Portfolio Update 12/15/2023 - Bull In The House 🐂

Fearful when others are greedy

Hey there!

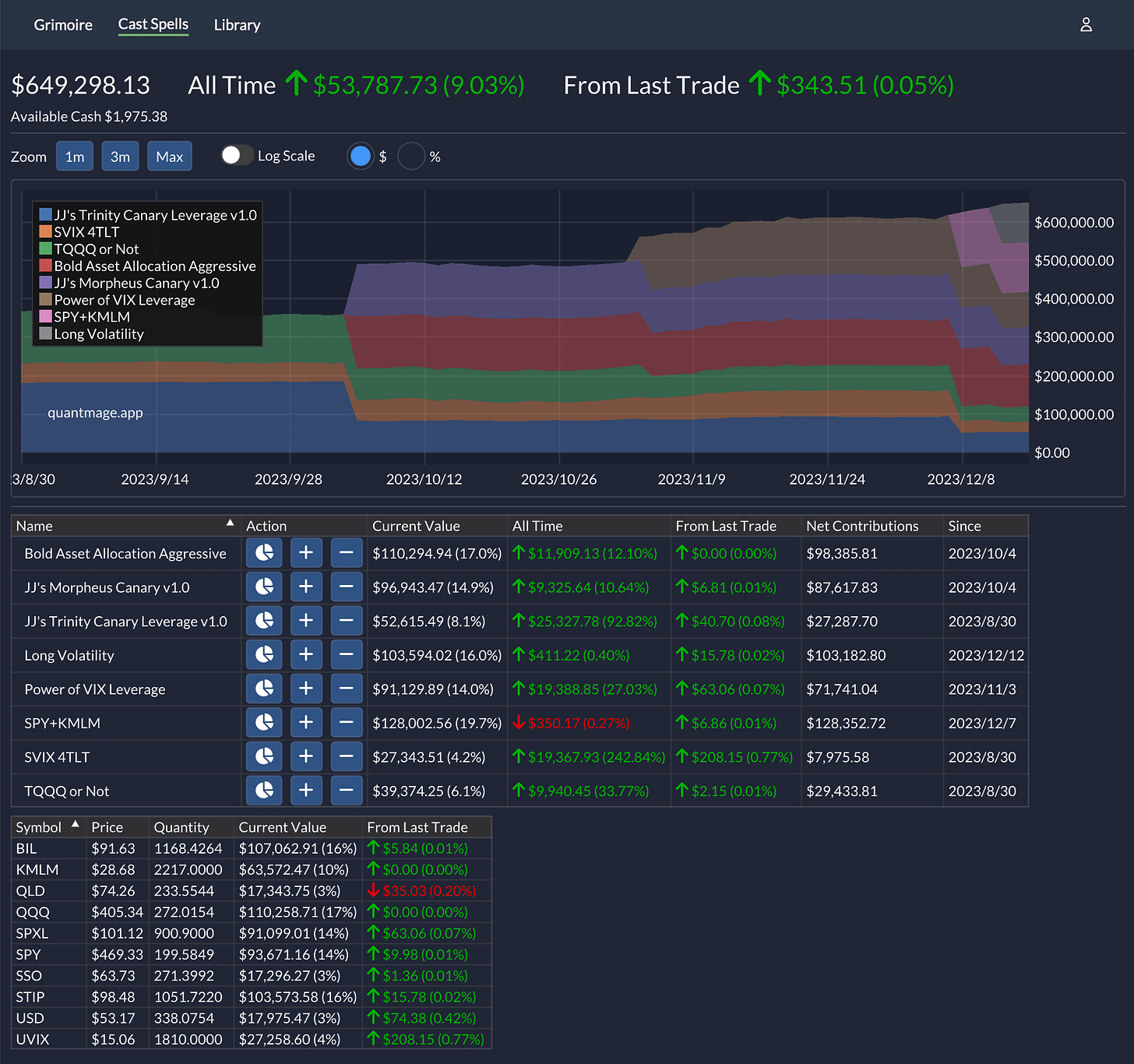

Wow, what a ride it's been in the market since my last update, right? The S&P 500 shot up by about 4.4%. Seems like Jerome Powell's latest comments at the Fed meeting really gave the rally an extra push. And hey, good news for me – the QuantMage portfolio is riding that wave too, with a nice leap from +0.75% to +9.03%!

So, what's new in my magic bag? I've mixed things up a bit and added two new spells to my collection. Let's dive in. First off, there's SPY+KMLM – just what you can expect from the name. I brought it on board to add some diversity to my mix, aiming for less correlation with my other spells. The second newcomer is the Long Volatility spell. It's a fresh take on the VIX signal, opting to long volatility when things look bearish instead of the usual play of shorting volatility (i.e. longing the market) in bullish times. Think of it as the yin to my other spells' yang. Hope I can share more about them in the future.

