Unlocking Donchian Channels in QuantMage with Aroon Indicators

A Clever Trick to Spot Channel Breakouts

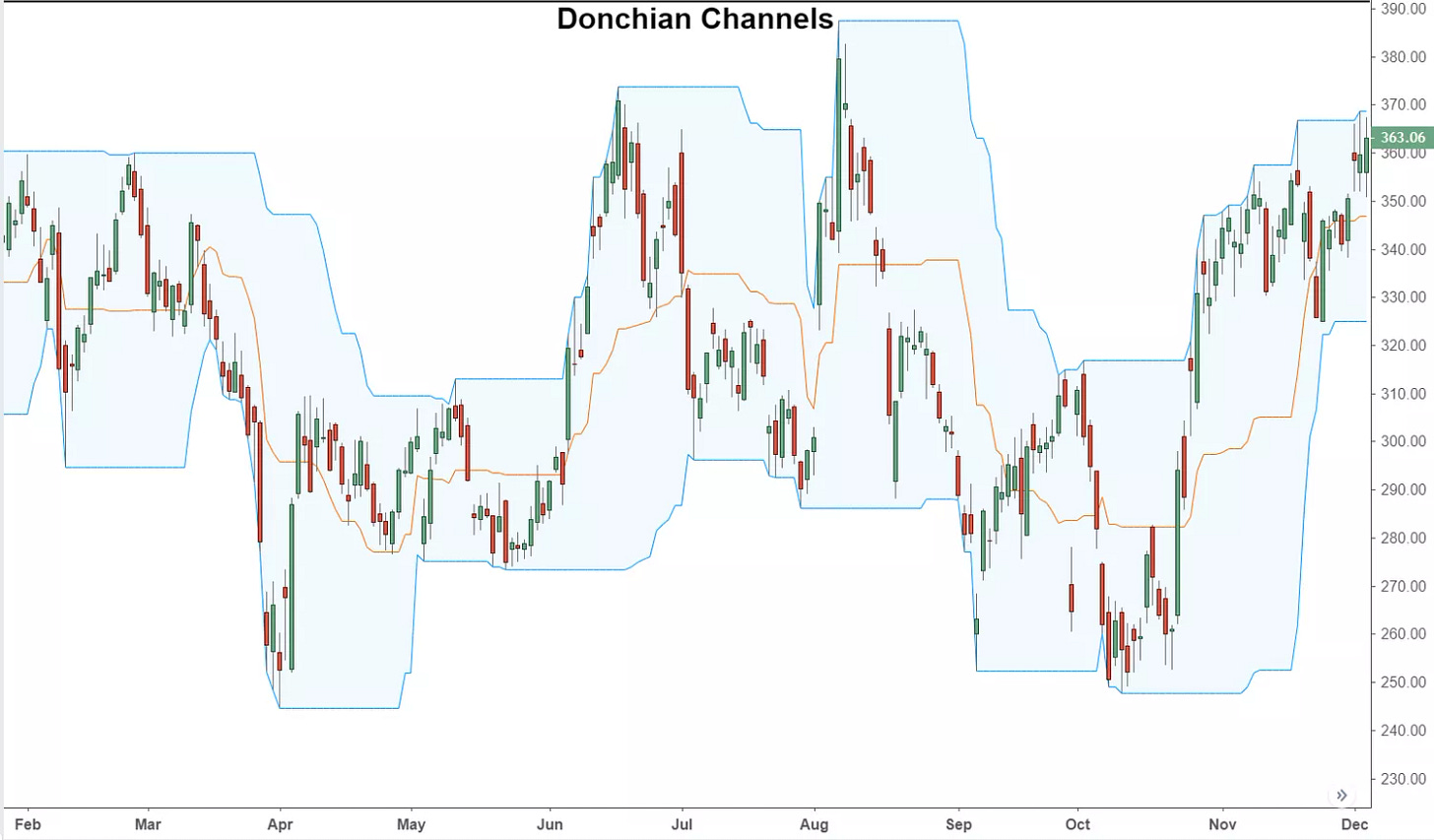

Let’s face it—the market can be a noisy place, especially when volatility kicks in. So how do we cut through the clutter to find meaningful signals? Many traders rely on channel breakouts like Bollinger Bands, Donchian Channels, and Keltner Channels, which adjust their widths based on market volatility. While QuantMage doesn’t directly support these channel indicators, there’s a nifty workaround to check Donchian Channel breakouts using other available tools. In this post, I’ll show you how.

