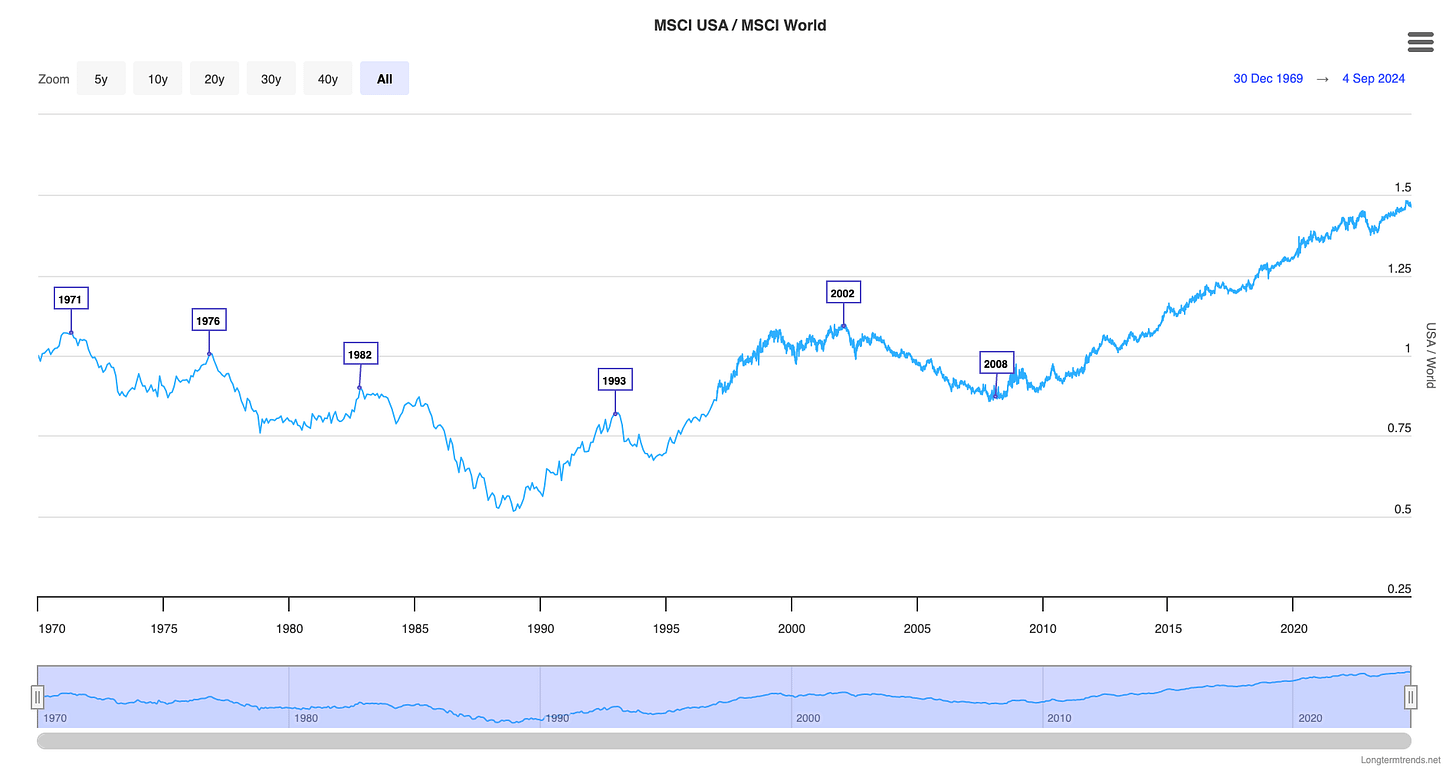

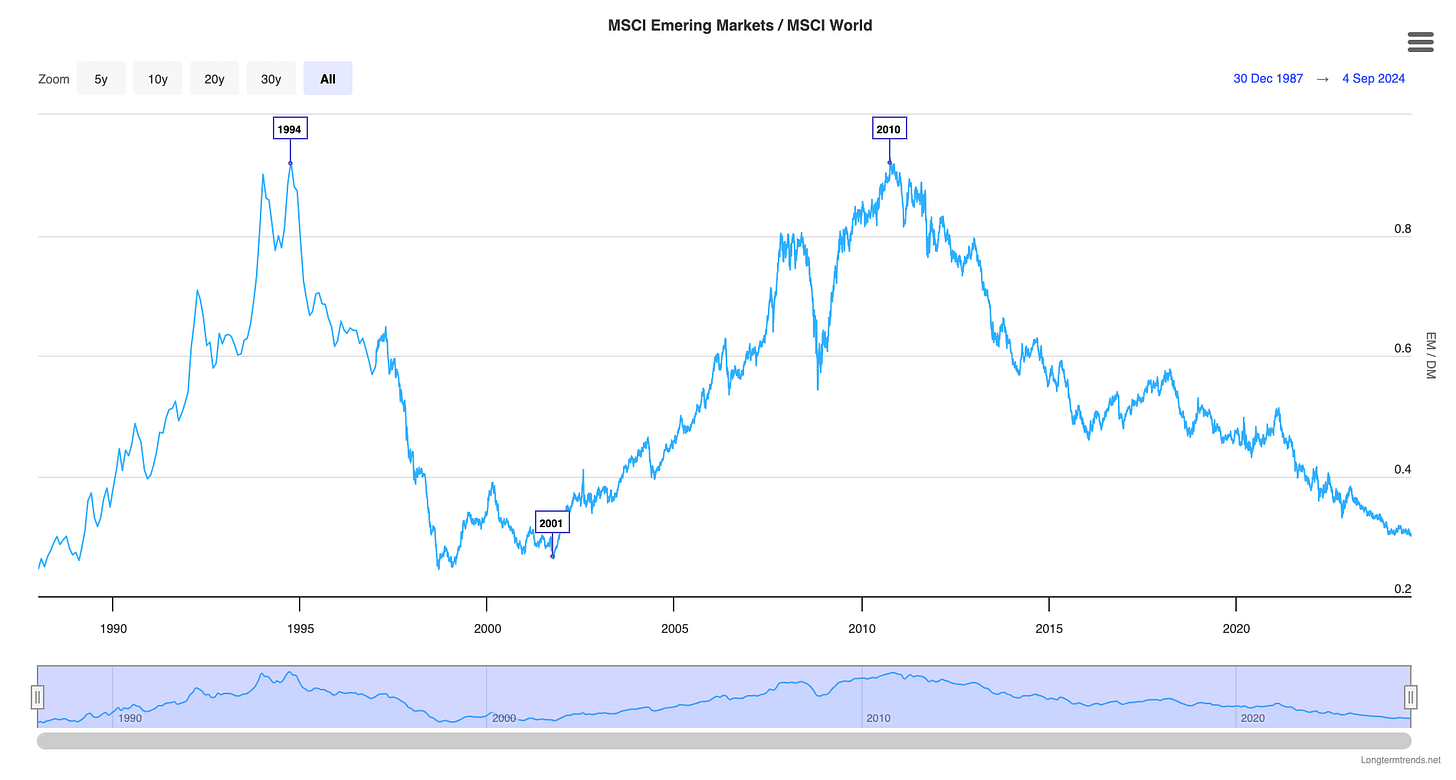

Inspired by two thought-provoking articles on asset rotation and emerging markets (the latter behind a paywall), I decided to dive into this topic myself. There’s been a lot of chatter among macro experts lately about big rotations on the horizon. These rotations involve market cycles that are interrelated but don’t perfectly sync up — think Market-cap Weight vs. Equal Weight, Growth vs. Value, Large-cap vs. Small-cap, US vs. The World, Emerging vs. Developed, Stocks vs. Commodities, and so on.

Given the U.S. stock market’s impressive performance since around 2010, it’s no surprise my portfolio strategies have also leaned heavily toward U.S. assets. So, I set out to create a compelling strategy that brings emerging markets back into focus.