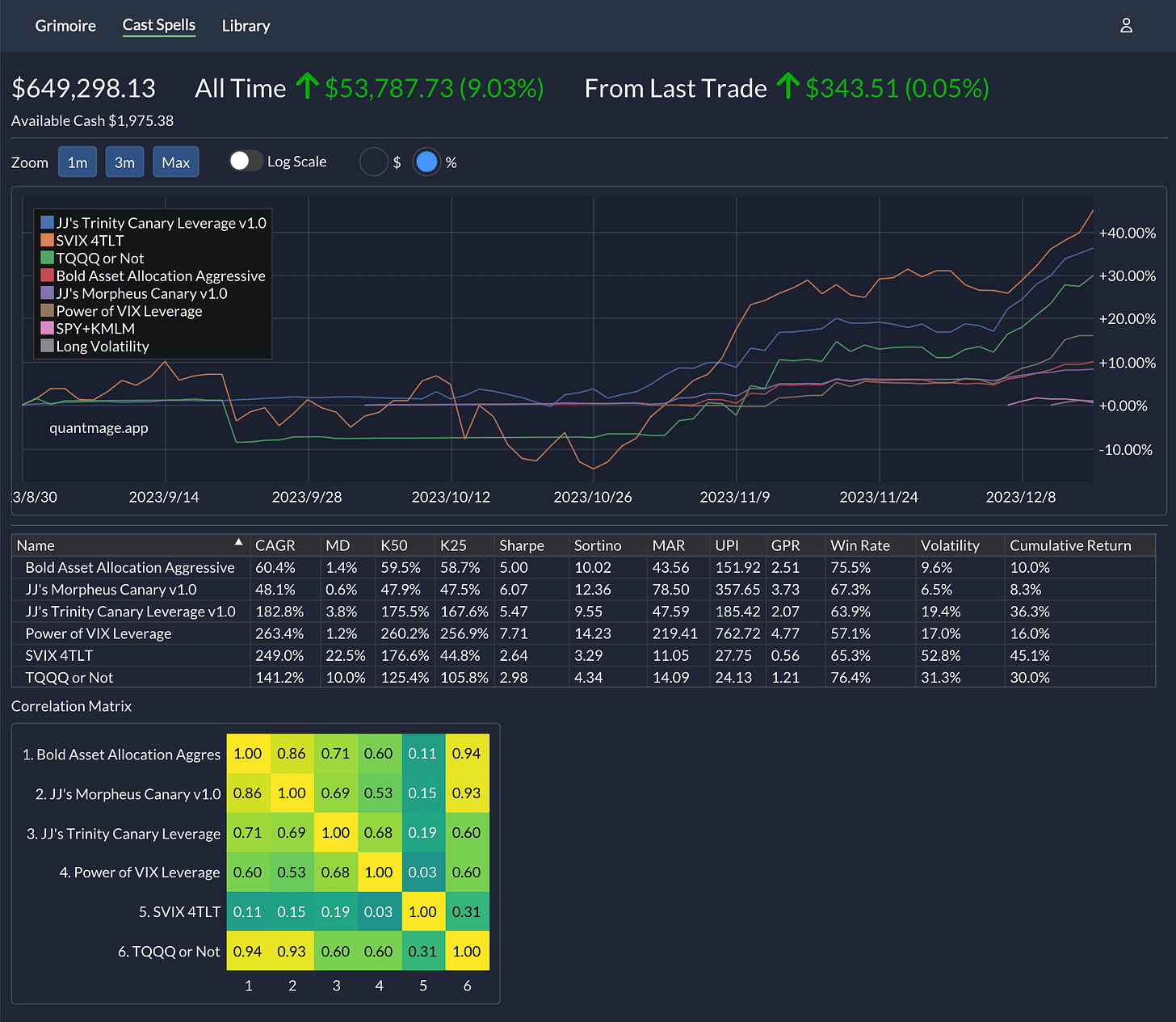

Previously, I used to set my allocations based on a bit of guesswork, eyeballing each spell's volatility. But hey, we're all about leveling up, right? So now, I'm taking a more systematic approach. I've rejigged things to a more conservative stance by applying a simplified risk parity model. It's pretty much inverse volatility weighting, spiced up with a low correlation booster. For now, it's manual, but I'm thinking of automating the calculation with QuantMage if I still have a fondness for it after a while.

I'm really digging the current mix in my portfolio. I've got a healthy dose of conservative plays, including the new long volatility spell, while still keeping a sprinkle of riskier moves for that potential high return. It's all about balance, after all. As I navigate this investment journey with QuantMage, expect to see some more tweaks here and there as I keep learning and refining our strategy. At some point, I think I’d better be more disciplined in how often the portfolio can be updated, though.

Remember – as tempting as it is to get swept up in the green wave, it's crucial, as they say, not to confuse a bull market with brains (or the efficacy of my spells in this case). The true test will be when the tides turn. But for now, let's enjoy the ride and keep our eyes open. Here's to smart, balanced investing!

As usual, everything I share is for your information. I'm not playing the role of a financial advisor here, nor am I recommending specific stocks. Always do your homework and consider chatting with a finance pro before you leap. 📣