JJ's Spell Series: KMLM+QQQ+BOXX

Managed Futures as a Diversifier and Signal

A Fresh Take on Managed Futures

Today, I want to share one of my live strategies that leans heavily on a managed futures ETF—using it both as a main asset and a signal. But first, let’s unpack what managed futures are all about.

Managed futures are investment vehicles where professional money managers, known as Commodity Trading Advisors (CTAs), use futures contracts to invest across a variety of asset classes: commodities, currencies, equity indexes, and interest rates. These folks employ systematic trading strategies, often taking both long and short positions to capitalize on market trends.

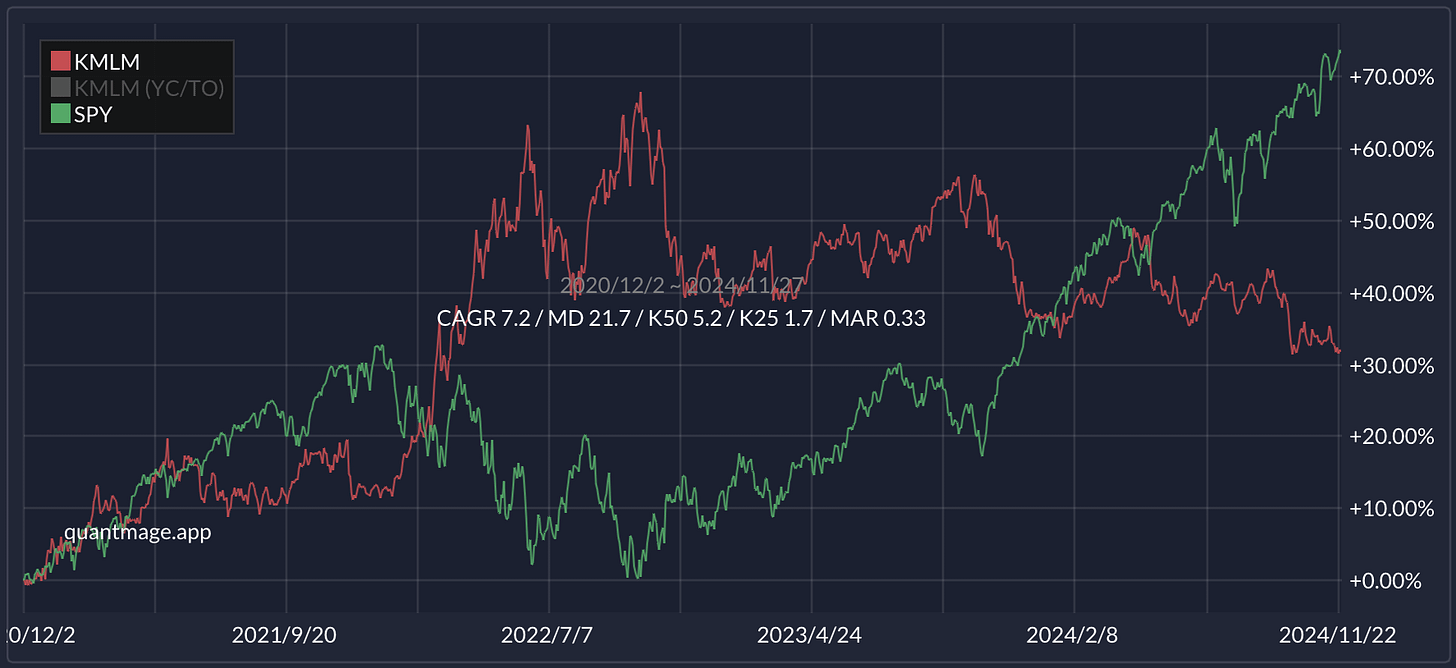

There are several ETFs that track managed futures, but I’ve been focusing on KMLM. Why? It has shown decent returns while being negatively correlated with the equity market—even if its track record is just three years. Check out this chart:

Evolving the Strategy

Notice how KMLM zigs when the SPY zags? That inverse relationship got me thinking. So, I tried allocating equally between QQQ and KMLM:

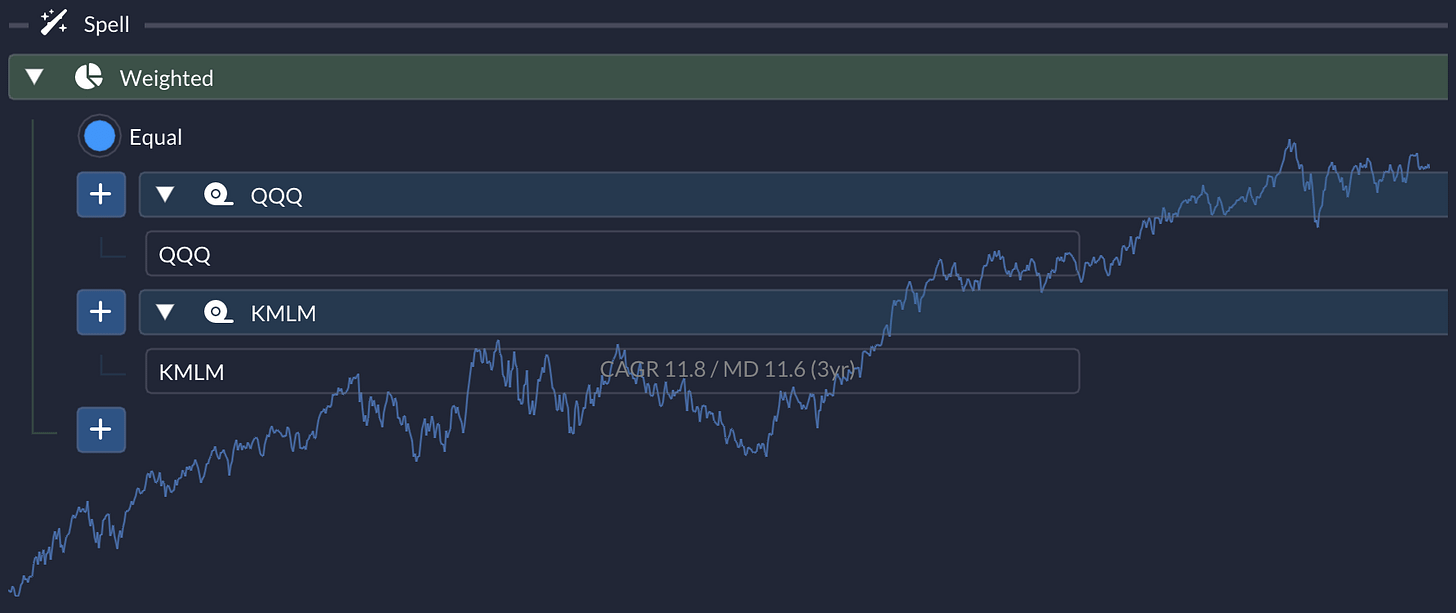

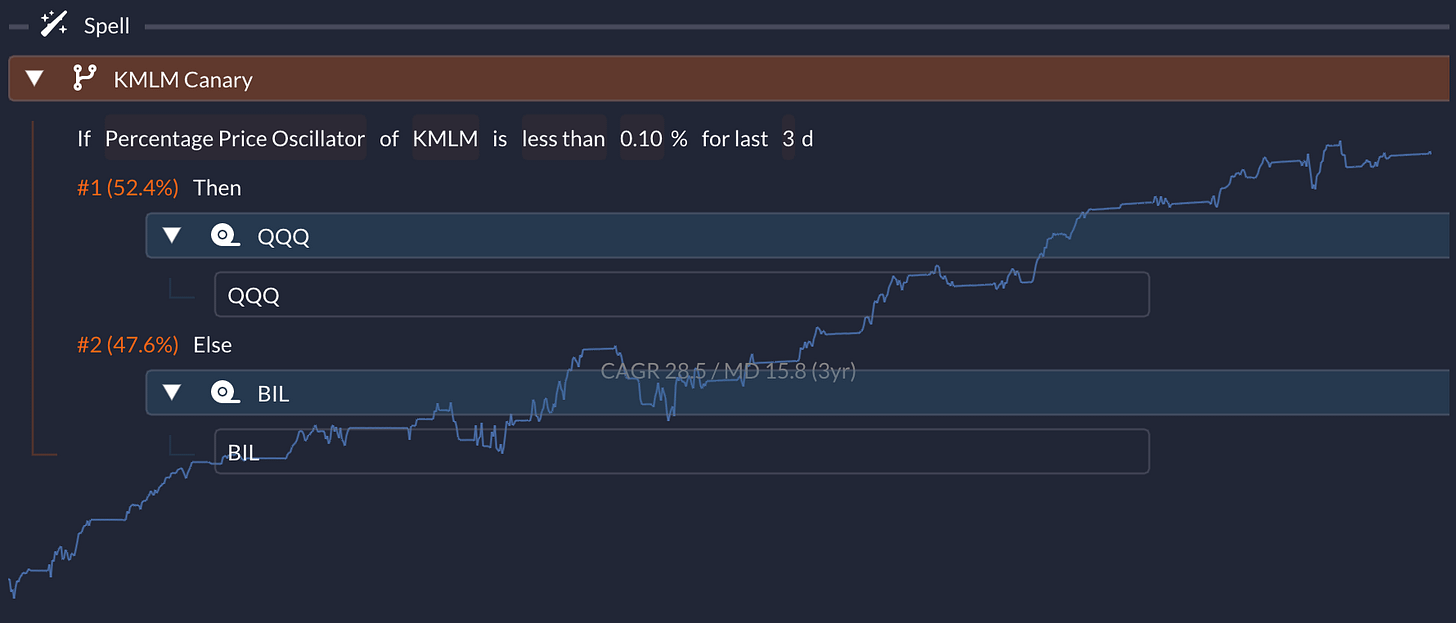

This simple approach already delivered an attractive risk-adjusted return, boasting a CAGR of 11.8% and a maximum drawdown of 11.6% over a three-year period. Excited by KMLM’s potential, I wondered if it had any predictive power on the market. So, I applied a Percentage Price Oscillator to it—and guess what? It looked promising:

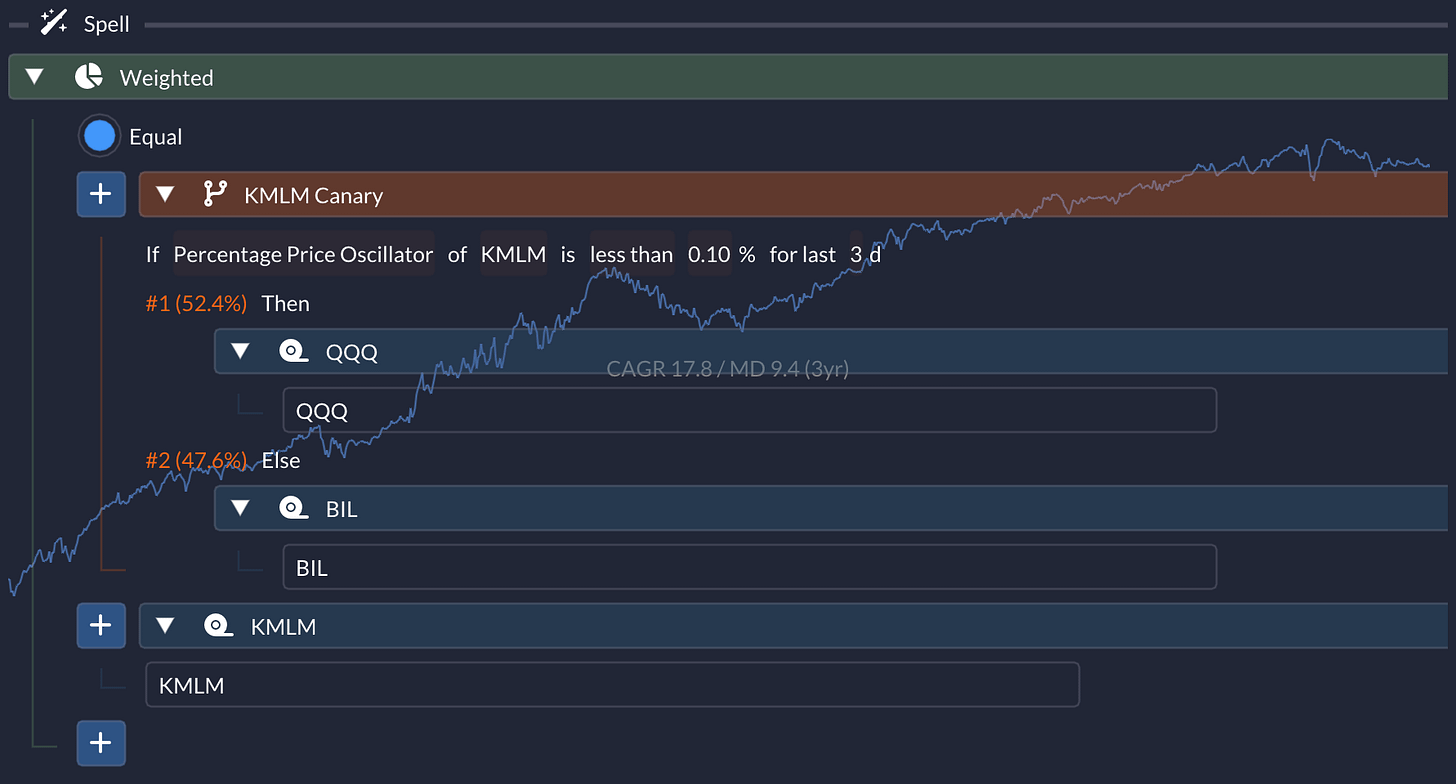

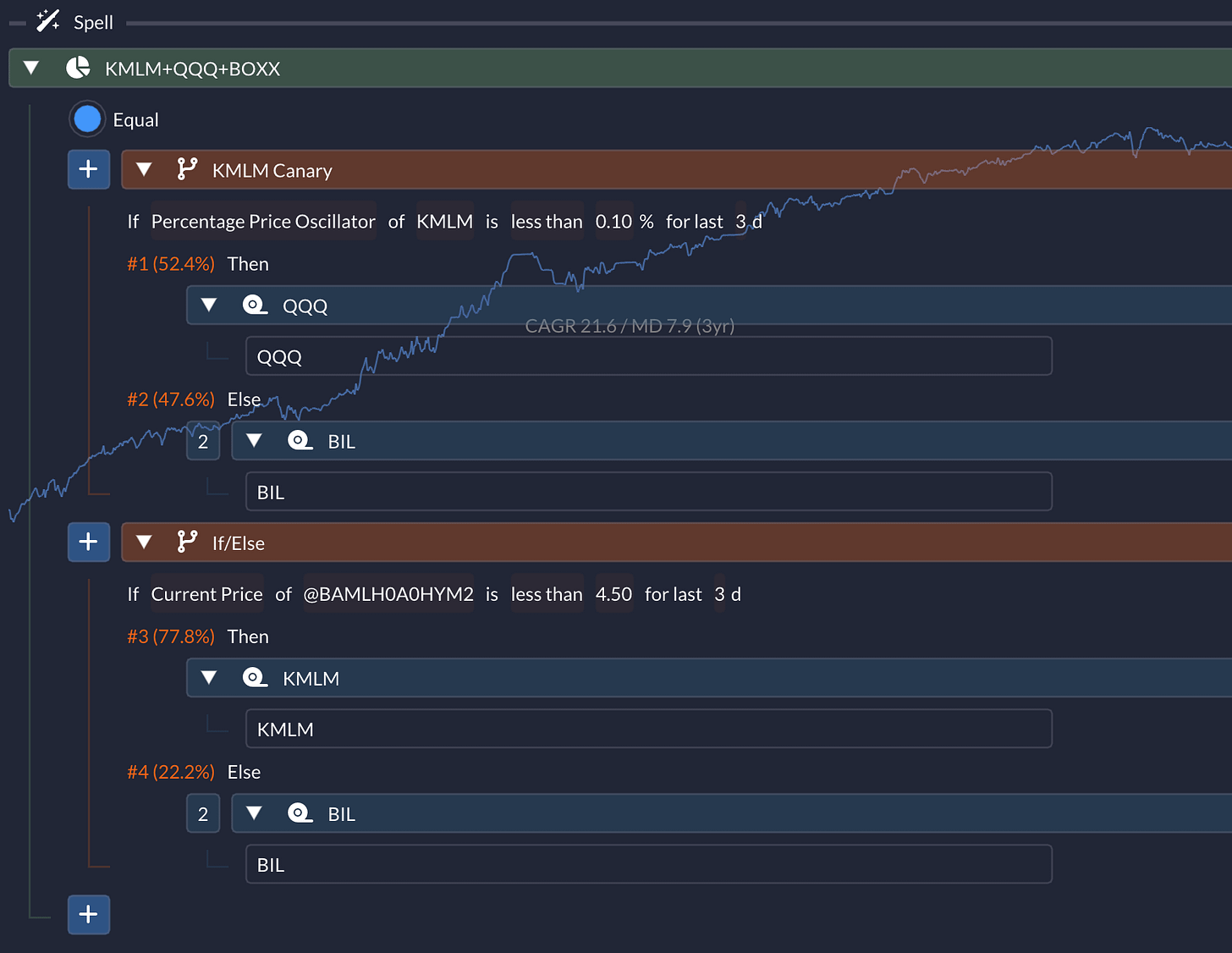

This tweak achieved an impressive Sharpe ratio of 1.66! Tempting to just go all-in on this, right? But I wanted to be cautious. So, I decided to include KMLM as a diversifier in the strategy:

Sure, it lost a bit of its edge, but I felt it was a good trade-off for lower drawdown and volatility.

Guarding Against Momentum Crashes

Then I came across the concept of momentum crashes. Since managed futures are essentially trend-following, they’re susceptible to these crashes. To mitigate this risk, I introduced another “canary” into the mix:

As you can see, I used high-yield credit spreads as a canary—one of the recently introduced macroeconomic indicators in QuantMage. Before that, I was using the VIX. This adjustment led to some stellar numbers: CAGR of 21.6%, maximum drawdown of 7.9%, and a Sharpe ratio of 1.97!

