Three Tidbits 06/16/2025

Bitcoin/Gold, Gold/Oil, and RSI Ensemble

Time for another round of small but intriguing strategy ideas I’ve been exploring lately. Nothing too heavy—just three signals worth your radar if you’re into data-driven investing.

🟡 Bitcoin-to-Gold Ratio as a Risk-On Signal

This first idea comes from a research paper I stumbled upon. It’s all about using the bitcoin-to-gold ratio as a proxy for risk appetite. The logic? When bitcoin is outperforming gold, it signals risk-on behavior.

I implemented it in QuantMage using a 12-month simple momentum (SMA12) applied to the GBTC/IAU ratio, with SPY as the risk-on asset:

Even with GBTC standing in for bitcoin, the backtest looks promising:

CAGR: 11.8%

Max drawdown: 10.4%

Period: 9 years

The downside? Bitcoin’s short history means limited data. Still, it’s a signal I’m keeping an eye on.

🛢 Gold-to-Oil Ratio + Aroon Indicator

Another paper sized up several gold‑centric ratios and crowned Gold/Oil the most predictive. Interestingly, traditional momentum indicators didn’t really work with this ratio—but the 60-day Aroon indicator did.

Using IAU (iShares Gold Trust ETF) for gold and USO (US Oil Fund ETF) for oil, the backtest returned:

CAGR: 11.3%

Max drawdown: 23.0%

Period: 18 years

One caveat: performance has been pretty flat for the past three years. Still, this one might shine again in the right macro environment.