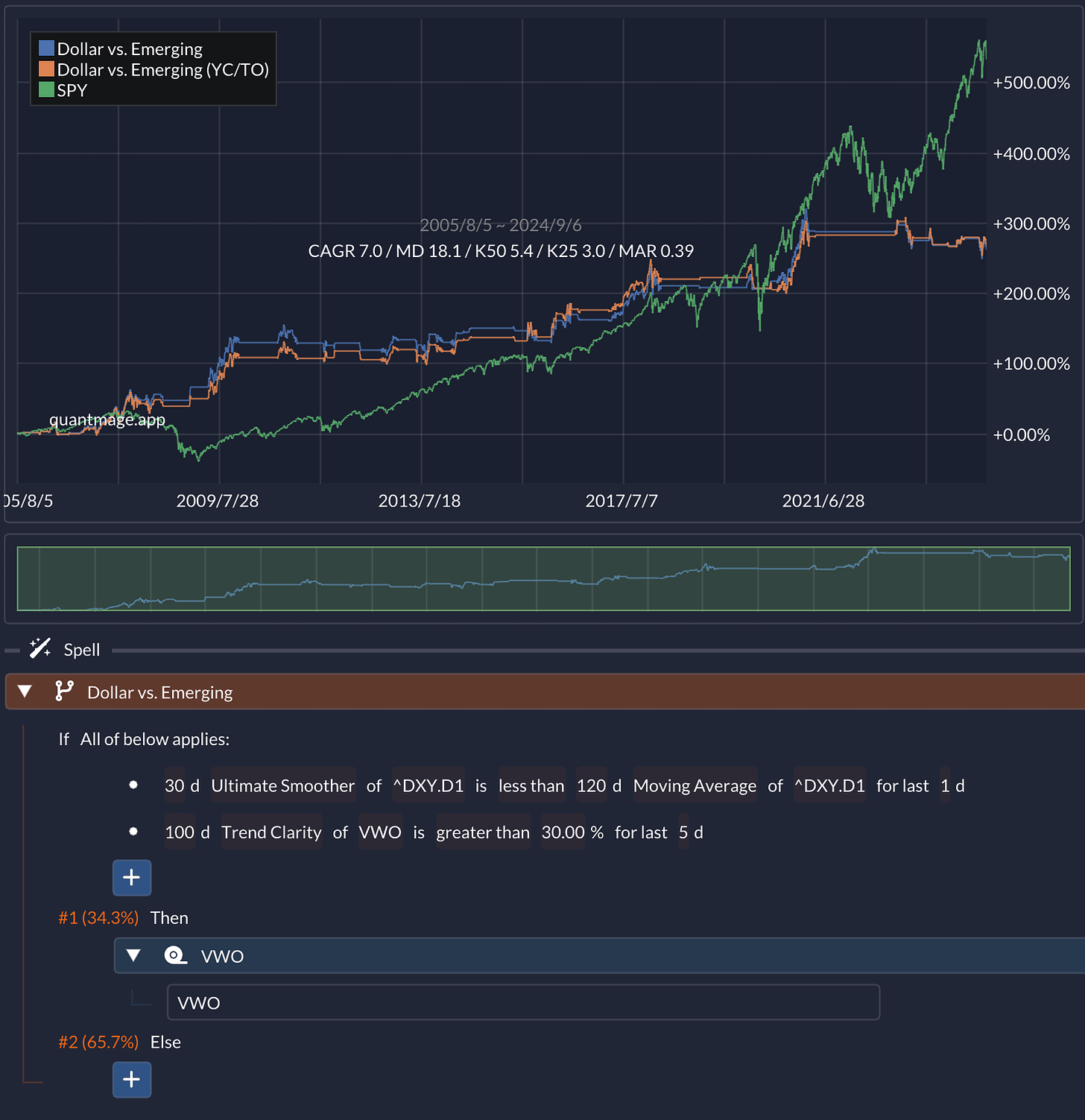

Dollar vs. Emerging Markets

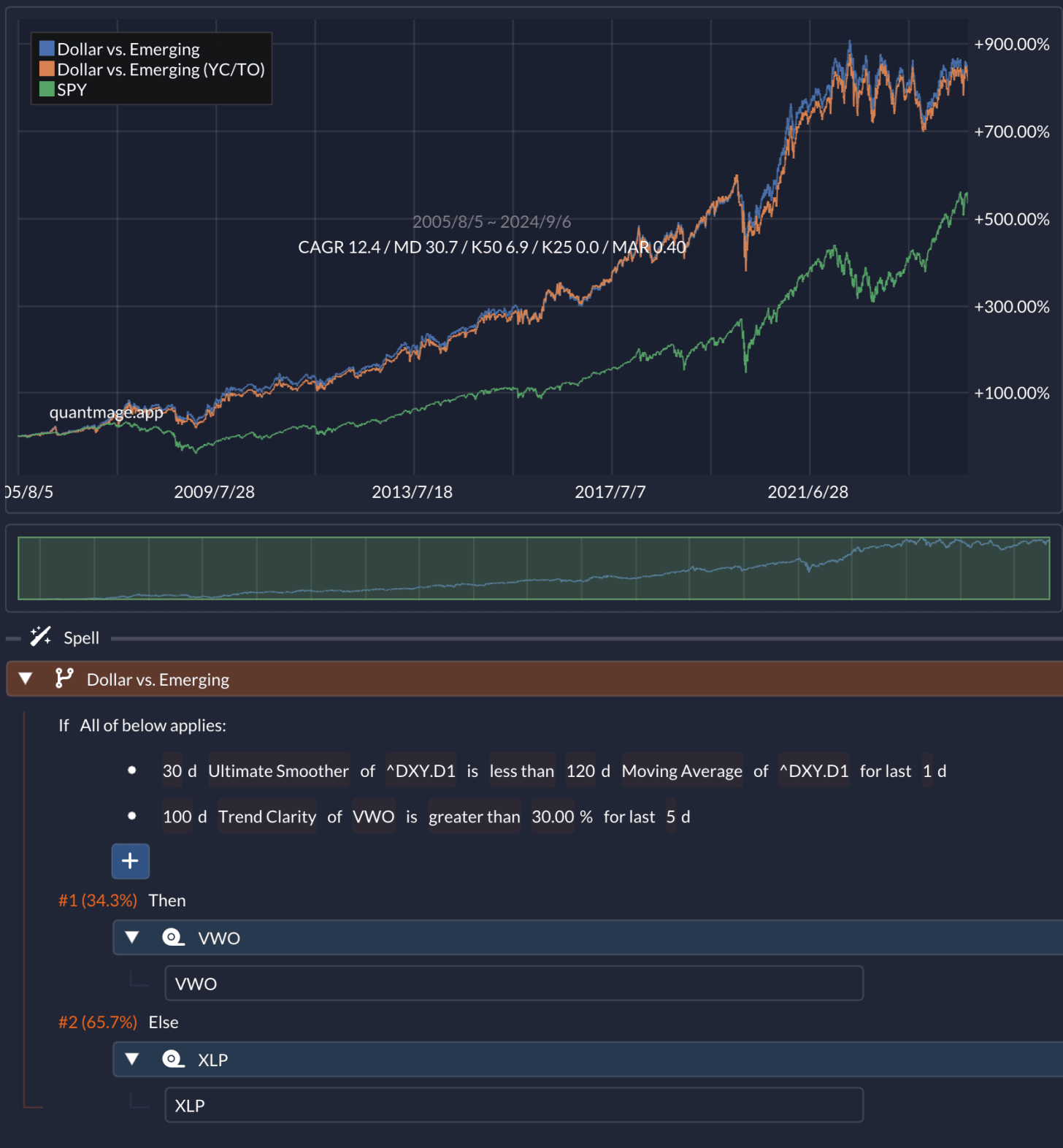

The crux of the idea is this: A strong dollar tends to hammer emerging markets due to their dollar-denominated debts, inflation issues, and potential capital outflows. My initial strategy takes advantage of this in addition to a trend clarity check on VWO, an emerging market ETF, as the primary asset:

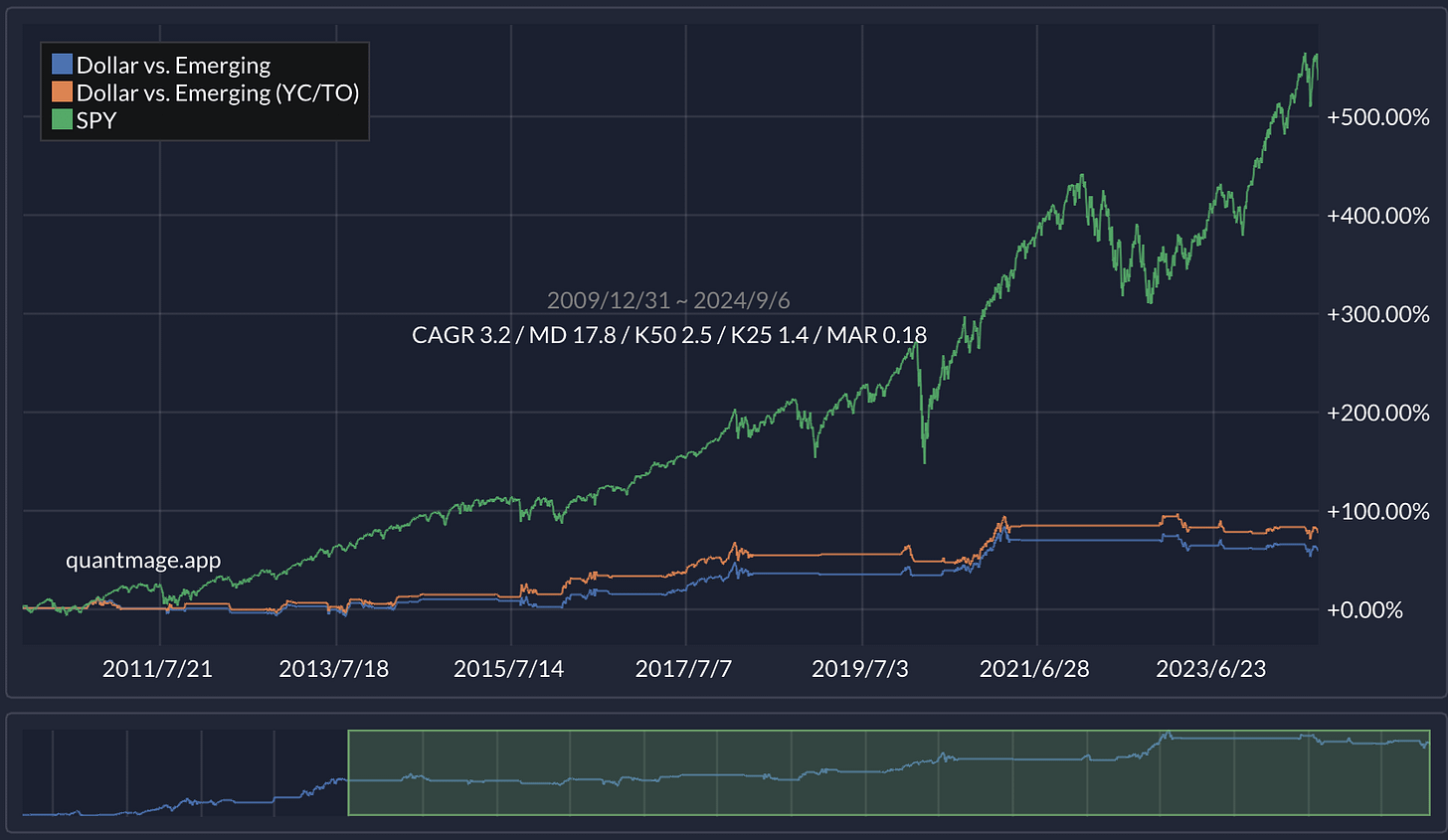

To do this, I evaluate the momentum of DXY (the dollar index) with a moving average crossover. And if you’re curious about the “Ultimate Smoother” think of it as a sort of moving average that is even more responsive than EMA and further reduces lag. The strategy enters VWO only when the dollar shows weak momentum and VWO’s trend is relatively clear. Over a 19-year period, this approach delivered a respectable CAGR of 7% with a max drawdown of 18.1%, while being in VWO just 34.3% of the time. It dodged GFC and Covid drawdowns with finesse. But, full disclosure, its performance since 2010 has been… let’s just say, not easy to stomach:

So, how can we juice it up a bit?

Adding Beta & a Diversifier

To spice things up, I added XLP, a consumer staples sector ETF, as an alternative asset to comfortably capture beta:

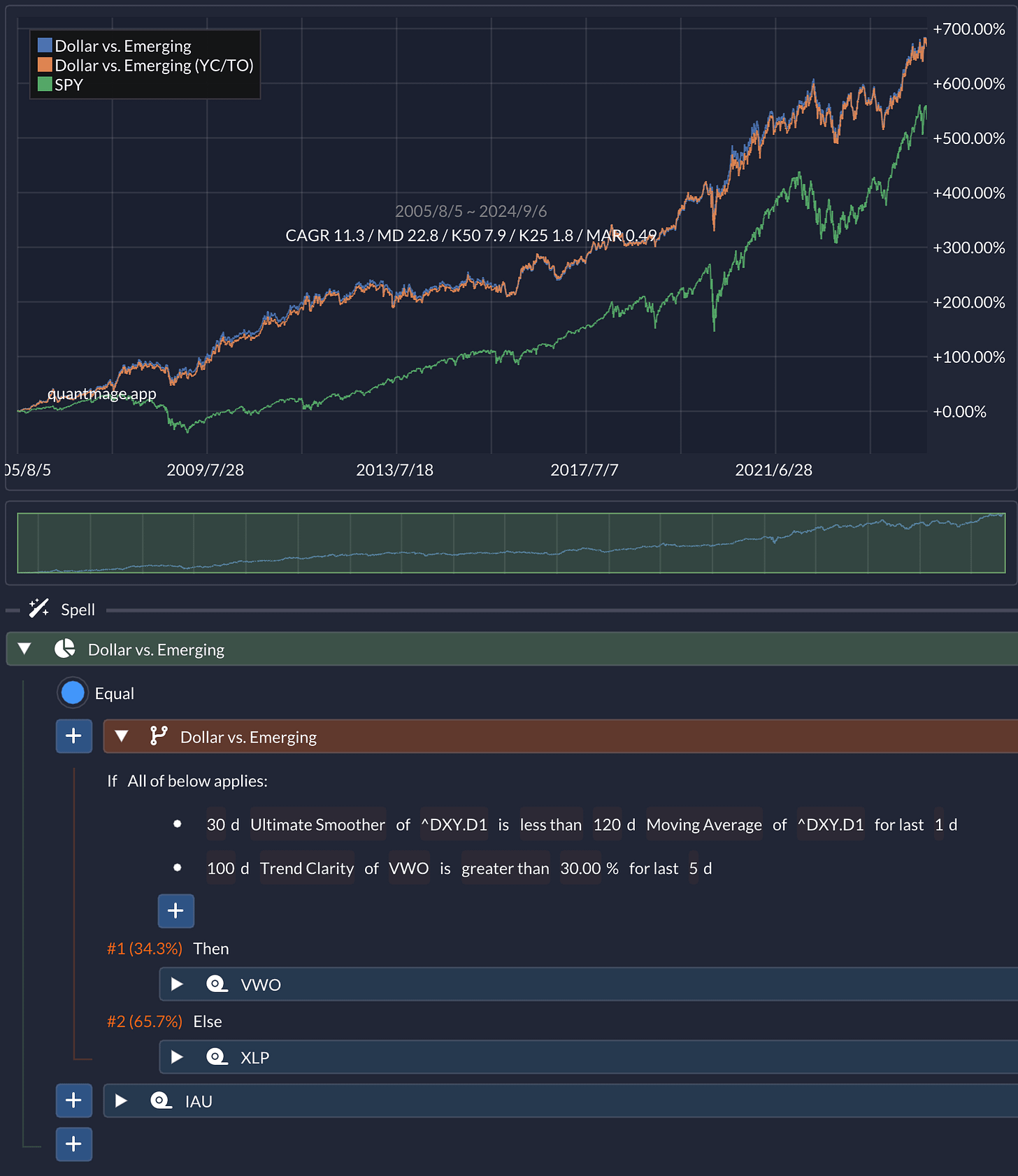

This addition made the strategy a little more exciting and even outperformed SPY, but it also cranked up the max drawdown quite a bit. So, I added an uncorrelated asset — gold. Enter IAU, a gold ETF:

This mix gave the strategy a more balanced profile while still beating SPY. You can test it out yourself here if you’re curious.

The Challenge of Being Long-term

A major challenge with this strategy is the lack of long-term data to further validate its efficacy. VWO itself was only created in 2005, so we can’t backtest during the earlier “glory days” of emerging markets. That’s one of the tricky parts about investing for the long term — a year or two can feel like an eternity, especially if you’re living through it. And recency bias? It’s hard enough to shake over short periods, let alone when considering market regimes from a decade or more ago that we’ve never experienced firsthand.

Speaking of which, I highly recommend an insightful paper by Cliff Asness titled “The Less-Efficient Market Hypothesis.” He argues that markets have actually become less efficient over the past few decades, thanks largely to technology, gamified 24/7 trading on your phone, and social media. Reading it might help you stay the course and maintain a long-term perspective through challenging times — which, in my view, is where true alpha is found. Here’s a particularly relevant quote for systematic investors like us:

Look at your favorite backtest. Mine might be the original backtest of Fama and French’s HML factor. You look at most of the historical drawdowns, in particular the one in 1999-2000, and say “yeah, of course, I would’ve stuck with that.” Well, maybe. But those 18 months of horror and 5 years or so of drawdown weren’t 18 months and 5 years to you. We have long borrowed a term from physics for this effect: time dilation. That 18 months and 5 years for you felt like forever, and many who look at the backtest and think they could’ve taken it, even added to it, really couldn’t have (partly as they are often simultaneously looking at the fact that it ended up fine, something not available real-time).

I’m not in a rush to introduce rotation themes into my portfolio given their long durations, but I’ll be watching the relevant charts closely. I’ll gradually but firmly steer my strategies as a turn of tides becomes clearer.

📣 Quick reminder: This content is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities. Past performance is not indicative of future results. Always do your own research and consider consulting a financial professional before making any investment decisions.