Three Tidbits

Interesting Strategy Ideas I Came Across

I love coming across new trading strategies—whether it's from articles, academic papers, or the broader trading community. Even better if I can adapt them for QuantMage! Today, I’m sharing three intriguing strategy ideas I’ve picked up recently.

📣 Quick note: This is all just informational—not financial advice. I’m not telling you to buy or sell anything specific. Always do your homework, and consult a professional if you're unsure.

Larry Connors’ Double 7

The first strategy comes from a Reddit post where the author shared backtesting results on Larry Connors’ Double 7 strategy. It's a simple setup with price-based entry and exit rules:

The close must be above the 200-day moving average.

The close must be at a seven-day low.

If conditions 1 and 2 are true, go long at the close.

Sell when the close hits a seven-day high.

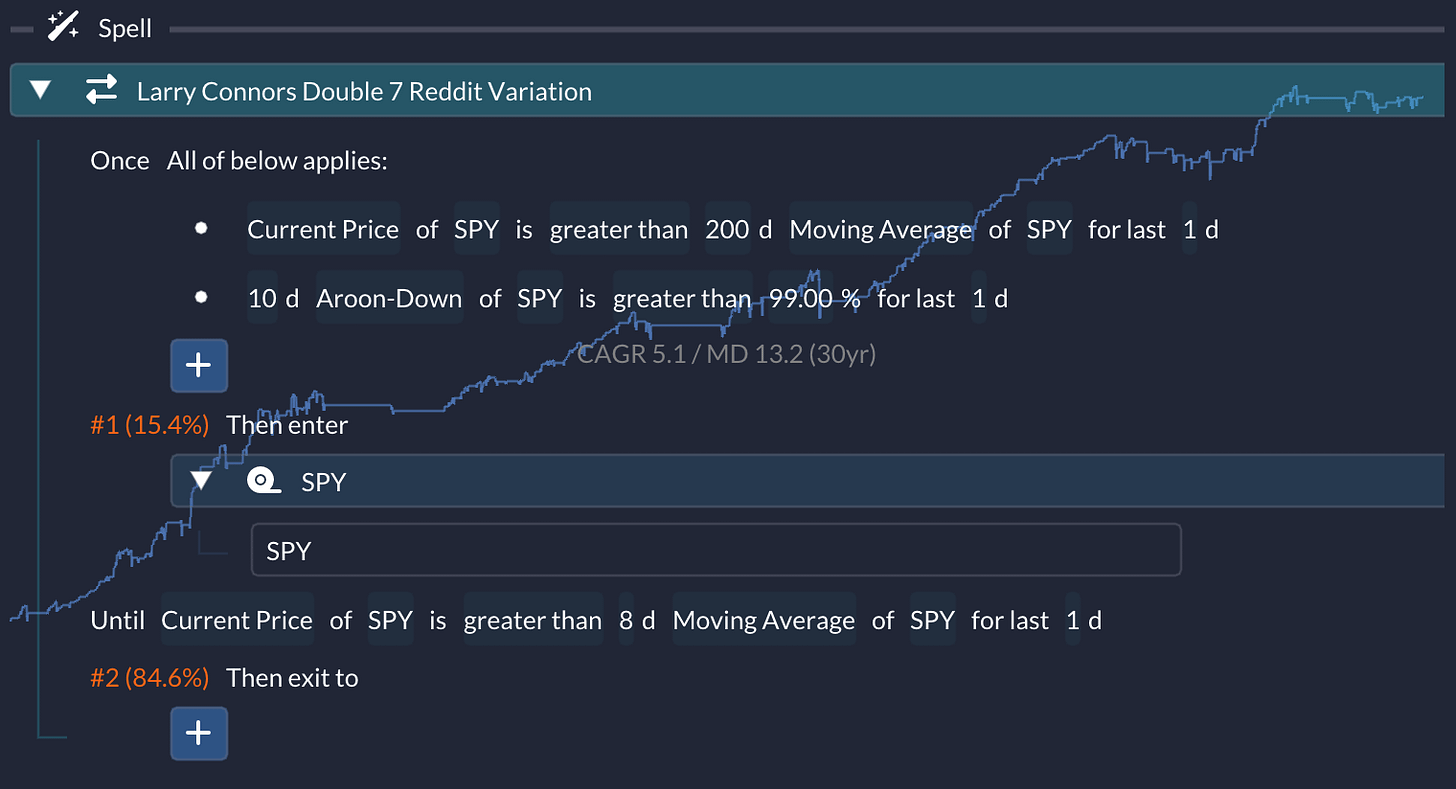

The Redditor mentioned a variation using a shorter moving average crossover (five days) as an exit signal, which performed well. Here's my adaptation with QuantMage, using SPY as the main asset:

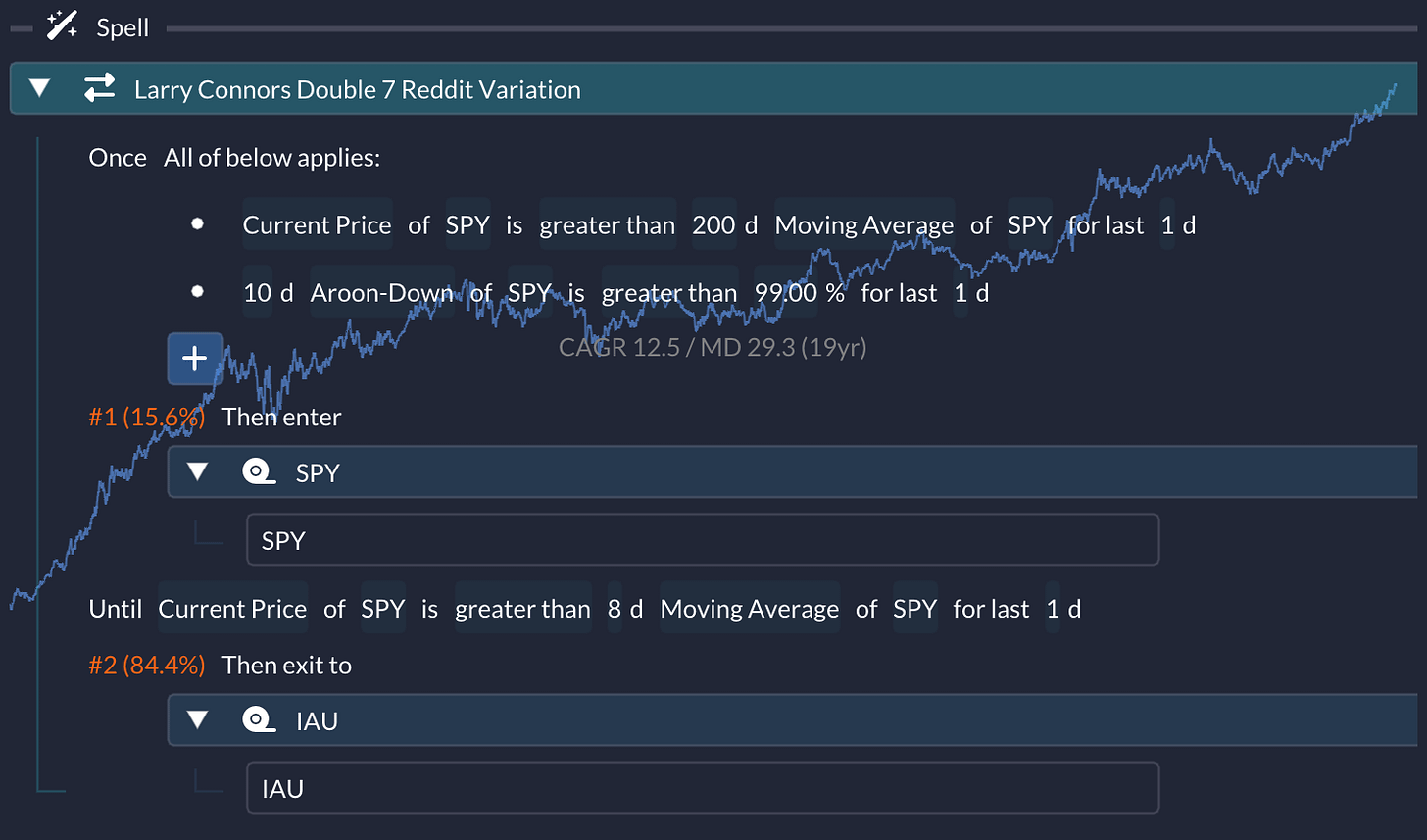

I modified it a bit: using a 10-day low instead of seven, and Aroon indicators to spot these lows. I also switched the exit signal to an eight-day moving average, which worked well in backtesting. The result? A CAGR of 5.1% with a max drawdown of 13.2% over a 30-year period. If you’re after a little more return, you can swap out cash (implied by the empty branch) for a gold ETF (like IAU) in the exit branch:

This shortens the backtesting period to 19 years, but it's an interesting twist worth exploring. Give it a try yourself here.