Aroon to the Rescue

The Donchian Channel’s upper and lower boundaries are defined by the highest high and lowest low over a period of n days. Interestingly, QuantMage offers Aroon indicators that also focus on high and low prices. Aroon-Up and Aroon-Down are percentage-based indicators that measure how recently the n-day high or low occurred. When Aroon-Up or Aroon-Down hits 100%, it means today’s high or low is the highest or lowest in that period.

So, checking if an n-day Donchian Channel is breached is essentially the same as seeing if the (n+1)-day Aroon-Up or Aroon-Down is at 100%! Pretty neat, right?

Samples

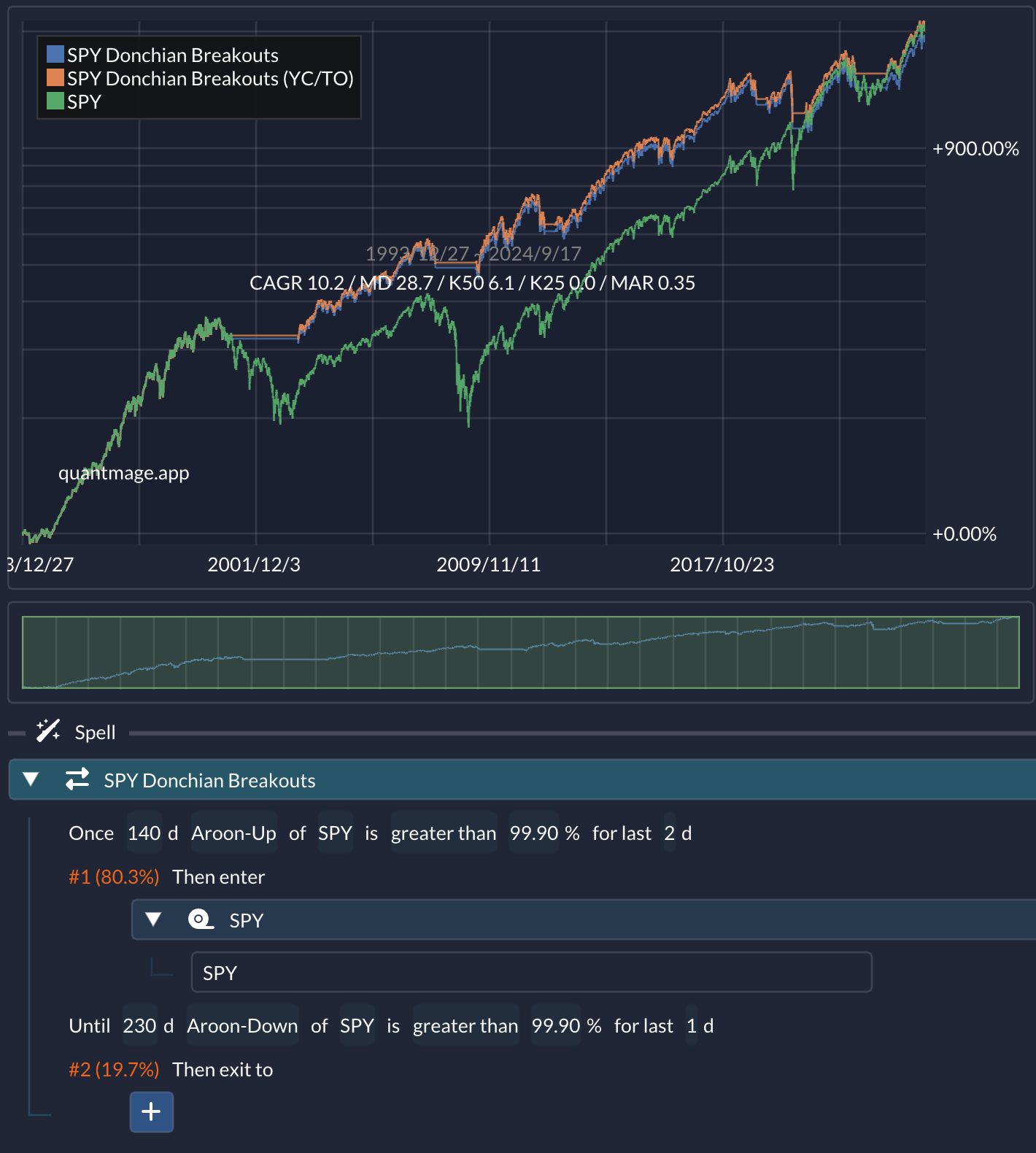

