All That Glitters

Tactical Strategies for Gold

Not all that glitters is gold… except, well, this year it kind of was.

Gold had a banner year in 2025. And if you’re feeling smug about SPY’s 18% return, Ray Dalio would like a word—he pointed out in his year-end recap that in gold terms, SPY actually lost 28%. Ouch.

Here’s the thing: gold is about as “hard” as money gets when it comes to preserving purchasing power over the long haul. Yes, after such a strong run, we might see some consolidation. But with major economies drowning in debt and fiscal discipline nowhere in sight, I still like gold’s odds against most fiat currencies over time. The diversification angle is compelling too—gold’s low correlation to stocks makes it a solid portfolio stabilizer.

So rather than debate narratives, here are three tactical, rules-based approaches (“spells”) you can use to manage exposure.

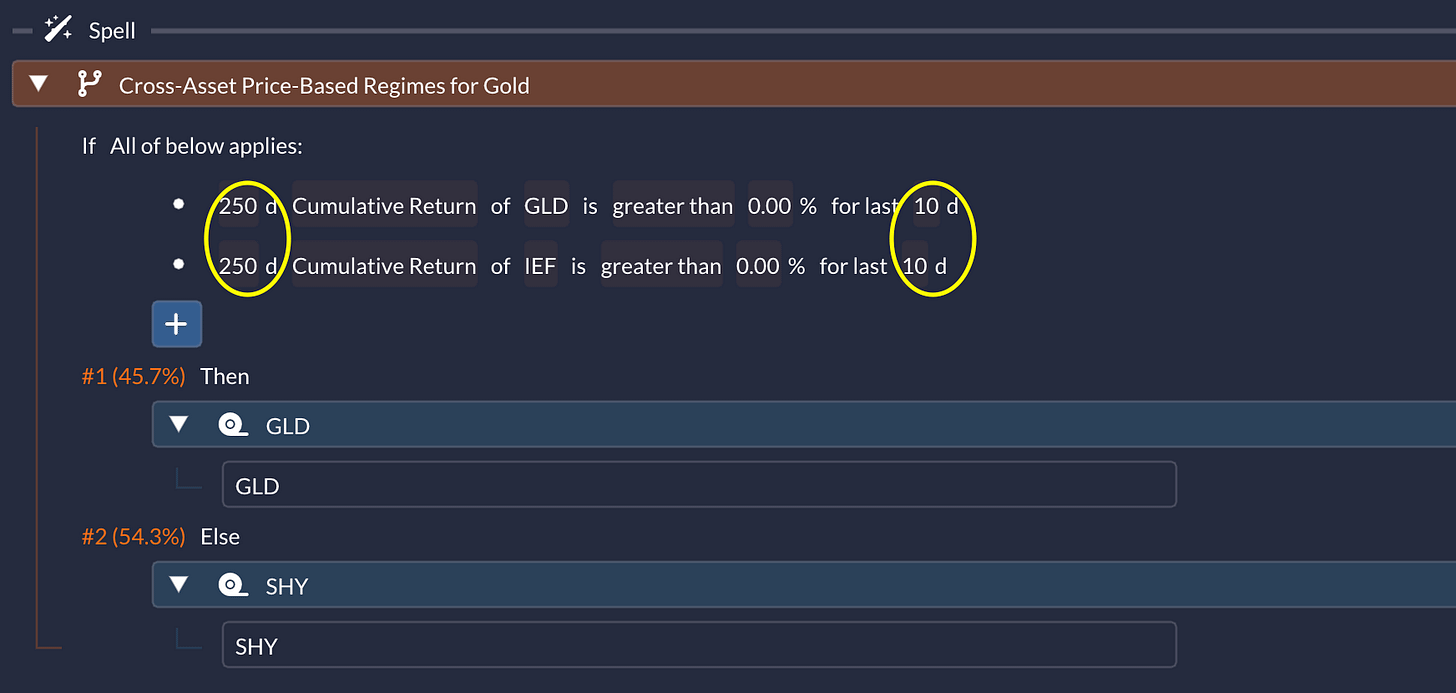

