Portfolio Update 02/15/2024 - Staying in the Game 🏃🏻♀️

Market's Upbeat Mood Persists Despite the Inevitable Bumps

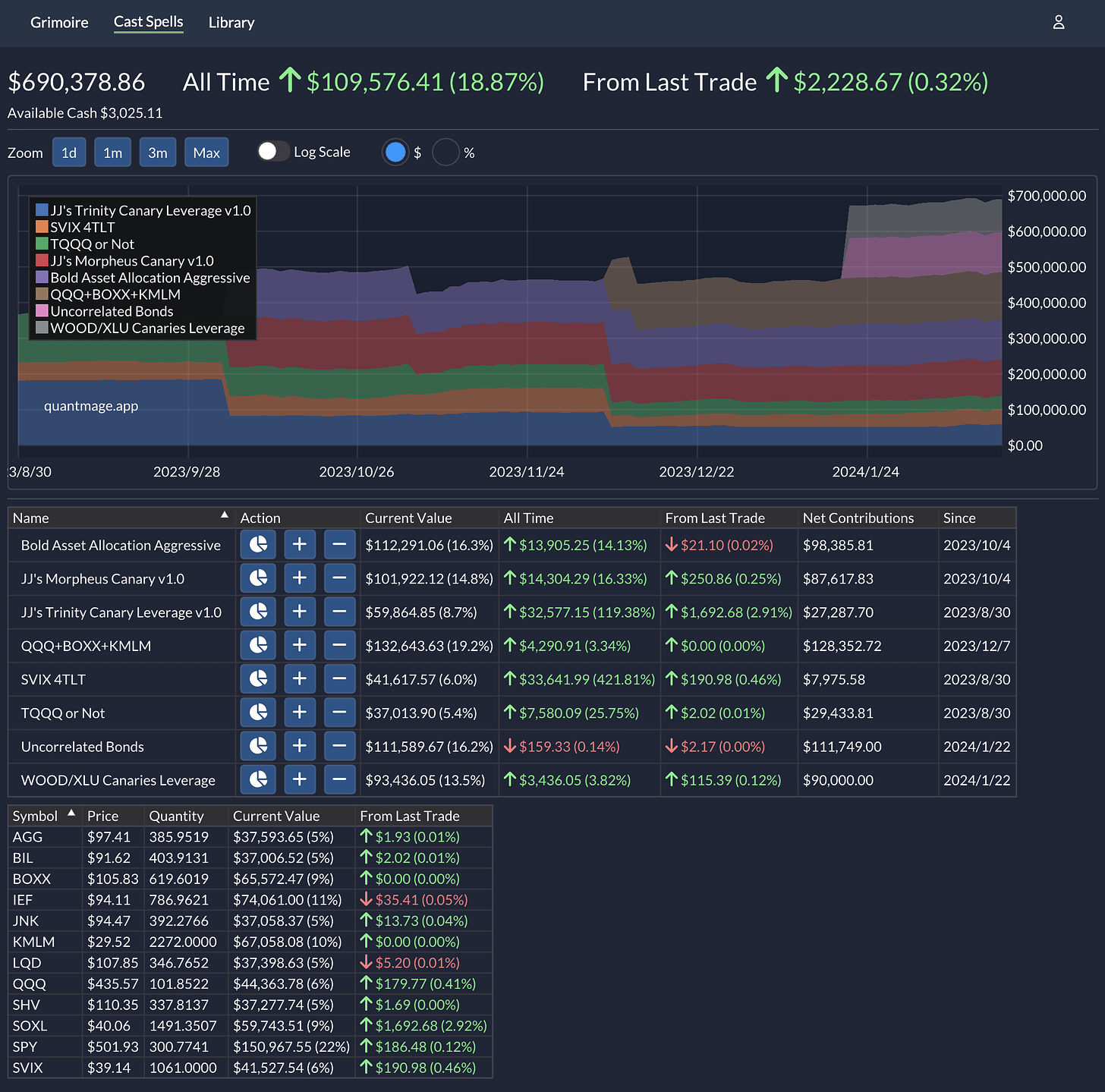

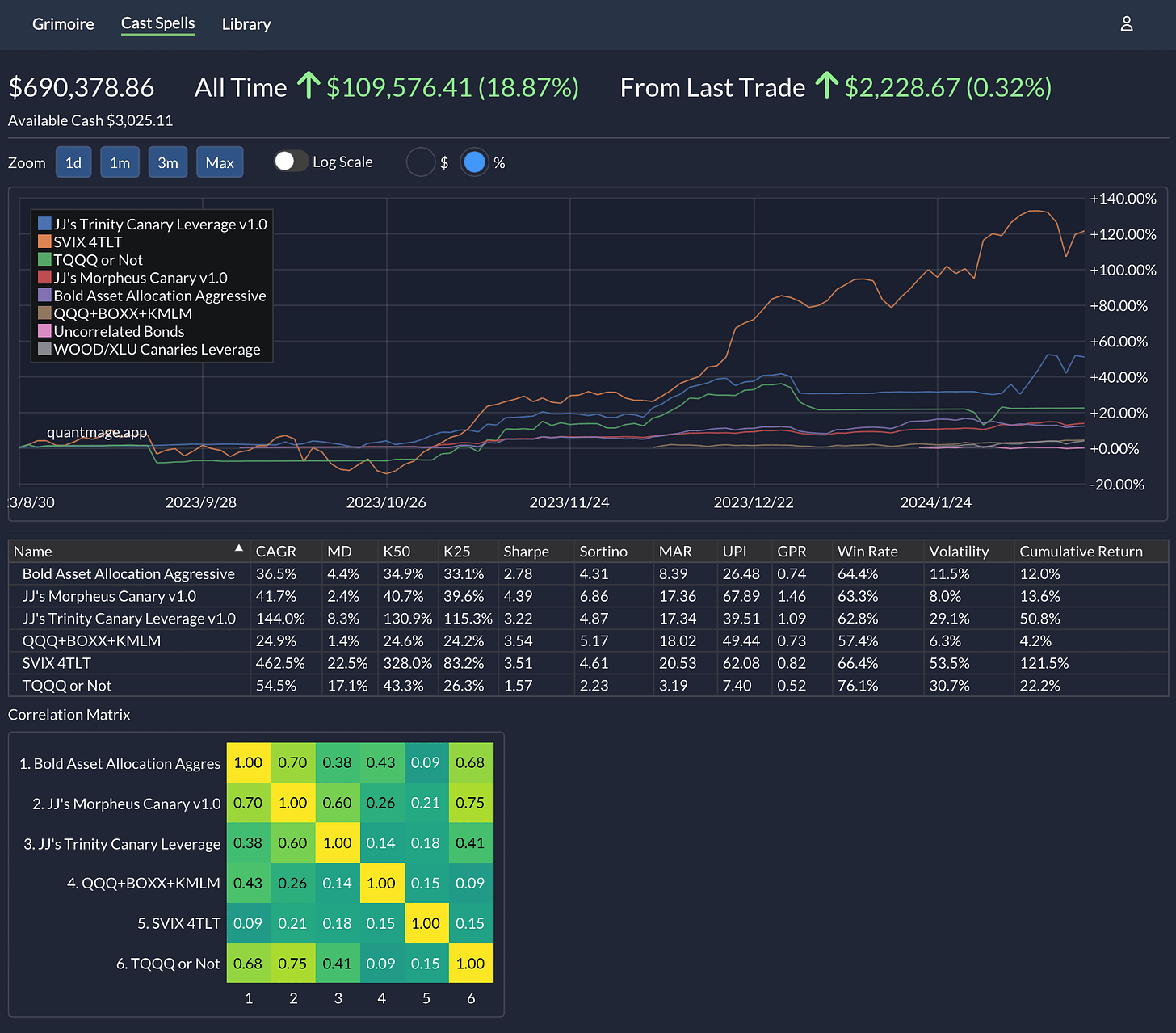

Quick update on my QuantMage portfolio journey - we’re sitting at a 4.7% gain since the last chat a month back. Not too shabby, although we did trail a bit behind SPY’s 5.7% stride for the same lap. We’ve had our share of market dips, thanks to the usual suspects (hello, FOMC and CPI), but the bullish beat goes on.