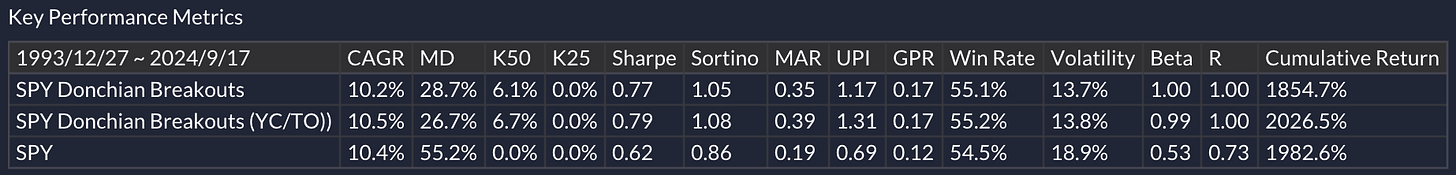

Let’s put this trick to the test with SPY:

As you can see, we’re checking if the Aroon values are greater than 99.9%, due to QuantMage’s lack of equality comparison. After some experimentation, I found that periods of 140 days for the high channel and 230 days for the low channel work quite well. Plus, looking for a high channel breakout signal over two consecutive days gave a slight performance boost.

Over a 30-year span, this strategy delivered a significantly better risk-adjusted return compared to a simple buy-and-hold of SPY, while being in the market only 80.3% of the time. Not too shabby!

