Canary Signal Series: BND / VWO

Aggregate bond and emerging market ETFs as a canary signal

Hey there savvy investors! Welcome to the first entry in our "Canary Signal Series," where we explore useful signals for tactical asset allocation strategies, which you can think of as traditional asset allocation with a sprinkle of market timing. The effectiveness of these canary signals for market timing is key to their success, and I'm excited to share some of the useful ones I've come across.

🚀 Quick Heads Up! Just a friendly reminder: everything I share is for your information. I'm not playing the role of a financial advisor here, nor am I recommending specific stocks. Always do your homework and consider chatting with a finance pro before you leap. Now, let's dive into the good stuff!

We're kicking off with signals from Dr. Wouter J. Keller’s Defensive Asset Allocation strategy. He suggests a unique "canary" universe for signaling when to brace for market downturns. He starts with four ETFs: SPY (S&P 500 ETF), VEA (developed market ETF), VWO (emerging market ETF), and BND (total bond market ETF) to find the best mix for crash protection, particularly for SPY. Keller zeroes in on BND and VWO as key indicators. Let's see how they perform in QuantMage’s backtests.

BND Canary

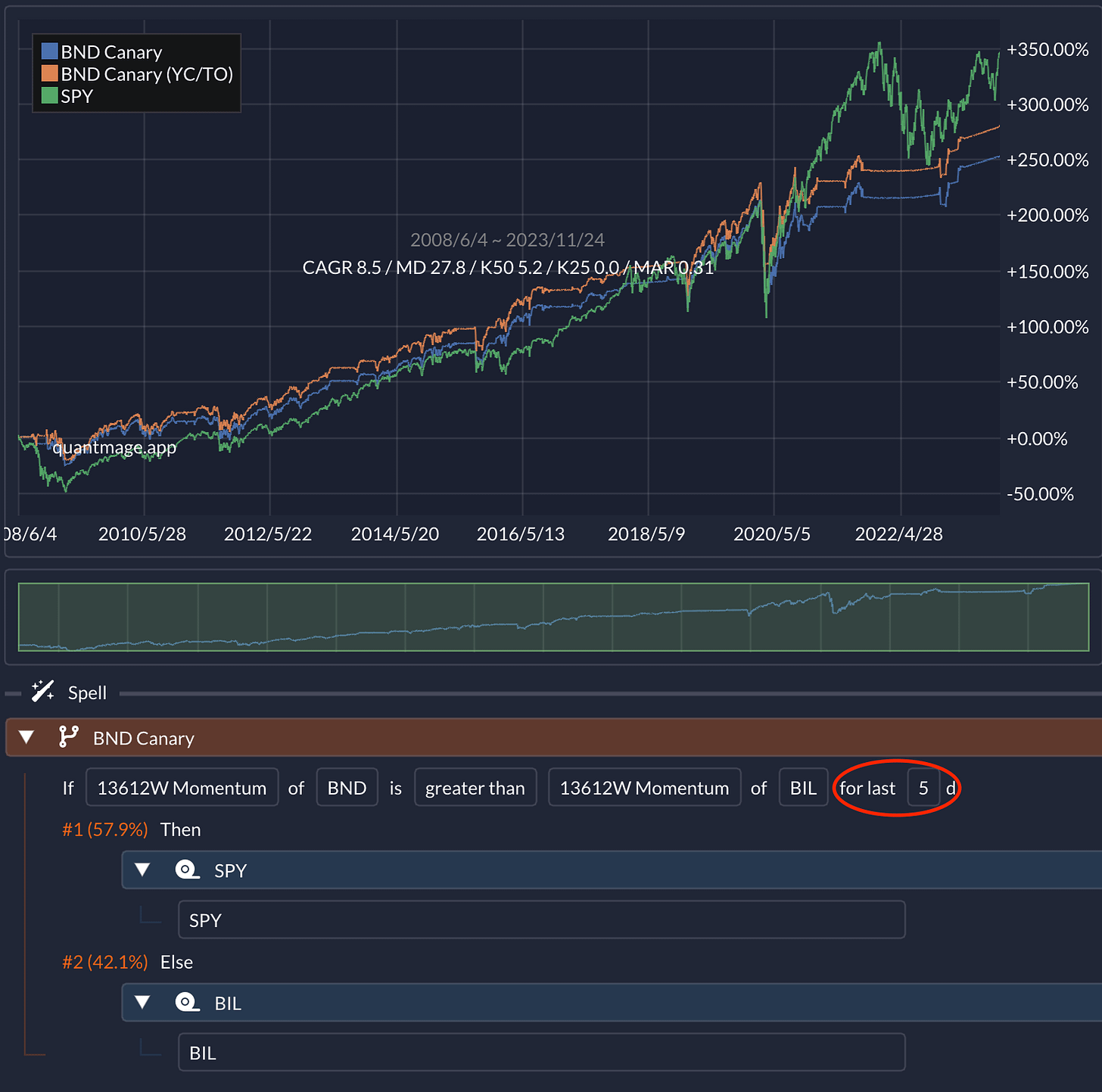

Starting with the BND canary, I used its 13612W Momentum (as noted in the paper) to gauge market sentiment:

The max drawdown decreased from 51.5% to 44.6% (against SPY buy-and-hold), but it also meant a lower CAGR, from 10.2% to 7.9%. To spice things up, I tried comparing it with BIL’s (a short-term bond ETF) momentum:

This tweak brought the MD further down from 44.6% to 35.7% while boosting the CAGR from 7.9% to 9.0%. Not bad! I also played around with the number of days for the condition to hold, finding 5 days to be the sweet spot:

The max drawdown got another noteworthy reduction, with only a 0.5% dip in CAGR. You can check out the BND canary strategy here. Please note that it’s using threshold trading, not monthly rebalancing, which is how Dr. Keller’s DAA is traded.

