The Divergence of Fear Gauges

MOVE vs. VIX as a Canary in the Coal Mine

So, I stumbled upon an interesting research paper that digs into the divergence between the MOVE (Merrill Lynch Option Volatility Estimate) Index and the VIX (Chicago Board Options Exchange Volatility Index) as a predictor of future stock market returns. For those not familiar, the MOVE Index is like the "fear gauge" for Treasury bonds, while the VIX serves that role for equities. The paper suggests that when the bond market (measured by MOVE) is more fearful than the equity market (measured by VIX), it can be a bearish signal for stocks. On the flip side, if the bond market is showing less fear, it could be a bullish sign for equities. Naturally, I had to see if this thesis holds water by simulating it in QuantMage.

MOVE vs. VIX: A Simple Experiment

The research measures the divergence between these indexes as a residual from regressing MOVE on VIX, but it also explores using the ratio of MOVE to VIX. I decided to take a different route and tested several indicators from QuantMage—eventually landing on comparing their 60-day RSIs (Relative Strength Index). Interestingly, this worked pretty well. I cooked up a simple strategy: invest in SPY (S&P 500 ETF) if MOVE's RSI is lower than VIX's for five consecutive days, and switch to cash otherwise.

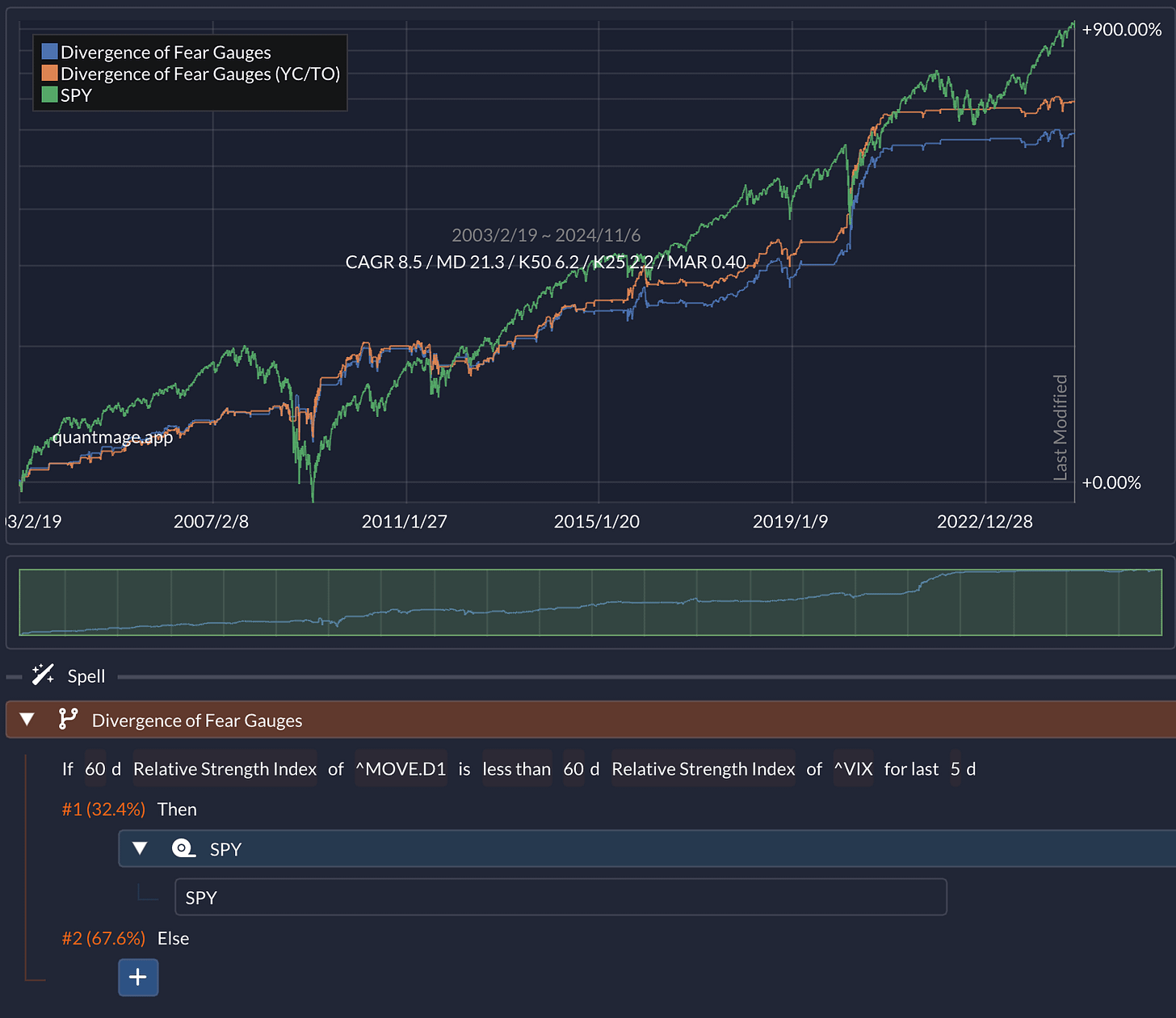

Here's how that looks:

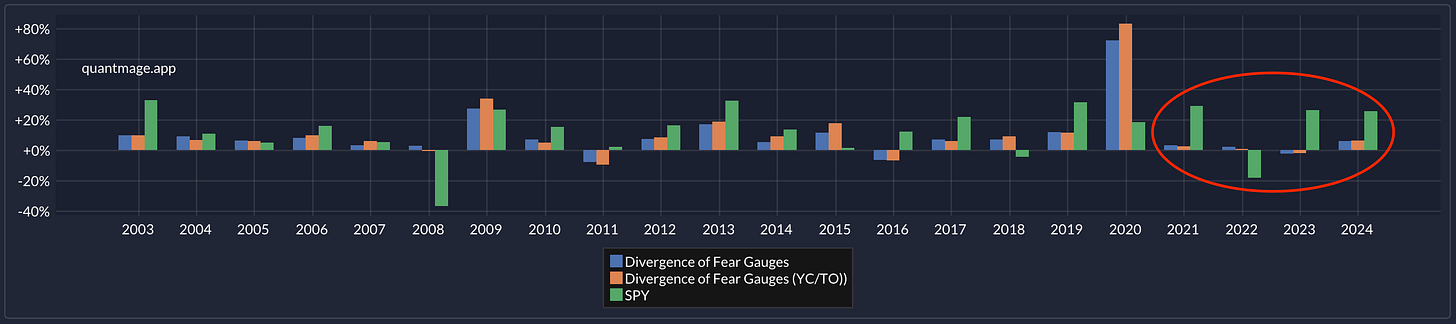

Backtesting showed a decent risk-adjusted return with a CAGR of 8.5% and a max drawdown of 21.3% over a 21-year period. As you can see, it achieved returns comparable to a SPY buy-and-hold but with much less volatility. That said, it's only in the market about 32.4% of the time, so you end up with long, somewhat boring stretches—especially in recent years:

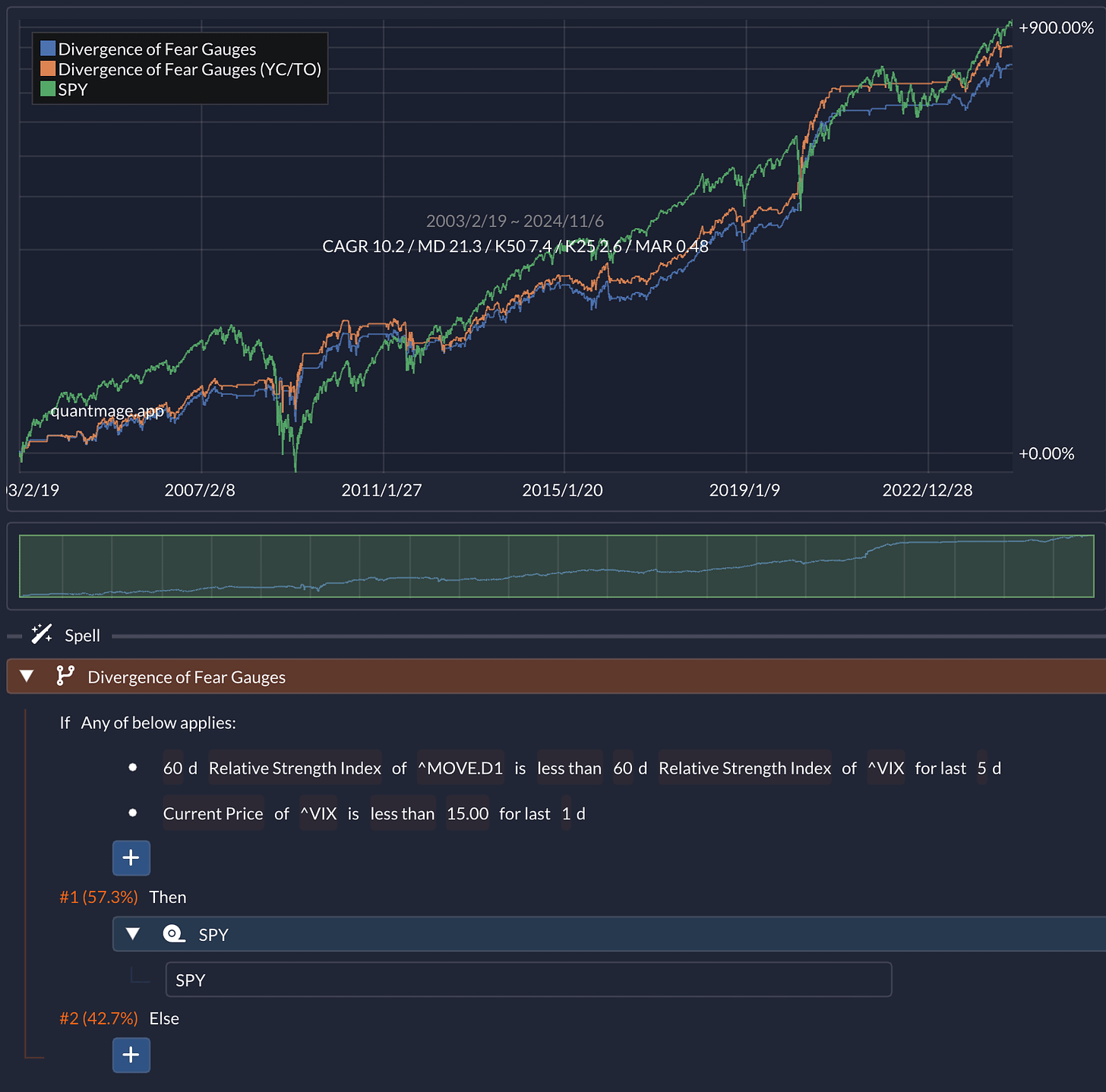

But if you want to spice things up, you could loosen the risk-on condition a bit—maybe enter SPY whenever VIX is also quite low (say, below 15):

