Portfolio Update 04/15/2024 - Weathering the Storm 🌪️

Sticky Inflation and Rising Geopolitical Tensions Take Center Stage

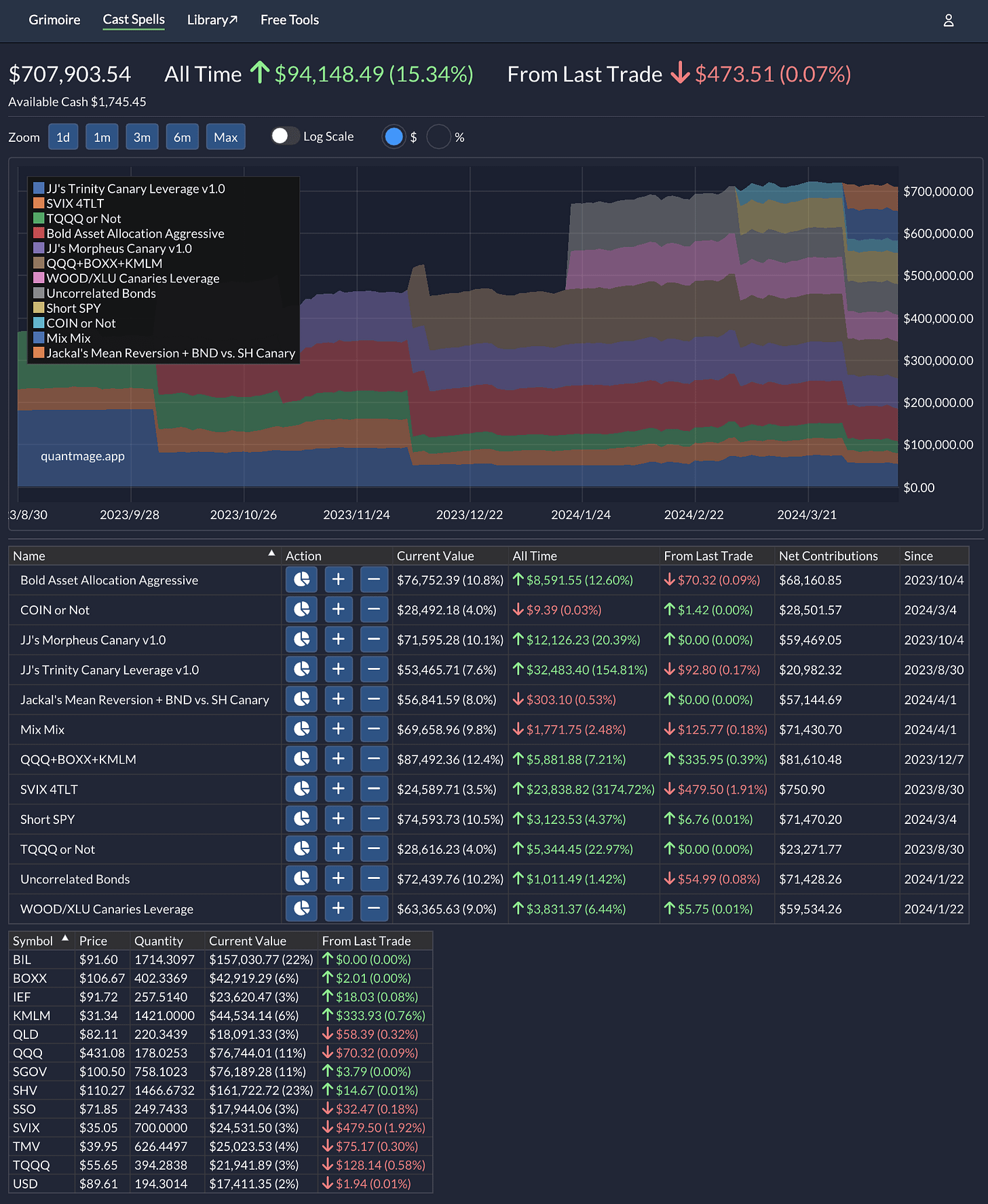

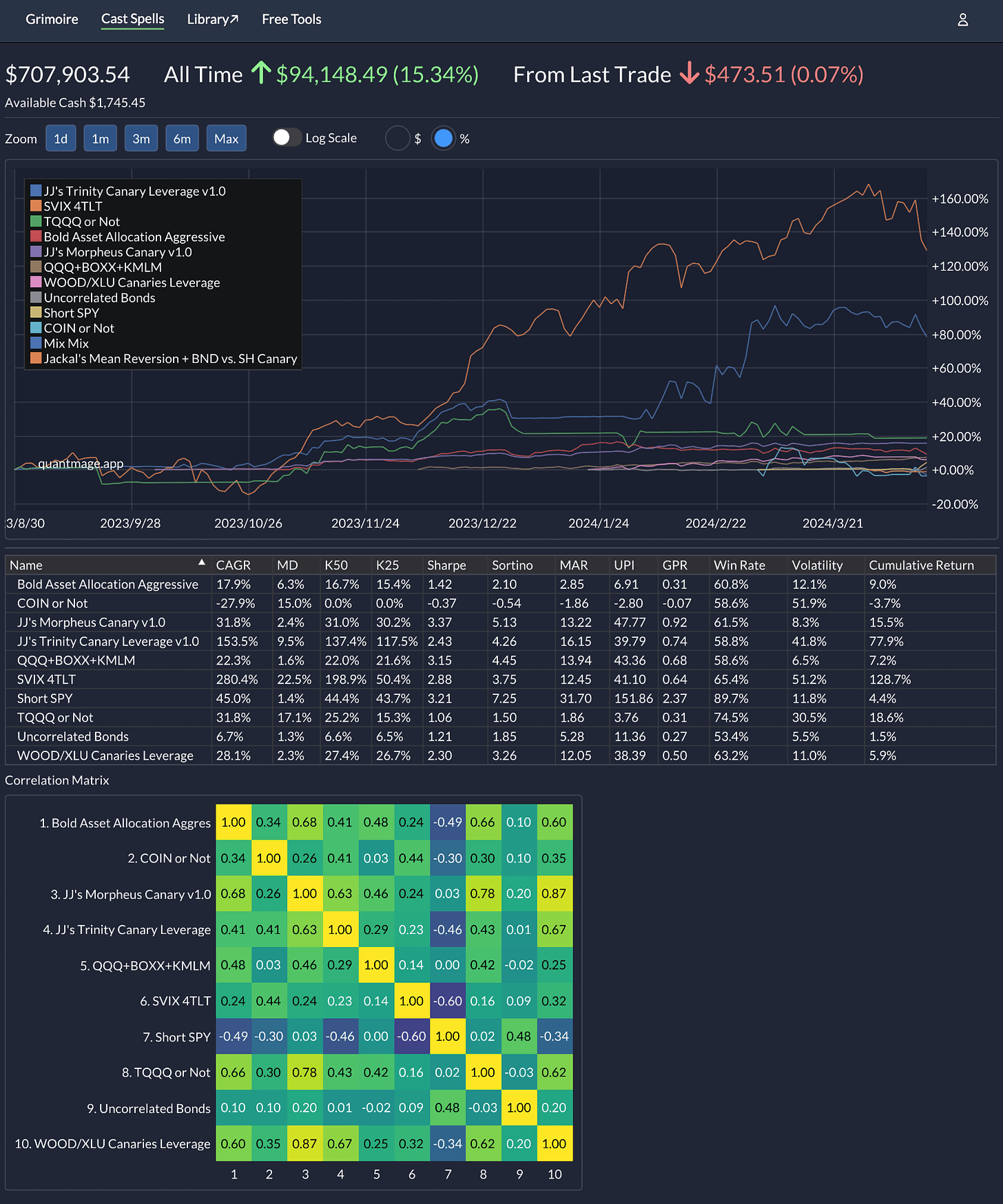

It’s been a wild ride in the markets this past week, and my portfolio definitely felt the impact. Despite deploying strategies like Uncorrelated Bonds and Short SPY to hedge against volatility, my portfolio pretty much broke even overall, with a slight gain of +0.17% since my last update. Meanwhile, the SPY dipped by 1% during the same timeframe.