🎯 RSI Ensemble

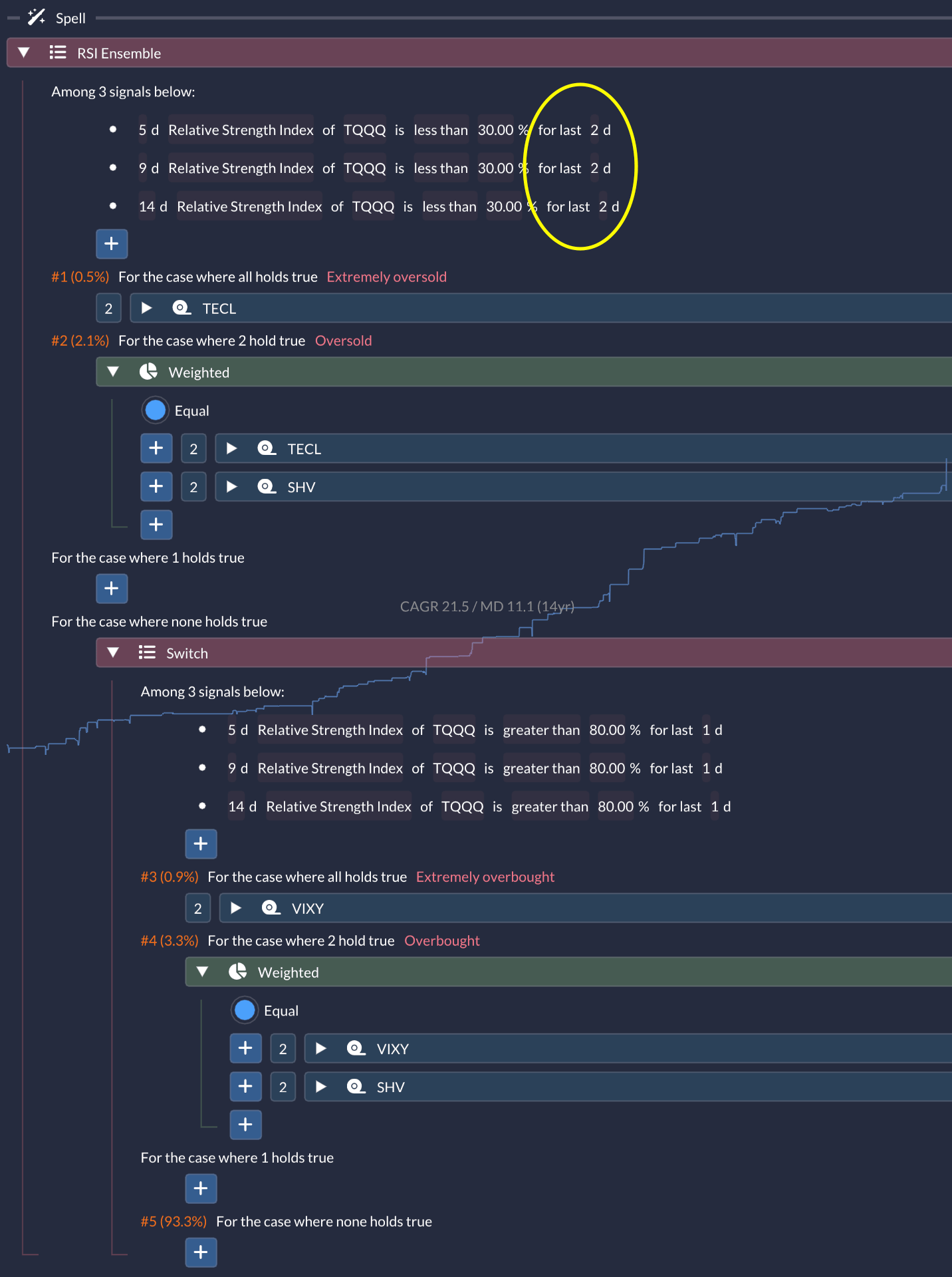

Finally, credit to a trading tool website for reminding me that you don’t need machine‑learning wizardry to squeeze more juice from RSI. Instead of using a single RSI, it stacks signals from three different periods—5-, 9-, and 14-day RSI—to better catch overbought/oversold moves.

I adapted it to my risk-adjusted RSI pop setup, and here’s how it works with QuantMage’s Switch incantation:

If all three RSIs agree → go full position.

If two agree → half position.

Less than that → stay in cash.

(Also: oversold triggers use two-day checks.)

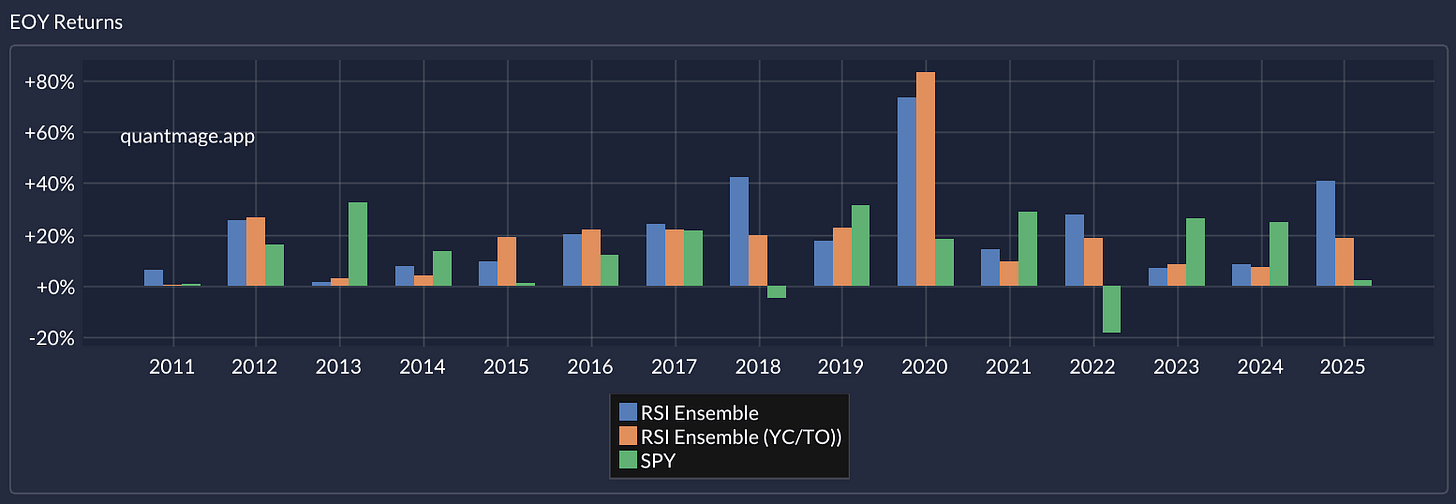

The results are… kind of nuts:

CAGR: 21.5%

Max drawdown: 11.1%

Market exposure: only 6.7%

Number of losing years across 14 years: 0

Yes, it’s cherry-picked, yes it’s niche—but still, the risk-adjusted performance is remarkable. A good example of how signal stacking can improve precision.

📣 Quick disclaimer: This is all informational, not a recommendation to buy or sell anything. Always do your own research and consider consulting a professional if you’re unsure.

💭 Parting Thoughts

What I love about these strategies is their simplicity – no black boxes or complex math, just straightforward signals based on solid market relationships. Each one offers a different angle on market timing, from crypto sentiment to commodity relationships to technical indicator ensembles.

If these ideas spark anything on your end—please share! Would love to see what you’re cooking up.

The RSI ensemble is similar to an algo Ive made in composer. However, using the switch logic in QM makes it much cleaner.

Why do you calculate the RSIs on TQQQ, but buy TECL instead of TQQQ?