Portfolio Update 03/15/2024 - Outsmarting the Market 🏆

Further Hedging with Long Volatility & A Dash of Crypto Savvy

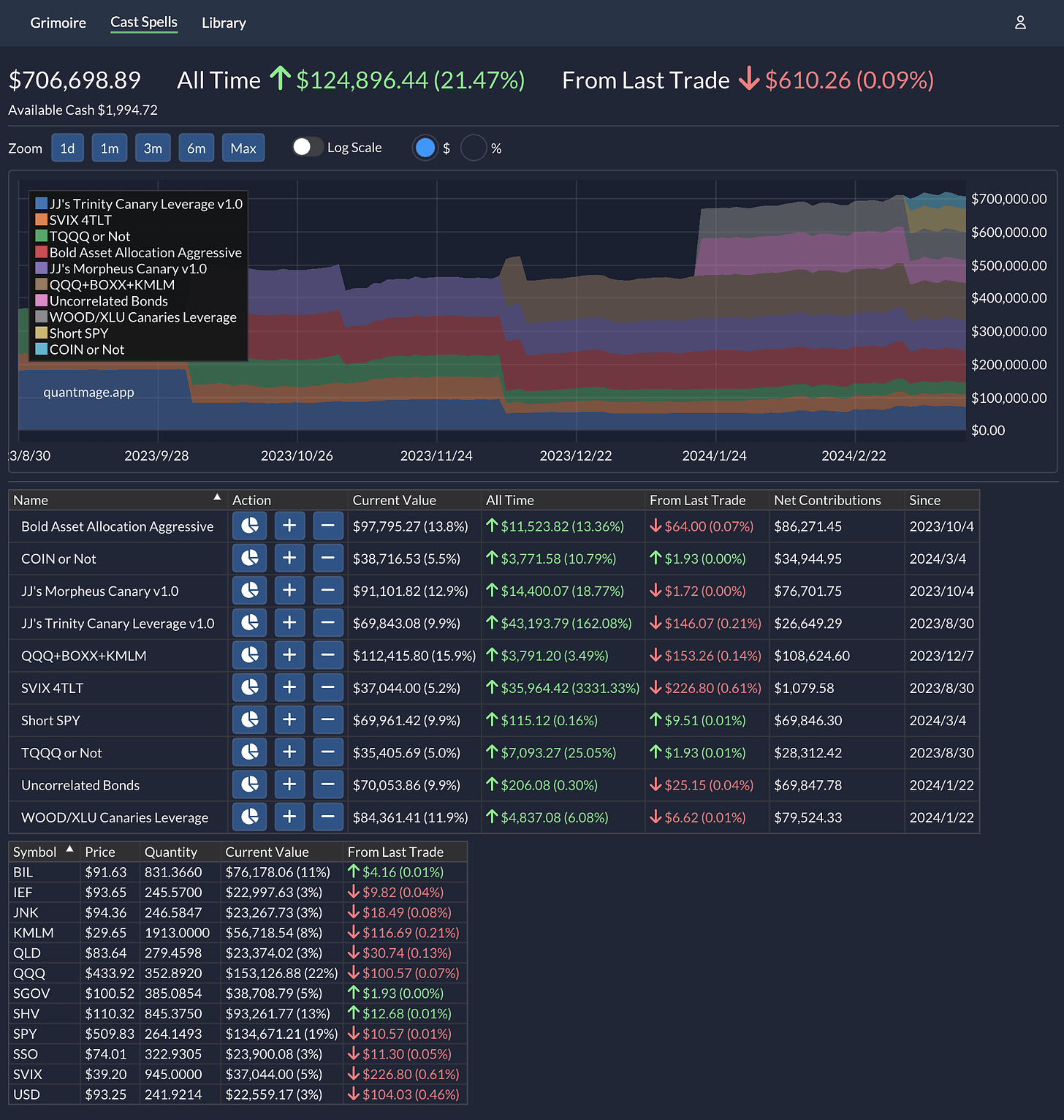

This past month, my portfolio outshone the broader market, posting a solid 2.36% gain compared to the SPY's modest 1.56%. The market's been on a bullish streak, but who knows when the music will stop?