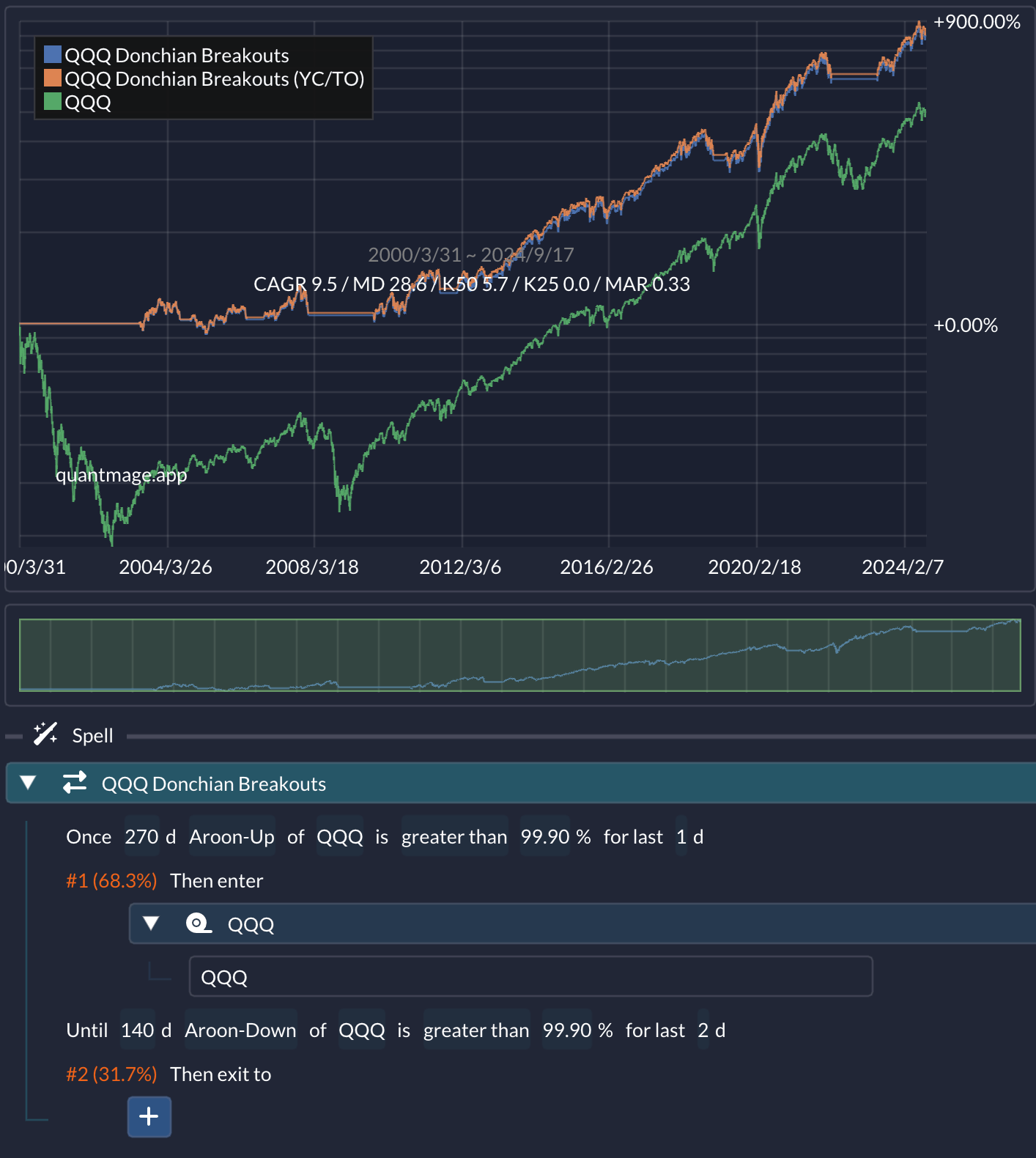

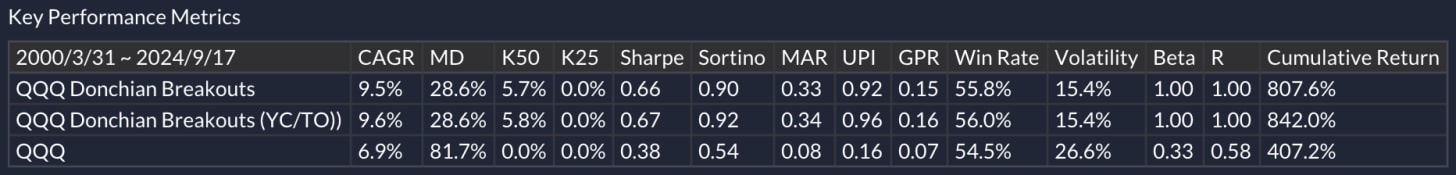

I applied the same approach to QQQ:

And got similar results over a 24-year period. Feel free to explore these samples further here and here.

🚨 This content is for informational purposes only and isn’t investment advice or a recommendation to buy or sell any securities. Always do your own research and consider consulting a financial professional before making investment decisions.

Takeaway

So, what are your thoughts? Do you use Donchian Channels in your trading strategy? Which bands or channels do you prefer? And have you tried out Aroon indicators? They’re quite unique since they measure elapsed time rather than just price changes.