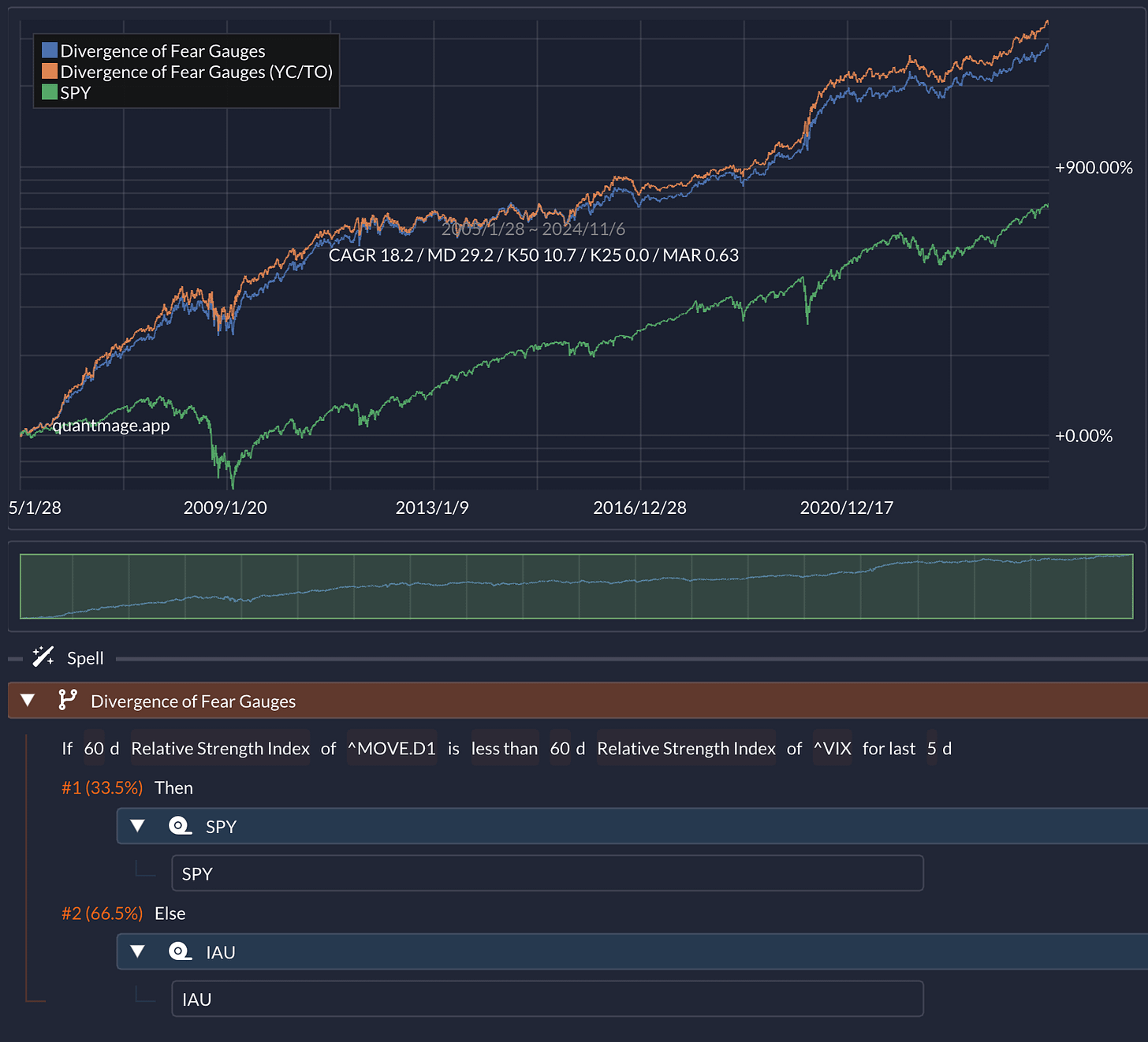

This version cranks up the annualized return to 10.2% while being in the market 57.3% of the time, giving a bit more action, especially during recent market conditions. Another fun twist is to swap out cash for gold—using IAU (a gold ETF) for the risk-off periods:

This option becomes a bit more volatile, but the CAGR jumps to 18.2% over a 19-year period. Not too shabby for adding some bling to your risk-off play.

Do you have more ideas to try? Give it a whirl yourself here.

Bottom Line

This was a quick seat-of-the-pants experiment, but I think it showed some intriguing results. Assuming there's something to it, what could explain its effectiveness? Well, the bond market is often seen as more sensitive and forward-looking regarding macroeconomic conditions—things like interest rates, inflation, and overall economic health. When the bond market is more fearful than equities, it might be signaling turbulence ahead that hasn't yet been priced into stocks. On the other hand, if MOVE is lower relative to VIX, it might suggest that the equity market is overreacting to short-term events, presenting a potential buying opportunity as the dust settles.

What do you think—does this have legs? And if so, why do you think it might work?

📣 Just a heads-up: everything I share here is purely informational. I'm not your financial advisor, and this isn't a recommendation to buy or sell anything. Always do your own homework, and if you're ever unsure, consult a pro.

I’m curious to hear your thoughts. Does the bond market’s fear tell a story worth listening to, or is it just noise?