Dow Theory

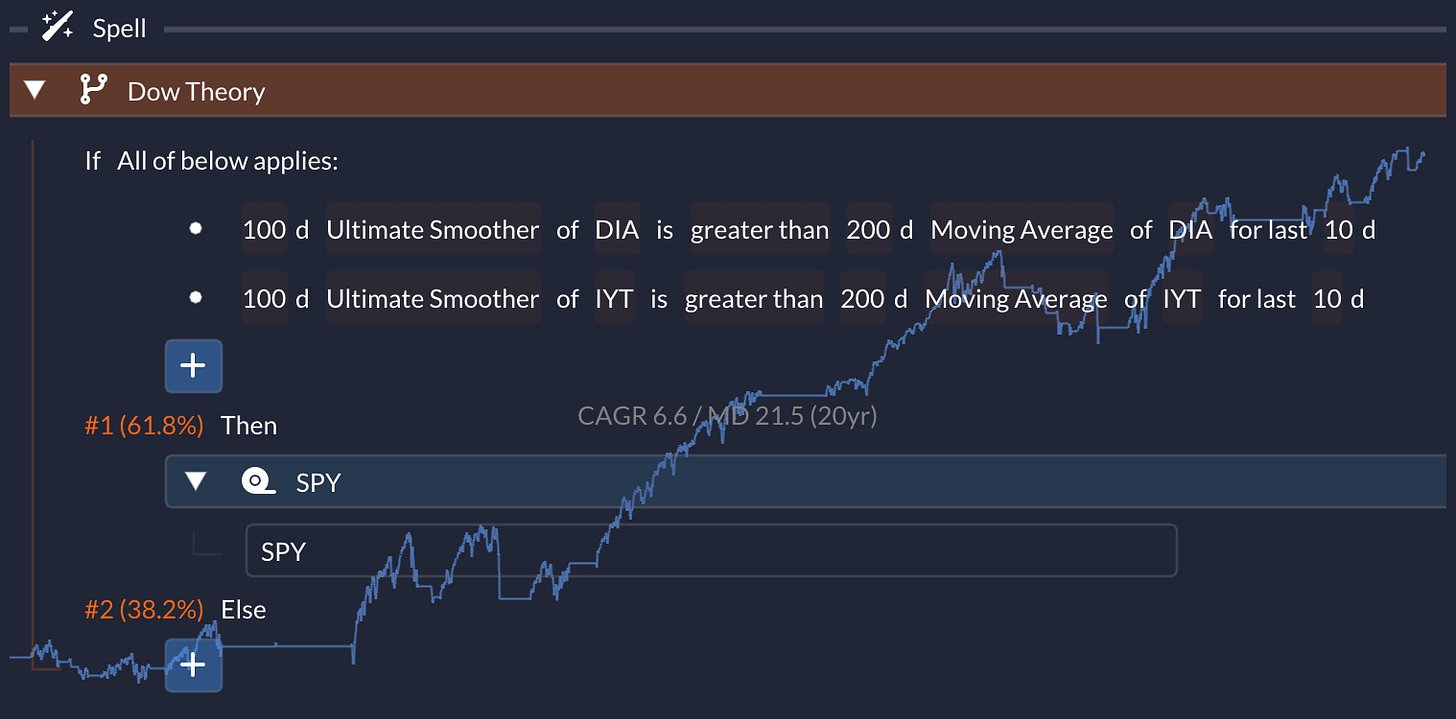

The next idea is inspired by the Dow Theory, which I recently came across. The core of Dow Theory is identifying trends in both the Dow Jones Industrial Average and the Dow Jones Transportation Average. You go bullish when both confirm an uptrend.

