Canary Signal Series: WOOD / XLU

Lumber and Utilities as a canary signal

Hey there, welcome back to our “Canary Signal Series”! Today, we’re diving into two intriguing signals both introduced by Michael Gayed of Lead-Lag Publishing. Let's see what these signals are all about and how they fare in the practical world.

🚀 Quick Heads Up! Just a friendly reminder: everything I share is for your information. I'm not playing the role of a financial advisor here, nor am I recommending specific stocks. Always do your homework and consider chatting with a finance pro before you leap. Now, let's dive into the good stuff!

WOOD Canary

First up, we have a gem from Michael's engagingly titled paper, “Lumber: Worth Its Weight in Gold”. The gist? It's about leveraging the performance of the lumber market (yep, good old wood) against gold to gauge stock investment opportunities. The logic is pretty neat: lumber, a cyclical leading indicator, versus the non-cyclical, uncorrelated gold can shed light on economic trends. I'm all for signals that my brain can happily digest and rationalize, and this one passes the test.

So, how does this theory pan out in the real world? I took it for a spin in QuantMage and made a few tweaks:

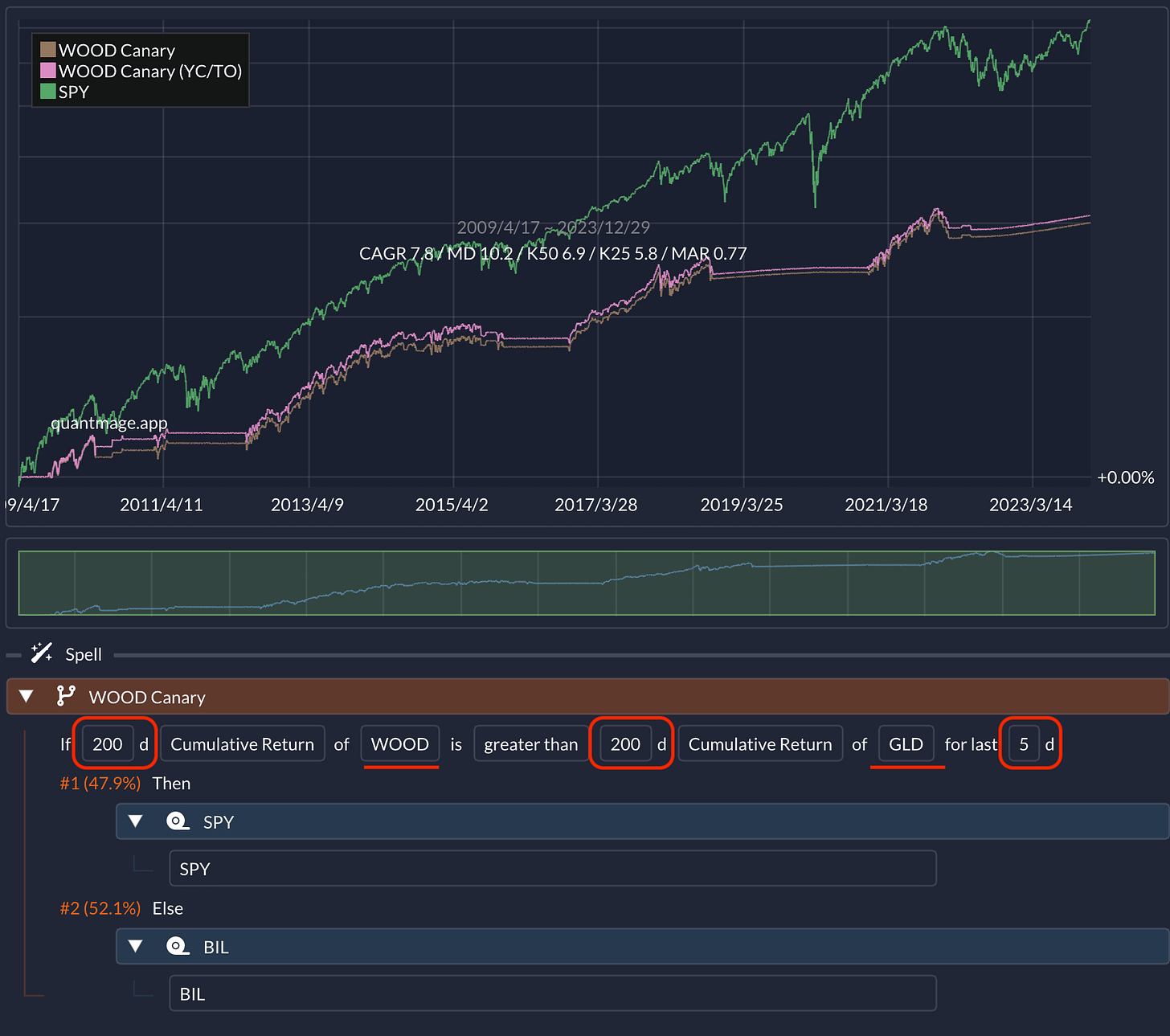

Instead of actual lumber futures, I used the WOOD ETF (a close cousin, but not a twin). Similarly, GLD ETF stepped in for the gold spot index, XAU. I also stretched the look-back period to 200 days and waited for the signal to hold steady for 5 consecutive days before triggering. And, oh, I opted for threshold trading rather than the weekly rebalancing suggested in the paper. The result? A CAGR of 7.8% and a Max Drawdown of 10.2%. Not too shabby, right?