Now, about the bitcoin strategy I rolled out recently—let’s just say it hasn’t been pulling its weight yet 🤦🏻♂️. On a brighter note, I’ve introduced two new strategies into the mix: Mix Mix and Jackal’s Mean Reversion + BND vs. SH Canary. Both are fresh from the strategic oven, the former mainly utilizing the new incantation Mixed and the latter leveraging insights I’ve picked up from the vibrant community. They’re still finding their footing, showing early negative returns, but I’m optimistic they'll come around. Sharp-eyed readers might have noticed that the all time portfolio return numbers have significantly changed from the last time. It’s due to a portfolio rebalancing with the new spells, which involved the pro-rata withdrawals.

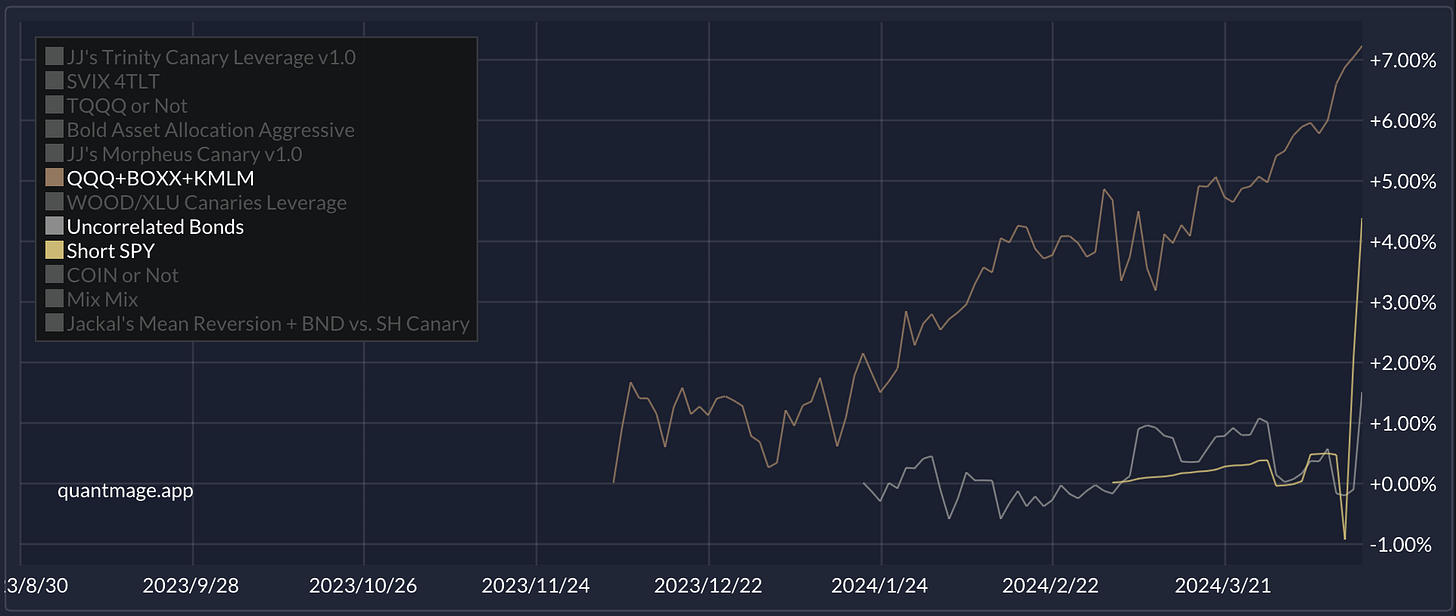

The long volatility plays mentioned in the beginning and the anti-beta strategy (QQQ+BOXX+KMLM) have been the anchors this week, holding steady amidst the chaos:

With multiple macro factors at play, from inflation worries to geopolitical tensions, it’s a reminder of the complex tapestry we navigate as investors. Here’s hoping for calmer waters ahead, where prudence and peace prevail.