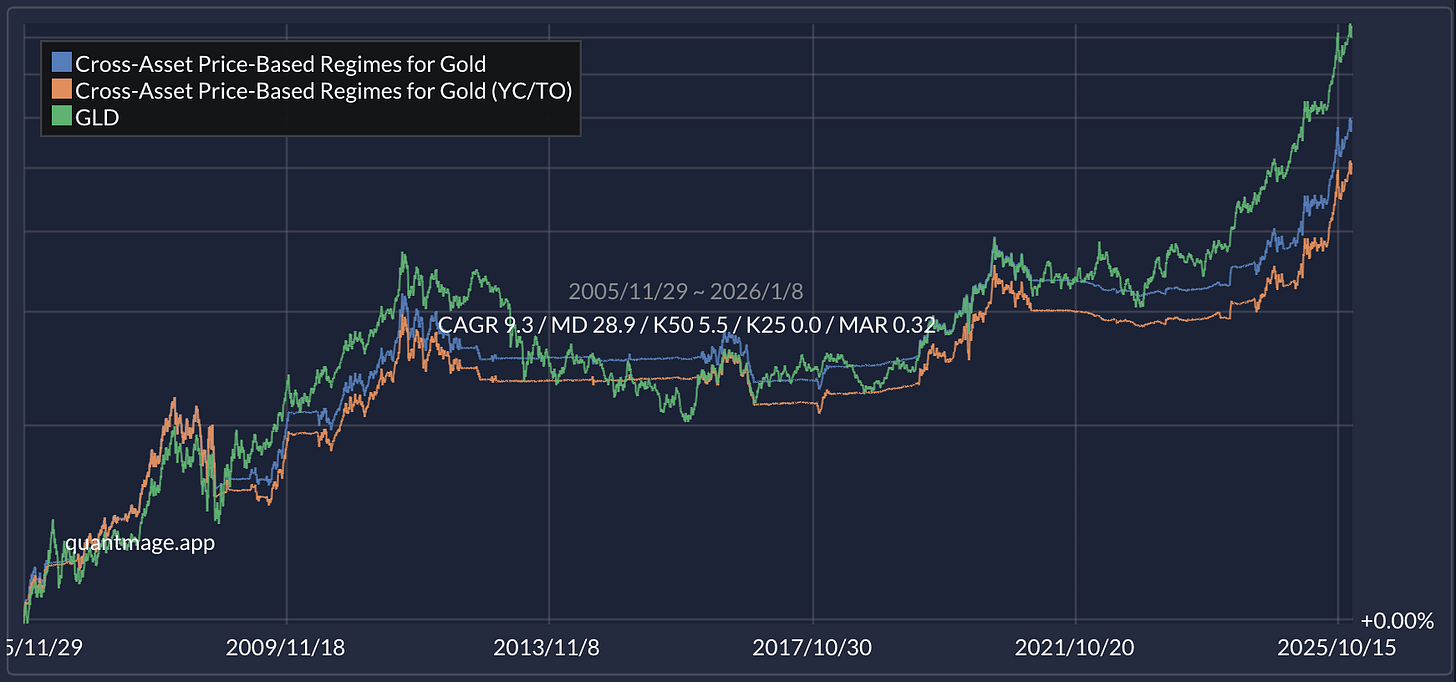

Cross-Asset Price-Based Regimes for Gold

I picked up this idea from a recent Quantpedia article. The concept: use 12-month momentum signals from both gold and treasury bonds to determine when to hold gold.

The setup is straightforward. GLD represents gold, IEF (an intermediate-term treasury bond ETF) provides the bond signal. You only hold GLD when both assets show positive momentum—otherwise, you park in SHY (cash). I’m using 250-day cumulative returns as my momentum measure, checked over ten consecutive days.

The results? Over ~20 years, this trails GLD buy-and-hold in raw return, but shows a small edge in risk-adjusted performance. It also handled ugly gold years like 2013 and 2015 more gracefully (when gold saw meaningful drawdowns).

Intuition: you’re basically asking for “gold strength + bond strength” before you take gold risk—otherwise you default to something cash-like.