VWO Canary

Switching gears to the VWO canary:

The initial results weren't as impressive, with a 3.7% CAGR and a 29.6% max drawdown. However, applying the same BIL comparison and 5-day condition improved it noticeably:

The CAGR is still lower compared to passive SPY or BND canary, but the max drawdown is significantly reduced. Check out this strategy here.

Combining Canaries

What if we combine both canaries? Using a 'Switch' incantation, I allowed different behaviors based on the number of signals firing:

The strategy became overly cautious when set to switch to SPY only if both signals were active. Adjusting it to invest in SPY when either signal is active yielded:

A more balanced outcome with 9.7% CAGR and 28.2% MD. For a more aggressive approach, switching to a leveraged SPY ETF like SSO when both canaries signal a bull market:

Boosted the CAGR to 13.3%.

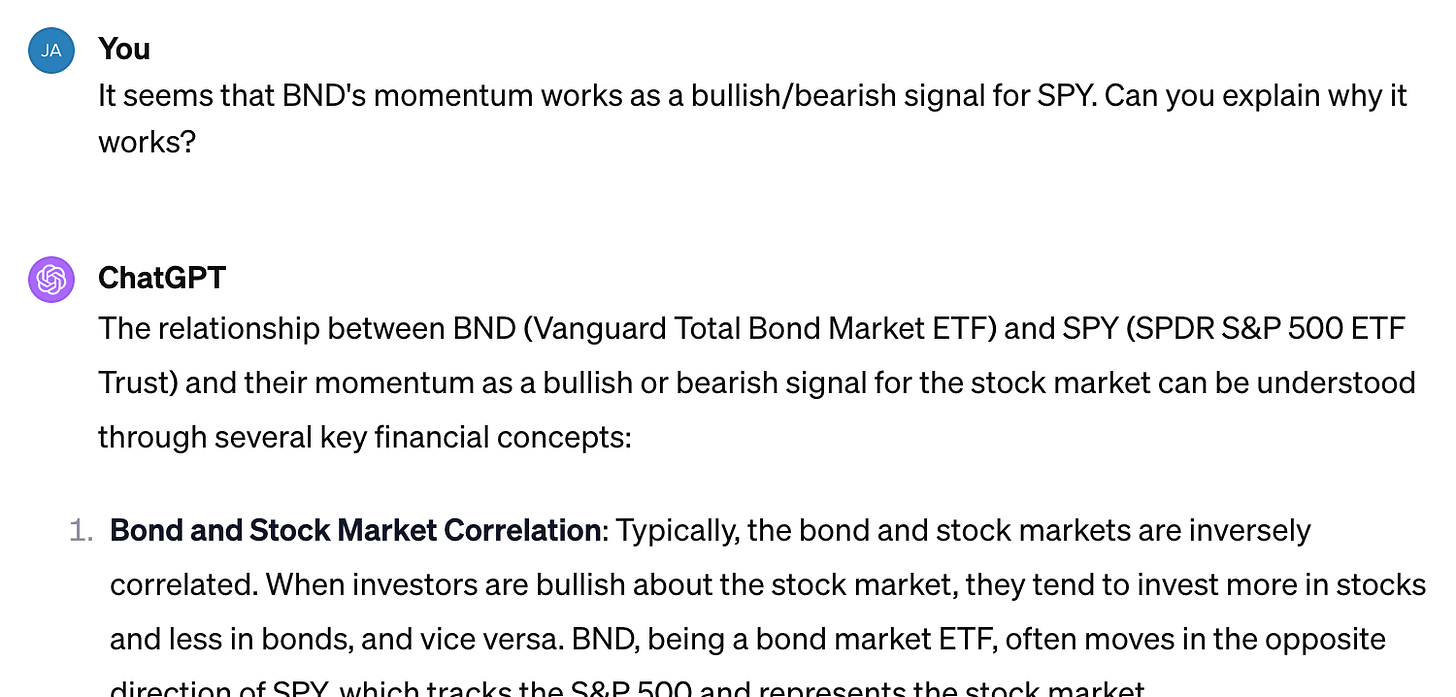

Understanding the 'why' behind the 'how' is crucial, especially with investments. From my non-expert perspective, the bond market's momentum is key because bond prices and yields are inversely related. Strong bond market momentum could signal lowering yields and interest rates, usually favorable for stocks. Similarly, positive momentum in emerging markets might hint at a weakening dollar, beneficial for the broader economy and risk assets. But remember, this is just my take – not professional opinion! If you’d like a second opinion, you can ask ChatGPT, too, as below:

Your Turn

What do you think? Could the BND / VWO canaries be added to your toolbox for market timing and tactical asset allocation? Know any other signals worth exploring? Let’s chat about it!