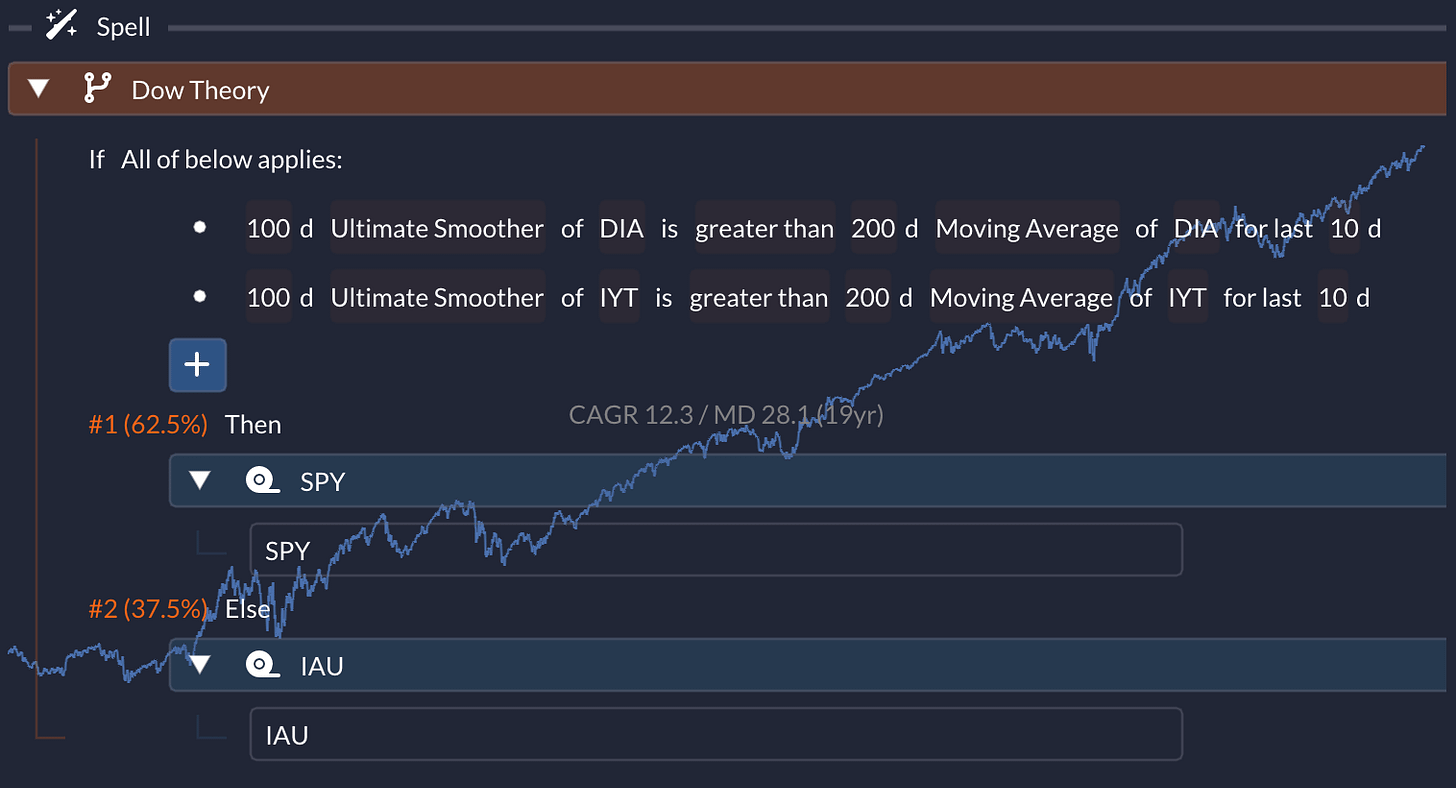

In this adaptation, I used the ETFs DIA and IYT instead of the actual indices. An uptrend is determined by comparing their 100-day Ultimate Smoothers to their 200-day moving averages:

The strategy delivered a CAGR of 6.6% and a max drawdown of 21.5% over a 20-year period. Again, substituting gold for cash as a risk-off asset can improve those returns:

Explore the strategy further here.