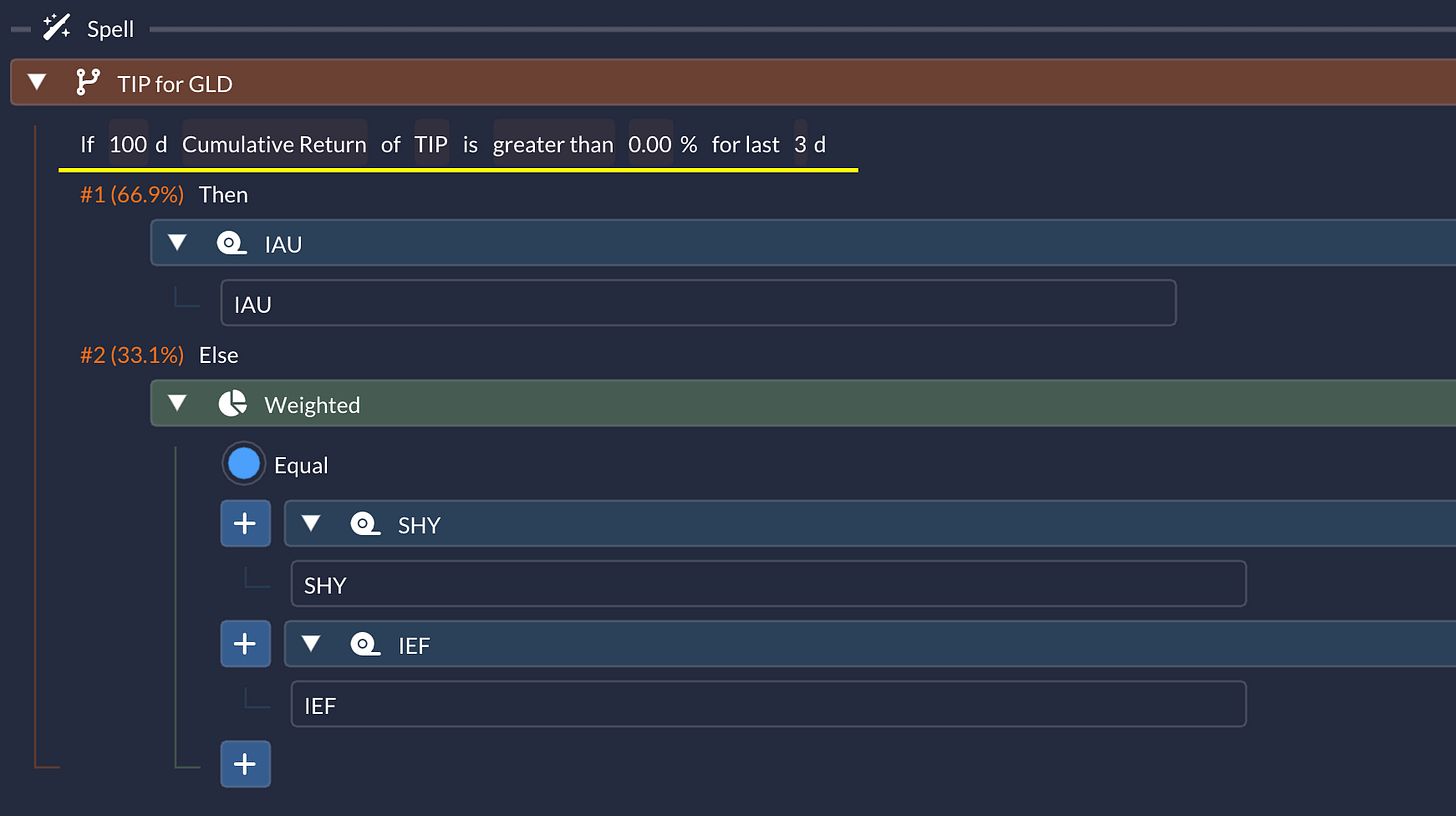

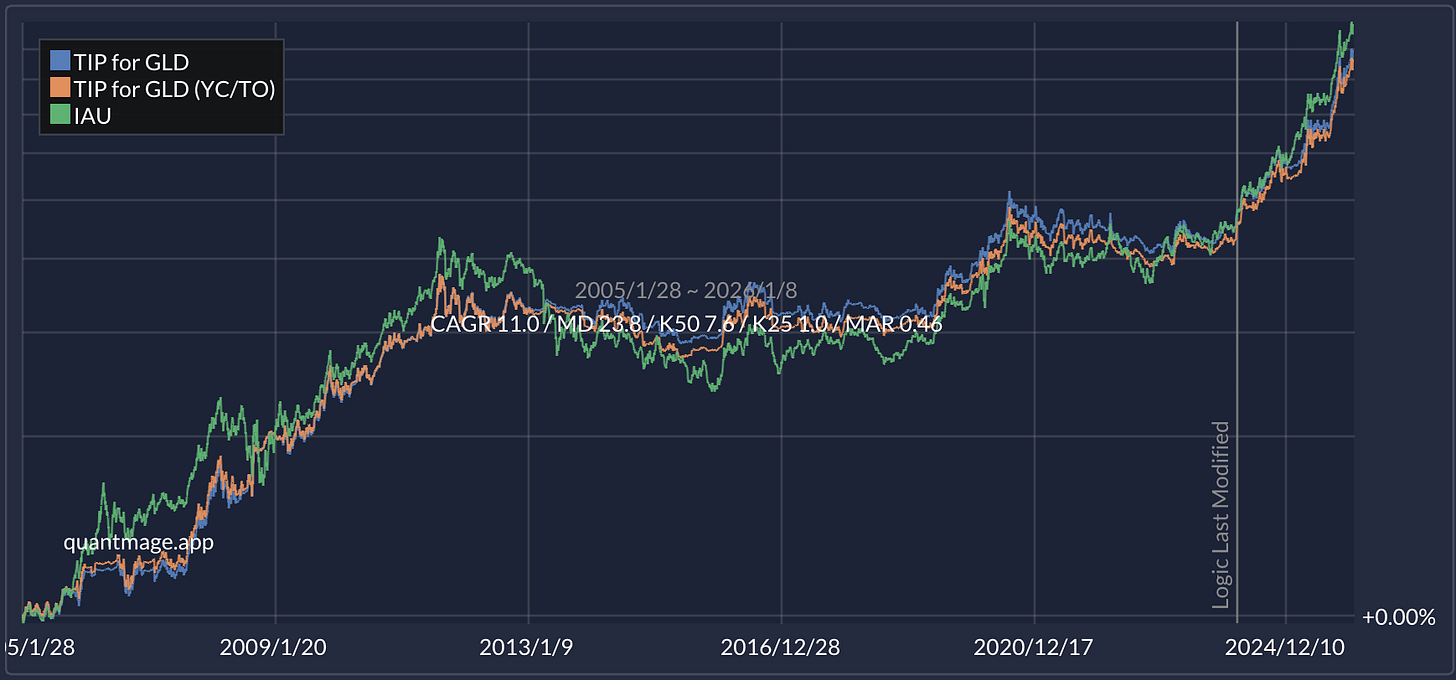

TIP for GLD

Another article-inspired strategy, and it shares DNA with something I’ve covered before—both use inflation expectations (via TIP) as the primary signal.

The rule: go long gold (IAU this time) when TIP’s 100-day return stays positive for three consecutive days. When that condition fails, rotate into a defensive 50/50 split between SHY and IEF.

This one delivers comparable absolute returns to buy-and-hold over a similar timeframe, but again with noticeably better risk-adjusted performance.

Intuition: you’re letting a “macro-sensitive” asset (TIPS) act as a gatekeeper for when you want gold exposure, and otherwise you hold a conservative bond/cash blend.