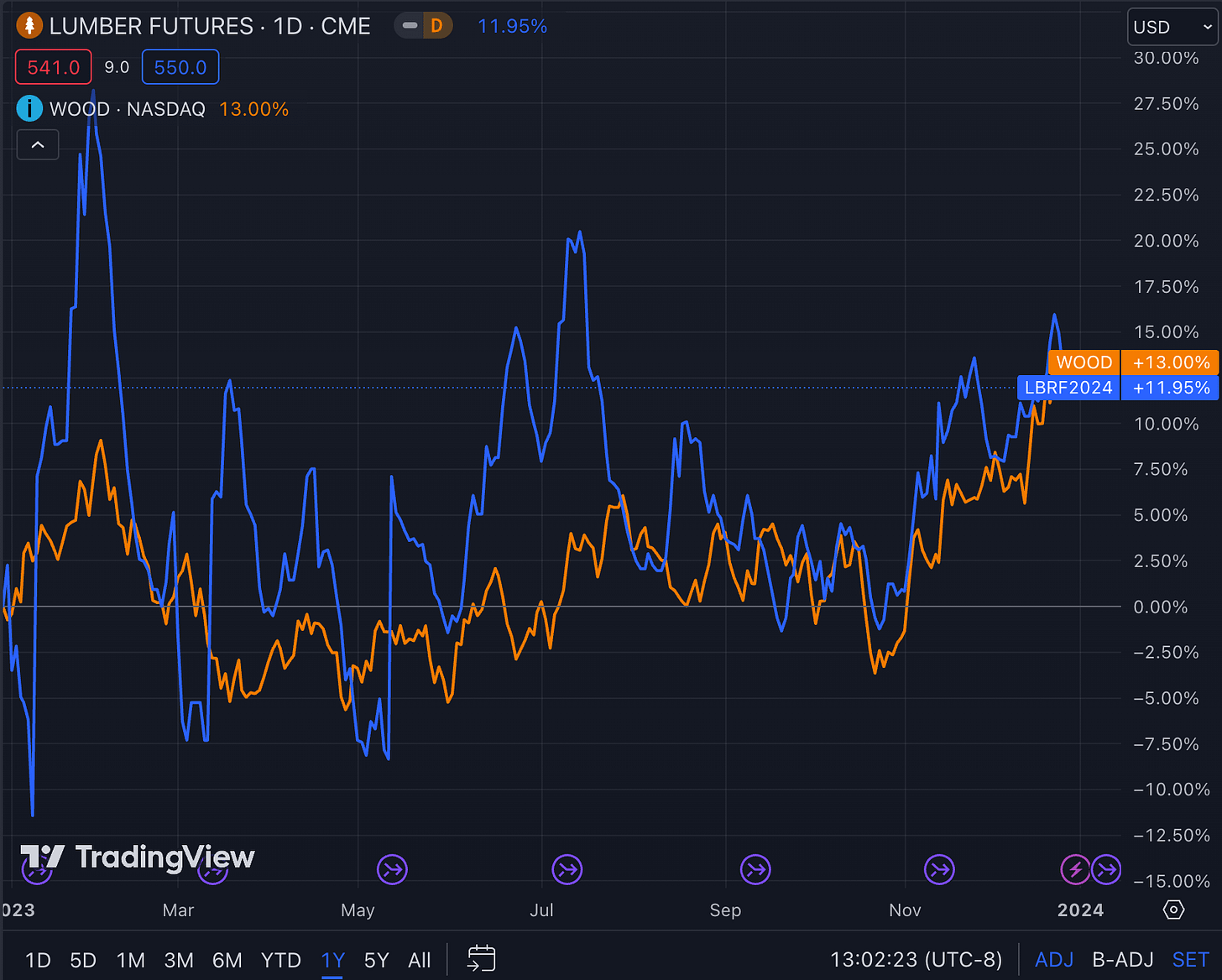

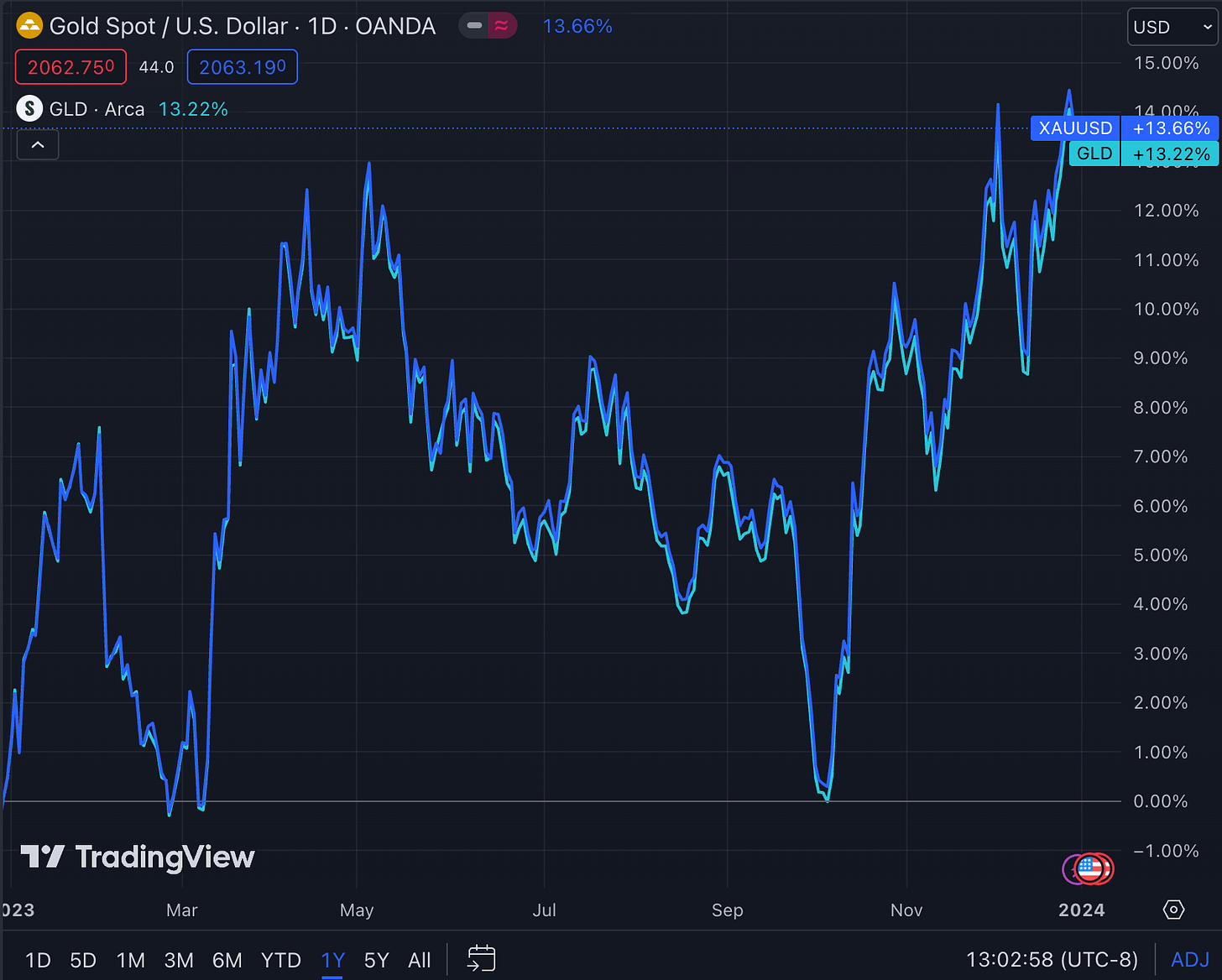

A quick heads-up: the WOOD ETF is somewhat of a rough sketch of the actual lumber futures index. It's in the ballpark but doesn't mirror it move for move. On the flip side, the GLD ETF does a pretty solid job tracking the XAU.

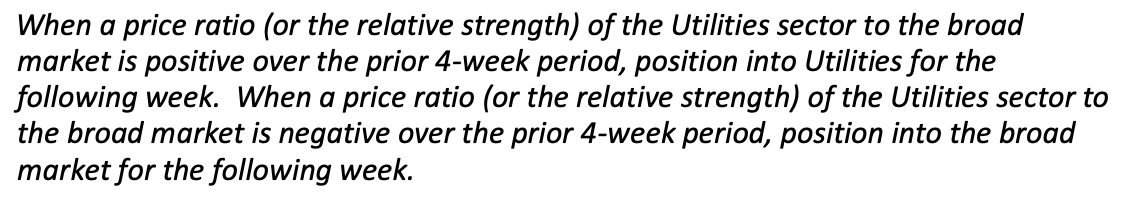

XLU Canary

Next, we have the signal from “An Intermarket Approach to Beta Rotation”, a paper that shines the spotlight on utilities. The core idea here is using the utilities sector's performance against the broader market as our canary. Given the sector's higher yield, lower beta, and its nonchalance towards cyclical swings, this makes a lot of sense.

I ran this through QuantMage, with SPY representing the broad market and XLU the utilities sector. The results weren't as stellar as the lumber-gold pair, mainly due to the harsh hit during the great recession (something the younger WOOD ETF didn’t face):

