Canary Signal Series: Tech vs. Utilities

Tech Sector Momentum against Utilities' as a Canary

Today, I’m excited to introduce another powerful “canary” signal — a twist on the idea of using the utilities sector as a benchmark, which I shared in a previous post.

📣 Quick note: Everything I share here is purely informational. I’m not your financial advisor, and I’m not telling you to buy or sell anything specific. Always do your homework, and if you’re ever in doubt, talk to a pro. Now, let’s dive into the fun stuff!

Tech vs. Utilities: The Signal

Instead of comparing against the SPY, this signal looks at the tech sector’s momentum and matches it up against XLU (Utilities Select Sector SPDR Fund). The logic here is simple: if utilities are beating tech, it’s a classic risk-off signal. For the tech sector, I’ve chosen FDN (First Trust Dow Jones Internet Index Fund) as our ETF. And as a momentum indicator, I’m using the 200-day RSI (Relative Strength Index).

The strategy is straightforward: invest in tech (specifically QQQ) if FDN’s momentum is stronger than XLU’s; otherwise, move to cash. The condition needs to be met for five consecutive days. Sure, checking it just for today often worked fine in my experiments, but the five-day rule seemed to deliver more reliable signals across different variations.

How Did It Perform?

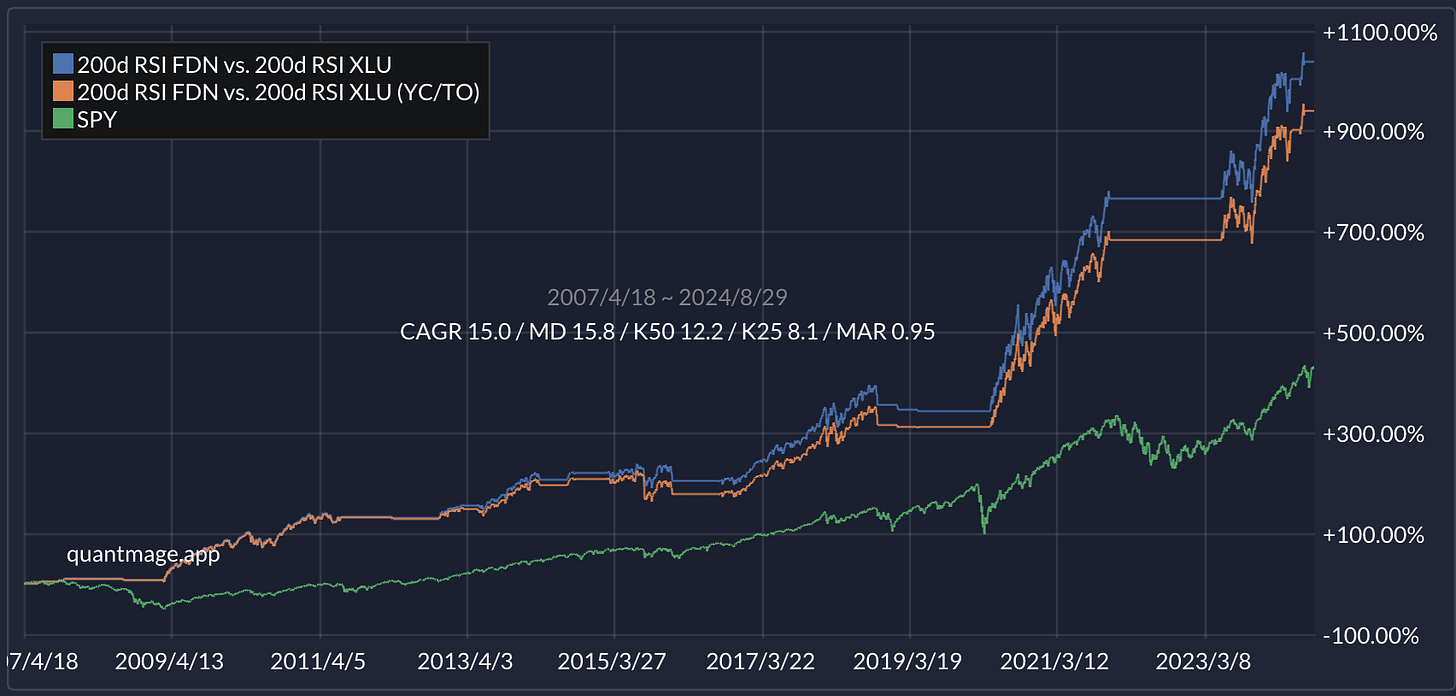

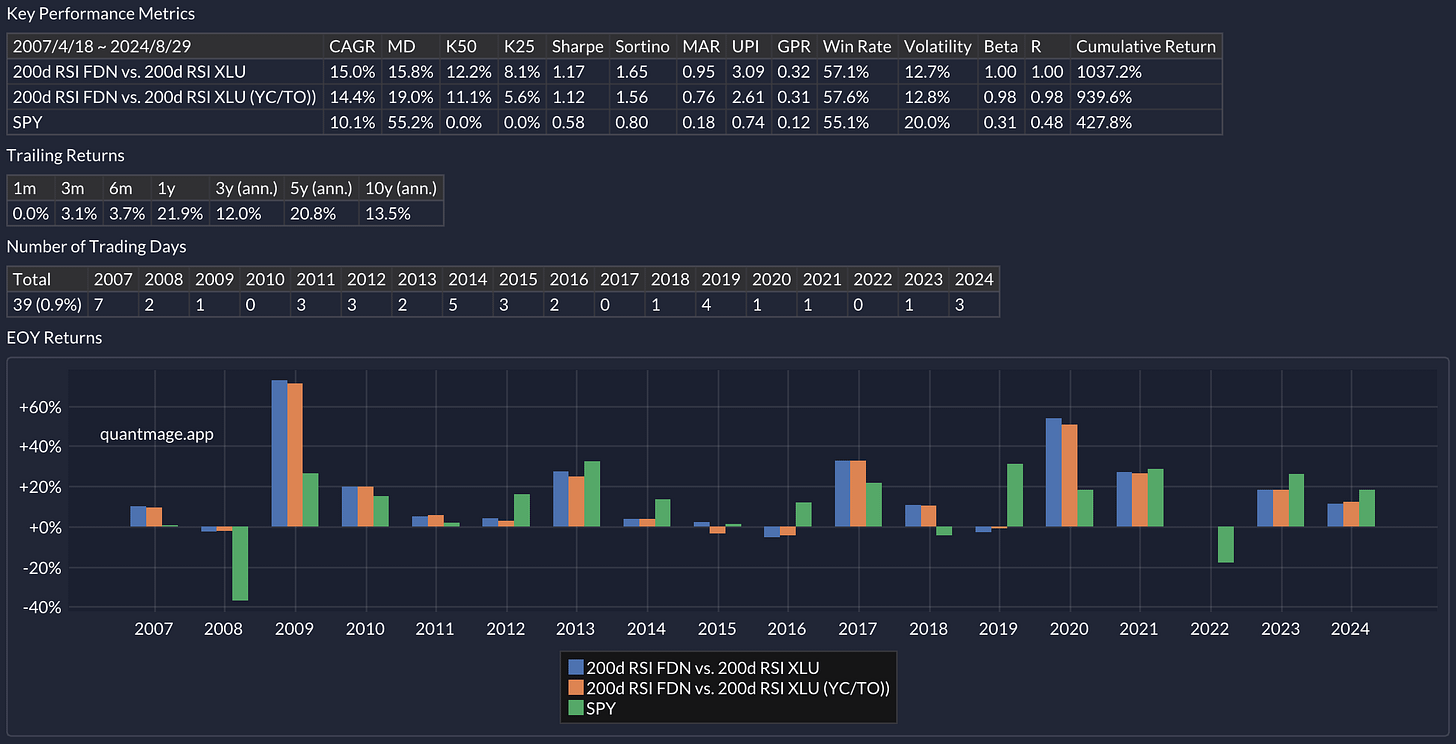

This strategy significantly outperformed SPY over a 17-year period, boasting a Sharpe ratio of 1.17 (compared to SPY’s 0.58). It also had a much lower max drawdown and volatility. It almost seemed to have a sixth sense in sidestepping the major market downturns of 2008, 2020, and 2022.

You might be wondering, why FDN instead of QQQ? I tested various tech ETFs both as the signal and the risk-on asset, and they all produced decent results. But FDN in the signal delivered the best performance. Meanwhile, the choice of the risk-on asset didn’t matter as much — swapping QQQ for FDN, for instance, yielded similar outcomes. I actually picked up on the idea of using FDN from a community on Discord. Feel free to experiment with the strategy yourself on QuantMage!

Bottom Line

What do you think? Does this risk-off canary have wings? Do these ideas spark any other “canary” strategies in your mind? (You can test them out on QuantMage.) Drop your thoughts in the comments below! 💡💬👇