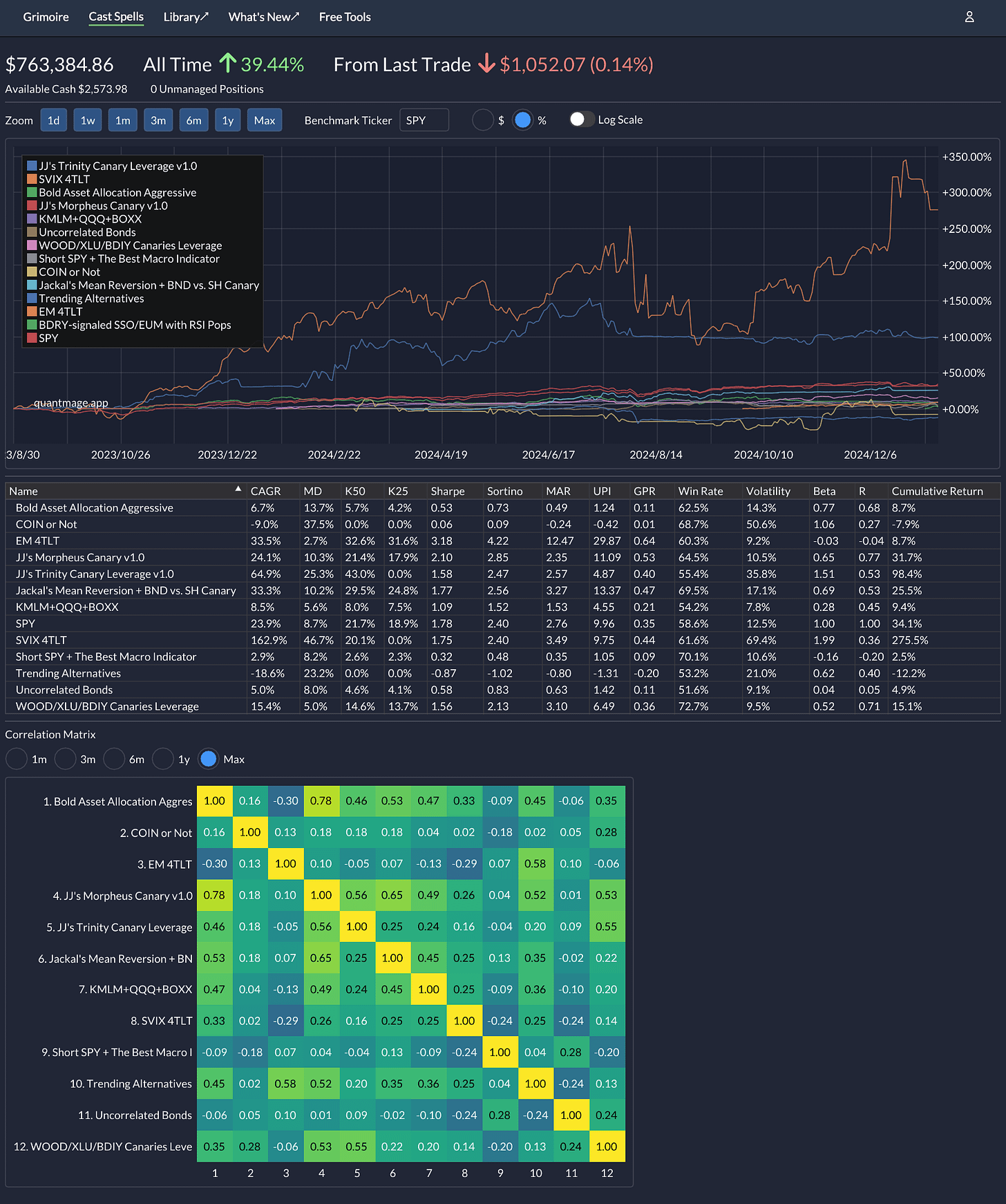

It’s time for my first portfolio update of 2025. Unfortunately, I’m starting the year off on a slightly sour note: my portfolio dropped 1.4% since the last update, while the S&P 500 (SPY) dipped 1.9% in the same period. Even though I’ve technically outperformed the market, a loss still stings.

Several forces have been making the market a bit jittery. Inflation remains an issue, there’s constant chatter about how many rate cuts are on the horizon, and investors are watching the new administration’s upcoming policies very closely. These factors come together to create a decent amount of uncertainty—and I’m feeling it in my portfolio, too.

On top of that, QuantMage is about to end support for several index data feeds because of an unexpected policy change by our data provider. This forced me to make some changes to my live spells that rely on the Dollar Index, the Baltic Dry Index, and multiple VIX indices. In particular, Power of VIX1D Combo had to be retired since its key index (VIX1D) won’t be available soon. I also retired Mix Mix, a strategy I felt less confident about anyway. In their place, I added BDRY-signaled SSO/EUM with RSI Pops, which should help keep things interesting and potentially offer some upside.

While I was at it, I rebalanced my whole portfolio based on IV+LCB (Inverse Volatility + Low Correlation Boost), with a bit of discretionary adjustment for good measure. I realized my overall approach had become too conservative over time, so I wanted to spice it up a bit.

Looking ahead, with stretched valuations in the U.S. and the possibility of policy curveballs from the incoming administration, I suspect 2025 will be more challenging than 2024. Still, I remain confident in my portfolio and my ability to navigate a choppy market. Here’s hoping we can steer us through any turbulence that comes our way!