Sector Momentum

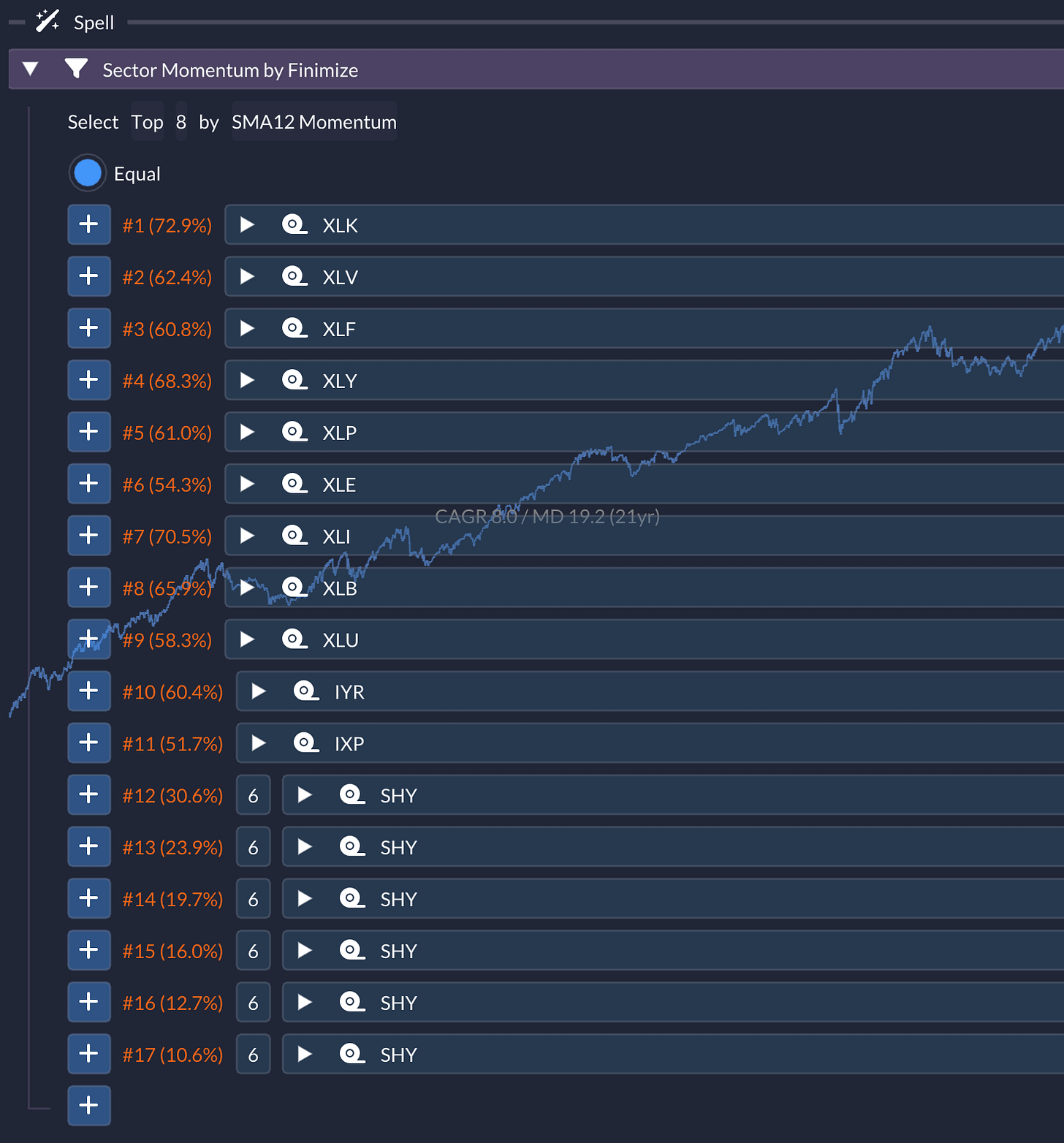

Lastly, we have a sector momentum strategy I read about on Finimize. It’s a dual-momentum sector rotation strategy, and here’s how I adapted it in QuantMage:

I used SMA12 to measure momentum, which differs slightly from the article. Plus, I swapped some ETFs to extend the backtesting period. This version selects eight sector ETFs instead of three and uses a threshold approach rather than monthly rebalancing. And only up to six of the sectors can escape into SHY if most sectors aren’t doing well. Why the changes? They simply performed better in backtesting—CAGR 8% with a max drawdown of 19.2% over a 21-year period. Check it out here.

What do you think? Does any of them inspire you to experiment, too?💡🧪📈