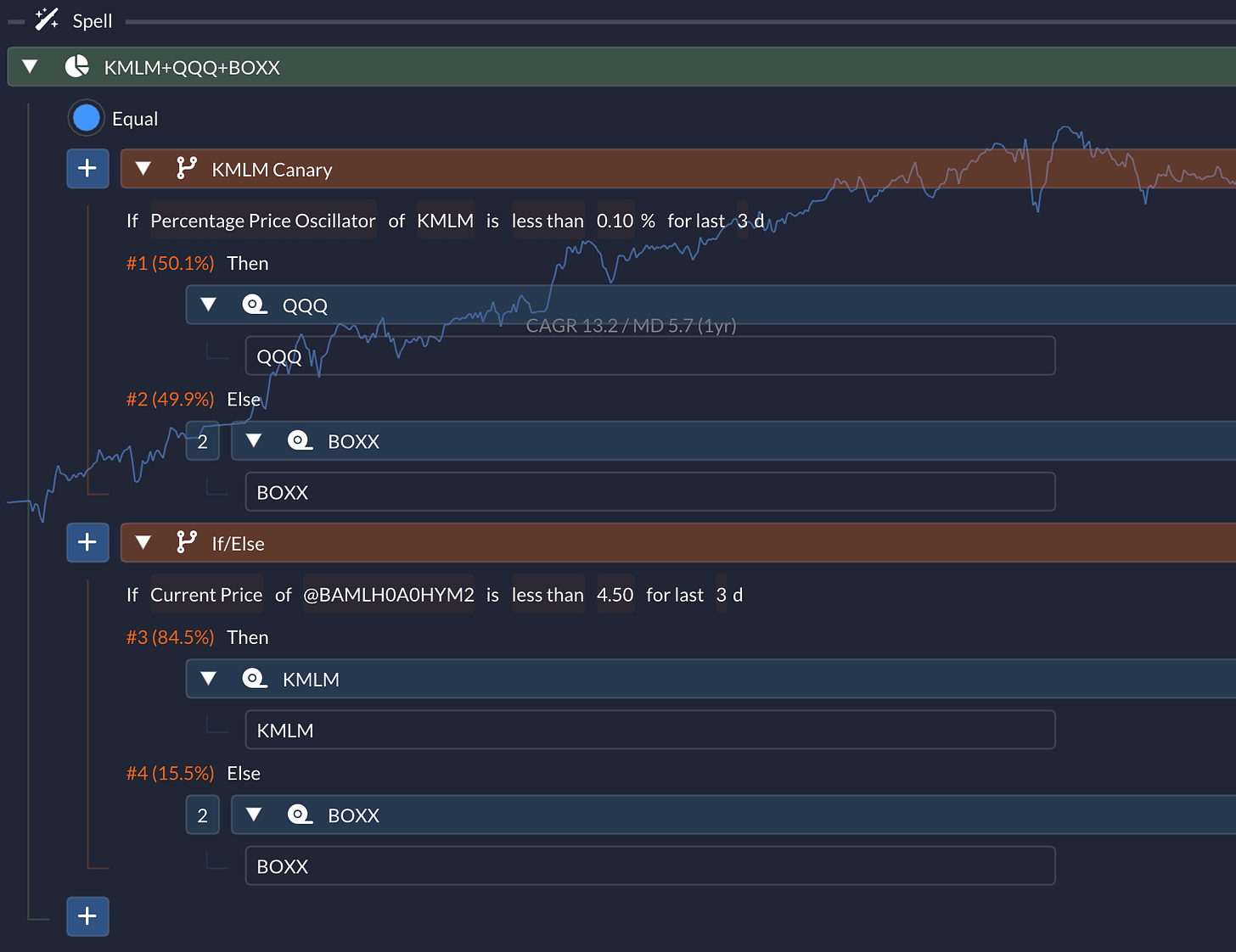

So, What’s Up with BOXX?

Great question! BOXX comes into play as a cash equivalent in my strategy, replacing BIL. I wanted to diversify even my cash holdings. Unfortunately, BOXX has an even shorter history, so I used BIL in the charts above to give you a fuller picture.

Wrapping It Up

What do you think? Has KMLM caught your attention now? I’ll be honest—the strategy is part of my live portfolio, but I have some reservations due to its short track record and the somewhat opaque nature of the managed futures ETF. Plus, the strategy has been moving sideways for the past six months or so.

I’d love to hear your thoughts! Feel free to share any insights or questions you might have. 💬👇

🚨 Disclaimer: This content is for informational purposes only and isn’t investment advice or a recommendation to buy or sell any securities. Always do your own due diligence and consider consulting with a financial professional before making any investment decisions. Keep in mind that I may update or even retire this strategy in the future, and I might not be able to share these changes with you promptly.

yes, you have my attention, so I'll be watching this one as time goes bye. Good catch!

(It's too young and unproven to spend any serious money on, though...)

By the way, as I always like to simplify, here's my version. CAGR 12.98%, max drawdown -5.41%.

https://tinyurl.com/2tdckdek

I recall we had tried to get you to setup a synthetic KMLM based upon old historical data. That might help see if this would have worked better over a longer time period or not. The index it's based on goes back to the late 80s or 90s I think. From memory I think you tried, but there was something fishy about the data?