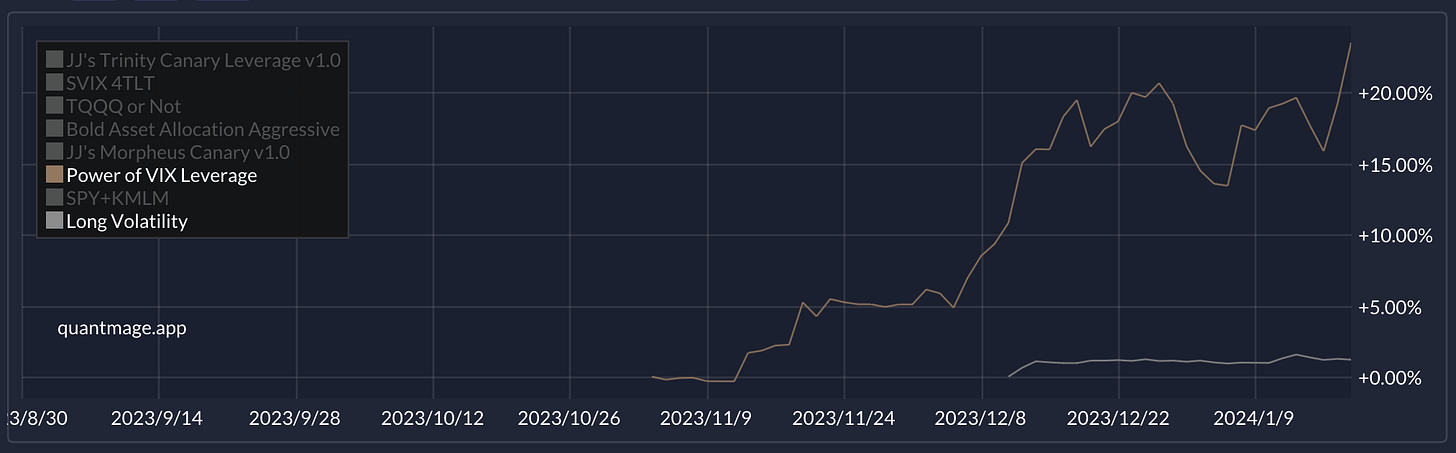

For those keeping score, I've benched a couple of VIX-focused strategies: Power of VIX Leverage and Long Volatility. As I fessed up in an earlier post, a pesky data snafu gave us a false read on their backtest success—yep, the dreaded look-ahead bias. 🤦🏻 Silver lining? Both strategies actually turned a profit while they were in play, so not all was lost:

Stepping up to the plate, we've got WOOD/XLU Canaries Leverage, which pumps a bit of adrenaline into the original WOOD/XLU Canaries play. And taking the place of our retired long volatility player is Uncorrelated Bonds, which leans on bond ETFs to zig when the market zags. Also, a quick shout-out to SPY+KMLM, now sporting a fresh moniker and strategy tweaks as QQQ+BOXX+KMLM. I'm excited to dive into the details of these revamped spells in upcoming posts.

Sure, it stings a tad not to have outpaced SPY this round, but I'm all about celebrating the wins, no matter the size. I'm under no illusion that my current spellbook is the be-all and end-all. It's a work in progress, and I'm learning as I go. But remember, knee-jerk reactions to market swings are a no-go. It's all about striking that sweet spot between adaptability and consistency.

Stay tuned, and let's keep the magic alive! 🪄

Would you mind discussing how you size the positions between the various algorithms? maybe as part of your next post.