Why I Detest the Moving Average of Returns

How Moving Average of Returns Can Mislead And Why I Still Added It

I really didn’t want to add it to QuantMage. To me, the Moving Average of Returns (MAR) has always felt like the poor cousin of Cumulative Return. And just to be clear, we’re not talking about the Moving Average of Prices here, which is fine and useful. Today, I’ll explain why I’m not a fan of MAR and why, despite my reservations, it made its way into QuantMage.

How It Misleads

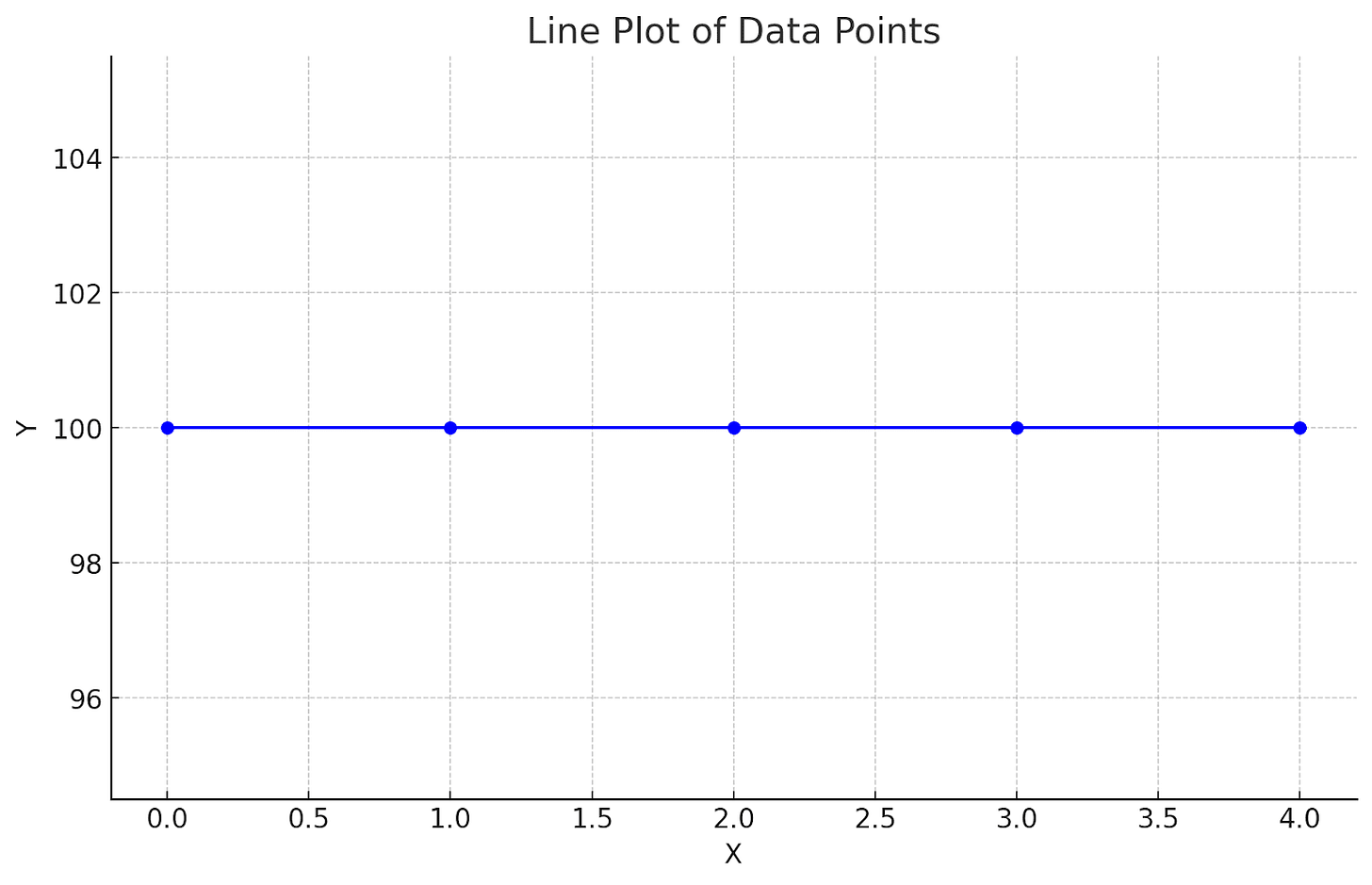

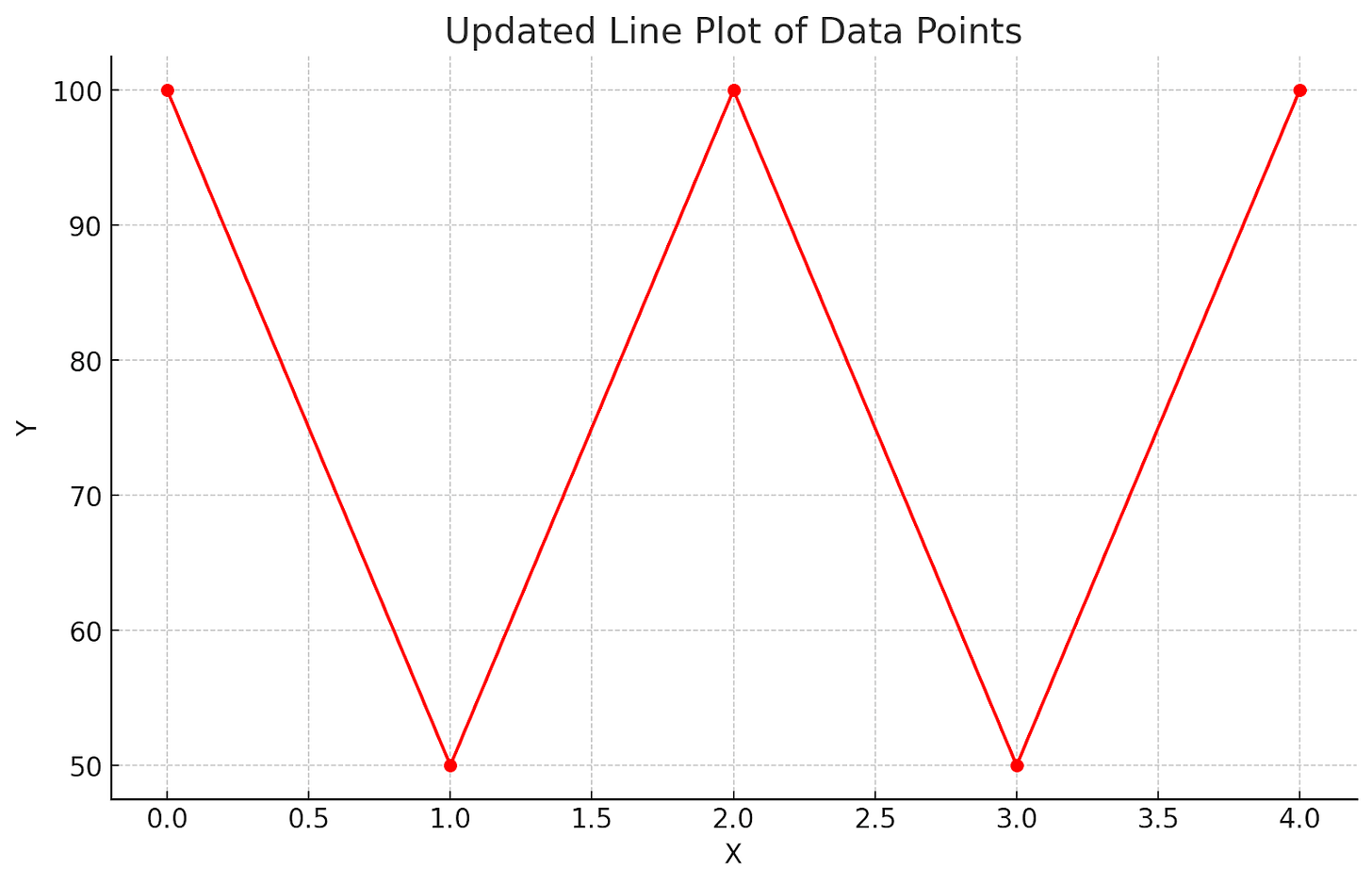

Let’s get concrete to make things clearer. Consider these two return paths:

Both paths end up at their starting prices after four days, but Path B is much more volatile. Now, before we calculate the MAR for each path, let me ask you: which path looks better to you as an investment? The calculation is straightforward: just average the daily returns over the period.

So comparing them suggests that Path B has a better return. But does your intuition agree?

Arithmetic vs. Geometric Returns

The reason these results feel counter-intuitive is because they use the arithmetic average, which ignores compounding. Instead, we should be using the geometric average for compounding. Let’s calculate the geometric returns for both paths:

Both ended up being 0% as expected. Essentially, the geometric return is the cumulative return exponentiated by one over the period. So, you can just compare the cumulative returns of two assets if you intend to compare their geometric returns.

You might have heard that the geometric average is roughly the arithmetic average minus half of the variance. This answer in the quantitative finance Q&A site explains the relationship from the perspective of stochastic differential equations. Another paper here explains it using the Maclaurin series expansion and suggests why it tends to underestimate the geometric return in practice. The key takeaway is that the arithmetic return tends to overestimate the true return, especially when the path is more volatile.

Why I Still Added It

So, my advice is not to use the Moving Average of Returns. Just use the Cumulative Return if you want to compare the returns of two assets over a certain period.

So why did it get added to the app? Because several users wanted it. More precisely, they wanted to import and keep using their strategies from a similar tool, which happened to support MAR as an indicator. In the end, we’re not in this journey to be correct; we’re here to make money. So, if anyone believes they can find an edge using MAR, who am I to argue? Even though I still see it as an inferior or misleading indicator. 🤷🏻♂️

Catering to user familiarity shouldn’t compromise analytical integrity. Understanding both arithmetic and geometric returns is crucial for accurate investment analysis.