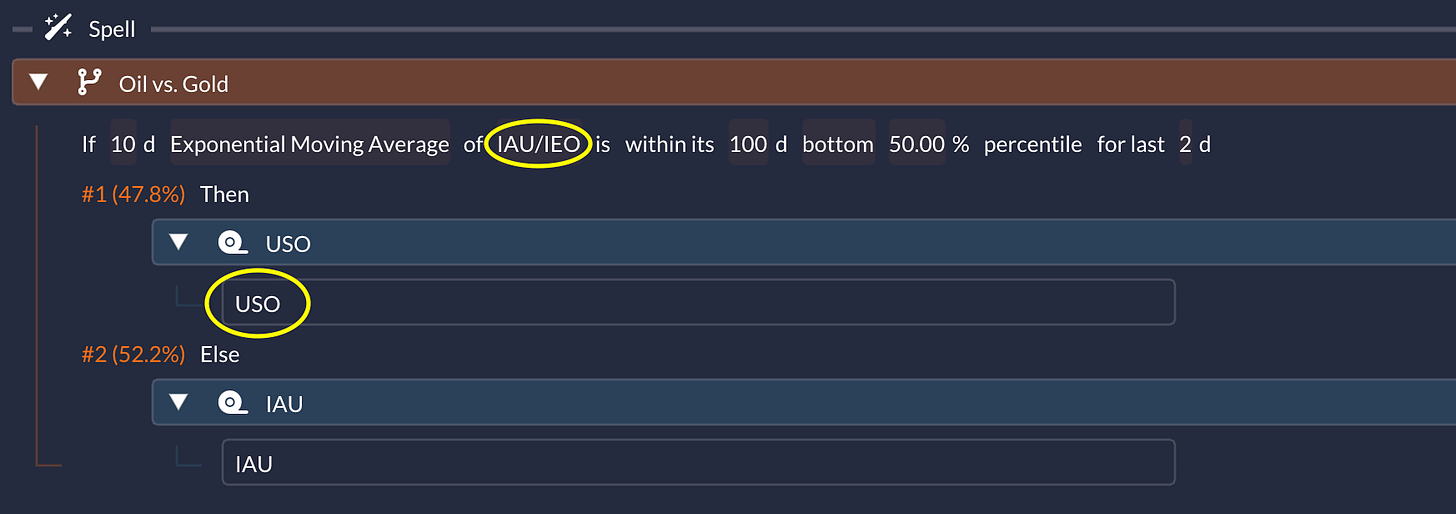

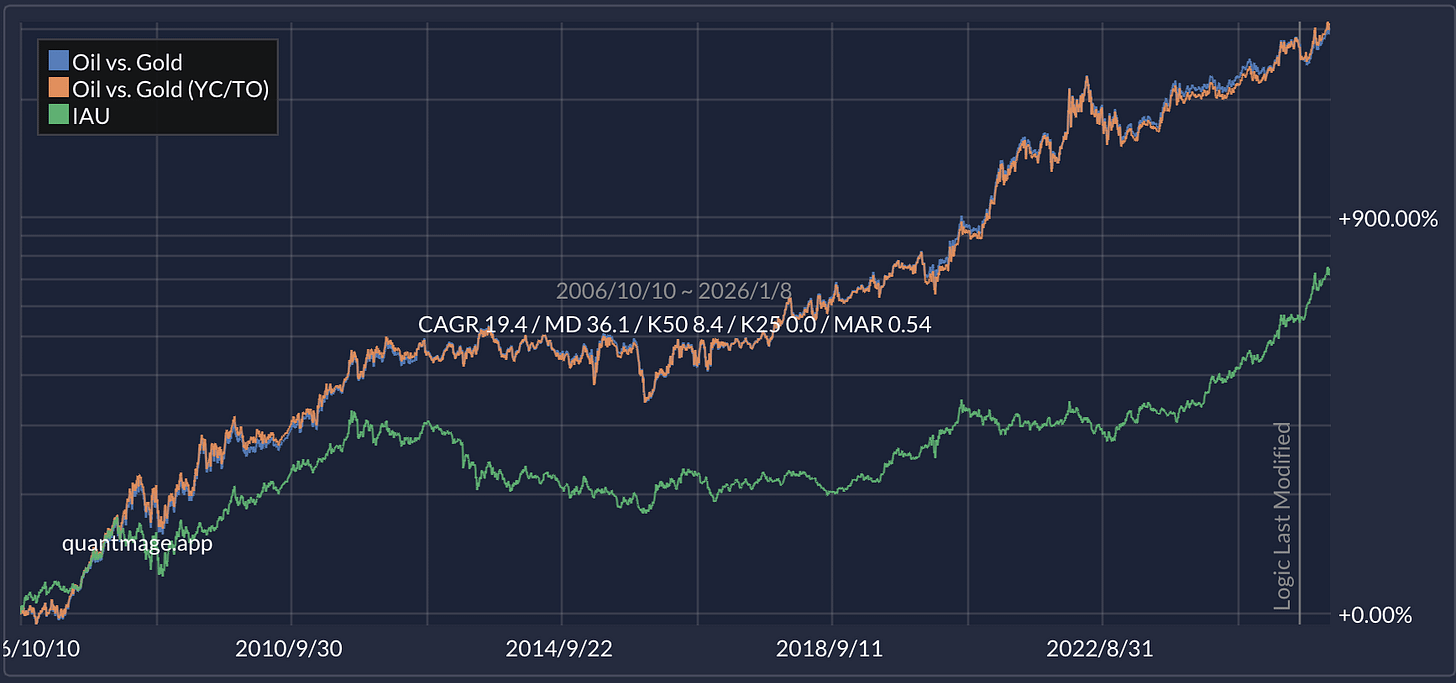

Oil vs. Gold

For the final strategy, we’re pitting gold against “liquid gold.”

This approach uses price ratio and percentile ranking to measure IAU’s momentum against IEO (iShares U.S. Oil & Gas Exploration & Production ETF). When oil is winning the momentum battle, you rotate into USO (United States Oil Fund, LP).

The backtest over 19 years shows more exciting returns—though with volatility to match. Fair warning: that flat stretch from 2012 to 2015 would have tested anyone’s patience.

Intuition: sometimes gold and oil trade like competing “macro hedges.” This spell tries to own whichever one is acting stronger right now, instead of committing to gold as the only hedge.

📣 Quick disclaimer: This post is for informational purposes only and isn’t financial advice. Please do your own research and consider talking to a professional before making any investment decisions.

Final Thoughts

Gold isn’t just for doomsday preppers and central banks. It can be a smart, tactical piece of a modern portfolio—especially when paired with regime-based logic to avoid the dead zones.

So what’s your 2026 gold outlook? Bullish, bearish, or just waiting for Powell to flinch? Got any smart signals or ideas I should test next? I’d love to hear your take.

Thank you!