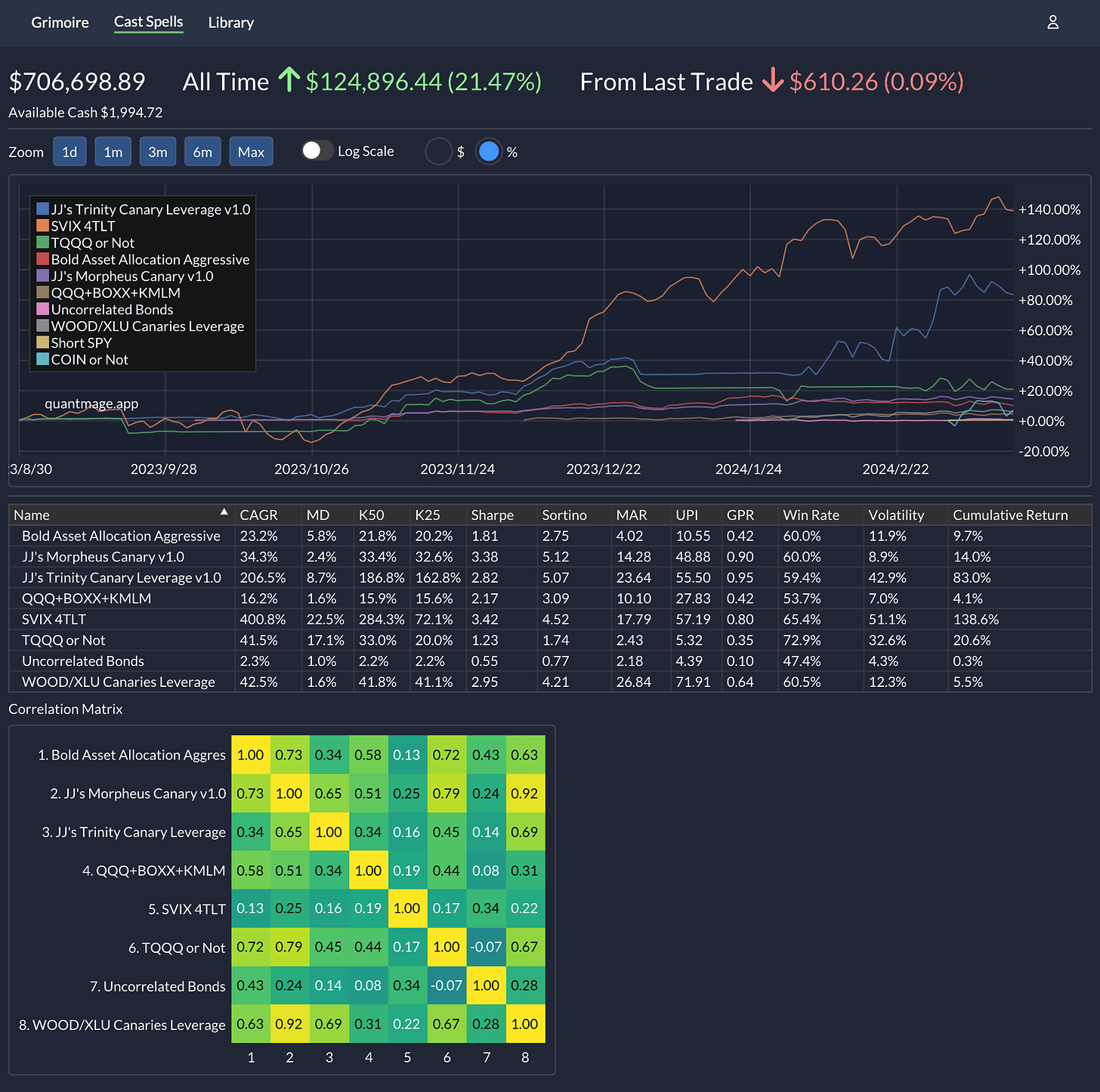

Since my last update, there's been a bit of tinkering on my end. I've dipped my toes into a crypto strategy dubbed COIN or Not, adding a sprinkle of excitement, as fleshed out in my previous post. Additionally, I beefed up my volatility play with another strategy, aptly named Short SPY. Coupled with the existing Uncorrelated Bonds, these long volatility strategies now make up about 20% of the portfolio. I'm banking on them to serve as a reliable safety net when the market decides to take a nosedive, despite their modest gains during bullish runs. Both were inversely correlated to SPY and they complemented each other quite nicely in my backtests. However, the true test will come when the market faces its next big challenge. Stay tuned for a deeper dive into these strategies in the posts to come.