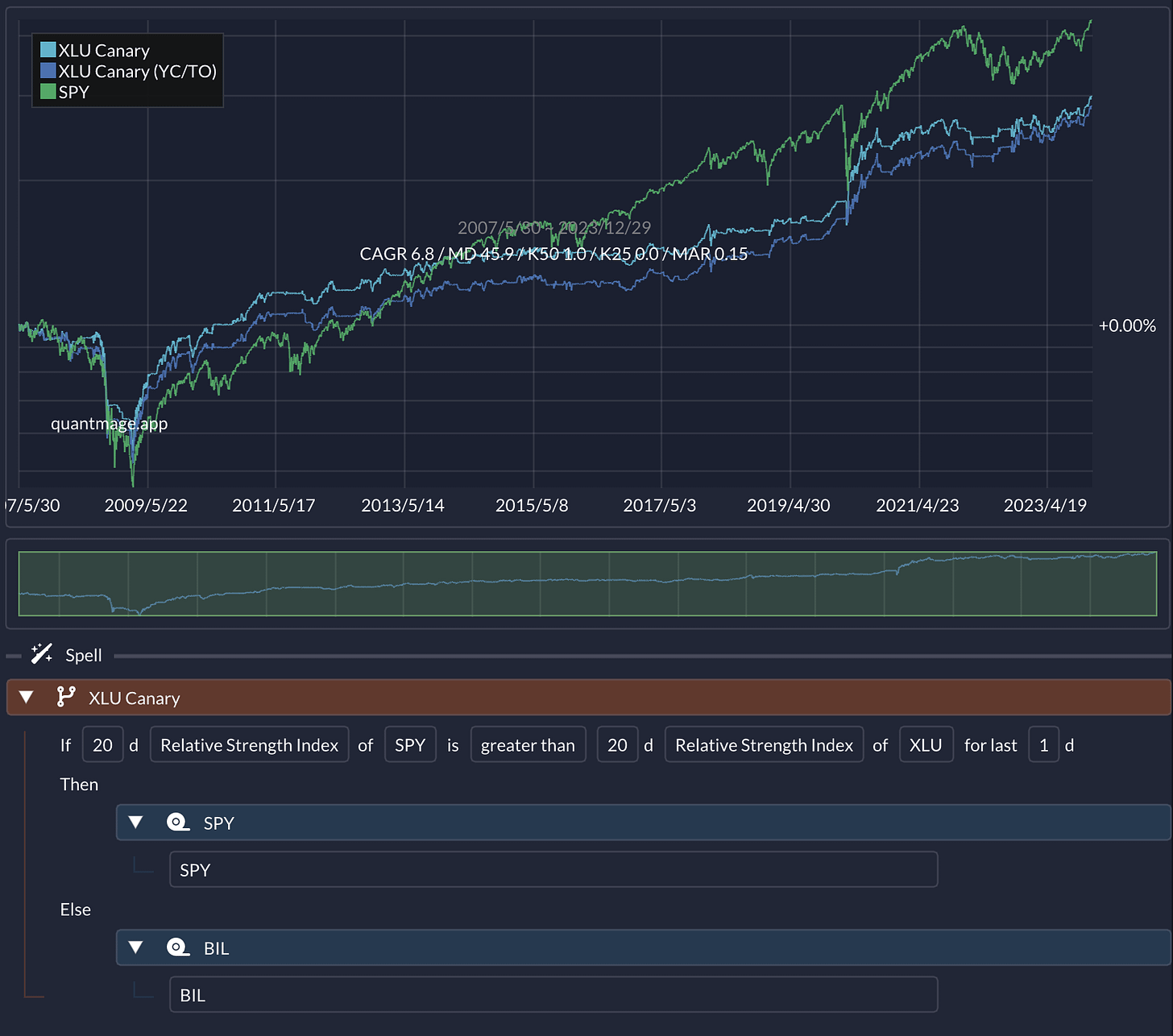

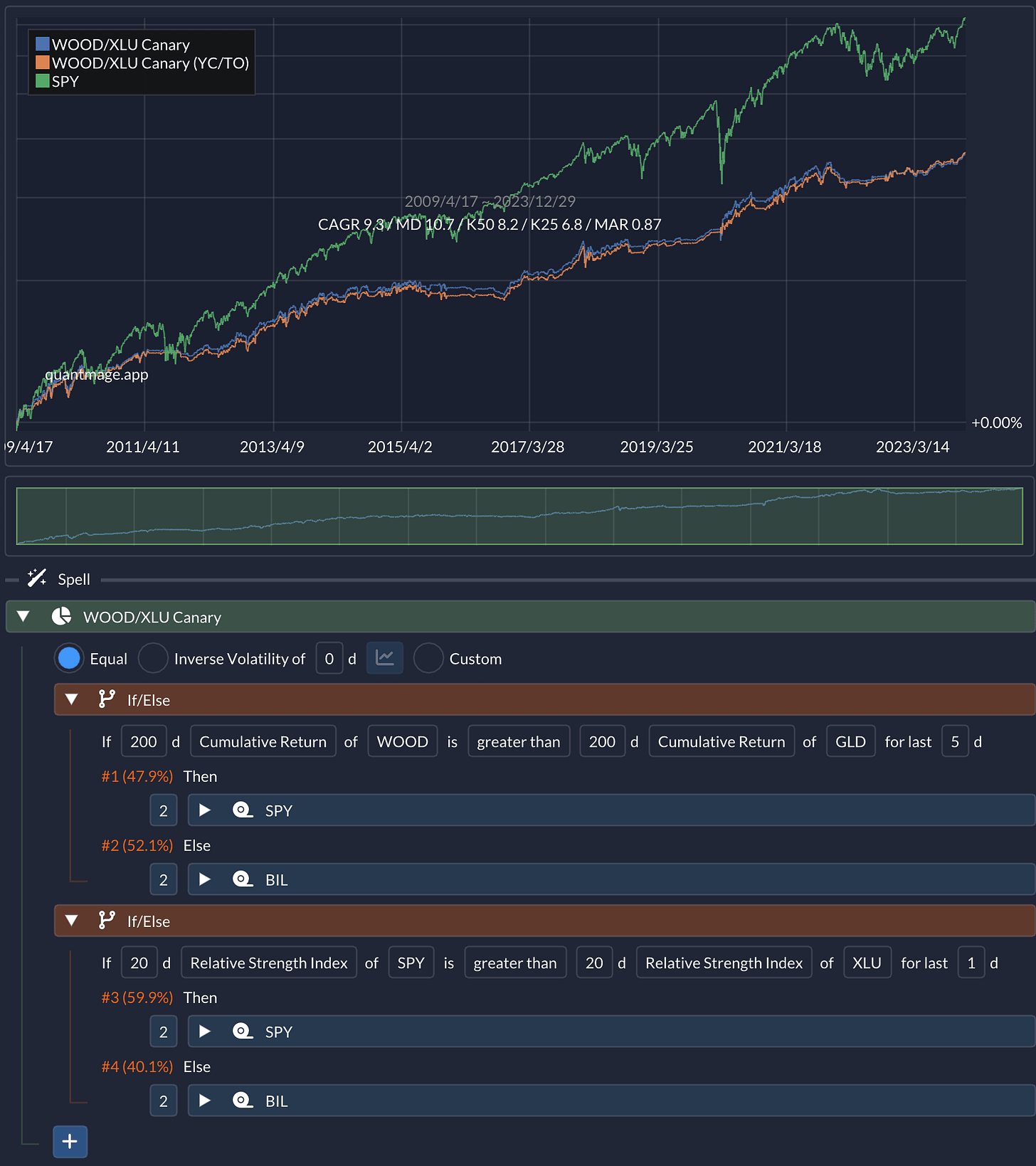

Combo Time!

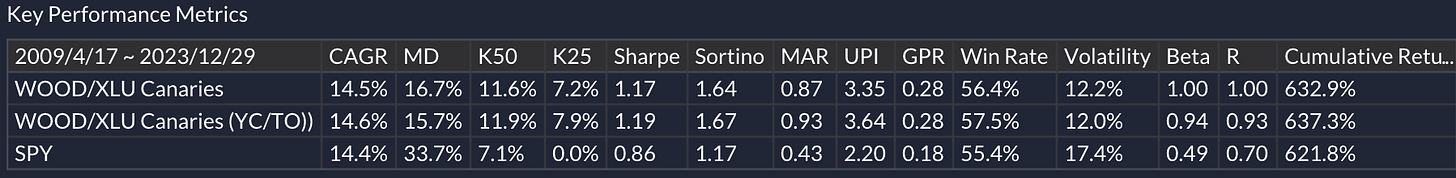

Why settle for one when you can have both? I tried blending these two strategies with equal weight. The outcome? A CAGR of 9.3% and a Max Drawdown of 10.7%, which looks pretty good compared to SPY’s CAGR of 14.4% and MD of 33.7% for the same period. This combo also boasts a higher Sharpe / Sortino / MAR / UPI ratio:

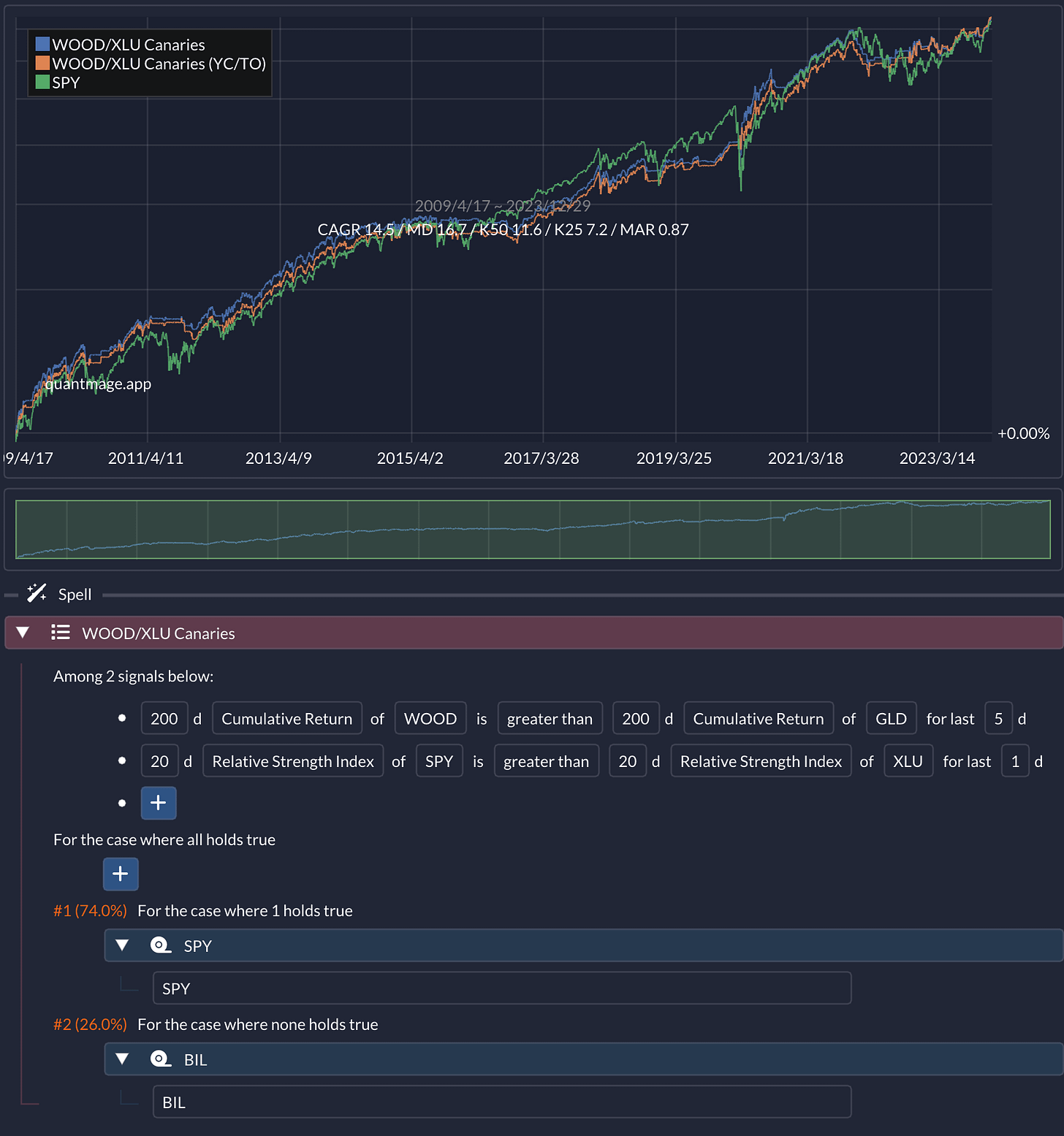

Feeling adventurous? Try this: invest in SPY whenever either signal goes green. This approach outperforms SPY in CAGR and is easier on the nerves with lower drawdowns and volatility:

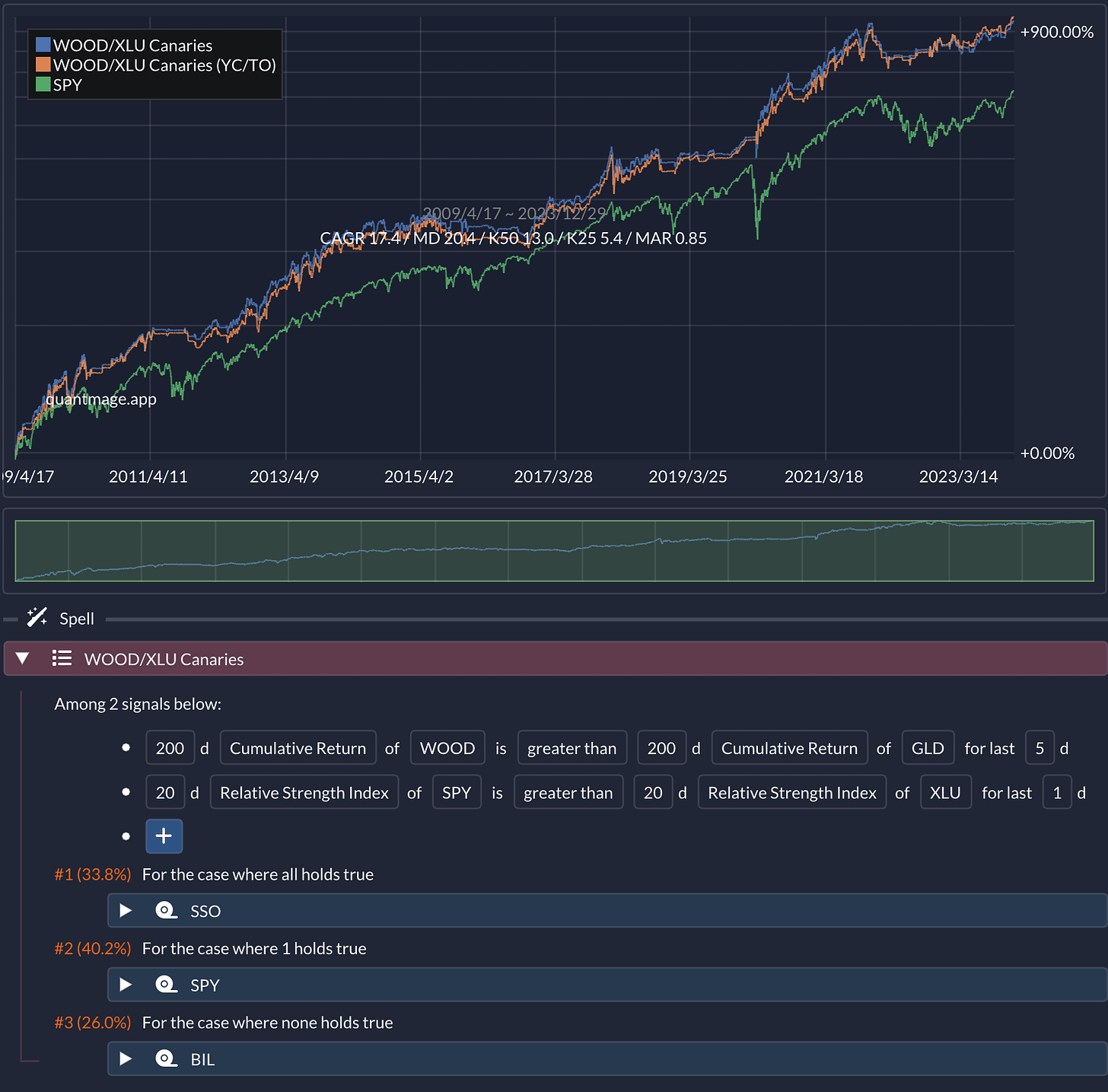

Want to kick it up a notch? Go for the 2x leveraged S&P 500 ETF, SSO, but only when both signals are a go:

So, what’s your take? Do these signals make the cut for your canary lineup? Which one would you put your bets on?

As we wrap up this edition and with it, the year, I want to take a moment to wish you all a fantastic New Year! May the coming year be filled with insightful investments, prosperous strategies, and a bit of that QuantMage magic in all your endeavors. Here's to a year of new opportunities and continued success – Happy New Year! 🎉

Looking forward to exploring more investment strategies and sharing insights with you in the upcoming year. Cheers to a prosperous and fulfilling 2024!