Shannon's Demon

The Magic of Geometric Returns

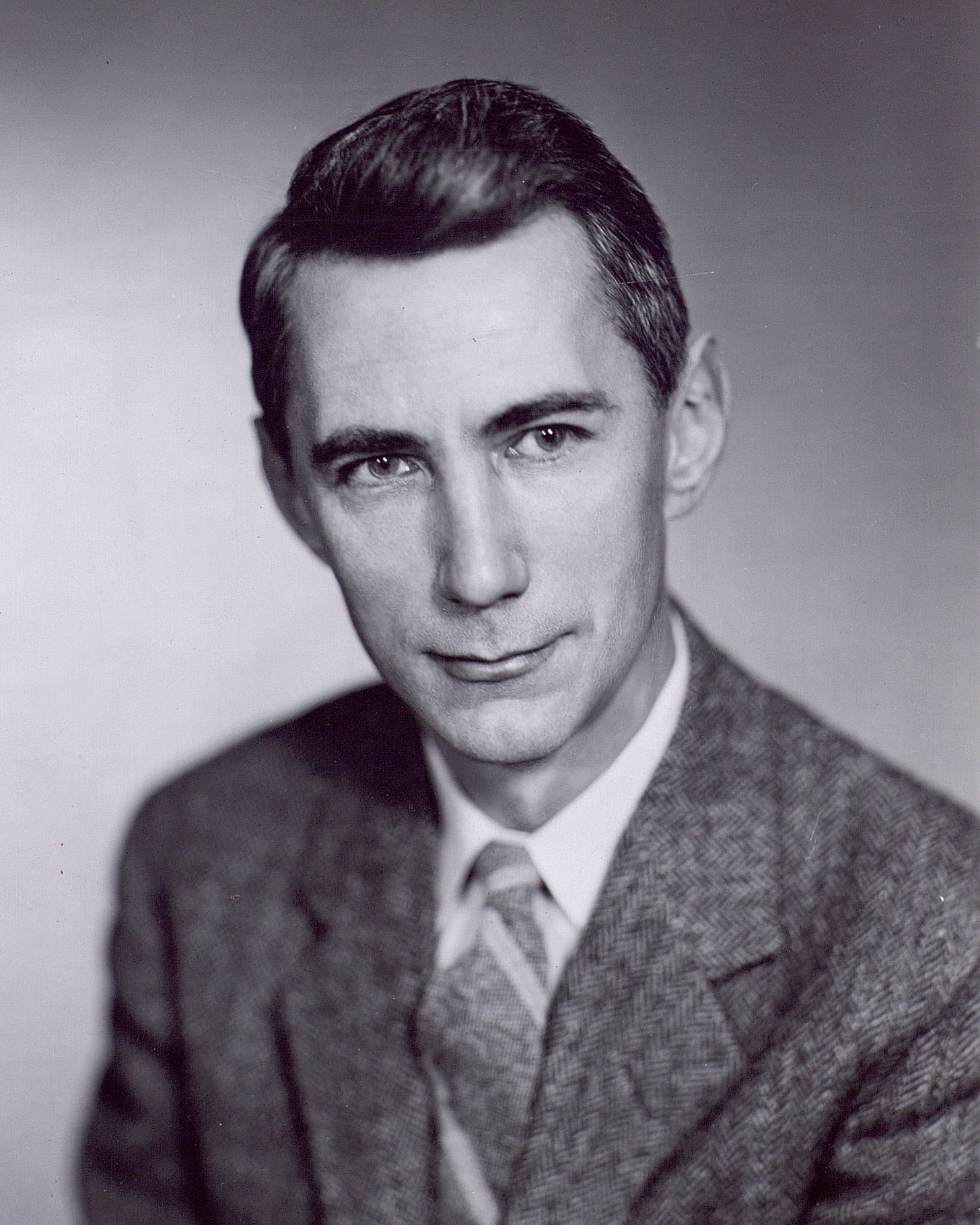

Claude Shannon, often called the father of Information Theory, was not only a brilliant engineer and scientist but also a remarkably successful investor:

When Warren Buffett bought Berkshire Hathaway in 1965, it was trading at $18 a share. By 1995, each share was worth $24,000. Over thirty years, that represents a return of 27 percent. From the late 1950s through 1986, Shannon’s return on his stock portfolio was about 28 percent.

— William Poundstone, Fortune’s Formula

One of Shannon's famous lectures at MIT introduced a thought experiment now known as Shannon’s Demon.

Thought Experiment

Imagine a coin flip game where a head doubles your money and a tail cuts it in half. If you start with $1, after one bet you could have either $2 or $0.50. With a fair coin, the expected value is ($2 + $0.50)/2 = $1.25, suggesting a 25% expected gain. Sounds great, right? Not so fast. This arithmetic mean doesn’t account for compounding. The correct measure here is the geometric mean: sqrt(2 * 0.5) = 1, which means you just break even over time. So, playing this game repeatedly won't get you ahead.

Shannon proposed a strategy where you bet only half of your money and rebalance before the next bet. Starting with $1, you bet $0.50. A win gives you $1.50 (=3/2), and you bet $0.75 next. A loss leaves you with $0.75 (=3/4), and you bet $0.375 next. What happens in the long run? Let's look at a derivation from 10-K Diver, a fantastic financial educator on X/Twitter:

Out of thin air, you have a positive expectation of 1.06066 (+6.066%) per bet! How? The secret lies in sqrt(3/2 * 3/4) vs. sqrt(2 * 0.5). By rebalancing, you changed the geometric mean from sqrt(1) to sqrt(9/8), which is greater than 1. Neither cash nor the game alone had a positive expectation, but rebalancing created one. This mysterious source of returns from rebalancing is what’s known as Shannon’s Demon.

Shannon’s Demon in Reality

Does this theory hold up in practice? Absolutely. Here's a strategy investing equally in an S&P 500 ETF and a Gold ETF with daily rebalancing:

Over a 19-year period, this strategy outperformed a buy-and-hold approach for either SPY or IAU, both in absolute and risk-adjusted terms. Another example involves rebalancing two assets with closer-to-zero expectations:

SBUX (Starbucks) had a lower return over the last five years, even worse than a short-term bond ETF (BIL). But mixing them with daily rebalancing produced better returns than either alone. One thing to note is that frequent rebalancing was impractical in Shannon's time due to high trading fees, but it's much more feasible now.

Paradox Solved?

This concept is related to Parrondo’s paradox, where combining losing strategies results in a winning strategy. These ideas seem paradoxical because we often confuse time series averages (which compound and require geometric means) with ensemble averages (which do not compound and use arithmetic means). Understanding this is key to grasping ergodicity.

This post from Market Sentiment is another great article on the topic. Also I strongly recommend all the series by 10-K Diver, which are insightful and thought-provoking. It's a shame he stopped posting in early 2023; I hope he returns soon!

free money 🤔